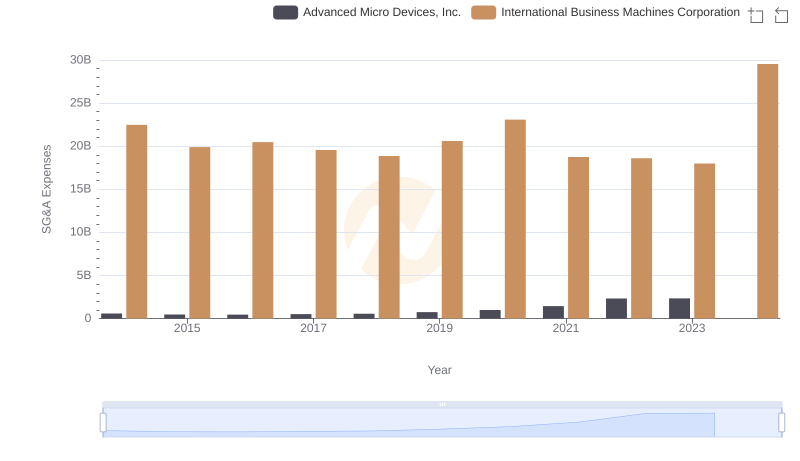

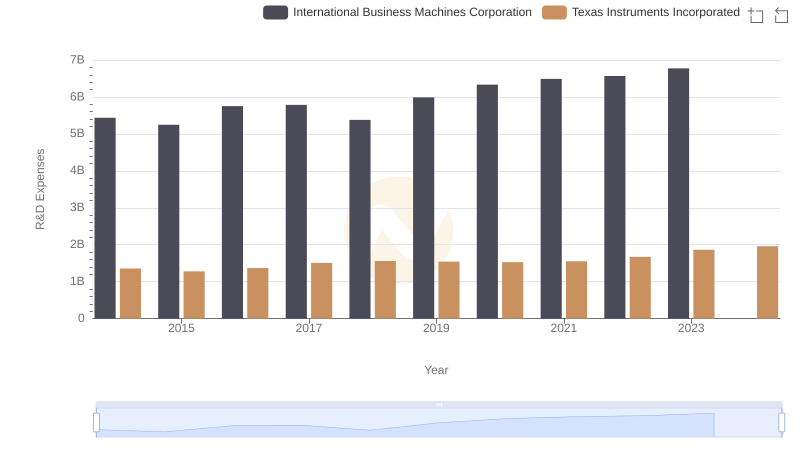

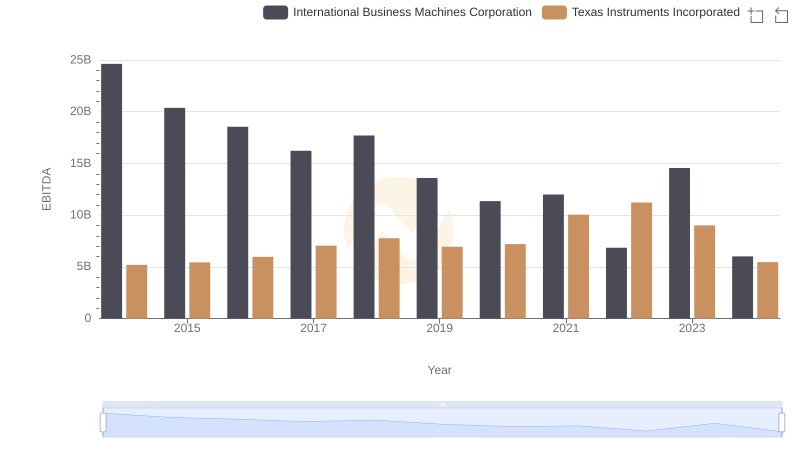

| __timestamp | International Business Machines Corporation | Texas Instruments Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 22472000000 | 1843000000 |

| Thursday, January 1, 2015 | 19894000000 | 1748000000 |

| Friday, January 1, 2016 | 20279000000 | 1767000000 |

| Sunday, January 1, 2017 | 19680000000 | 1694000000 |

| Monday, January 1, 2018 | 19366000000 | 1684000000 |

| Tuesday, January 1, 2019 | 18724000000 | 1645000000 |

| Wednesday, January 1, 2020 | 20561000000 | 1623000000 |

| Friday, January 1, 2021 | 18745000000 | 1666000000 |

| Saturday, January 1, 2022 | 17483000000 | 1704000000 |

| Sunday, January 1, 2023 | 17997000000 | 1825000000 |

| Monday, January 1, 2024 | 29536000000 | 1794000000 |

Infusing magic into the data realm

In the competitive landscape of technology giants, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, International Business Machines Corporation (IBM) and Texas Instruments Incorporated (TI) have showcased contrasting strategies in this domain. From 2014 to 2024, IBM's SG&A expenses fluctuated significantly, peaking in 2024 with a 42% increase from its lowest point in 2023. In contrast, TI maintained a more stable trajectory, with expenses decreasing by approximately 3% over the same period.

IBM's higher SG&A costs, averaging around 12 times those of TI, reflect its expansive global operations and diverse product offerings. Meanwhile, TI's leaner cost structure highlights its focus on efficiency and specialization in semiconductor manufacturing. As businesses navigate economic uncertainties, these insights into SG&A management offer valuable lessons in balancing growth and cost control.

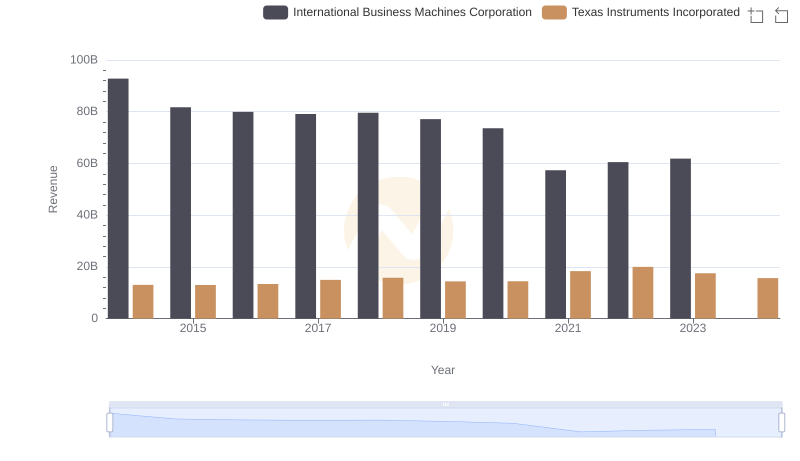

Annual Revenue Comparison: International Business Machines Corporation vs Texas Instruments Incorporated

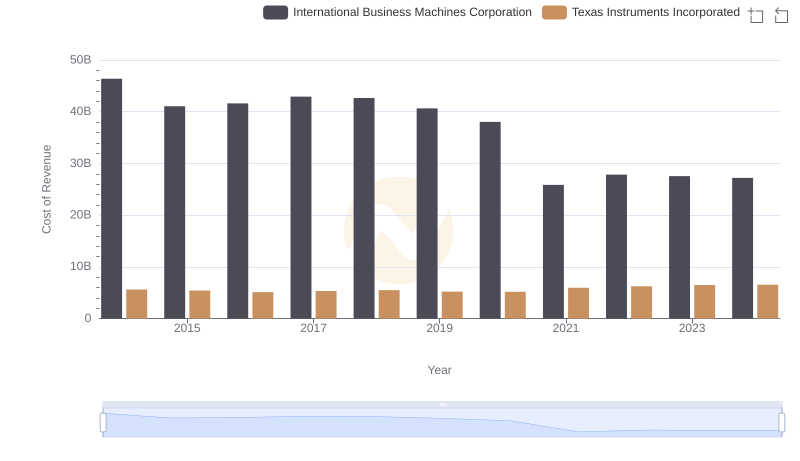

Cost Insights: Breaking Down International Business Machines Corporation and Texas Instruments Incorporated's Expenses

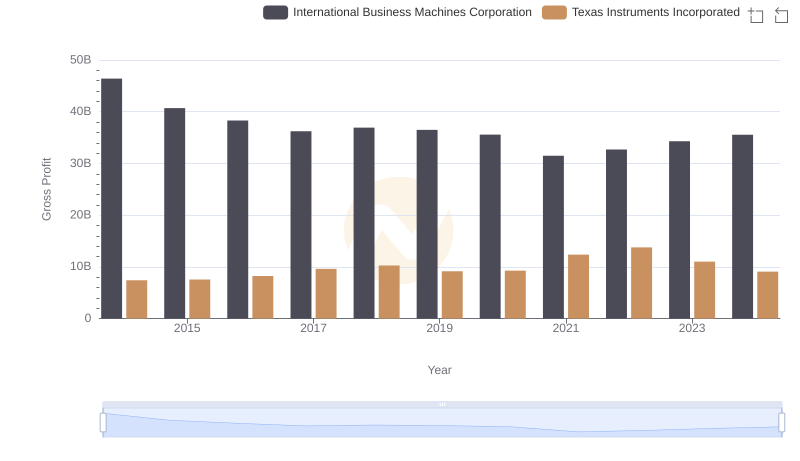

Gross Profit Comparison: International Business Machines Corporation and Texas Instruments Incorporated Trends

Operational Costs Compared: SG&A Analysis of International Business Machines Corporation and Advanced Micro Devices, Inc.

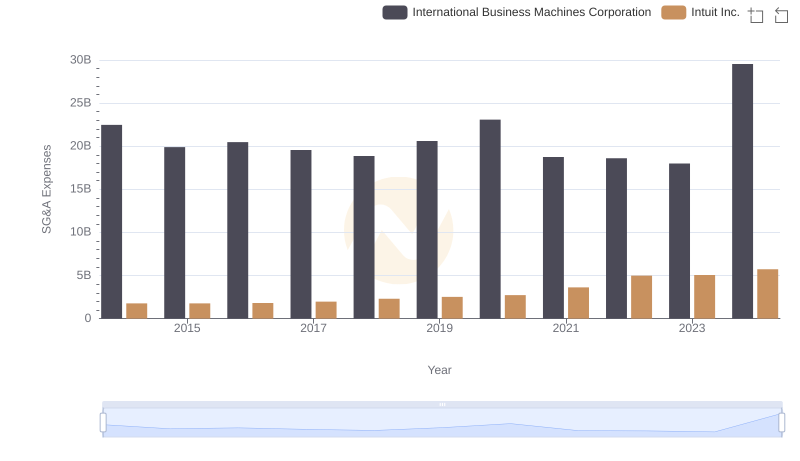

International Business Machines Corporation or Intuit Inc.: Who Manages SG&A Costs Better?

R&D Spending Showdown: International Business Machines Corporation vs Texas Instruments Incorporated

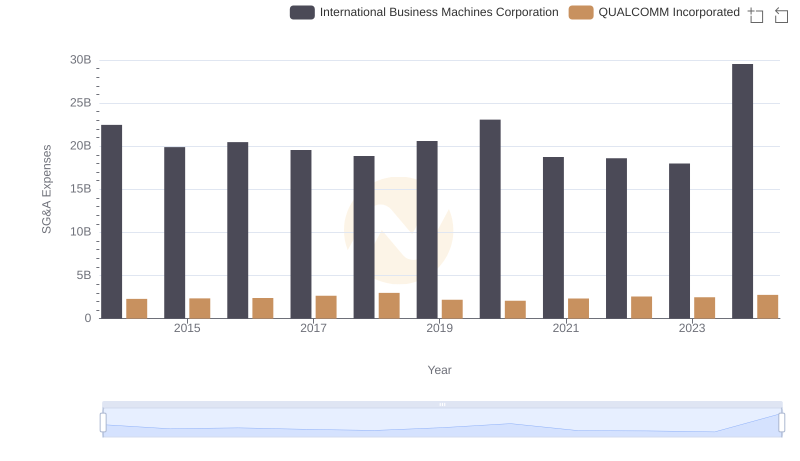

Breaking Down SG&A Expenses: International Business Machines Corporation vs QUALCOMM Incorporated

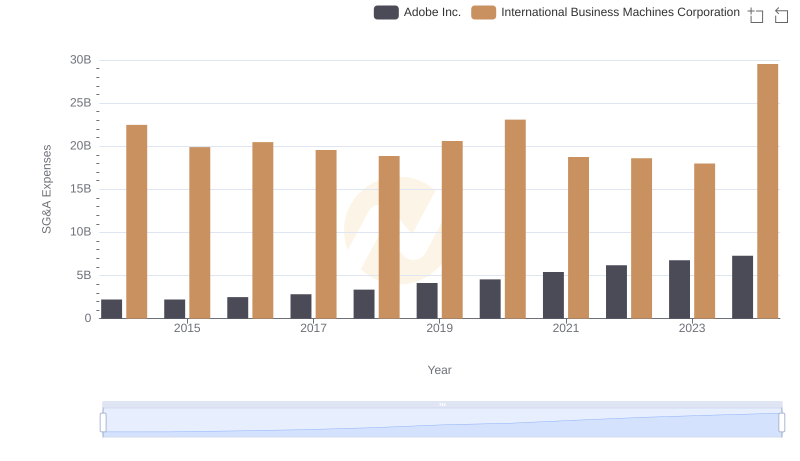

Comparing SG&A Expenses: International Business Machines Corporation vs Adobe Inc. Trends and Insights

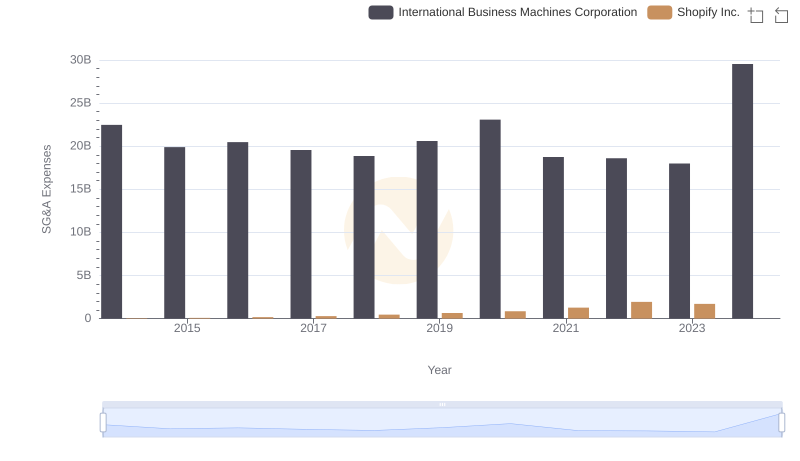

International Business Machines Corporation vs Shopify Inc.: SG&A Expense Trends

EBITDA Performance Review: International Business Machines Corporation vs Texas Instruments Incorporated

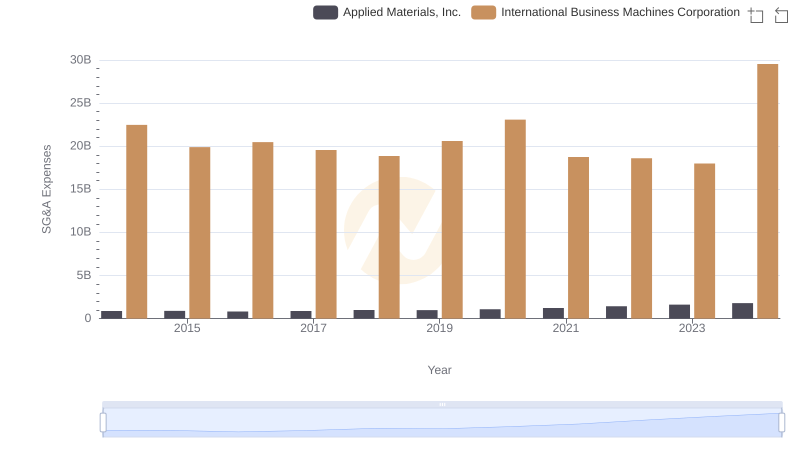

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and Applied Materials, Inc.

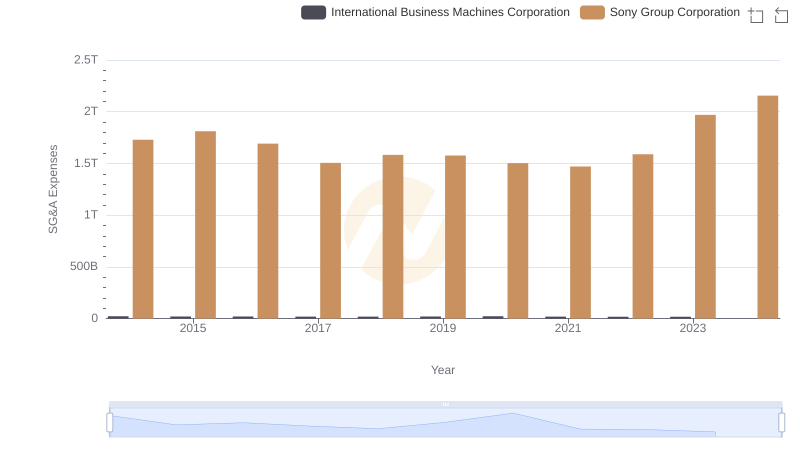

Who Optimizes SG&A Costs Better? International Business Machines Corporation or Sony Group Corporation