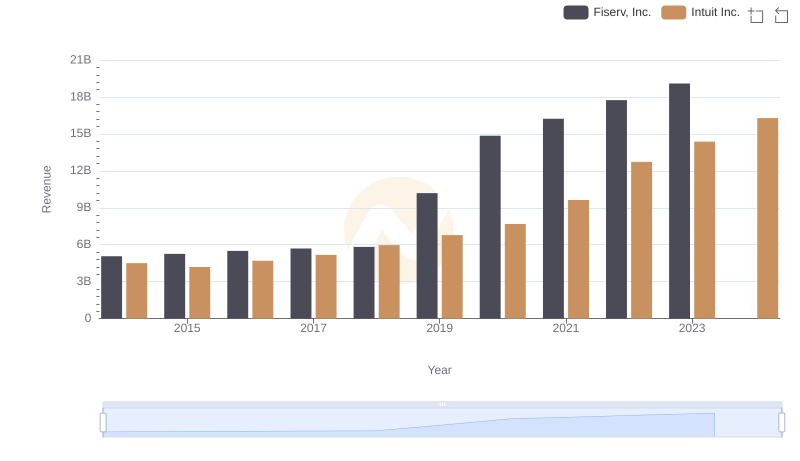

| __timestamp | Fiserv, Inc. | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 5066000000 | 4506000000 |

| Thursday, January 1, 2015 | 5254000000 | 4192000000 |

| Friday, January 1, 2016 | 5505000000 | 4694000000 |

| Sunday, January 1, 2017 | 5696000000 | 5177000000 |

| Monday, January 1, 2018 | 5823000000 | 5964000000 |

| Tuesday, January 1, 2019 | 10187000000 | 6784000000 |

| Wednesday, January 1, 2020 | 14852000000 | 7679000000 |

| Friday, January 1, 2021 | 16226000000 | 9633000000 |

| Saturday, January 1, 2022 | 17737000000 | 12726000000 |

| Sunday, January 1, 2023 | 19093000000 | 14368000000 |

| Monday, January 1, 2024 | 20456000000 | 16285000000 |

Igniting the spark of knowledge

In the ever-evolving landscape of financial technology, Intuit Inc. and Fiserv, Inc. have emerged as formidable players. Over the past decade, these companies have demonstrated impressive revenue growth, reflecting their strategic prowess and market adaptability.

From 2014 to 2023, Fiserv, Inc. saw its revenue surge by approximately 277%, starting from $5.1 billion and reaching a remarkable $19.1 billion. This growth trajectory underscores Fiserv's successful expansion and innovation in financial services. Meanwhile, Intuit Inc. experienced a robust 219% increase in revenue, climbing from $4.5 billion to $14.4 billion by 2023. Intuit's focus on empowering small businesses and individuals with cutting-edge financial tools has clearly paid off.

While Fiserv's revenue consistently outpaced Intuit's, both companies have shown resilience and adaptability in a competitive market. As we look to the future, the missing data for 2024 leaves room for speculation on how these industry giants will continue to evolve.

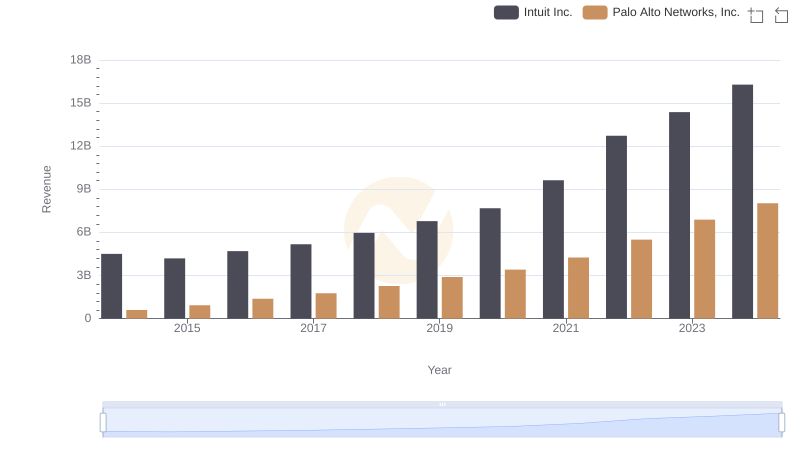

Breaking Down Revenue Trends: Intuit Inc. vs Palo Alto Networks, Inc.

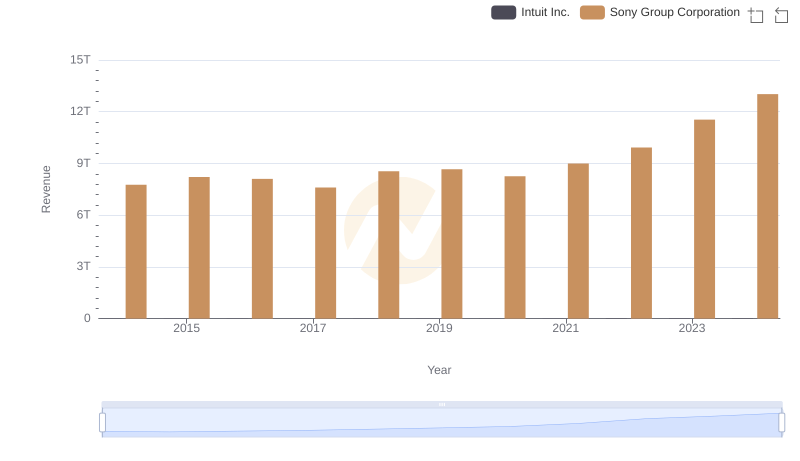

Annual Revenue Comparison: Intuit Inc. vs Sony Group Corporation

Annual Revenue Comparison: Intuit Inc. vs Fiserv, Inc.

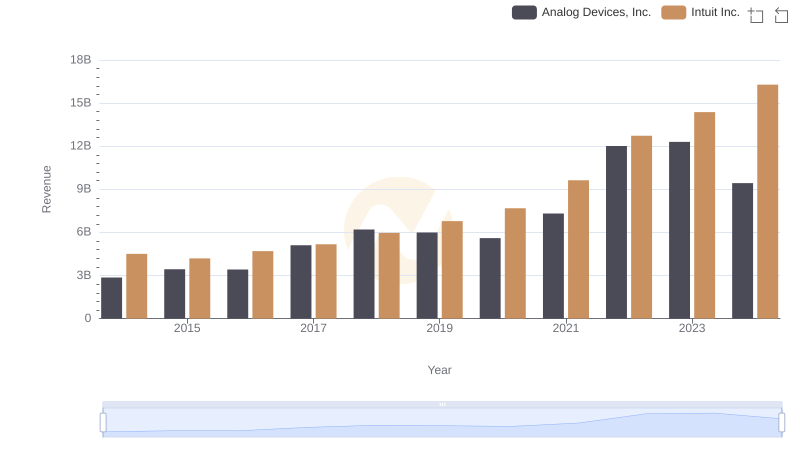

Who Generates More Revenue? Intuit Inc. or Analog Devices, Inc.

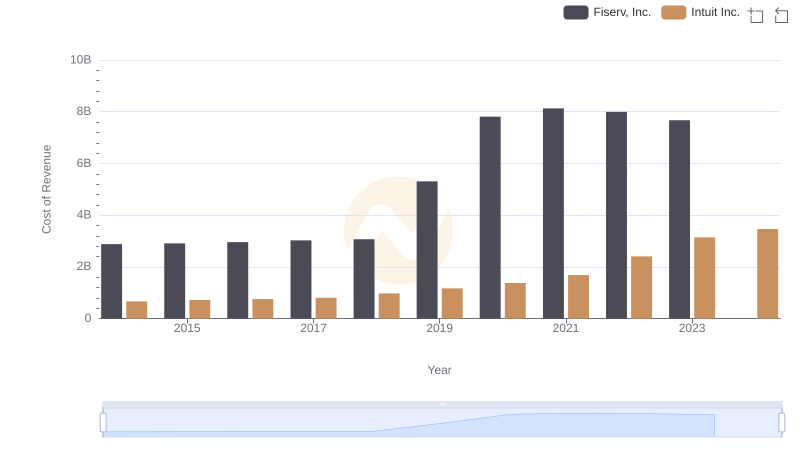

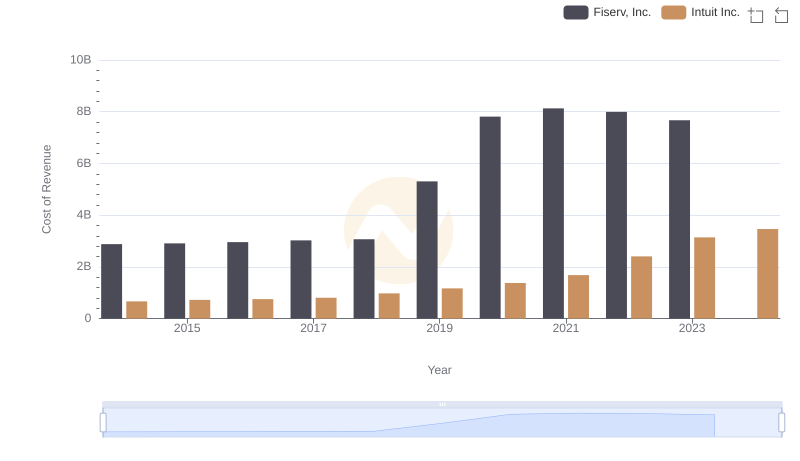

Cost Insights: Breaking Down Intuit Inc. and Fiserv, Inc.'s Expenses

Cost Insights: Breaking Down Intuit Inc. and Fiserv, Inc.'s Expenses

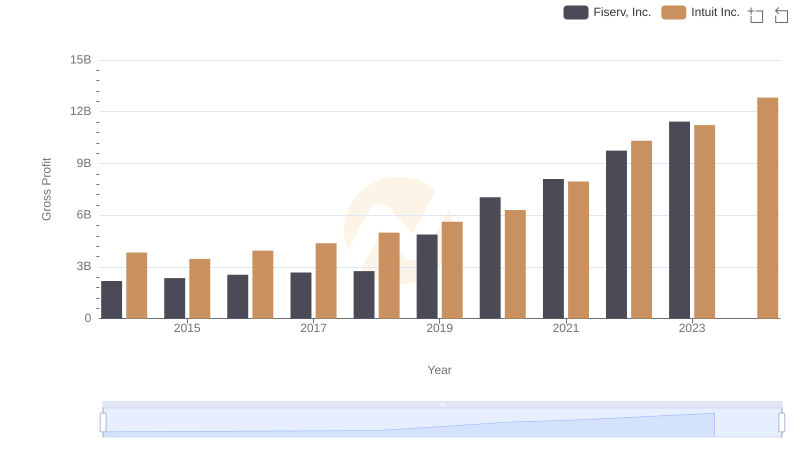

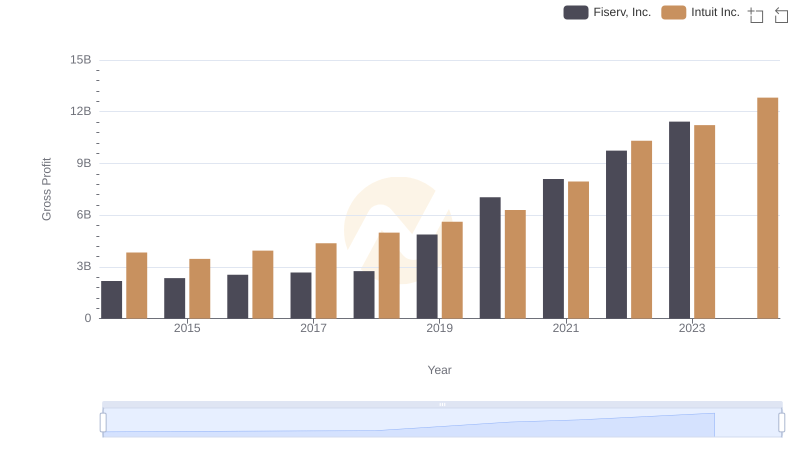

Who Generates Higher Gross Profit? Intuit Inc. or Fiserv, Inc.

Intuit Inc. vs Fiserv, Inc.: A Gross Profit Performance Breakdown

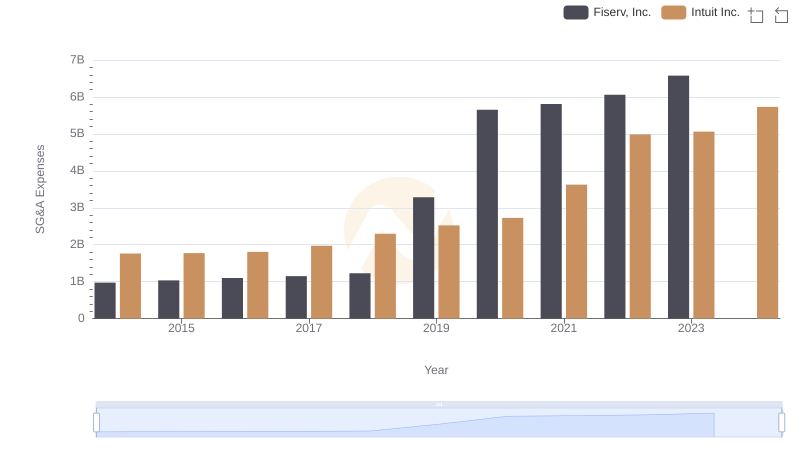

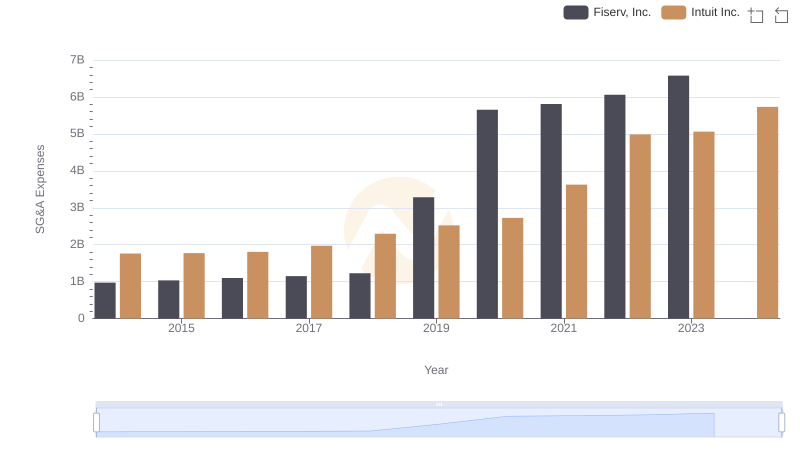

Cost Management Insights: SG&A Expenses for Intuit Inc. and Fiserv, Inc.

Intuit Inc. or Fiserv, Inc.: Who Manages SG&A Costs Better?

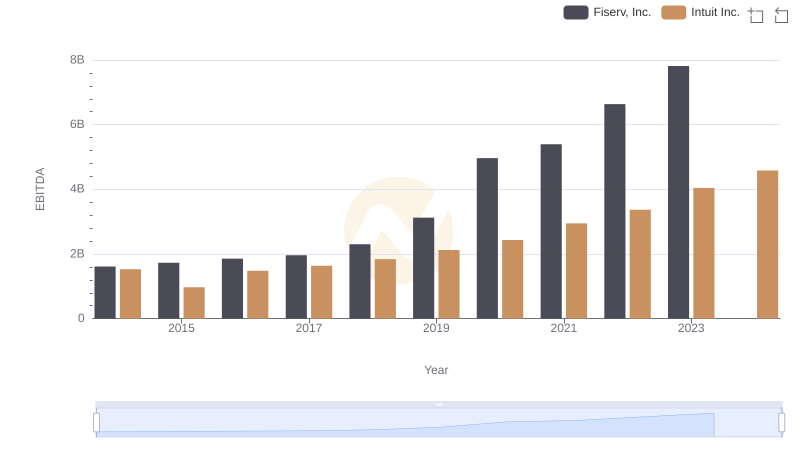

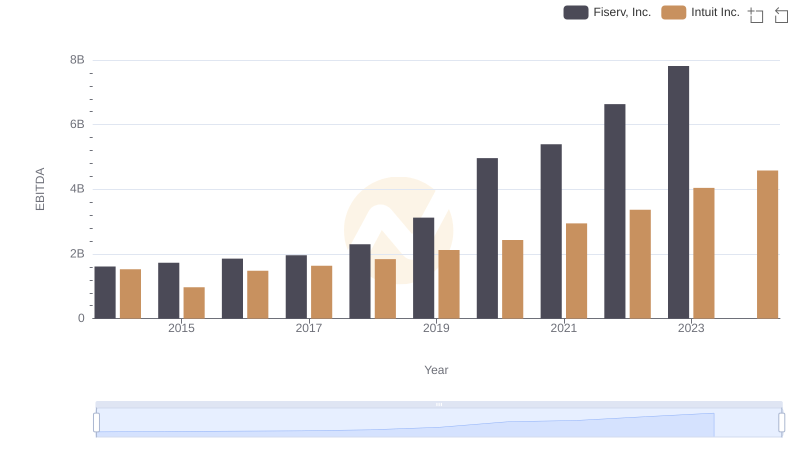

Comprehensive EBITDA Comparison: Intuit Inc. vs Fiserv, Inc.

Comprehensive EBITDA Comparison: Intuit Inc. vs Fiserv, Inc.