| __timestamp | Block, Inc. | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 206797000 | 1762000000 |

| Thursday, January 1, 2015 | 289084000 | 1771000000 |

| Friday, January 1, 2016 | 425869000 | 1807000000 |

| Sunday, January 1, 2017 | 503723000 | 1973000000 |

| Monday, January 1, 2018 | 750396000 | 2298000000 |

| Tuesday, January 1, 2019 | 1061082000 | 2524000000 |

| Wednesday, January 1, 2020 | 1688873000 | 2727000000 |

| Friday, January 1, 2021 | 2600515000 | 3626000000 |

| Saturday, January 1, 2022 | 3744800000 | 4986000000 |

| Sunday, January 1, 2023 | 4228199000 | 5062000000 |

| Monday, January 1, 2024 | 5730000000 |

Unlocking the unknown

In the ever-evolving landscape of financial technology, understanding the spending patterns of industry giants like Intuit Inc. and Block, Inc. (formerly Square) offers valuable insights. Over the past decade, both companies have shown a consistent upward trend in their Selling, General, and Administrative (SG&A) expenses, reflecting their growth and strategic investments.

From 2014 to 2023, Intuit Inc. has seen its SG&A expenses rise by approximately 187%, reaching over $5 billion in 2023. This increase underscores Intuit's commitment to expanding its market presence and enhancing its product offerings. Meanwhile, Block, Inc. has experienced an even more dramatic surge, with expenses growing by over 1,900% during the same period, highlighting its aggressive expansion and innovation strategies.

These trends indicate that both companies are heavily investing in their operations, marketing, and customer service to maintain competitive advantages in the fintech sector. However, the data for 2024 is incomplete, suggesting that the financial strategies of these companies continue to evolve.

Understanding these expense trends is crucial for investors and industry analysts aiming to gauge the future trajectory of these fintech leaders.

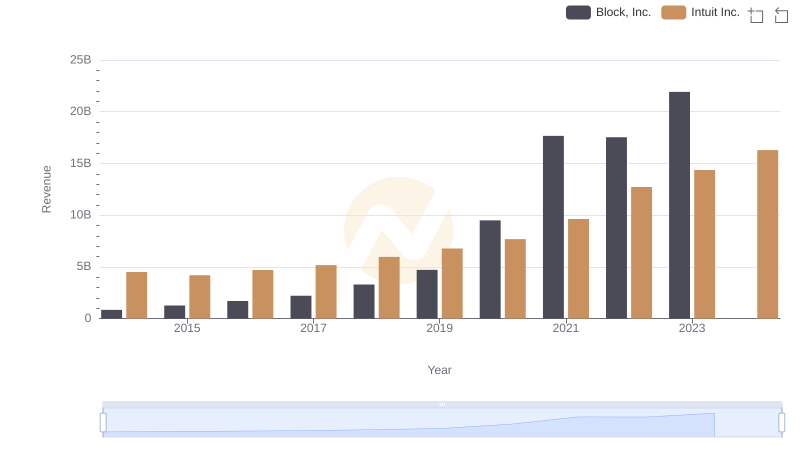

Breaking Down Revenue Trends: Intuit Inc. vs Block, Inc.

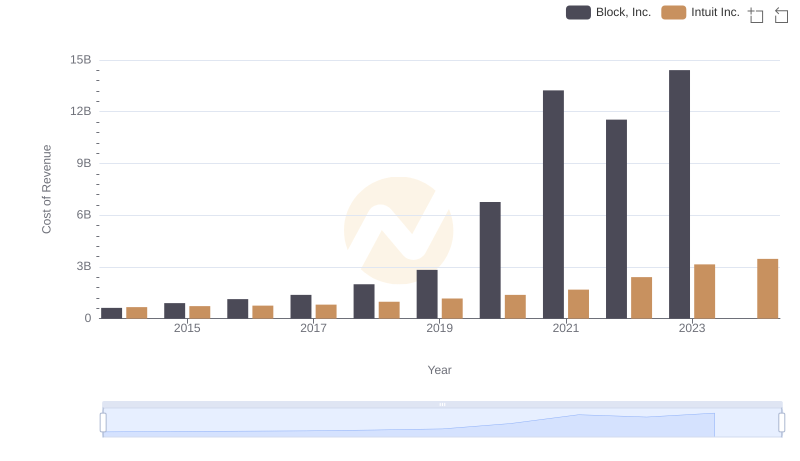

Cost Insights: Breaking Down Intuit Inc. and Block, Inc.'s Expenses

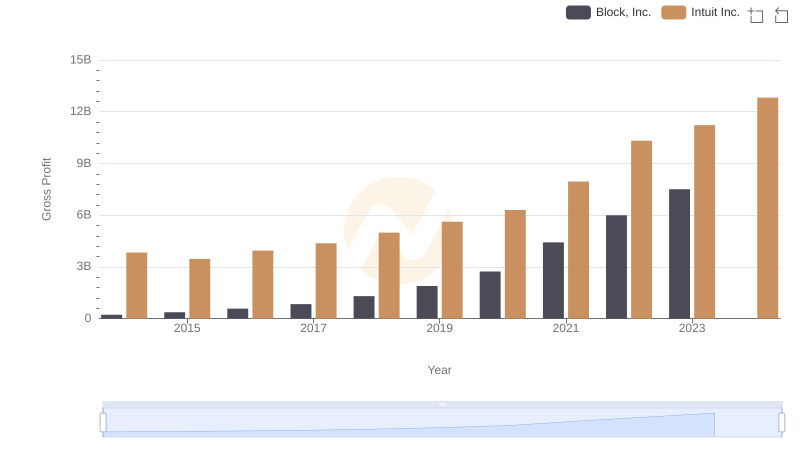

Gross Profit Comparison: Intuit Inc. and Block, Inc. Trends

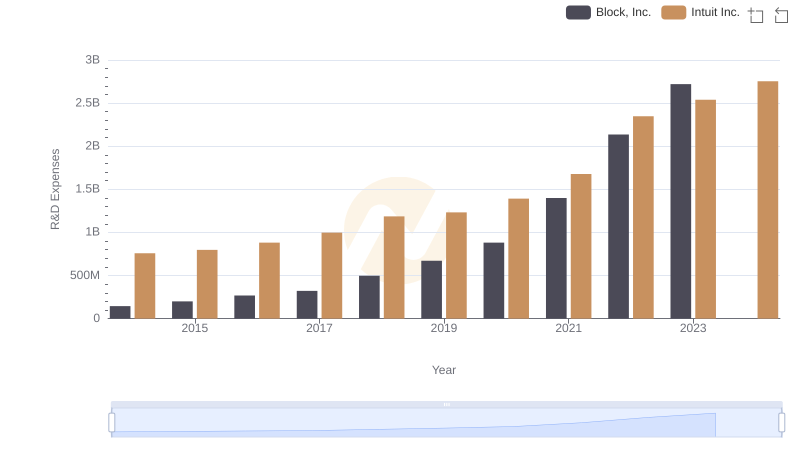

Comparing Innovation Spending: Intuit Inc. and Block, Inc.

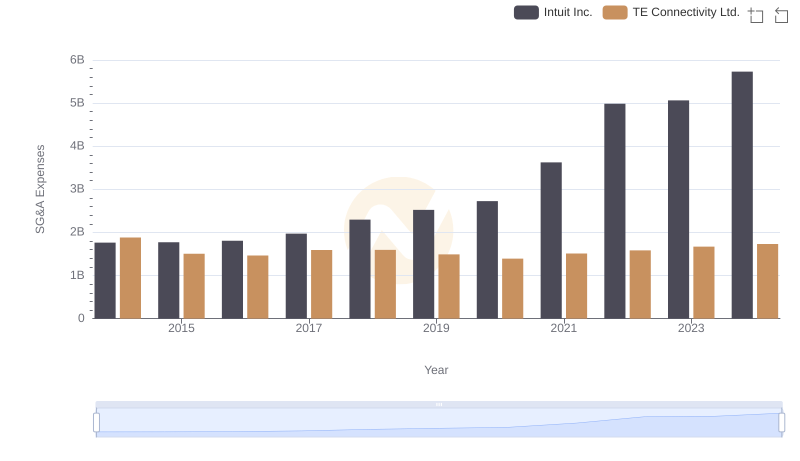

Cost Management Insights: SG&A Expenses for Intuit Inc. and TE Connectivity Ltd.

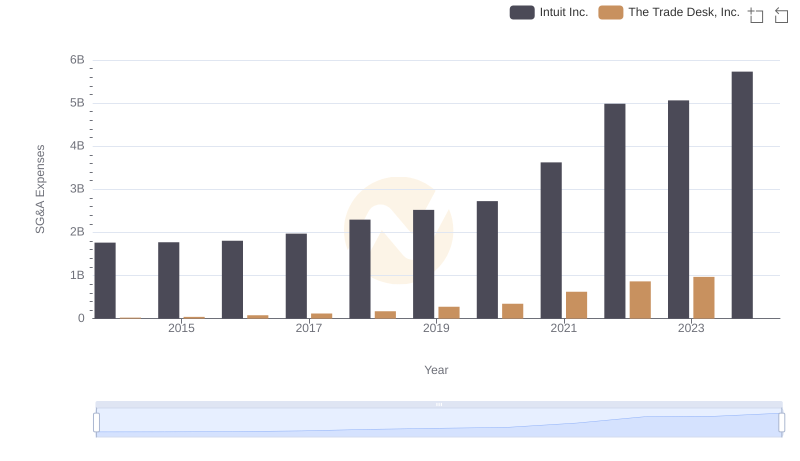

Intuit Inc. vs The Trade Desk, Inc.: SG&A Expense Trends

Cost Management Insights: SG&A Expenses for Intuit Inc. and NXP Semiconductors N.V.

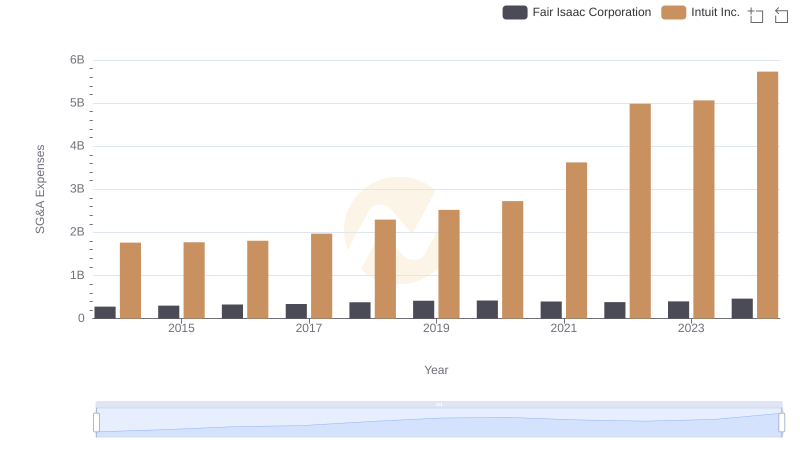

Comparing SG&A Expenses: Intuit Inc. vs Fair Isaac Corporation Trends and Insights

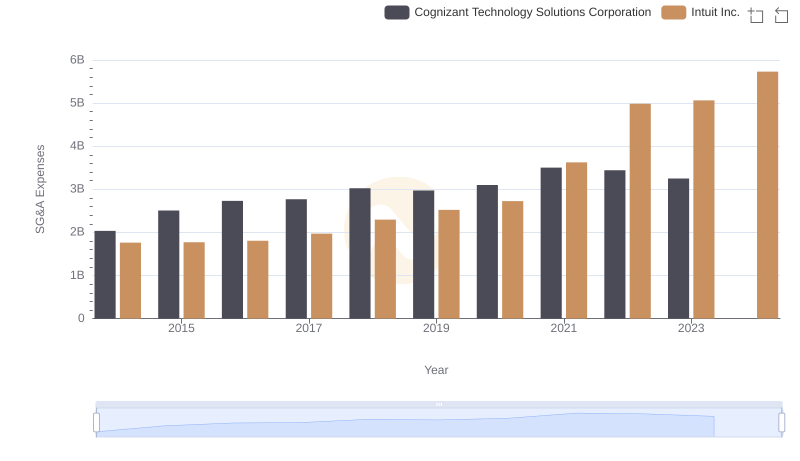

Cost Management Insights: SG&A Expenses for Intuit Inc. and Cognizant Technology Solutions Corporation

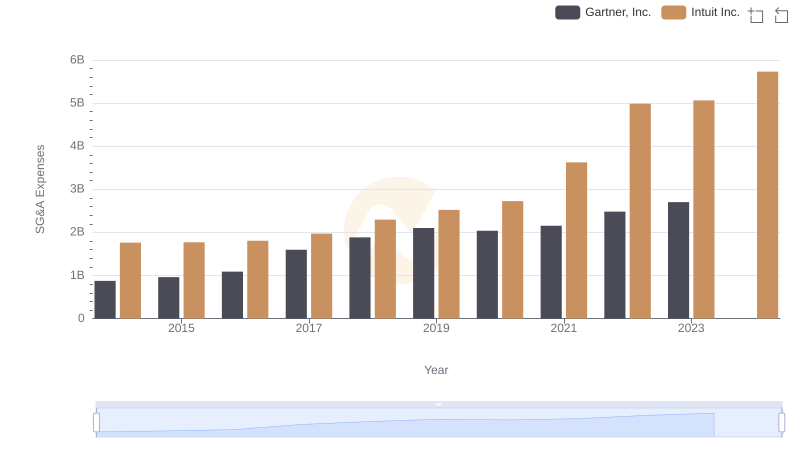

Intuit Inc. vs Gartner, Inc.: SG&A Expense Trends

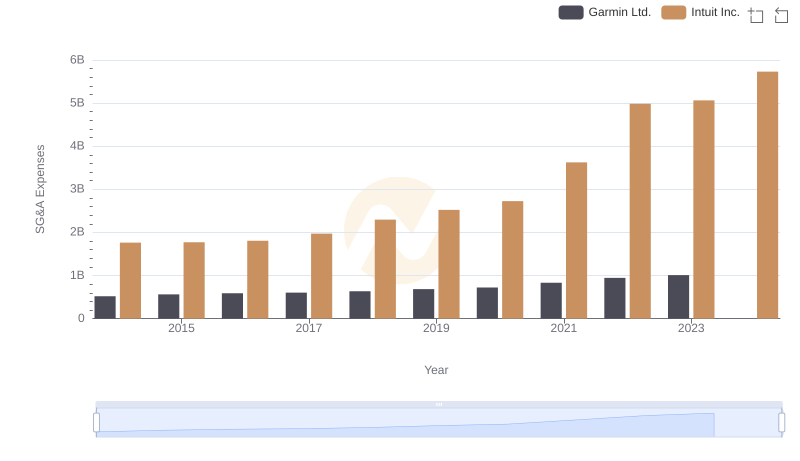

Who Optimizes SG&A Costs Better? Intuit Inc. or Garmin Ltd.

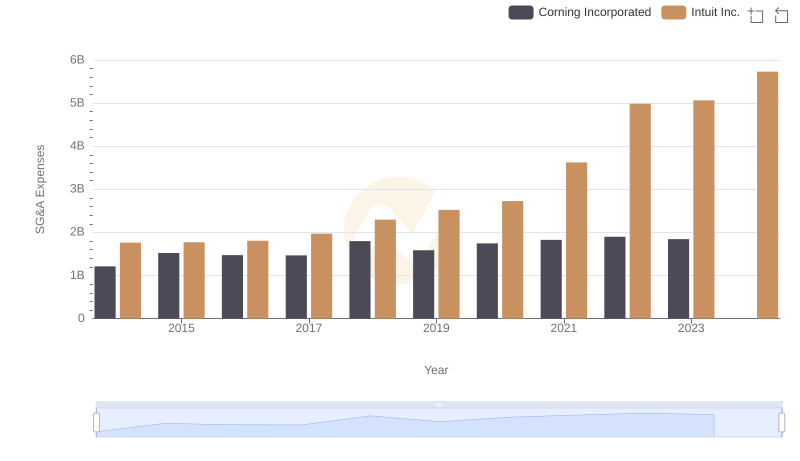

Selling, General, and Administrative Costs: Intuit Inc. vs Corning Incorporated