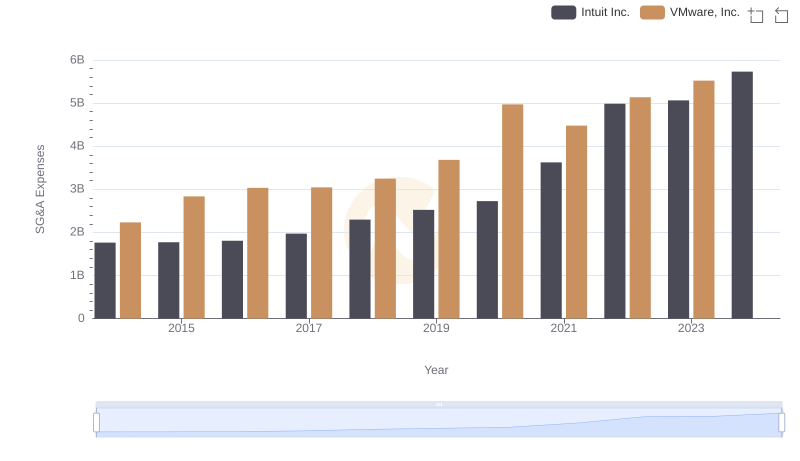

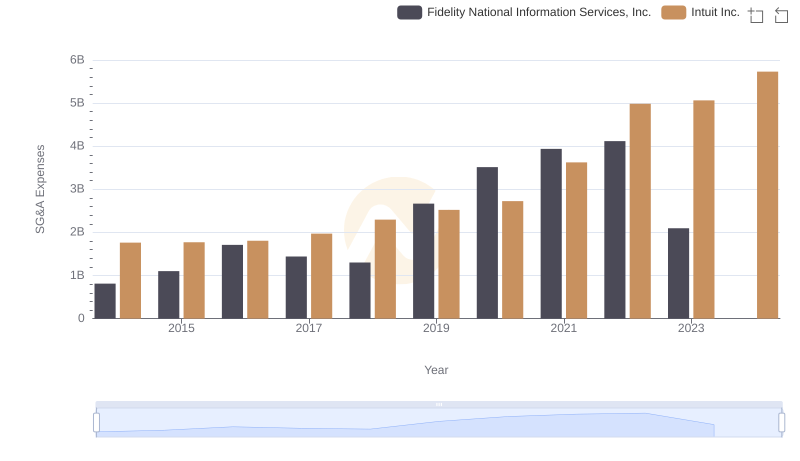

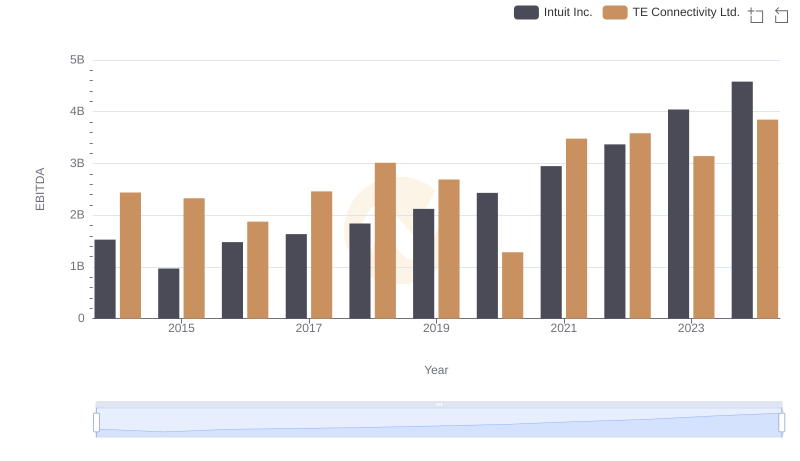

| __timestamp | Intuit Inc. | TE Connectivity Ltd. |

|---|---|---|

| Wednesday, January 1, 2014 | 1762000000 | 1882000000 |

| Thursday, January 1, 2015 | 1771000000 | 1504000000 |

| Friday, January 1, 2016 | 1807000000 | 1463000000 |

| Sunday, January 1, 2017 | 1973000000 | 1591000000 |

| Monday, January 1, 2018 | 2298000000 | 1594000000 |

| Tuesday, January 1, 2019 | 2524000000 | 1490000000 |

| Wednesday, January 1, 2020 | 2727000000 | 1392000000 |

| Friday, January 1, 2021 | 3626000000 | 1512000000 |

| Saturday, January 1, 2022 | 4986000000 | 1584000000 |

| Sunday, January 1, 2023 | 5062000000 | 1670000000 |

| Monday, January 1, 2024 | 5730000000 | 1732000000 |

Unleashing insights

In the ever-evolving landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Intuit Inc. and TE Connectivity Ltd. offer a fascinating study in contrasts over the past decade.

From 2014 to 2024, Intuit Inc. has seen a remarkable 225% increase in SG&A expenses, reflecting its aggressive growth strategy and investment in innovation. This upward trend, peaking in 2024, underscores Intuit's commitment to expanding its market presence and enhancing customer experience.

Conversely, TE Connectivity Ltd. has maintained a more stable SG&A expense profile, with only a 9% increase over the same period. This stability highlights TE Connectivity's focus on operational efficiency and cost control, ensuring steady growth without compromising profitability.

These insights reveal the diverse strategies companies employ to navigate the complexities of cost management in today's competitive market.

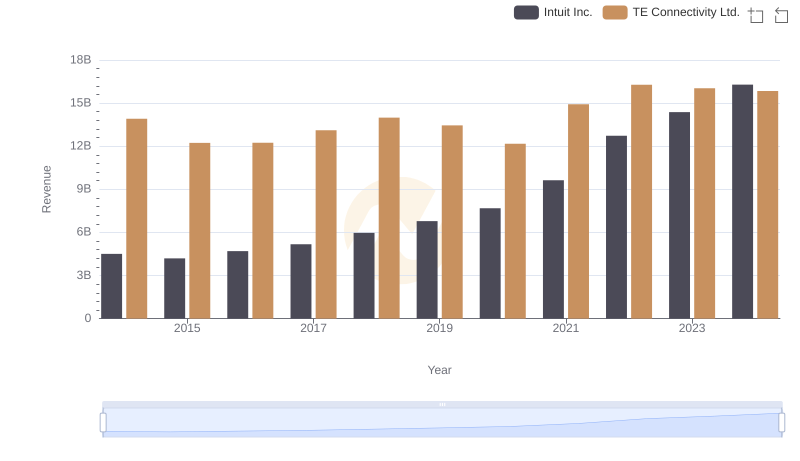

Annual Revenue Comparison: Intuit Inc. vs TE Connectivity Ltd.

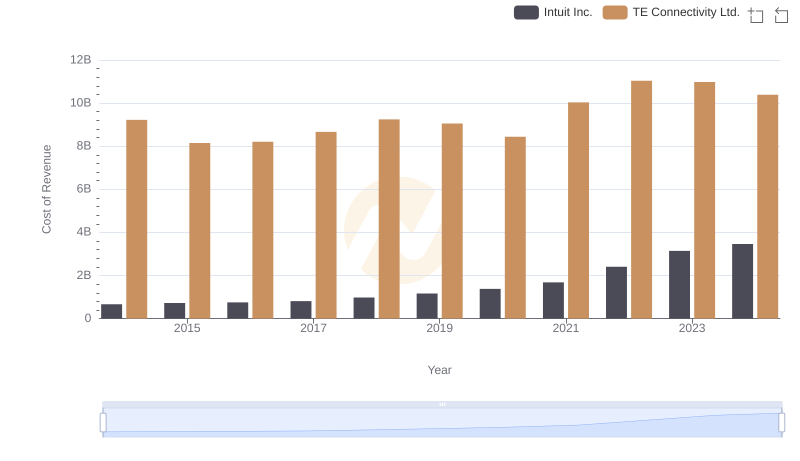

Cost of Revenue: Key Insights for Intuit Inc. and TE Connectivity Ltd.

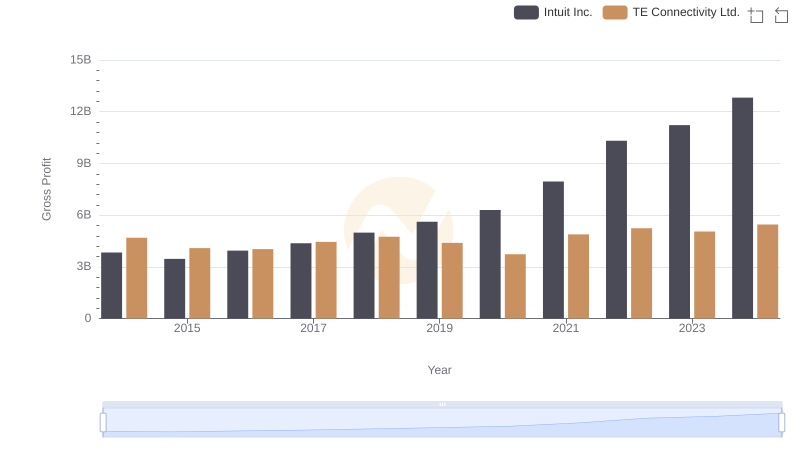

Intuit Inc. vs TE Connectivity Ltd.: A Gross Profit Performance Breakdown

Cost Management Insights: SG&A Expenses for Intuit Inc. and VMware, Inc.

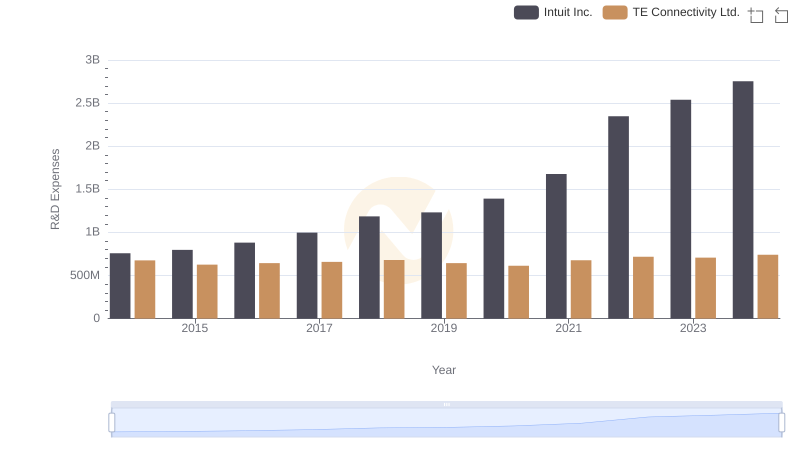

Intuit Inc. or TE Connectivity Ltd.: Who Invests More in Innovation?

Comparing SG&A Expenses: Intuit Inc. vs Fidelity National Information Services, Inc. Trends and Insights

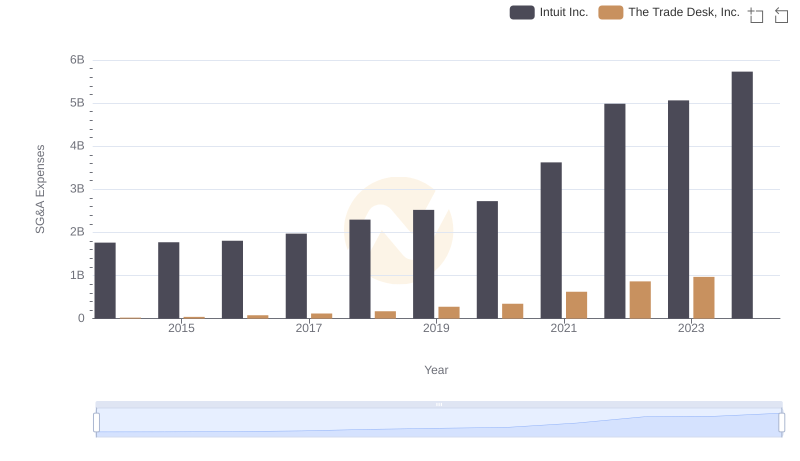

Intuit Inc. vs The Trade Desk, Inc.: SG&A Expense Trends

Cost Management Insights: SG&A Expenses for Intuit Inc. and NXP Semiconductors N.V.

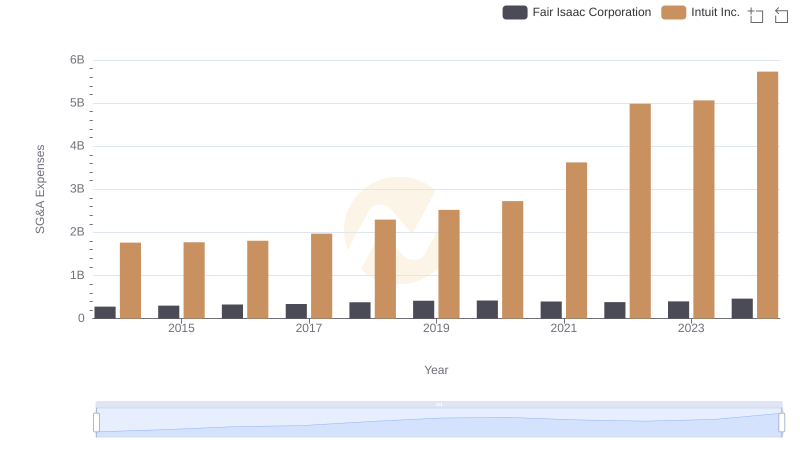

Comparing SG&A Expenses: Intuit Inc. vs Fair Isaac Corporation Trends and Insights

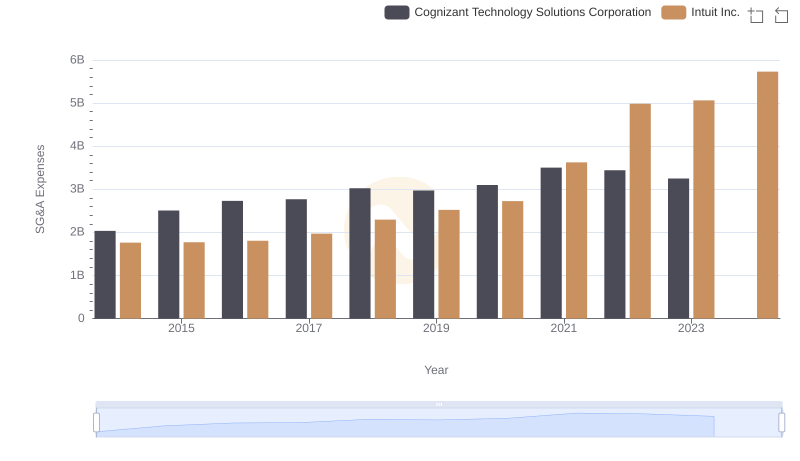

Cost Management Insights: SG&A Expenses for Intuit Inc. and Cognizant Technology Solutions Corporation

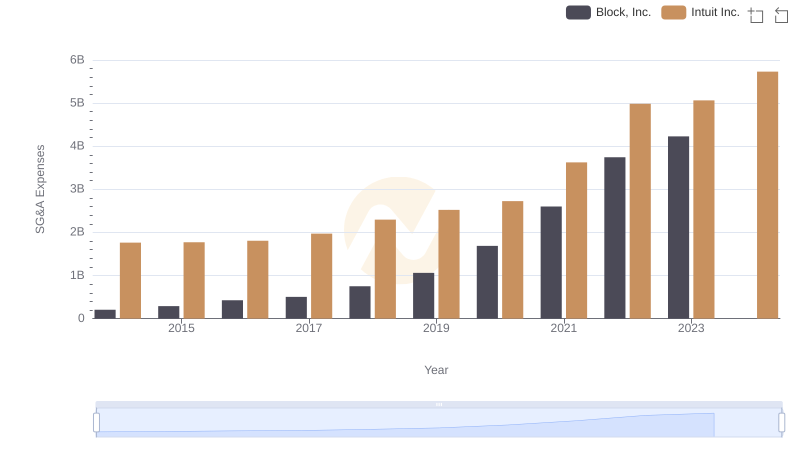

Intuit Inc. vs Block, Inc.: SG&A Expense Trends

Intuit Inc. vs TE Connectivity Ltd.: In-Depth EBITDA Performance Comparison