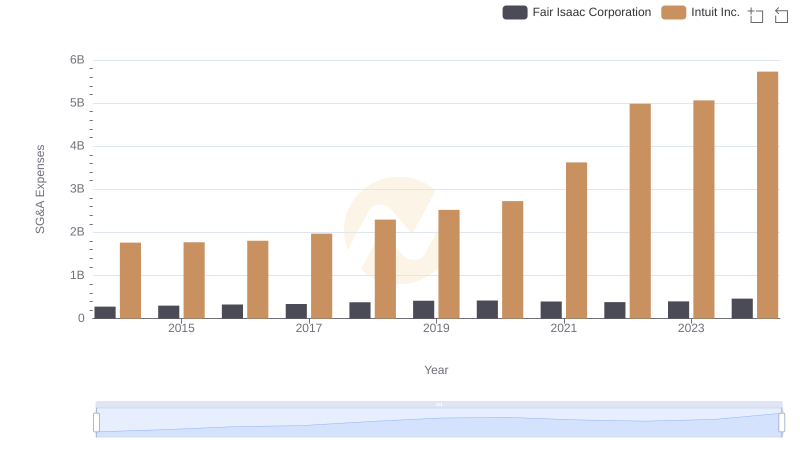

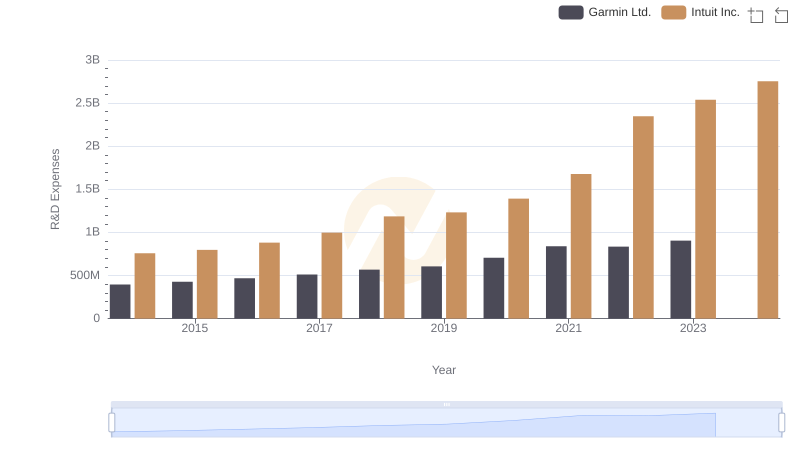

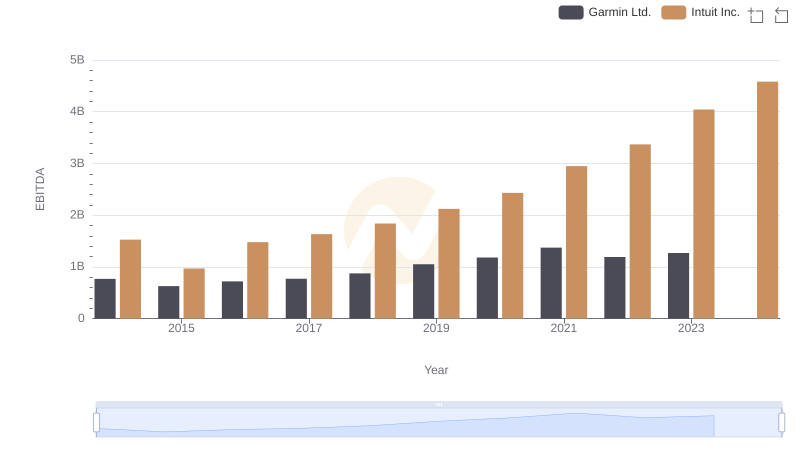

| __timestamp | Garmin Ltd. | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 518665000 | 1762000000 |

| Thursday, January 1, 2015 | 562080000 | 1771000000 |

| Friday, January 1, 2016 | 587701000 | 1807000000 |

| Sunday, January 1, 2017 | 602670000 | 1973000000 |

| Monday, January 1, 2018 | 633571000 | 2298000000 |

| Tuesday, January 1, 2019 | 683024000 | 2524000000 |

| Wednesday, January 1, 2020 | 721411000 | 2727000000 |

| Friday, January 1, 2021 | 831815000 | 3626000000 |

| Saturday, January 1, 2022 | 944003000 | 4986000000 |

| Sunday, January 1, 2023 | 1008099000 | 5062000000 |

| Monday, January 1, 2024 | 1108960000 | 5730000000 |

In pursuit of knowledge

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, Intuit Inc. and Garmin Ltd. have showcased contrasting strategies in optimizing these costs.

From 2014 to 2023, Intuit's SG&A expenses have surged by approximately 187%, reflecting its aggressive growth strategy. This increase, from $1.76 billion to $5.06 billion, underscores Intuit's investment in expanding its market reach and enhancing its product offerings.

Garmin, on the other hand, has seen a more moderate rise of about 94% in SG&A expenses, from $518 million to $1.01 billion. This suggests a more conservative approach, focusing on sustainable growth and operational efficiency.

As we look to 2024, Intuit's data continues, while Garmin's is yet to be revealed, leaving room for speculation on future strategies.

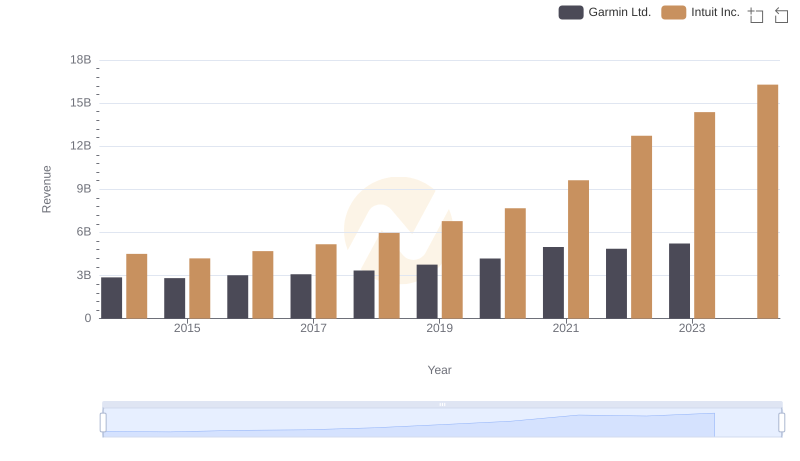

Revenue Showdown: Intuit Inc. vs Garmin Ltd.

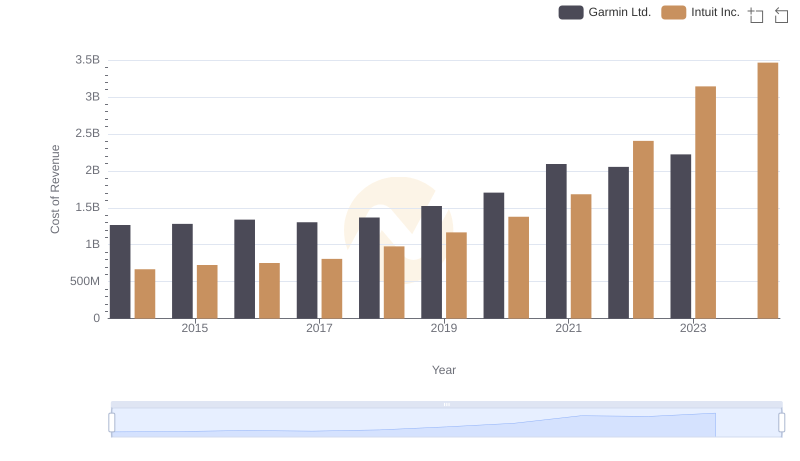

Cost of Revenue Comparison: Intuit Inc. vs Garmin Ltd.

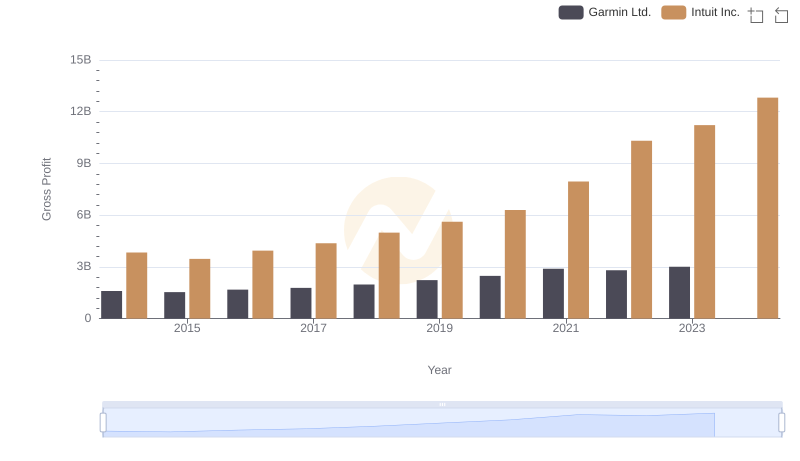

Intuit Inc. vs Garmin Ltd.: A Gross Profit Performance Breakdown

Comparing SG&A Expenses: Intuit Inc. vs Fair Isaac Corporation Trends and Insights

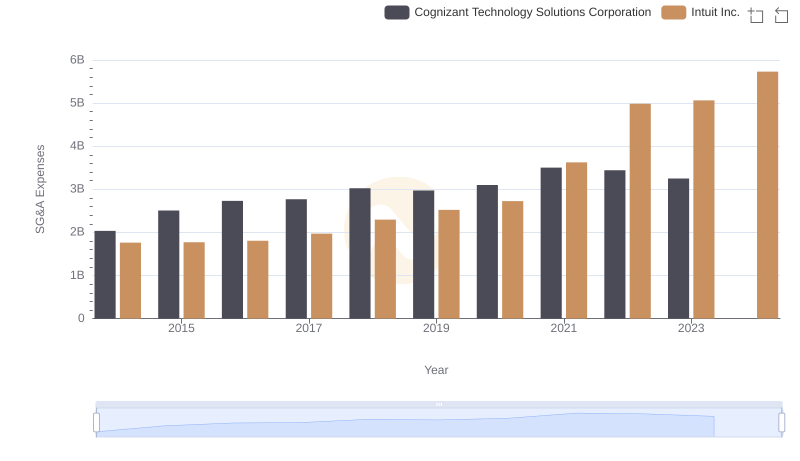

Cost Management Insights: SG&A Expenses for Intuit Inc. and Cognizant Technology Solutions Corporation

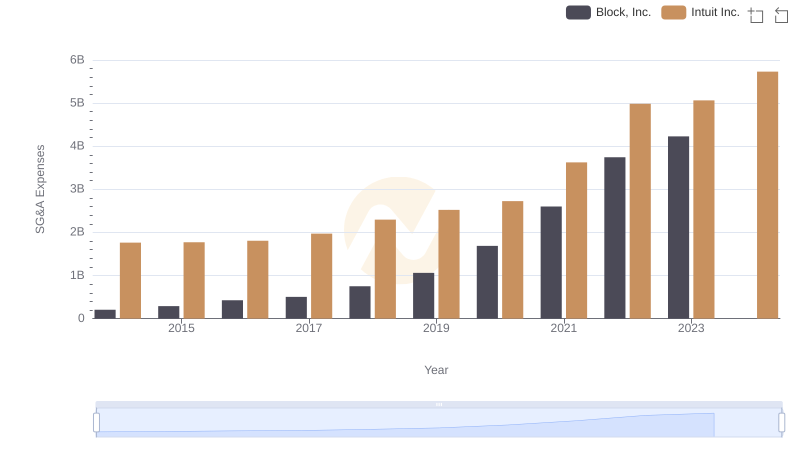

Intuit Inc. vs Block, Inc.: SG&A Expense Trends

Intuit Inc. vs Garmin Ltd.: Strategic Focus on R&D Spending

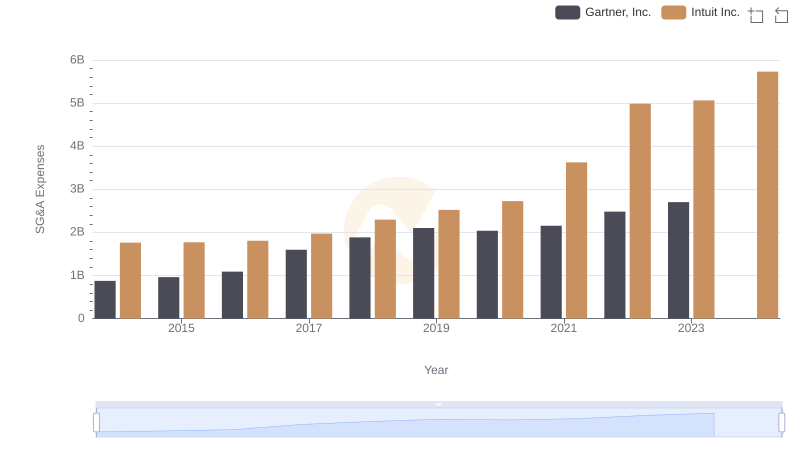

Intuit Inc. vs Gartner, Inc.: SG&A Expense Trends

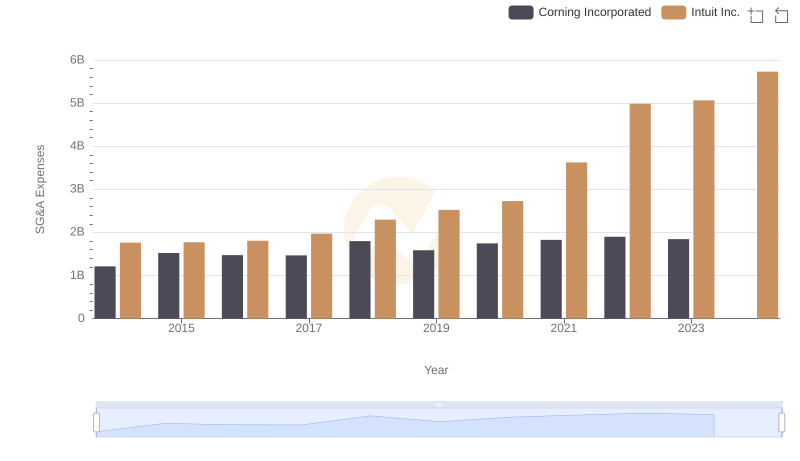

Selling, General, and Administrative Costs: Intuit Inc. vs Corning Incorporated

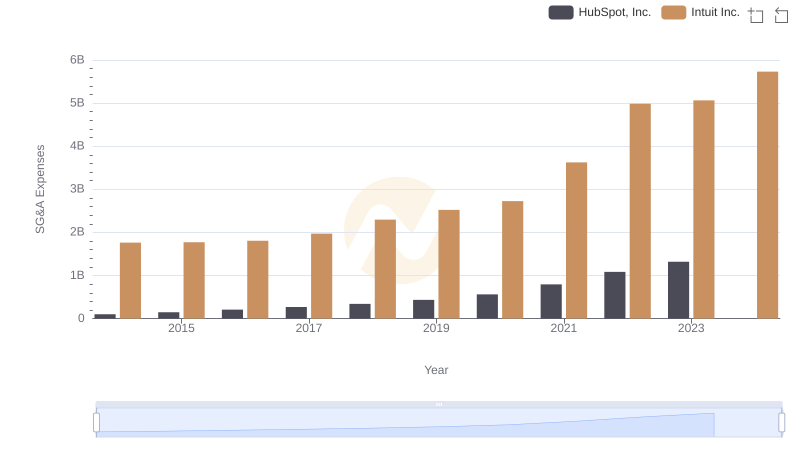

Intuit Inc. or HubSpot, Inc.: Who Manages SG&A Costs Better?

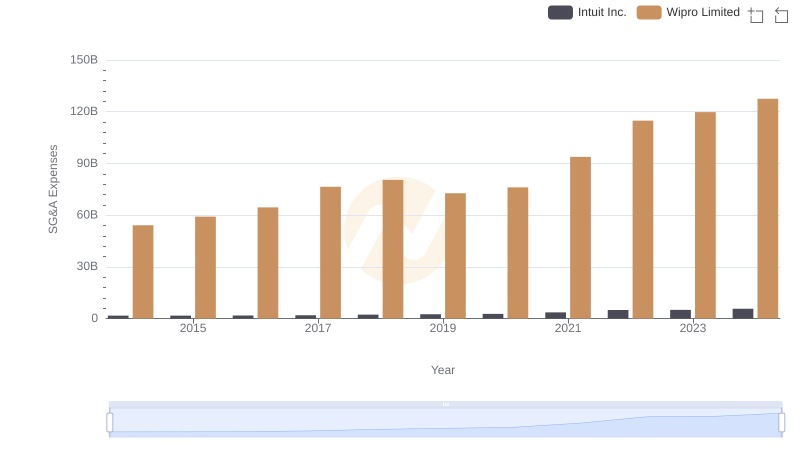

Breaking Down SG&A Expenses: Intuit Inc. vs Wipro Limited

Intuit Inc. vs Garmin Ltd.: In-Depth EBITDA Performance Comparison