| __timestamp | Fiserv, Inc. | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2185000000 | 3838000000 |

| Thursday, January 1, 2015 | 2345000000 | 3467000000 |

| Friday, January 1, 2016 | 2546000000 | 3942000000 |

| Sunday, January 1, 2017 | 2672000000 | 4368000000 |

| Monday, January 1, 2018 | 2754000000 | 4987000000 |

| Tuesday, January 1, 2019 | 4878000000 | 5617000000 |

| Wednesday, January 1, 2020 | 7040000000 | 6301000000 |

| Friday, January 1, 2021 | 8098000000 | 7950000000 |

| Saturday, January 1, 2022 | 9745000000 | 10320000000 |

| Sunday, January 1, 2023 | 11423000000 | 11225000000 |

| Monday, January 1, 2024 | 20456000000 | 12820000000 |

Unleashing the power of data

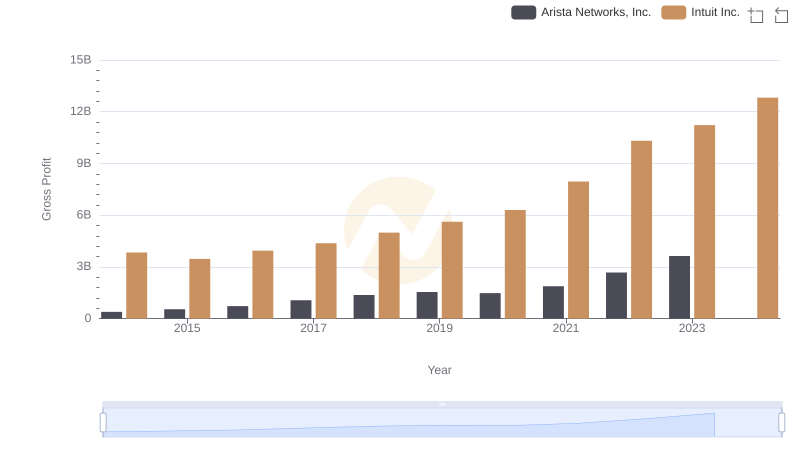

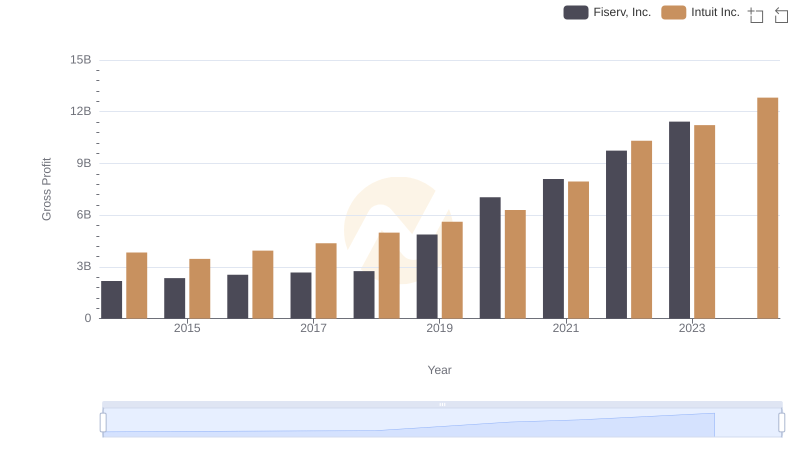

In the competitive landscape of financial technology, Intuit Inc. and Fiserv, Inc. have been pivotal players. Over the past decade, Intuit has consistently outperformed Fiserv in terms of gross profit, with a notable 30% higher average. Starting in 2014, Intuit's gross profit was approximately 76% higher than Fiserv's. By 2023, both companies showed remarkable growth, with Intuit reaching a gross profit of $11.23 billion, closely followed by Fiserv at $11.42 billion. This near parity in 2023 marks a significant shift from earlier years, highlighting Fiserv's aggressive growth strategy. However, Intuit's consistent upward trajectory, peaking at $12.82 billion in 2024, underscores its robust business model. The data reveals a fascinating narrative of competition and growth, with both companies pushing the boundaries of innovation in the fintech sector.

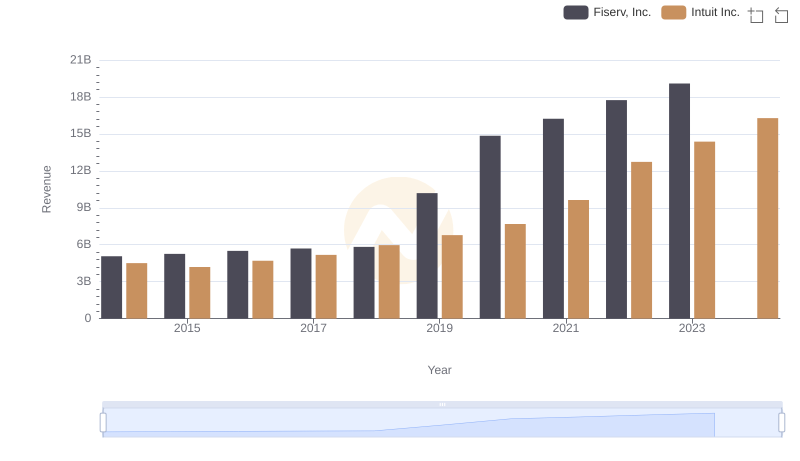

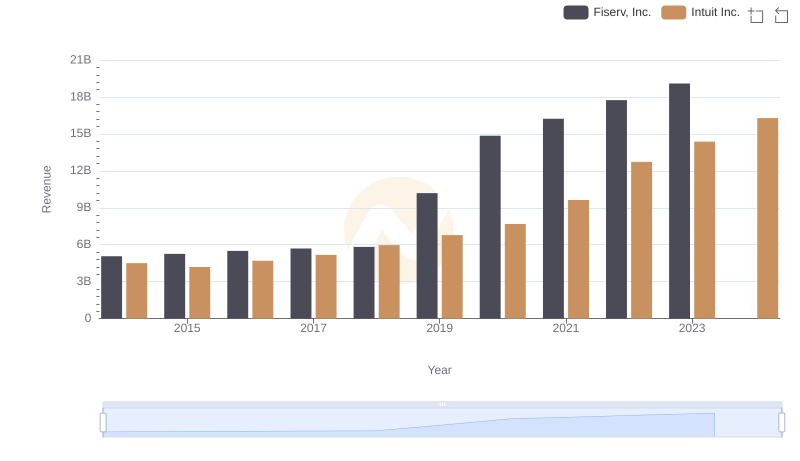

Comparing Revenue Performance: Intuit Inc. or Fiserv, Inc.?

Annual Revenue Comparison: Intuit Inc. vs Fiserv, Inc.

Intuit Inc. vs Arista Networks, Inc.: A Gross Profit Performance Breakdown

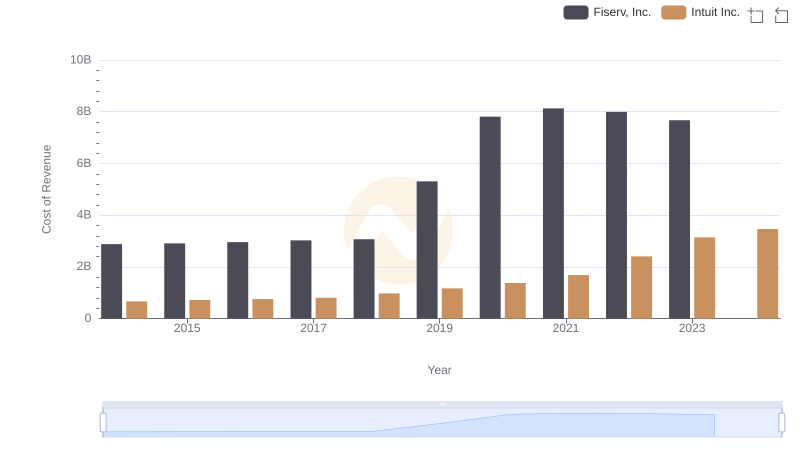

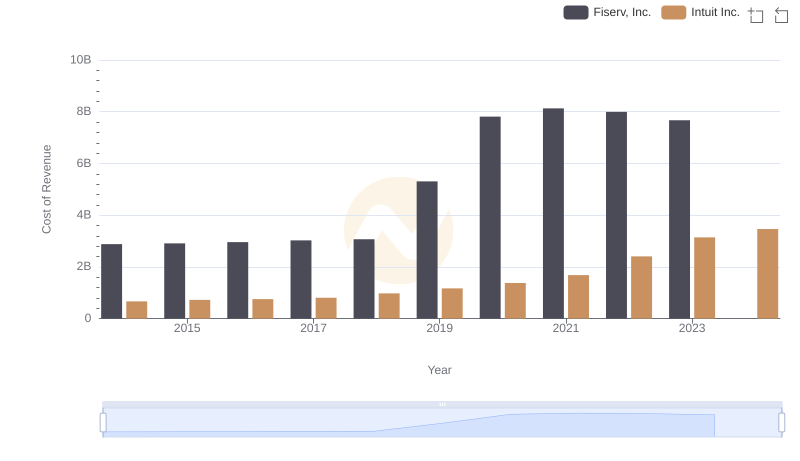

Cost Insights: Breaking Down Intuit Inc. and Fiserv, Inc.'s Expenses

Cost Insights: Breaking Down Intuit Inc. and Fiserv, Inc.'s Expenses

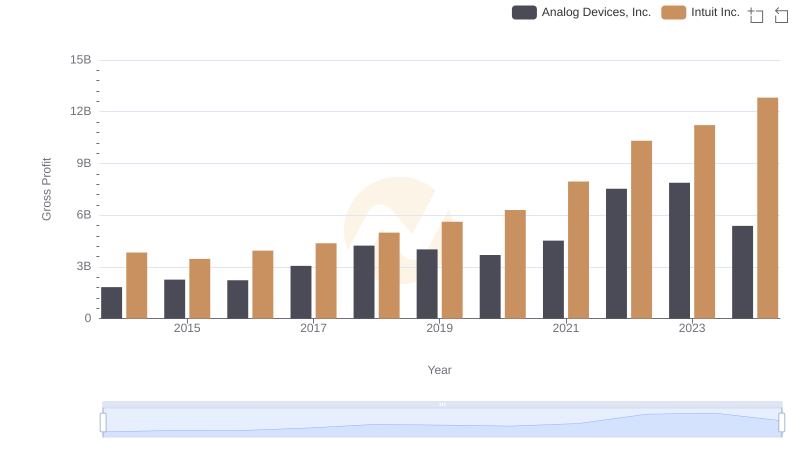

Who Generates Higher Gross Profit? Intuit Inc. or Analog Devices, Inc.

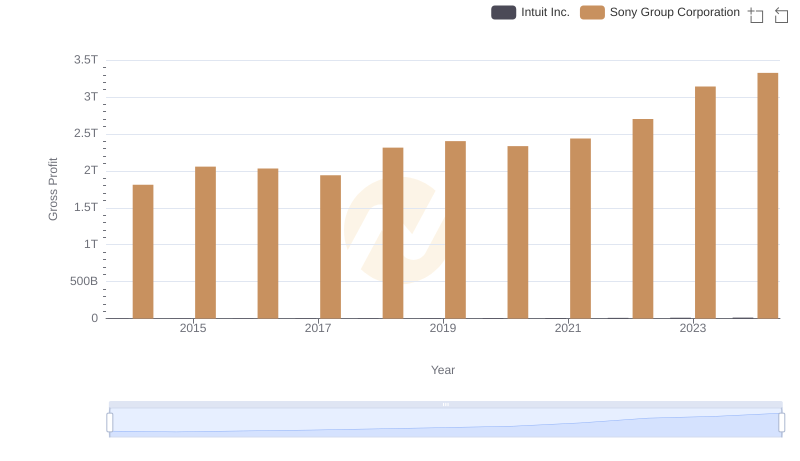

Gross Profit Analysis: Comparing Intuit Inc. and Sony Group Corporation

Intuit Inc. vs Fiserv, Inc.: A Gross Profit Performance Breakdown

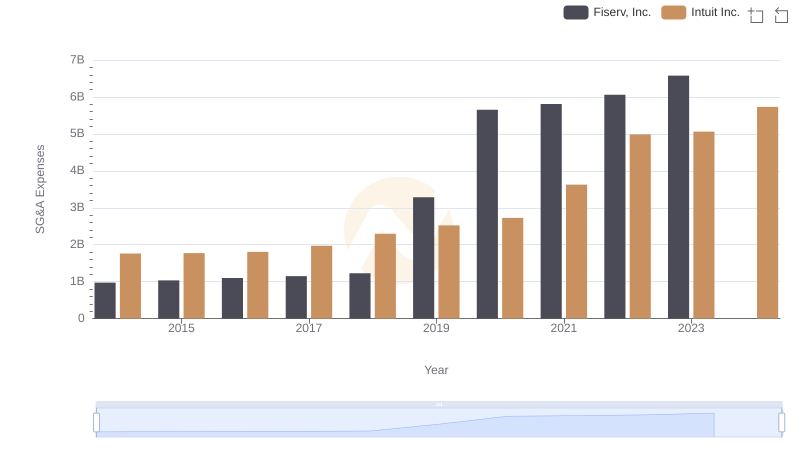

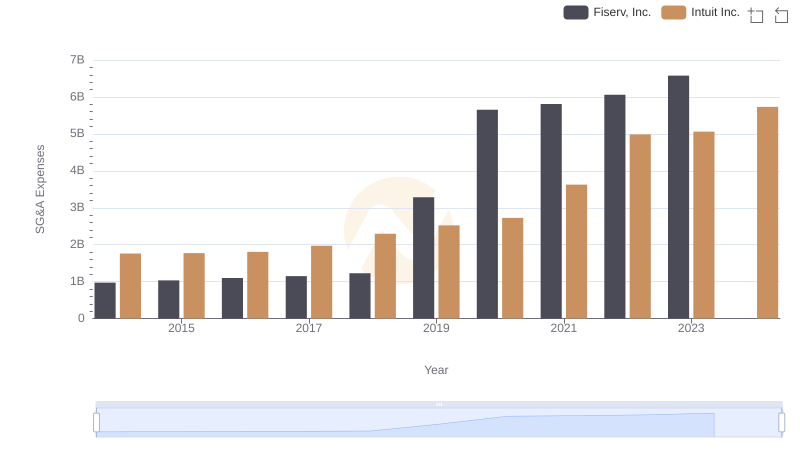

Cost Management Insights: SG&A Expenses for Intuit Inc. and Fiserv, Inc.

Intuit Inc. or Fiserv, Inc.: Who Manages SG&A Costs Better?

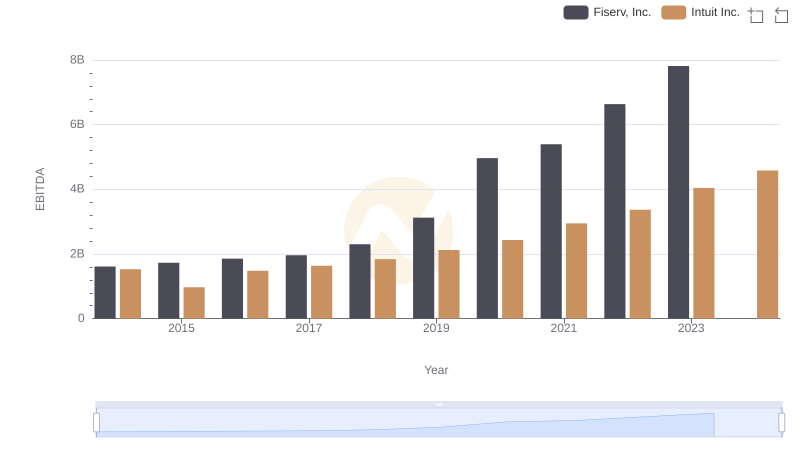

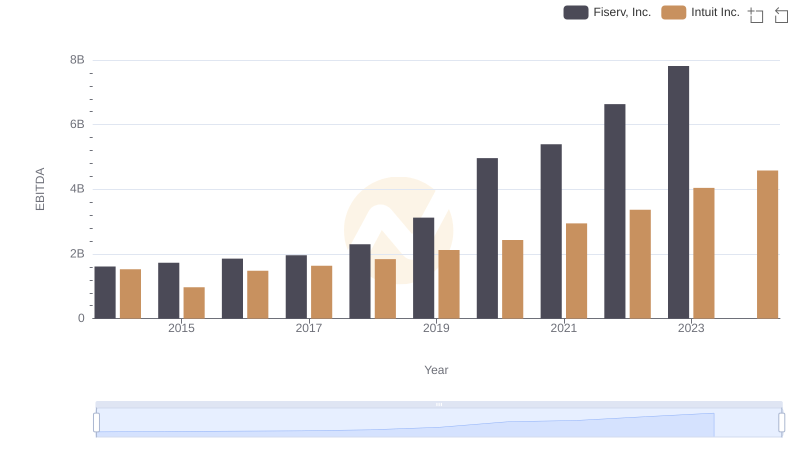

Comprehensive EBITDA Comparison: Intuit Inc. vs Fiserv, Inc.

Comprehensive EBITDA Comparison: Intuit Inc. vs Fiserv, Inc.