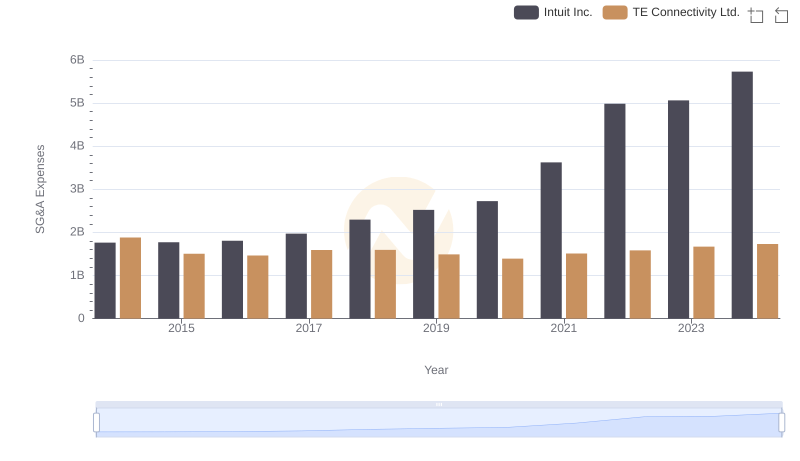

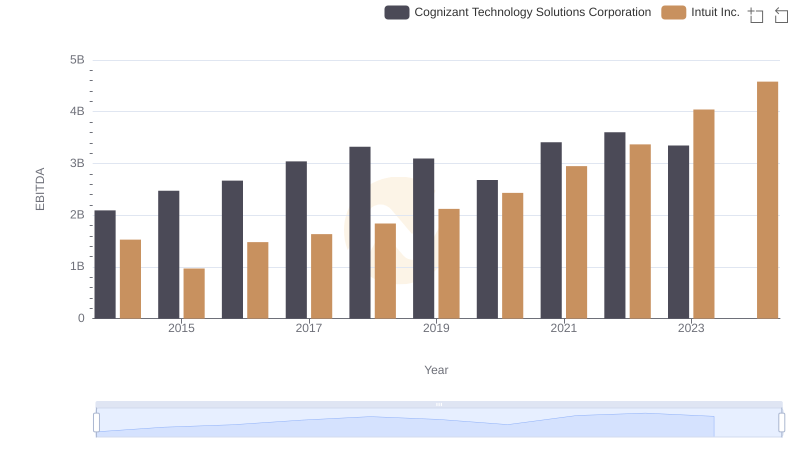

| __timestamp | Cognizant Technology Solutions Corporation | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2037021000 | 1762000000 |

| Thursday, January 1, 2015 | 2508600000 | 1771000000 |

| Friday, January 1, 2016 | 2731000000 | 1807000000 |

| Sunday, January 1, 2017 | 2769000000 | 1973000000 |

| Monday, January 1, 2018 | 3026000000 | 2298000000 |

| Tuesday, January 1, 2019 | 2972000000 | 2524000000 |

| Wednesday, January 1, 2020 | 3100000000 | 2727000000 |

| Friday, January 1, 2021 | 3503000000 | 3626000000 |

| Saturday, January 1, 2022 | 3443000000 | 4986000000 |

| Sunday, January 1, 2023 | 3252000000 | 5062000000 |

| Monday, January 1, 2024 | 3223000000 | 5730000000 |

Cracking the code

In the ever-evolving tech landscape, effective cost management is crucial for sustained growth. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of Intuit Inc. and Cognizant Technology Solutions Corporation from 2014 to 2023. Over this decade, Intuit's SG&A expenses surged by approximately 187%, peaking at $5.73 billion in 2024, reflecting its aggressive expansion and innovation strategies. In contrast, Cognizant's expenses grew by about 60%, reaching a high of $3.5 billion in 2021, before slightly declining. This divergence highlights Intuit's dynamic approach compared to Cognizant's more stable expenditure pattern. The data underscores the importance of strategic financial planning in maintaining competitive advantage in the tech industry. Missing data for Cognizant in 2024 suggests a need for further analysis to understand future trends.

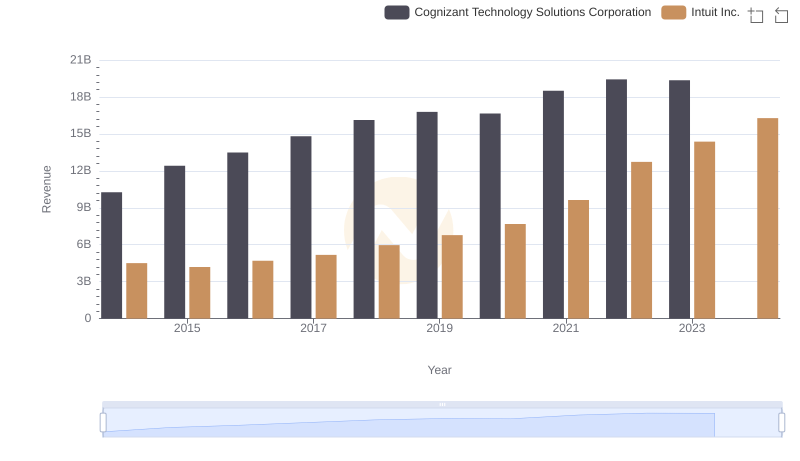

Revenue Insights: Intuit Inc. and Cognizant Technology Solutions Corporation Performance Compared

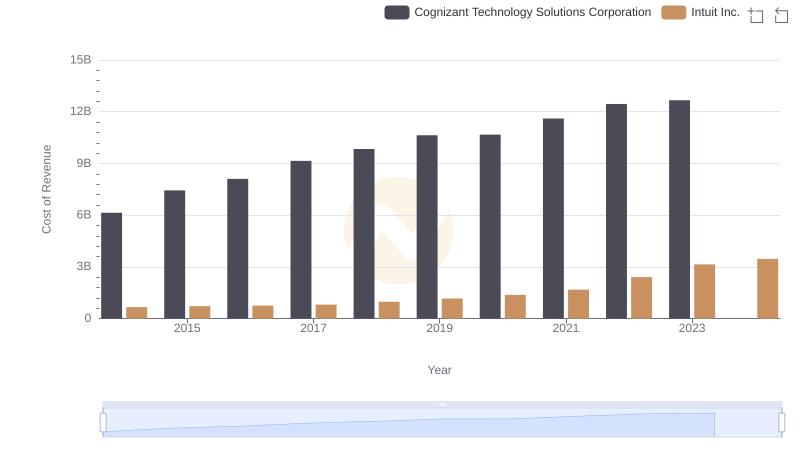

Cost Insights: Breaking Down Intuit Inc. and Cognizant Technology Solutions Corporation's Expenses

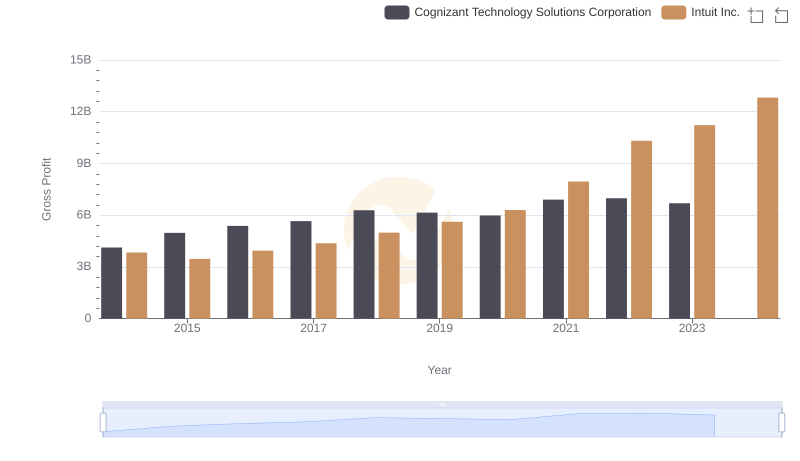

Gross Profit Analysis: Comparing Intuit Inc. and Cognizant Technology Solutions Corporation

Cost Management Insights: SG&A Expenses for Intuit Inc. and TE Connectivity Ltd.

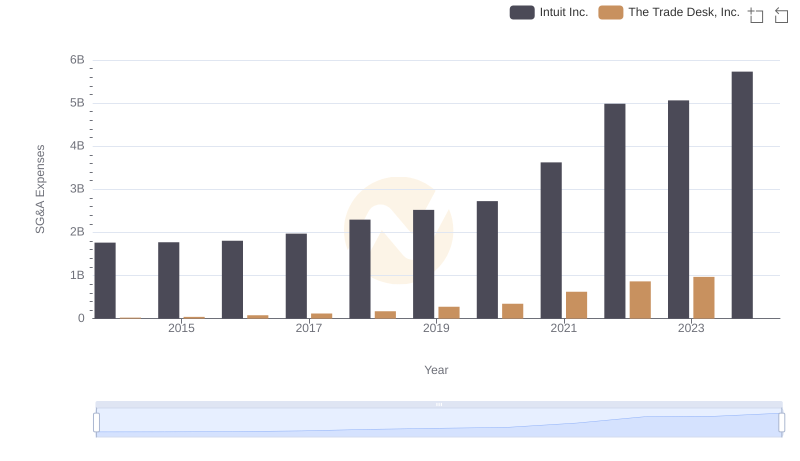

Intuit Inc. vs The Trade Desk, Inc.: SG&A Expense Trends

Cost Management Insights: SG&A Expenses for Intuit Inc. and NXP Semiconductors N.V.

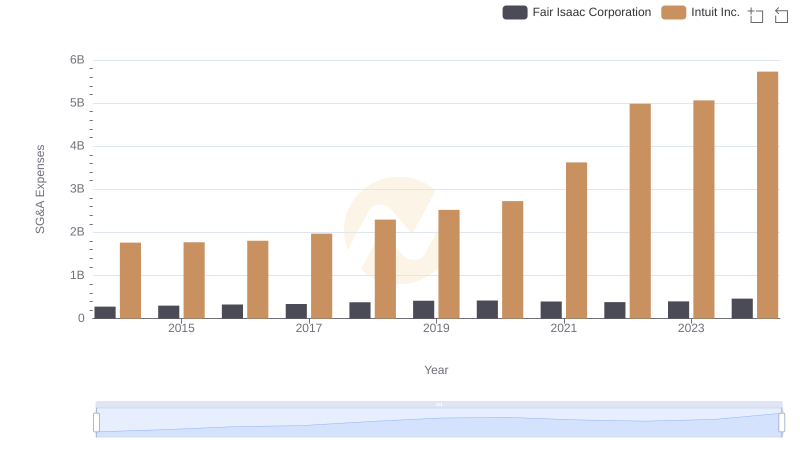

Comparing SG&A Expenses: Intuit Inc. vs Fair Isaac Corporation Trends and Insights

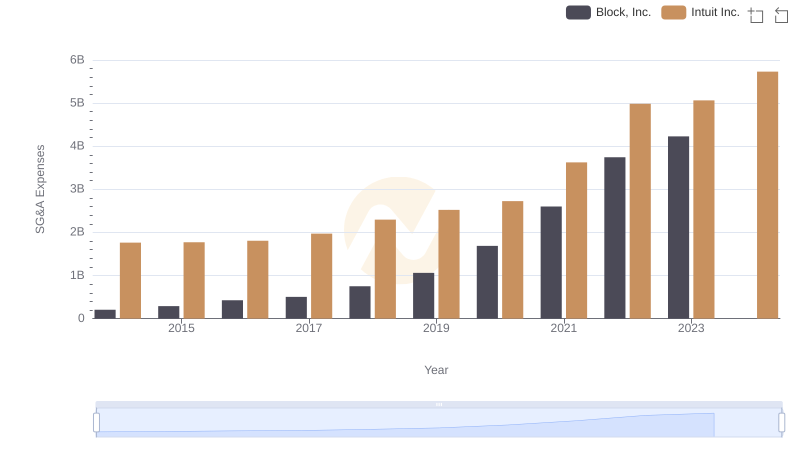

Intuit Inc. vs Block, Inc.: SG&A Expense Trends

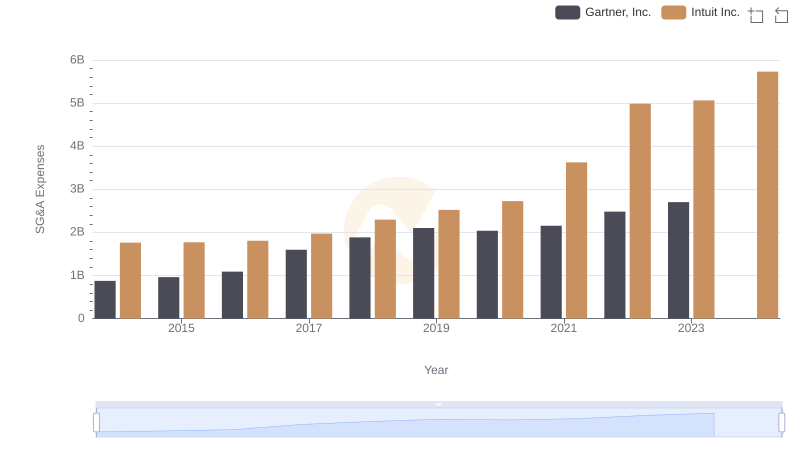

Intuit Inc. vs Gartner, Inc.: SG&A Expense Trends

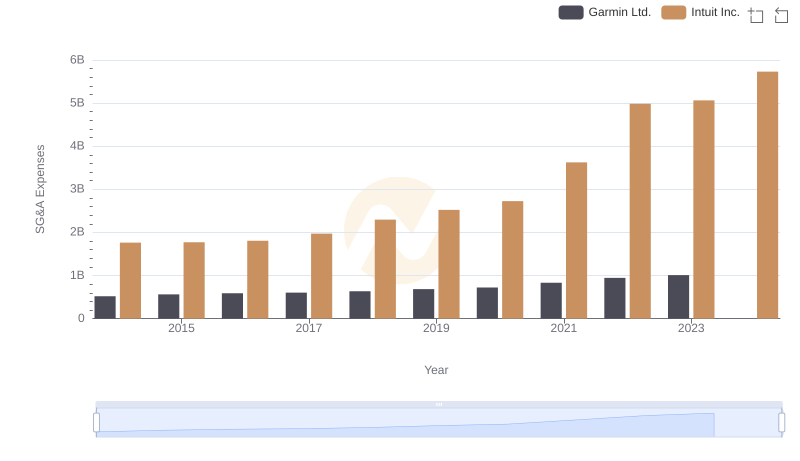

Who Optimizes SG&A Costs Better? Intuit Inc. or Garmin Ltd.

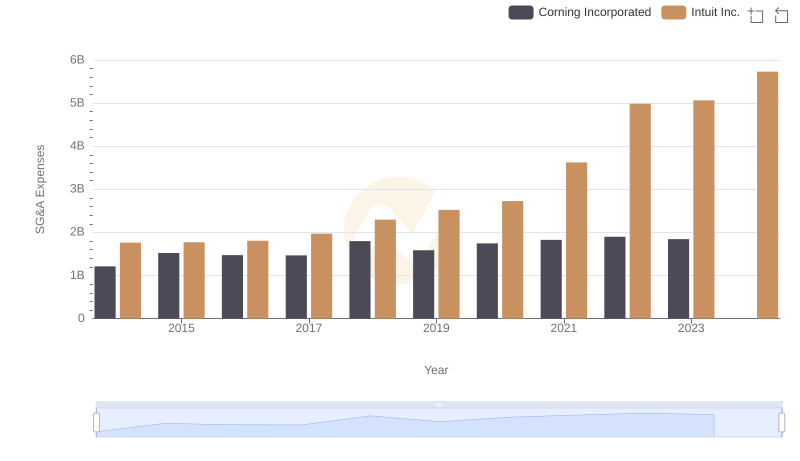

Selling, General, and Administrative Costs: Intuit Inc. vs Corning Incorporated

Comparative EBITDA Analysis: Intuit Inc. vs Cognizant Technology Solutions Corporation