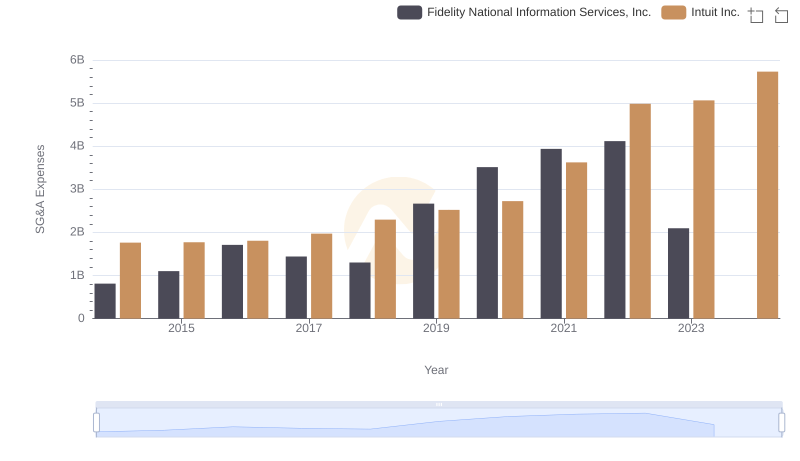

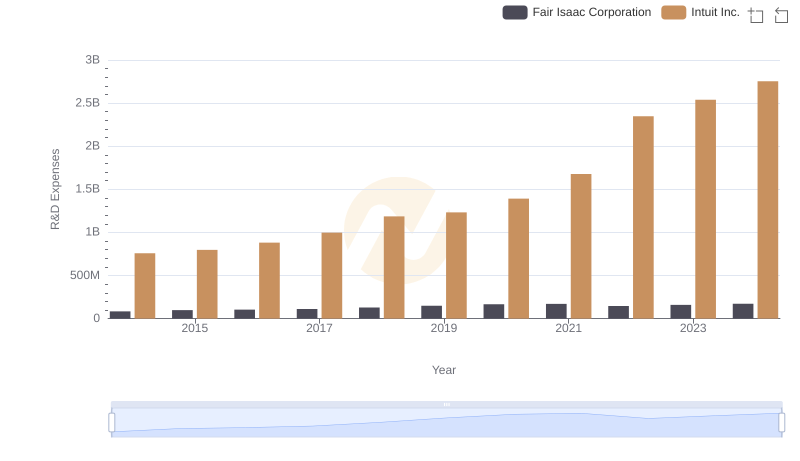

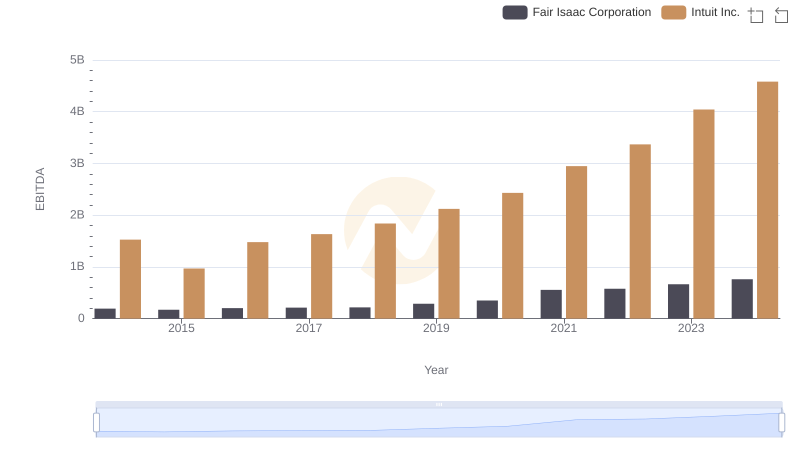

| __timestamp | Fair Isaac Corporation | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 278203000 | 1762000000 |

| Thursday, January 1, 2015 | 300002000 | 1771000000 |

| Friday, January 1, 2016 | 328940000 | 1807000000 |

| Sunday, January 1, 2017 | 339796000 | 1973000000 |

| Monday, January 1, 2018 | 380362000 | 2298000000 |

| Tuesday, January 1, 2019 | 414086000 | 2524000000 |

| Wednesday, January 1, 2020 | 420930000 | 2727000000 |

| Friday, January 1, 2021 | 396281000 | 3626000000 |

| Saturday, January 1, 2022 | 383863000 | 4986000000 |

| Sunday, January 1, 2023 | 400565000 | 5062000000 |

| Monday, January 1, 2024 | 462834000 | 5730000000 |

Igniting the spark of knowledge

In the ever-evolving landscape of financial technology, understanding the operational efficiency of industry giants is crucial. Over the past decade, Intuit Inc. and Fair Isaac Corporation have demonstrated distinct trajectories in their Selling, General, and Administrative (SG&A) expenses. From 2014 to 2024, Intuit's SG&A expenses surged by over 225%, reflecting its aggressive expansion and investment in innovation. In contrast, Fair Isaac Corporation's expenses grew by approximately 66%, indicating a more conservative approach.

These trends highlight differing strategic priorities, with Intuit focusing on rapid growth and Fair Isaac maintaining steady operational efficiency.

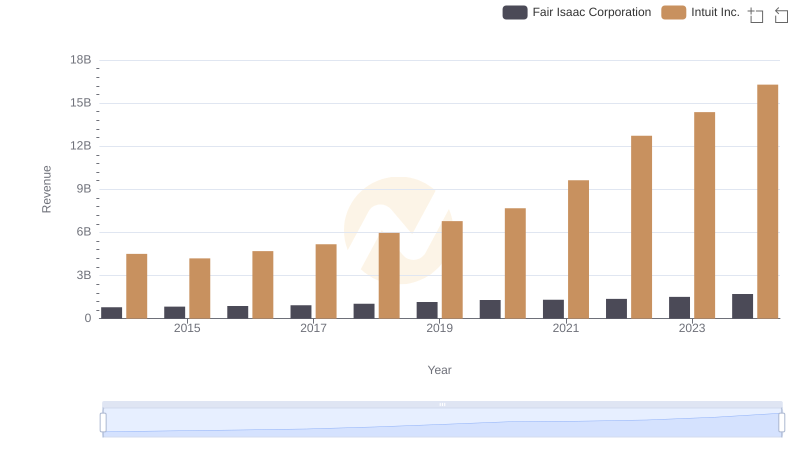

Revenue Insights: Intuit Inc. and Fair Isaac Corporation Performance Compared

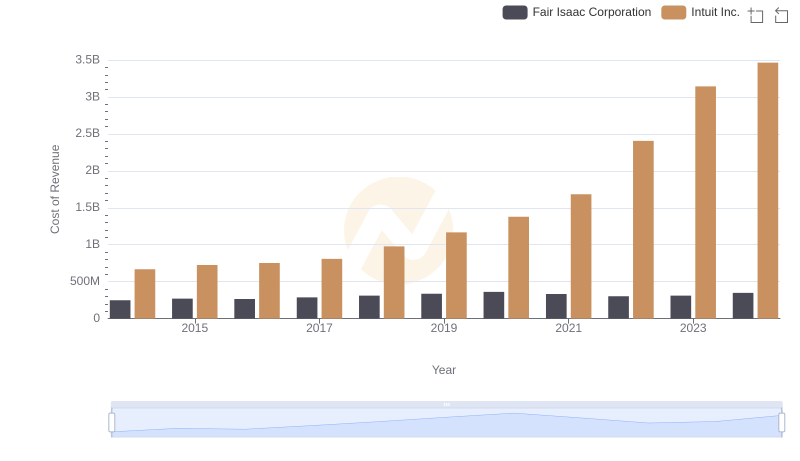

Cost of Revenue Comparison: Intuit Inc. vs Fair Isaac Corporation

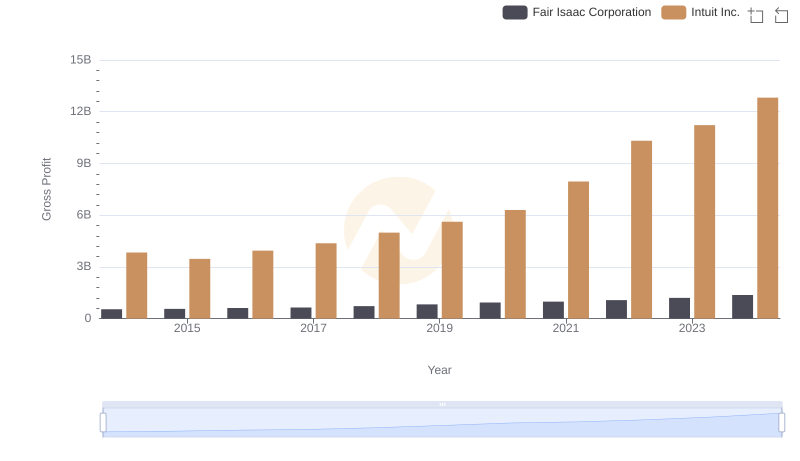

Intuit Inc. and Fair Isaac Corporation: A Detailed Gross Profit Analysis

Comparing SG&A Expenses: Intuit Inc. vs Fidelity National Information Services, Inc. Trends and Insights

R&D Spending Showdown: Intuit Inc. vs Fair Isaac Corporation

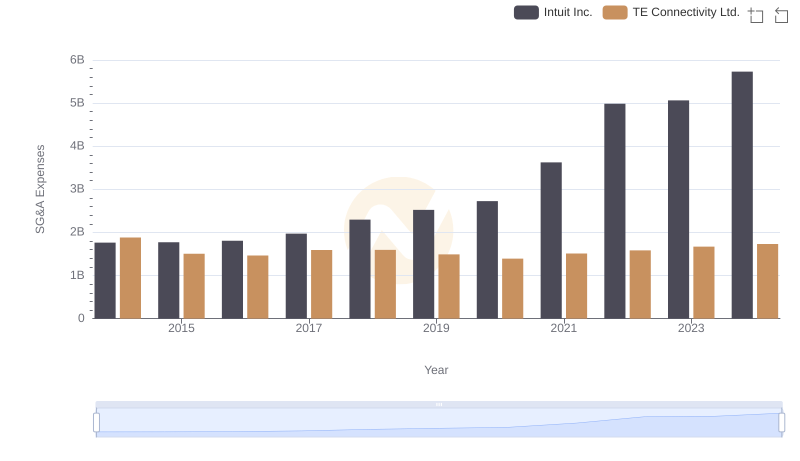

Cost Management Insights: SG&A Expenses for Intuit Inc. and TE Connectivity Ltd.

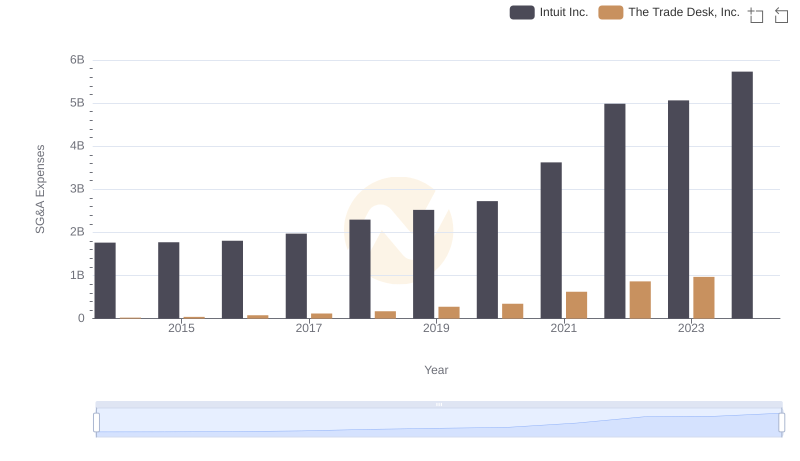

Intuit Inc. vs The Trade Desk, Inc.: SG&A Expense Trends

Cost Management Insights: SG&A Expenses for Intuit Inc. and NXP Semiconductors N.V.

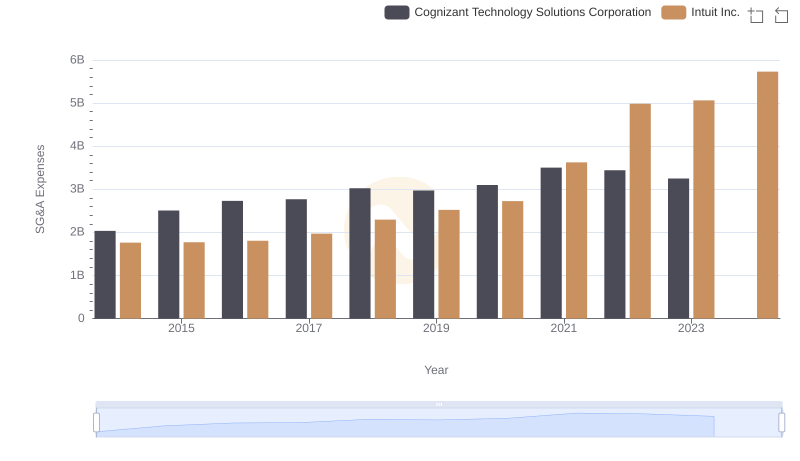

Cost Management Insights: SG&A Expenses for Intuit Inc. and Cognizant Technology Solutions Corporation

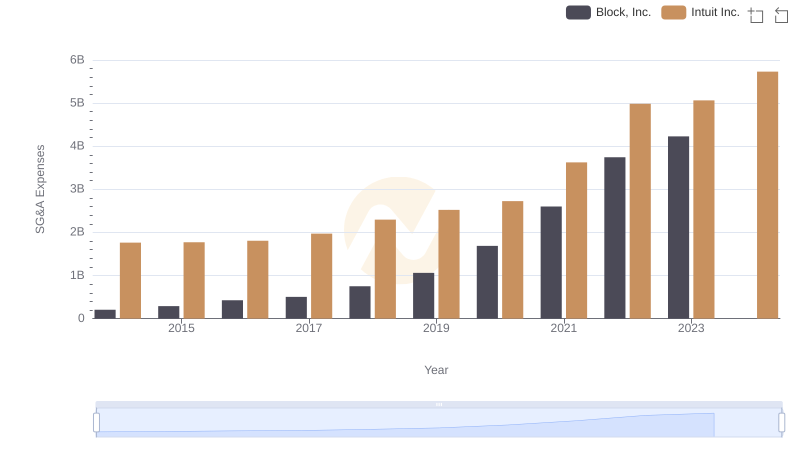

Intuit Inc. vs Block, Inc.: SG&A Expense Trends

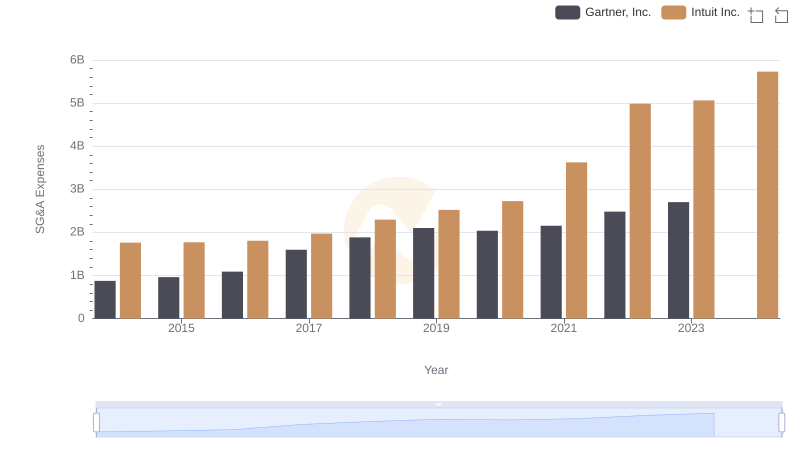

Intuit Inc. vs Gartner, Inc.: SG&A Expense Trends

EBITDA Analysis: Evaluating Intuit Inc. Against Fair Isaac Corporation