| __timestamp | Fiserv, Inc. | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2185000000 | 3838000000 |

| Thursday, January 1, 2015 | 2345000000 | 3467000000 |

| Friday, January 1, 2016 | 2546000000 | 3942000000 |

| Sunday, January 1, 2017 | 2672000000 | 4368000000 |

| Monday, January 1, 2018 | 2754000000 | 4987000000 |

| Tuesday, January 1, 2019 | 4878000000 | 5617000000 |

| Wednesday, January 1, 2020 | 7040000000 | 6301000000 |

| Friday, January 1, 2021 | 8098000000 | 7950000000 |

| Saturday, January 1, 2022 | 9745000000 | 10320000000 |

| Sunday, January 1, 2023 | 11423000000 | 11225000000 |

| Monday, January 1, 2024 | 20456000000 | 12820000000 |

Infusing magic into the data realm

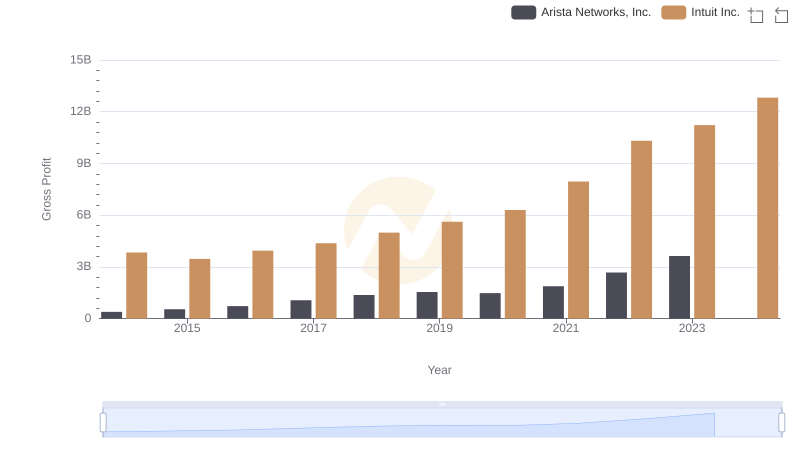

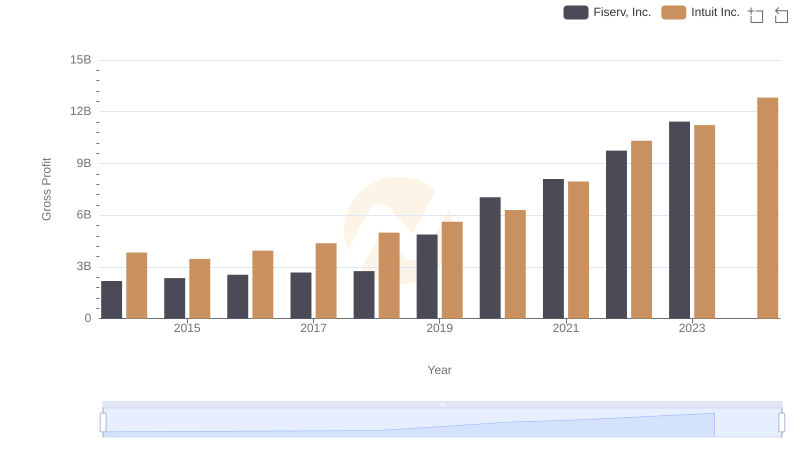

In the ever-evolving landscape of financial technology, Intuit Inc. and Fiserv, Inc. have emerged as titans, showcasing impressive growth in gross profit over the past decade. From 2014 to 2023, Intuit's gross profit surged by approximately 192%, while Fiserv's increased by an astounding 423%. This remarkable growth highlights the dynamic nature of the fintech industry and the strategic maneuvers these companies have employed to stay ahead.

In 2014, Intuit's gross profit was around 3.8 billion, while Fiserv's was approximately 2.2 billion. Fast forward to 2023, and Intuit's gross profit reached 11.2 billion, with Fiserv not far behind at 11.4 billion. Notably, Intuit's data for 2024 is missing, leaving room for speculation on its future trajectory.

As we look to the future, the question remains: will Intuit maintain its upward momentum, or will Fiserv continue to close the gap? Only time will tell.

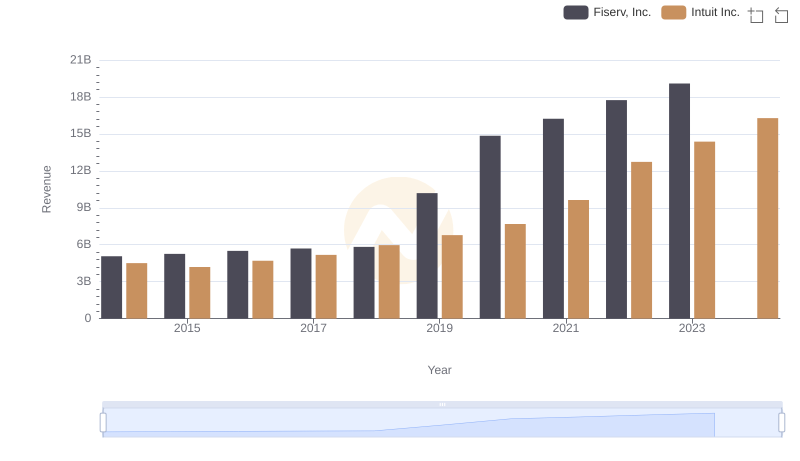

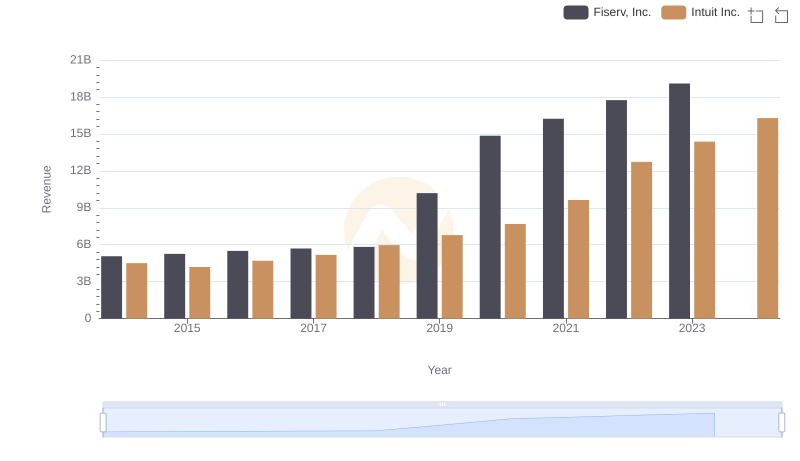

Comparing Revenue Performance: Intuit Inc. or Fiserv, Inc.?

Annual Revenue Comparison: Intuit Inc. vs Fiserv, Inc.

Intuit Inc. vs Arista Networks, Inc.: A Gross Profit Performance Breakdown

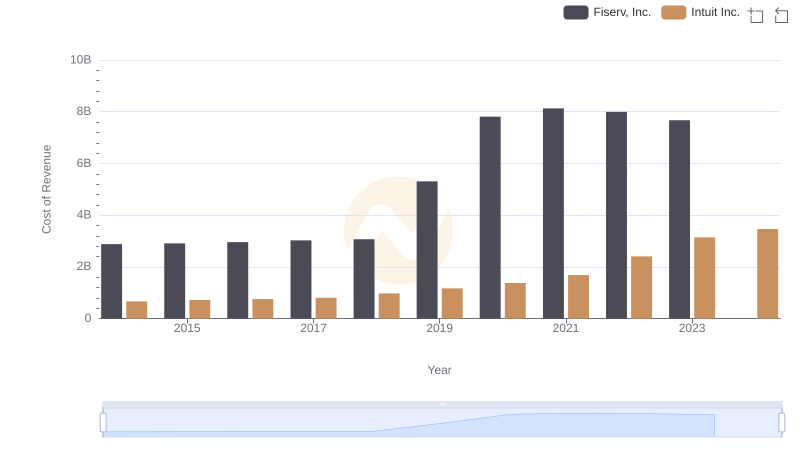

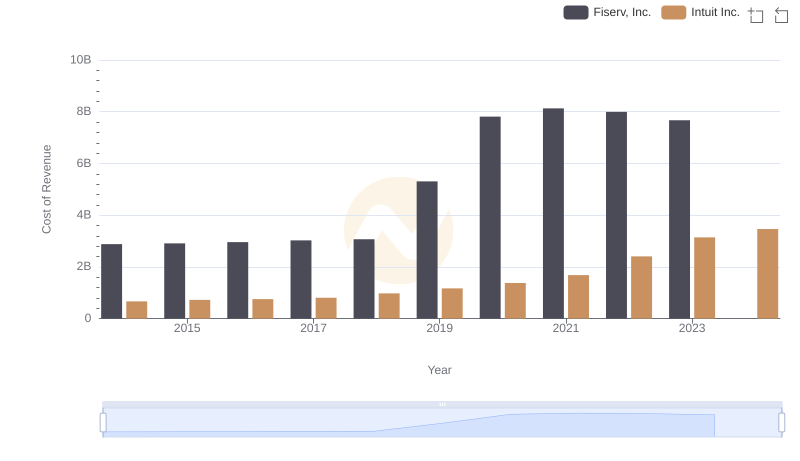

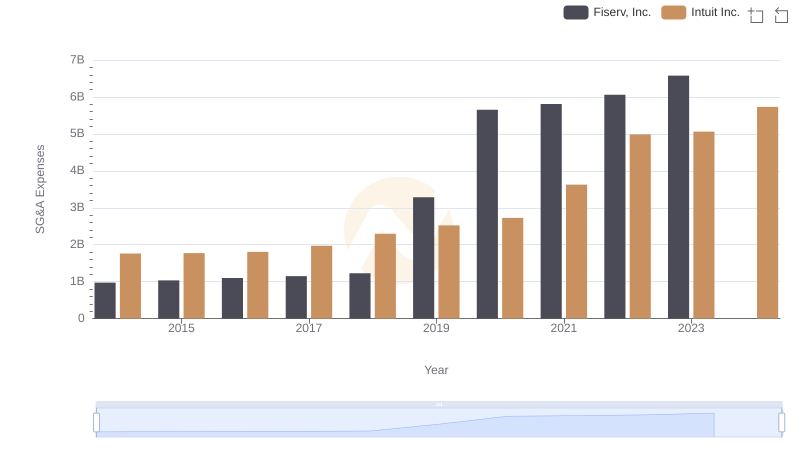

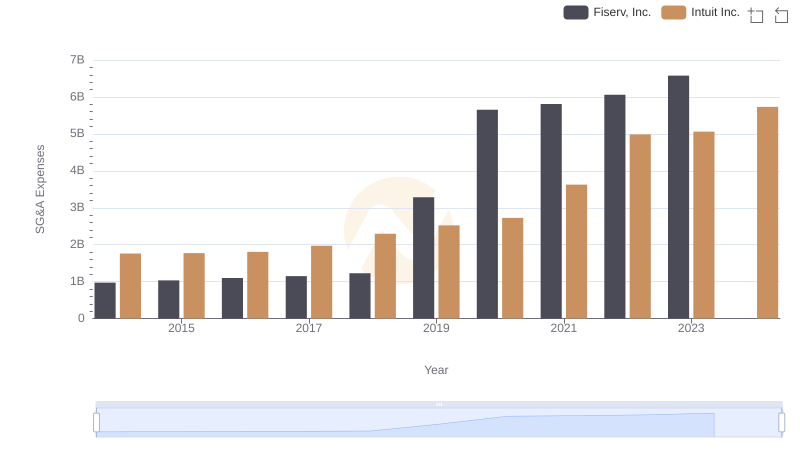

Cost Insights: Breaking Down Intuit Inc. and Fiserv, Inc.'s Expenses

Cost Insights: Breaking Down Intuit Inc. and Fiserv, Inc.'s Expenses

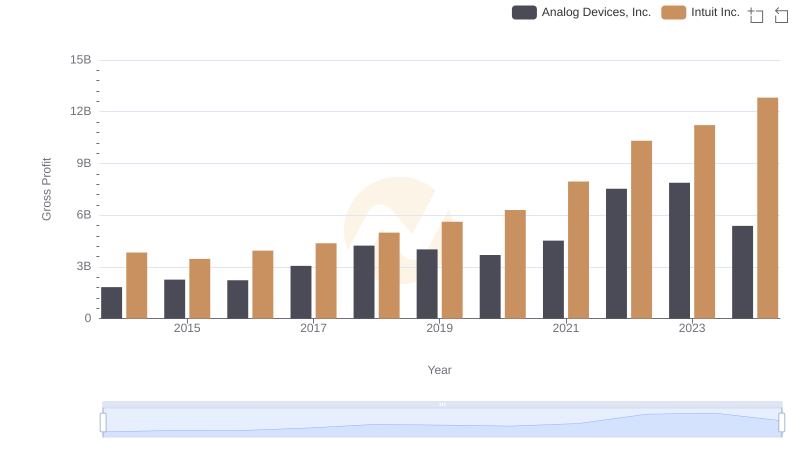

Who Generates Higher Gross Profit? Intuit Inc. or Analog Devices, Inc.

Who Generates Higher Gross Profit? Intuit Inc. or Fiserv, Inc.

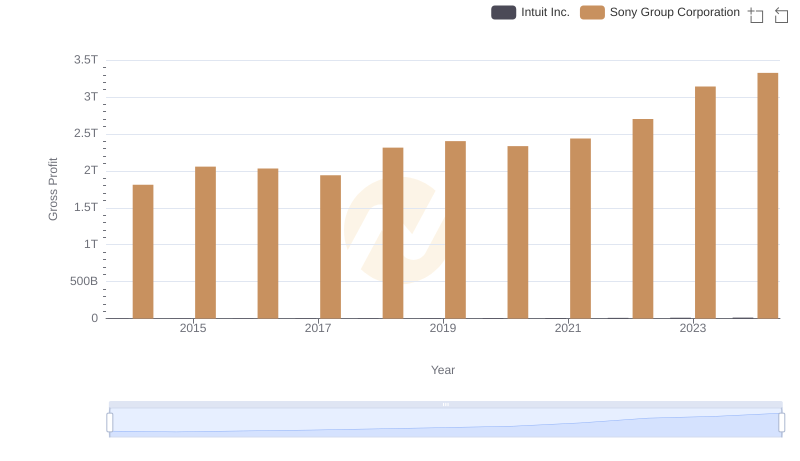

Gross Profit Analysis: Comparing Intuit Inc. and Sony Group Corporation

Cost Management Insights: SG&A Expenses for Intuit Inc. and Fiserv, Inc.

Intuit Inc. or Fiserv, Inc.: Who Manages SG&A Costs Better?

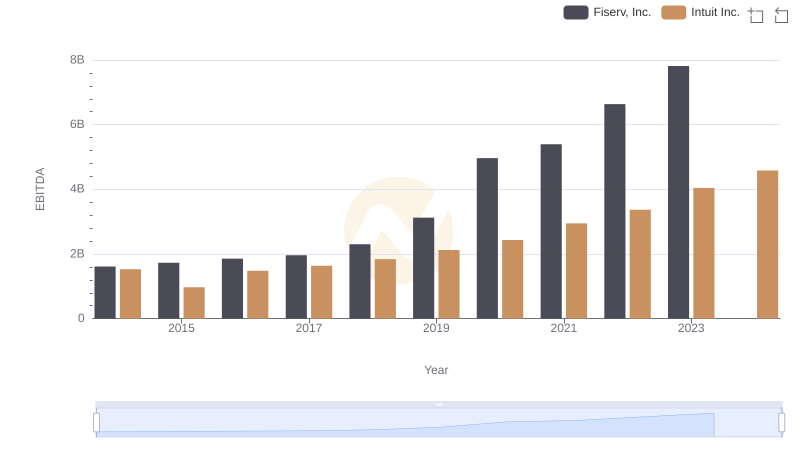

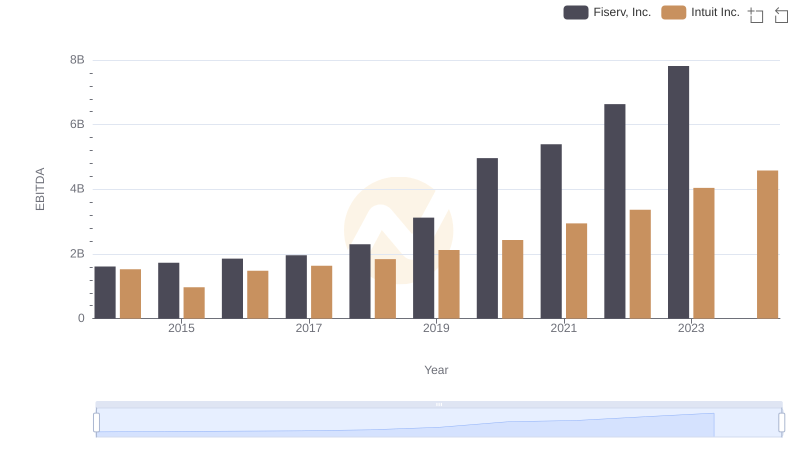

Comprehensive EBITDA Comparison: Intuit Inc. vs Fiserv, Inc.

Comprehensive EBITDA Comparison: Intuit Inc. vs Fiserv, Inc.