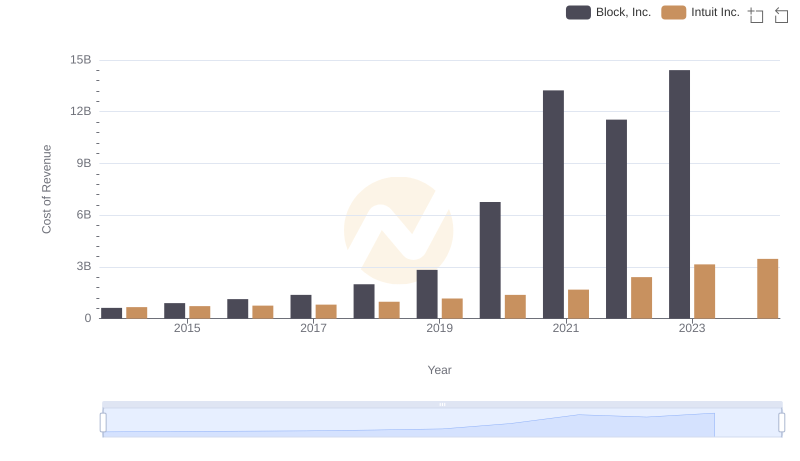

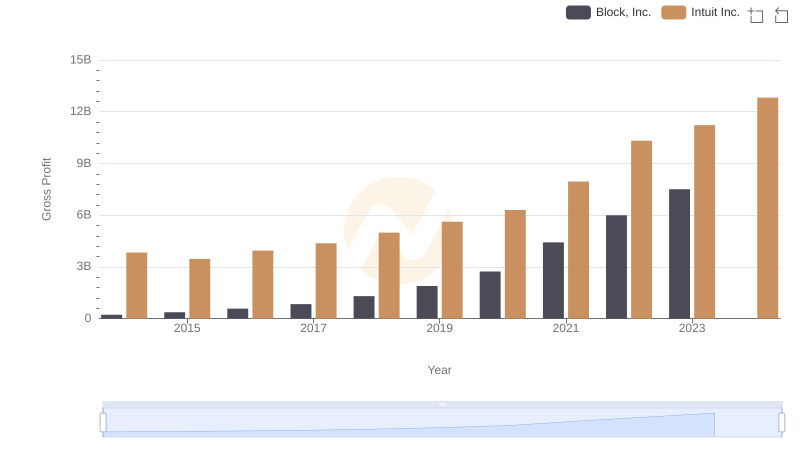

| __timestamp | Block, Inc. | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 850192000 | 4506000000 |

| Thursday, January 1, 2015 | 1267118000 | 4192000000 |

| Friday, January 1, 2016 | 1708721000 | 4694000000 |

| Sunday, January 1, 2017 | 2214253000 | 5177000000 |

| Monday, January 1, 2018 | 3298177000 | 5964000000 |

| Tuesday, January 1, 2019 | 4713500000 | 6784000000 |

| Wednesday, January 1, 2020 | 9497578000 | 7679000000 |

| Friday, January 1, 2021 | 17661203000 | 9633000000 |

| Saturday, January 1, 2022 | 17531587000 | 12726000000 |

| Sunday, January 1, 2023 | 21915623000 | 14368000000 |

| Monday, January 1, 2024 | 16285000000 |

Igniting the spark of knowledge

In the ever-evolving landscape of financial technology, Intuit Inc. and Block, Inc. (formerly Square) have emerged as formidable players. Over the past decade, these companies have demonstrated remarkable revenue growth, reflecting their strategic innovations and market adaptability.

From 2014 to 2023, Block, Inc. experienced a staggering increase in revenue, growing by over 2,500%. This meteoric rise underscores its aggressive expansion and diversification strategies. In contrast, Intuit Inc. showcased a steady and robust growth trajectory, with its revenue increasing by approximately 220% during the same period. This consistent growth highlights Intuit's stronghold in the financial software sector.

Interestingly, while Block, Inc. saw a significant leap in 2020, Intuit Inc. maintained a steady climb, even reaching a peak in 2024. However, data for Block, Inc. in 2024 is missing, leaving room for speculation on its future performance. As these giants continue to innovate, their revenue trends offer valuable insights into the fintech industry's dynamic nature.

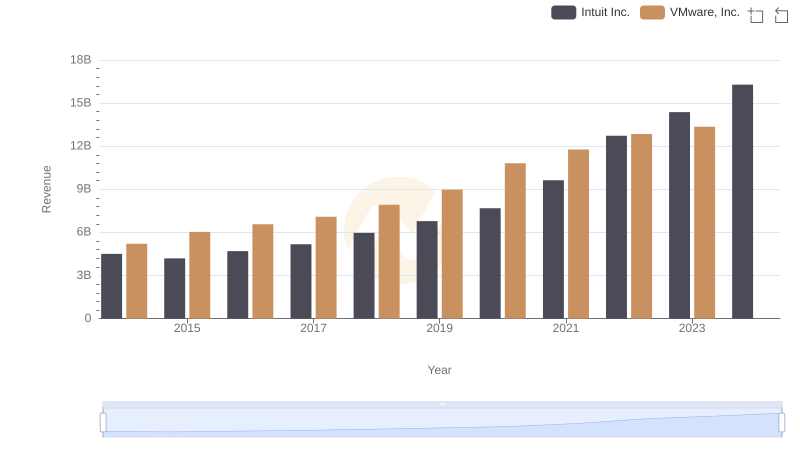

Intuit Inc. vs VMware, Inc.: Examining Key Revenue Metrics

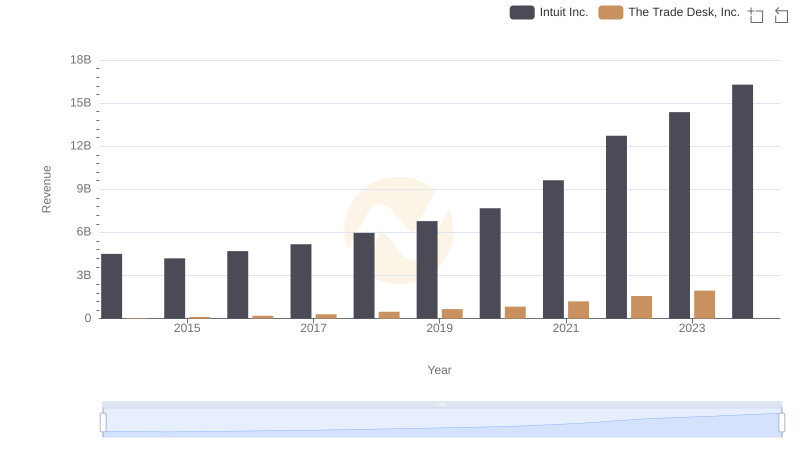

Revenue Insights: Intuit Inc. and The Trade Desk, Inc. Performance Compared

Intuit Inc. and NXP Semiconductors N.V.: A Comprehensive Revenue Analysis

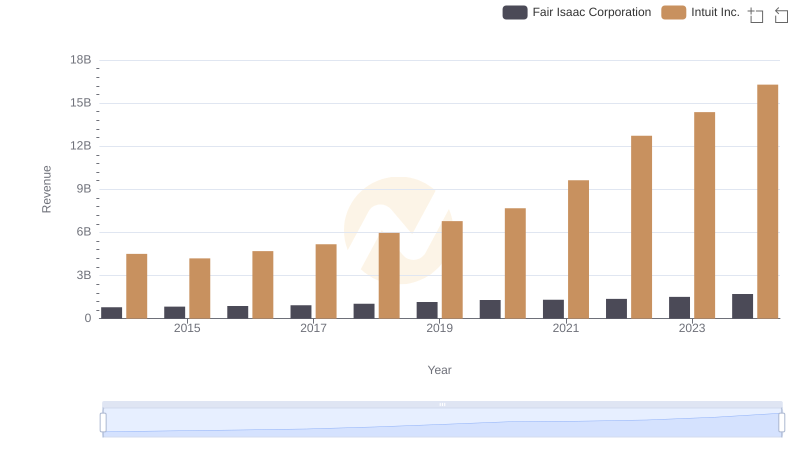

Revenue Insights: Intuit Inc. and Fair Isaac Corporation Performance Compared

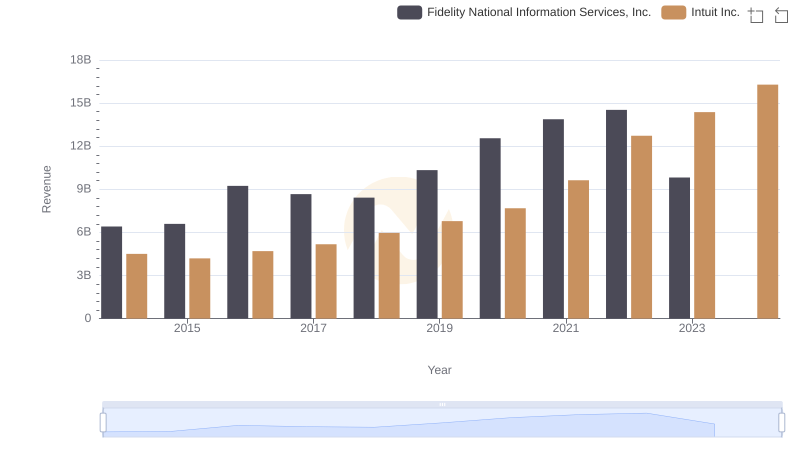

Revenue Insights: Intuit Inc. and Fidelity National Information Services, Inc. Performance Compared

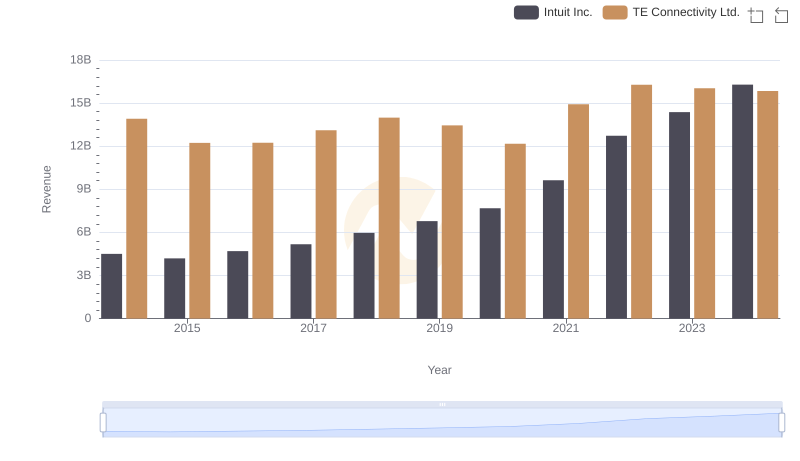

Annual Revenue Comparison: Intuit Inc. vs TE Connectivity Ltd.

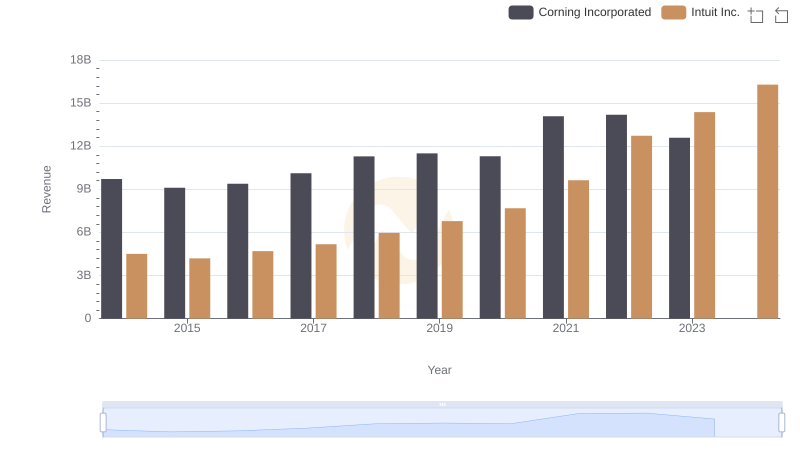

Intuit Inc. vs Corning Incorporated: Examining Key Revenue Metrics

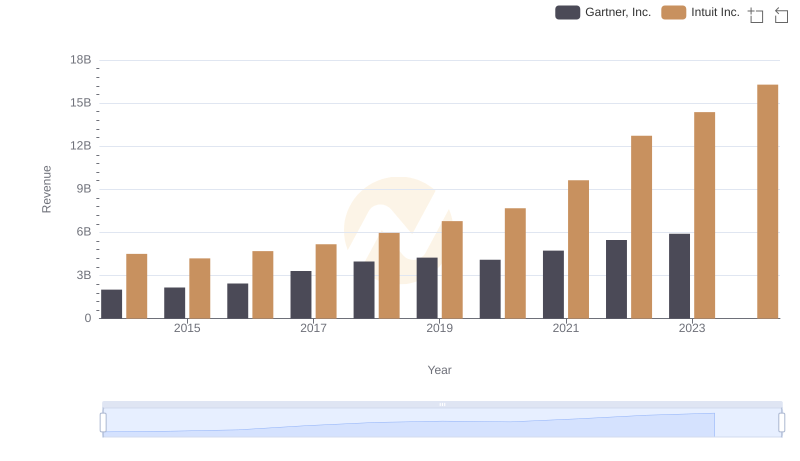

Intuit Inc. and Gartner, Inc.: A Comprehensive Revenue Analysis

Cost Insights: Breaking Down Intuit Inc. and Block, Inc.'s Expenses

Gross Profit Comparison: Intuit Inc. and Block, Inc. Trends

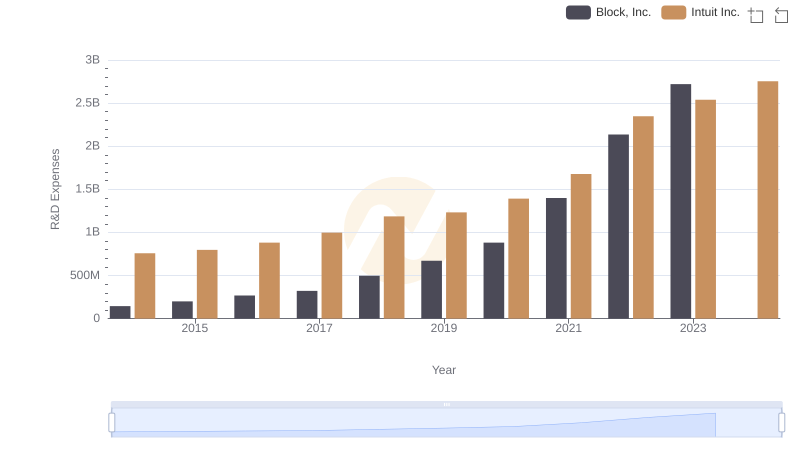

Comparing Innovation Spending: Intuit Inc. and Block, Inc.

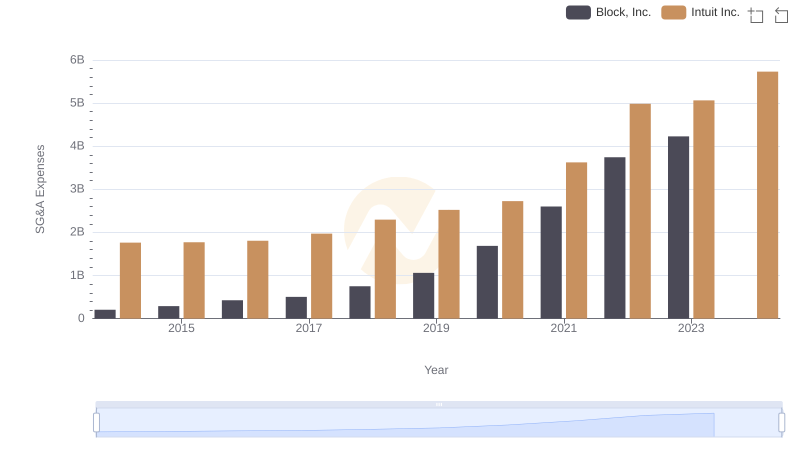

Intuit Inc. vs Block, Inc.: SG&A Expense Trends