| __timestamp | Intuit Inc. | NXP Semiconductors N.V. |

|---|---|---|

| Wednesday, January 1, 2014 | 1762000000 | 838000000 |

| Thursday, January 1, 2015 | 1771000000 | 922000000 |

| Friday, January 1, 2016 | 1807000000 | 1141000000 |

| Sunday, January 1, 2017 | 1973000000 | 1090000000 |

| Monday, January 1, 2018 | 2298000000 | 993000000 |

| Tuesday, January 1, 2019 | 2524000000 | 924000000 |

| Wednesday, January 1, 2020 | 2727000000 | 879000000 |

| Friday, January 1, 2021 | 3626000000 | 956000000 |

| Saturday, January 1, 2022 | 4986000000 | 1066000000 |

| Sunday, January 1, 2023 | 5062000000 | 1159000000 |

| Monday, January 1, 2024 | 5730000000 |

Data in motion

In the ever-evolving landscape of corporate finance, understanding Selling, General, and Administrative (SG&A) expenses is crucial for assessing a company's operational efficiency. This analysis delves into the SG&A expenses of Intuit Inc. and NXP Semiconductors N.V. from 2014 to 2023. Over this period, Intuit Inc. has seen a remarkable increase in its SG&A expenses, growing by over 225% from 2014 to 2023. This surge reflects Intuit's strategic investments in marketing and administrative capabilities to maintain its competitive edge. In contrast, NXP Semiconductors N.V. has maintained a more stable SG&A expense profile, with a modest increase of around 38% over the same period. This stability suggests a disciplined approach to cost management, even as the company navigates the complexities of the semiconductor industry. Notably, data for 2024 is incomplete, highlighting the dynamic nature of financial reporting.

Intuit Inc. and NXP Semiconductors N.V.: A Comprehensive Revenue Analysis

Comparing Cost of Revenue Efficiency: Intuit Inc. vs NXP Semiconductors N.V.

Gross Profit Trends Compared: Intuit Inc. vs NXP Semiconductors N.V.

Who Prioritizes Innovation? R&D Spending Compared for Intuit Inc. and NXP Semiconductors N.V.

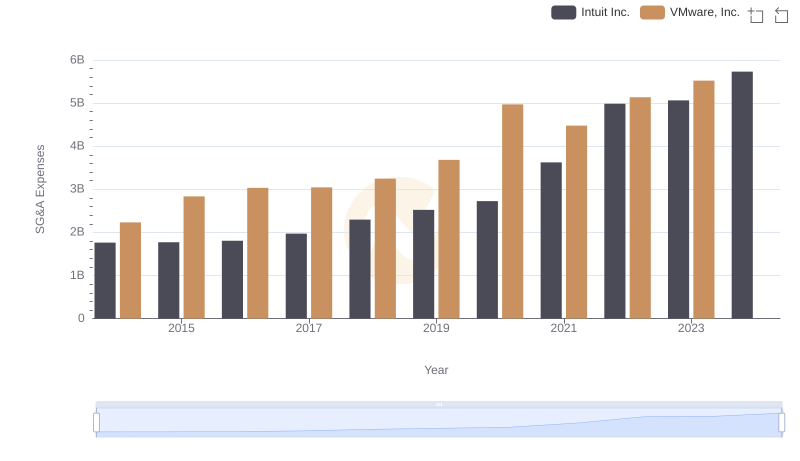

Cost Management Insights: SG&A Expenses for Intuit Inc. and VMware, Inc.

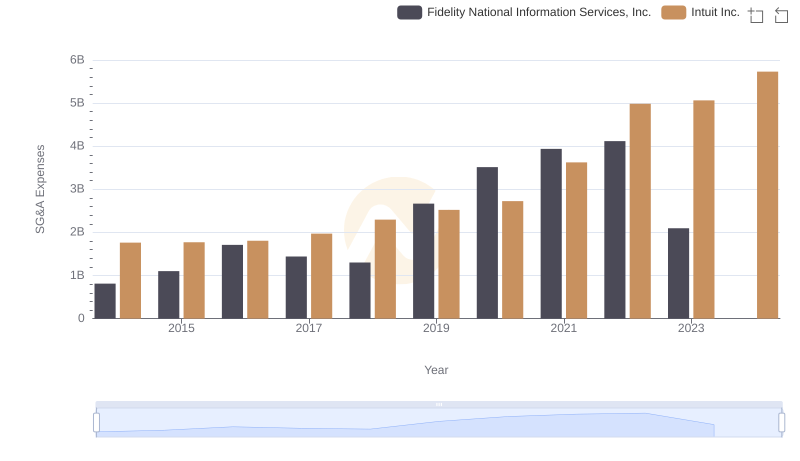

Comparing SG&A Expenses: Intuit Inc. vs Fidelity National Information Services, Inc. Trends and Insights

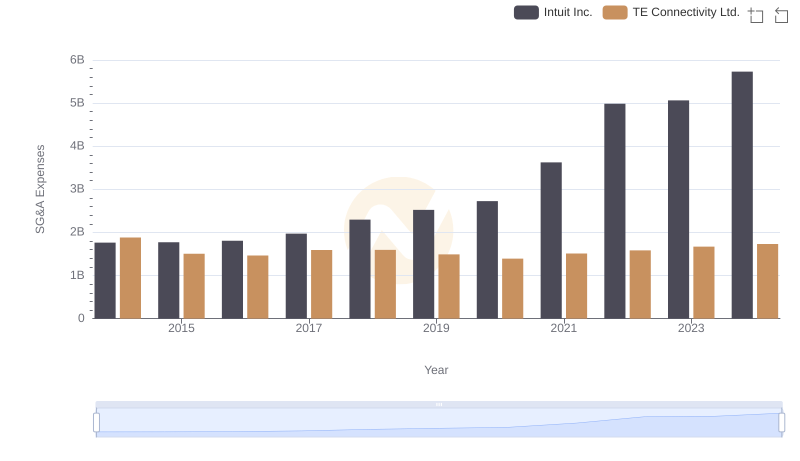

Cost Management Insights: SG&A Expenses for Intuit Inc. and TE Connectivity Ltd.

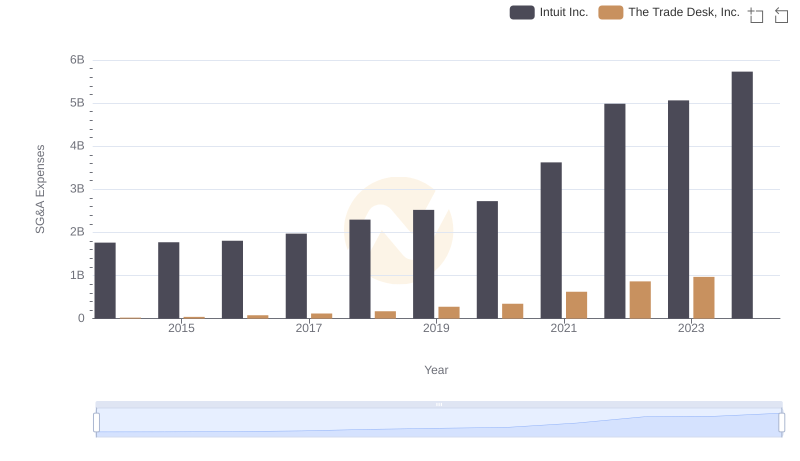

Intuit Inc. vs The Trade Desk, Inc.: SG&A Expense Trends

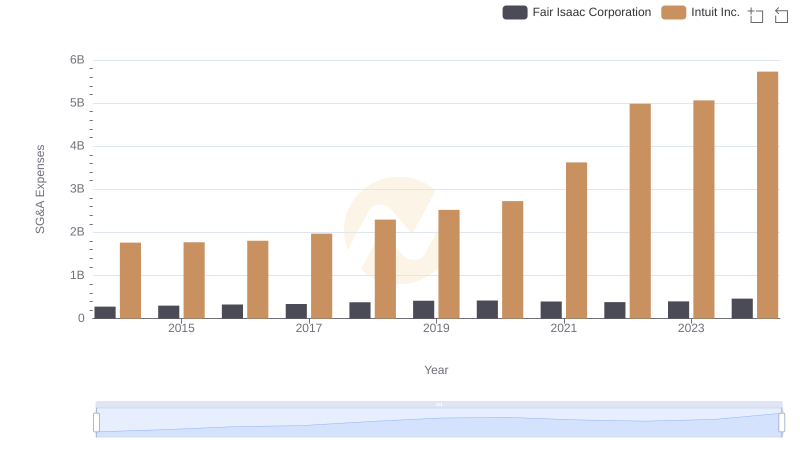

Comparing SG&A Expenses: Intuit Inc. vs Fair Isaac Corporation Trends and Insights

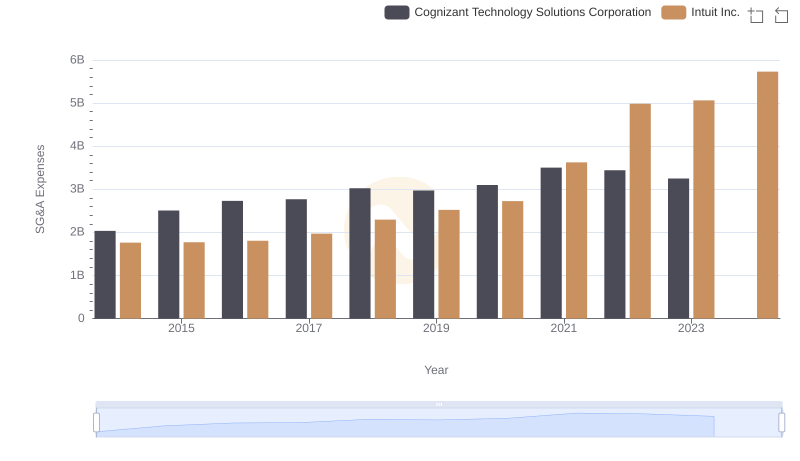

Cost Management Insights: SG&A Expenses for Intuit Inc. and Cognizant Technology Solutions Corporation

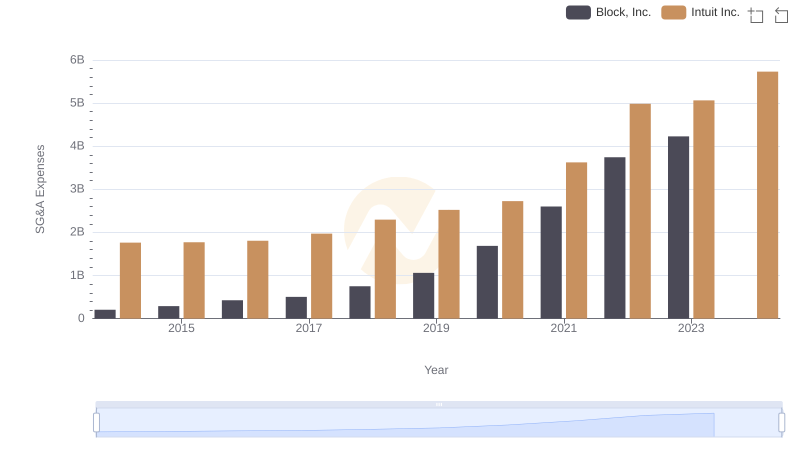

Intuit Inc. vs Block, Inc.: SG&A Expense Trends

Professional EBITDA Benchmarking: Intuit Inc. vs NXP Semiconductors N.V.