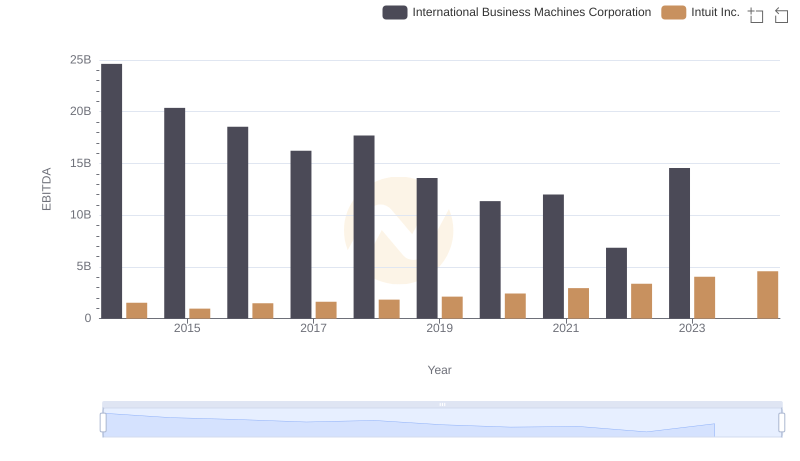

| __timestamp | International Business Machines Corporation | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 22472000000 | 1762000000 |

| Thursday, January 1, 2015 | 19894000000 | 1771000000 |

| Friday, January 1, 2016 | 20279000000 | 1807000000 |

| Sunday, January 1, 2017 | 19680000000 | 1973000000 |

| Monday, January 1, 2018 | 19366000000 | 2298000000 |

| Tuesday, January 1, 2019 | 18724000000 | 2524000000 |

| Wednesday, January 1, 2020 | 20561000000 | 2727000000 |

| Friday, January 1, 2021 | 18745000000 | 3626000000 |

| Saturday, January 1, 2022 | 17483000000 | 4986000000 |

| Sunday, January 1, 2023 | 17997000000 | 5062000000 |

| Monday, January 1, 2024 | 29536000000 | 5730000000 |

Unlocking the unknown

In the ever-evolving landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, International Business Machines Corporation (IBM) and Intuit Inc. have demonstrated contrasting approaches to handling these costs. From 2014 to 2023, IBM's SG&A expenses have fluctuated, peaking in 2024 with a 30% increase from the previous year. In contrast, Intuit has shown a steady upward trend, with a 225% rise over the same period. This suggests Intuit's strategic investments in growth and innovation, while IBM's volatility may reflect restructuring efforts. As businesses navigate the complexities of the modern economy, understanding these financial strategies offers valuable insights into corporate resilience and adaptability.

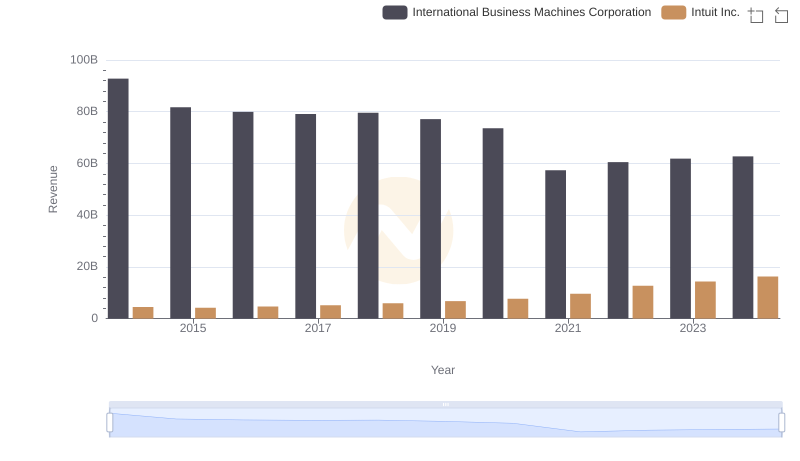

Annual Revenue Comparison: International Business Machines Corporation vs Intuit Inc.

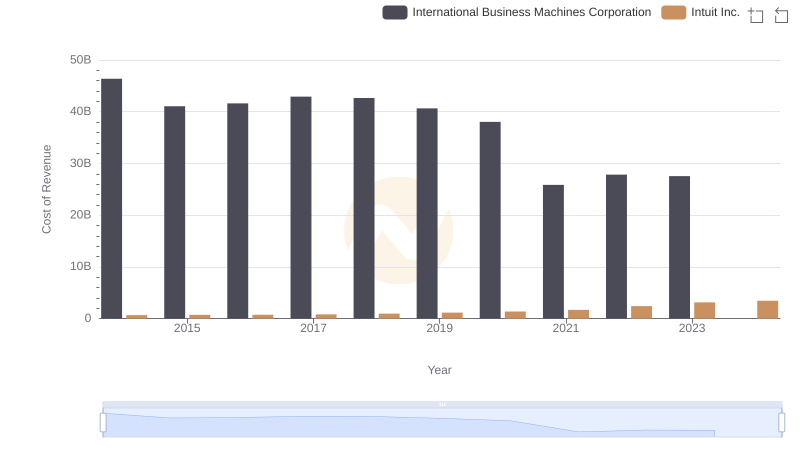

Cost of Revenue Comparison: International Business Machines Corporation vs Intuit Inc.

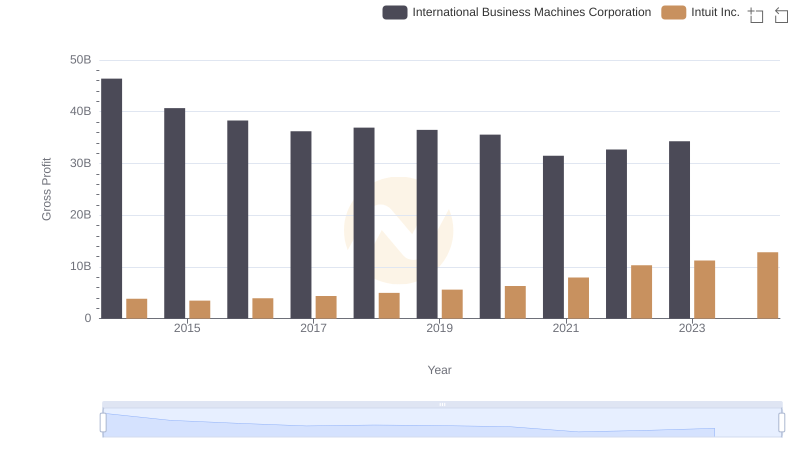

Gross Profit Comparison: International Business Machines Corporation and Intuit Inc. Trends

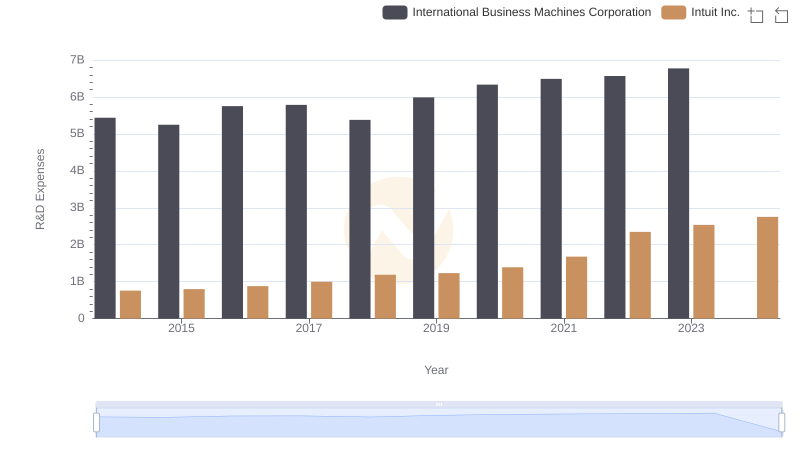

Analyzing R&D Budgets: International Business Machines Corporation vs Intuit Inc.

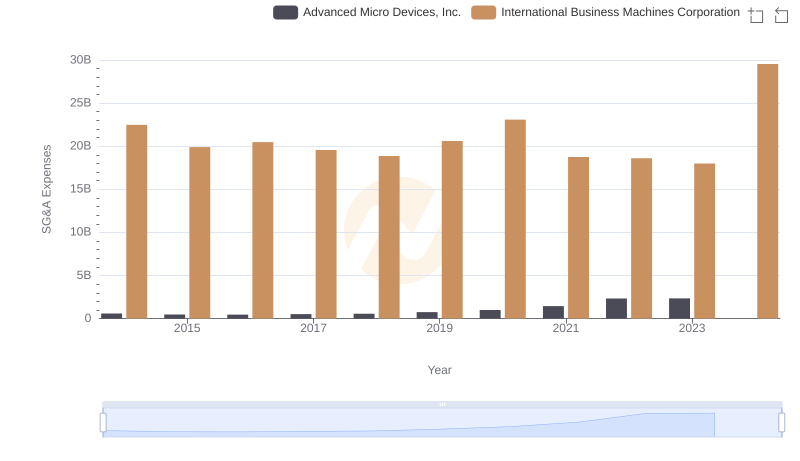

Operational Costs Compared: SG&A Analysis of International Business Machines Corporation and Advanced Micro Devices, Inc.

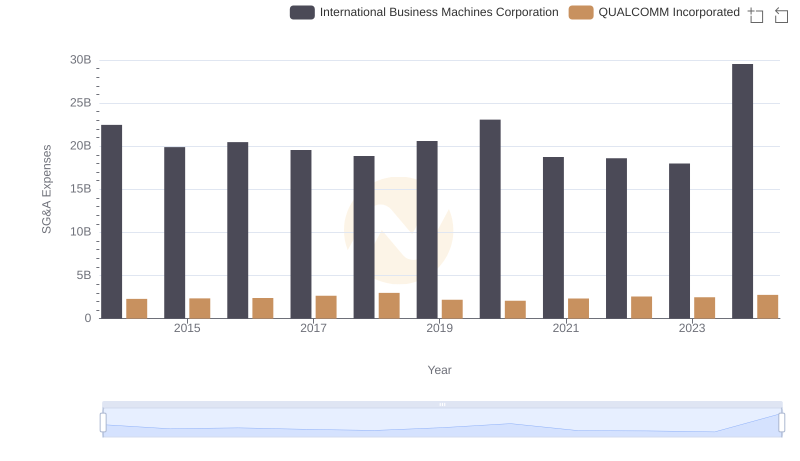

Breaking Down SG&A Expenses: International Business Machines Corporation vs QUALCOMM Incorporated

International Business Machines Corporation vs Intuit Inc.: In-Depth EBITDA Performance Comparison

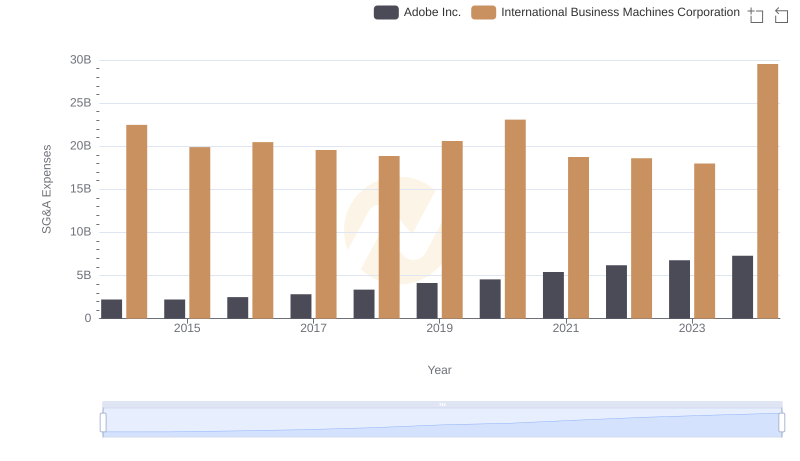

Comparing SG&A Expenses: International Business Machines Corporation vs Adobe Inc. Trends and Insights

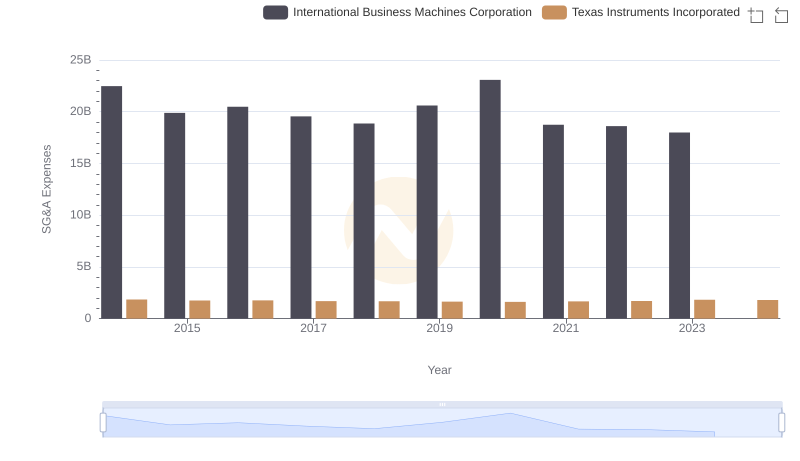

International Business Machines Corporation or Texas Instruments Incorporated: Who Manages SG&A Costs Better?

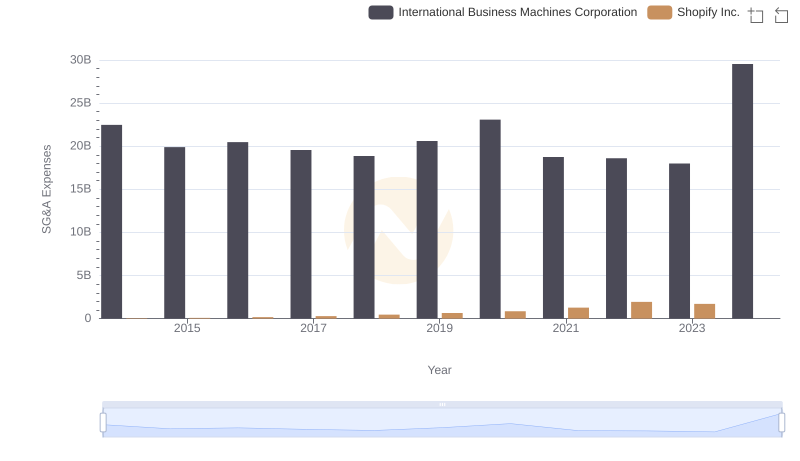

International Business Machines Corporation vs Shopify Inc.: SG&A Expense Trends

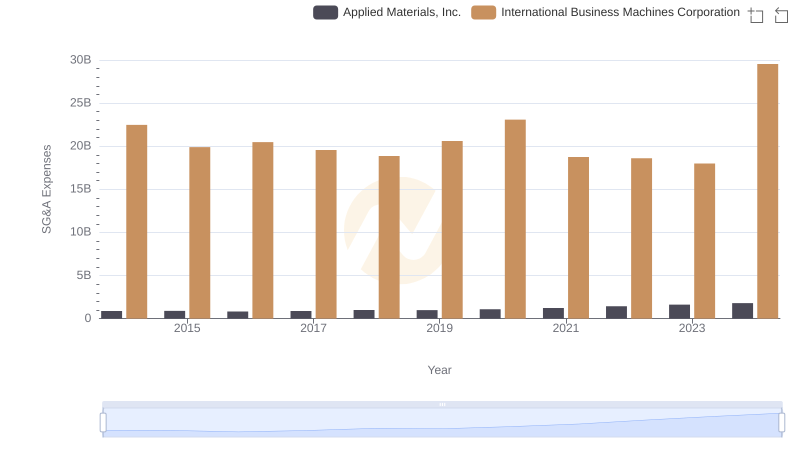

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and Applied Materials, Inc.

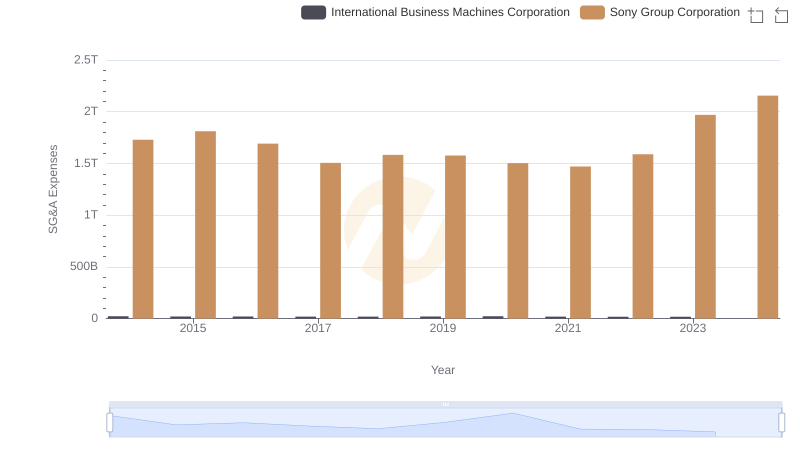

Who Optimizes SG&A Costs Better? International Business Machines Corporation or Sony Group Corporation