| __timestamp | Advanced Micro Devices, Inc. | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 599000000 | 22472000000 |

| Thursday, January 1, 2015 | 482000000 | 19894000000 |

| Friday, January 1, 2016 | 466000000 | 20279000000 |

| Sunday, January 1, 2017 | 516000000 | 19680000000 |

| Monday, January 1, 2018 | 562000000 | 19366000000 |

| Tuesday, January 1, 2019 | 750000000 | 18724000000 |

| Wednesday, January 1, 2020 | 995000000 | 20561000000 |

| Friday, January 1, 2021 | 1448000000 | 18745000000 |

| Saturday, January 1, 2022 | 2336000000 | 17483000000 |

| Sunday, January 1, 2023 | 2352000000 | 17997000000 |

| Monday, January 1, 2024 | 2783000000 | 29536000000 |

Infusing magic into the data realm

In the ever-evolving landscape of technology, operational efficiency is key. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry titans: International Business Machines Corporation (IBM) and Advanced Micro Devices, Inc. (AMD). Over the past decade, IBM's SG&A expenses have consistently dwarfed those of AMD, averaging around 20 times higher. However, AMD has shown a remarkable upward trend, with its SG&A expenses increasing by nearly 400% from 2014 to 2023. This growth reflects AMD's aggressive market expansion and strategic investments. Meanwhile, IBM's expenses have remained relatively stable, with a slight decline in recent years, indicating a focus on cost optimization. The data for 2024 is incomplete, but the trends suggest a continued divergence in strategies. As these companies navigate the future, their SG&A expenses will be a critical indicator of their operational priorities and market positioning.

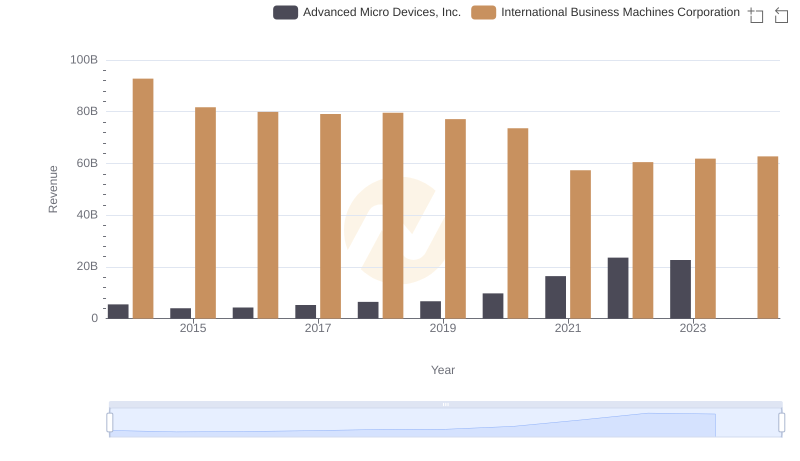

Breaking Down Revenue Trends: International Business Machines Corporation vs Advanced Micro Devices, Inc.

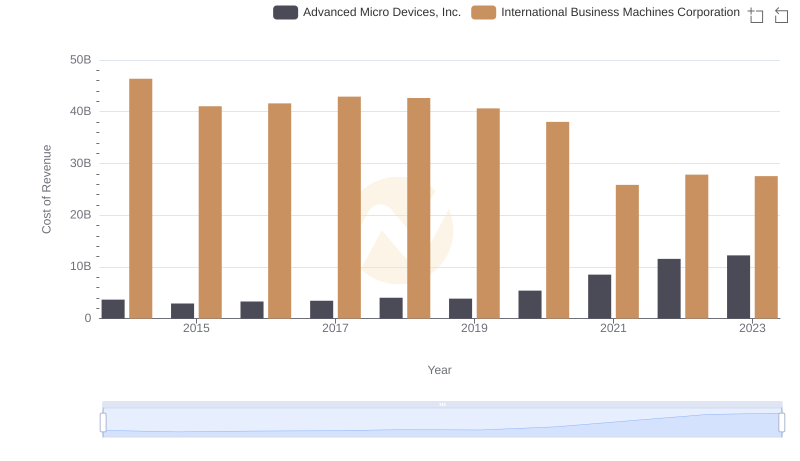

Cost of Revenue Trends: International Business Machines Corporation vs Advanced Micro Devices, Inc.

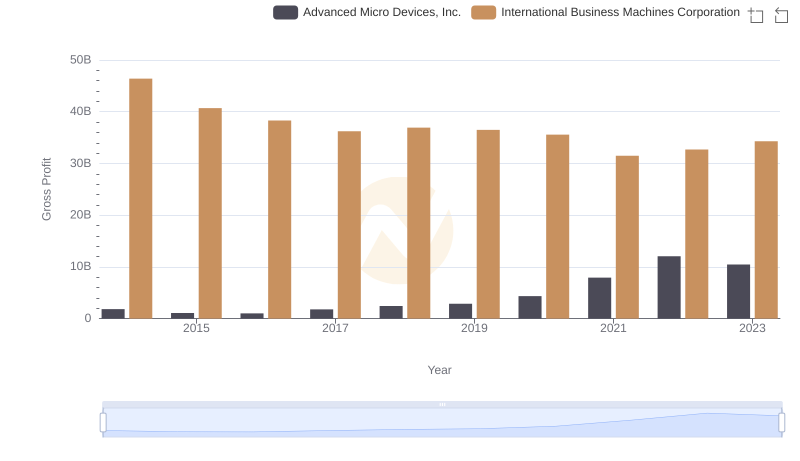

Key Insights on Gross Profit: International Business Machines Corporation vs Advanced Micro Devices, Inc.

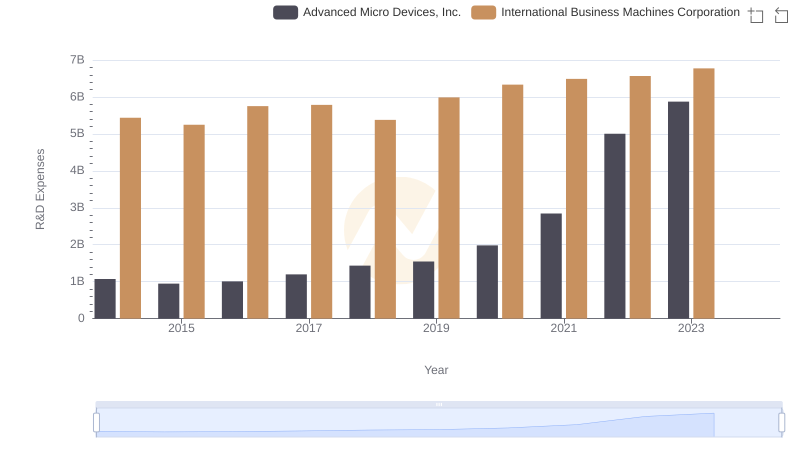

R&D Insights: How International Business Machines Corporation and Advanced Micro Devices, Inc. Allocate Funds

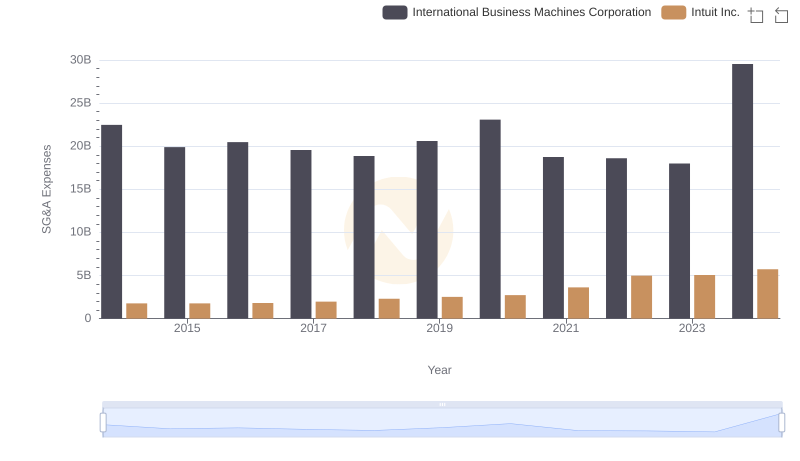

International Business Machines Corporation or Intuit Inc.: Who Manages SG&A Costs Better?

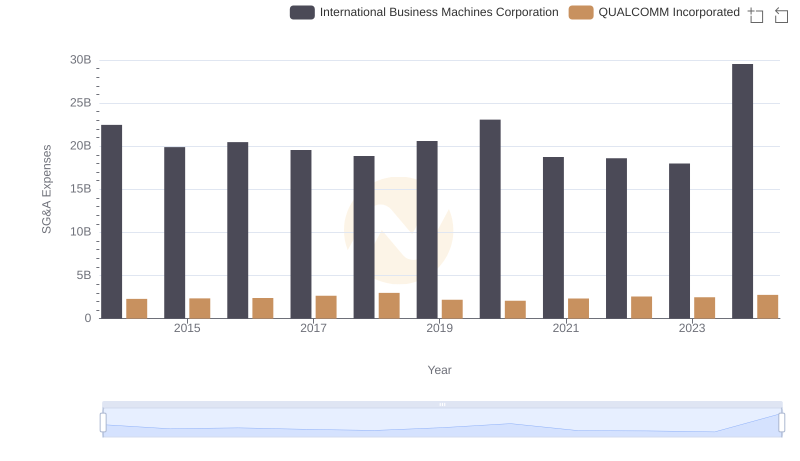

Breaking Down SG&A Expenses: International Business Machines Corporation vs QUALCOMM Incorporated

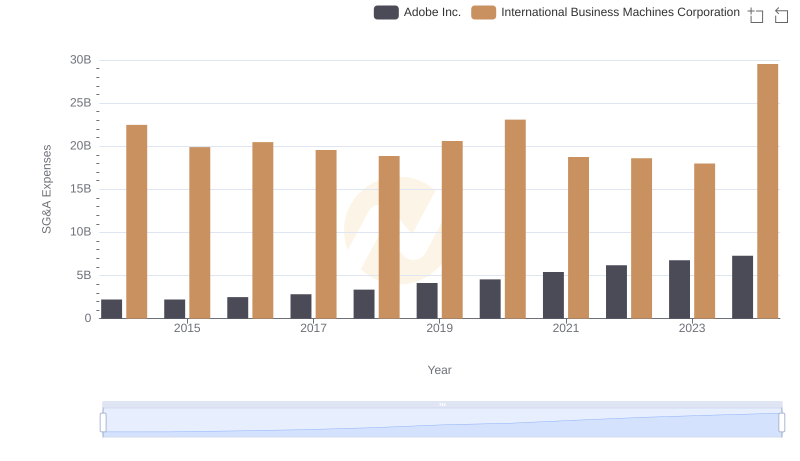

Comparing SG&A Expenses: International Business Machines Corporation vs Adobe Inc. Trends and Insights

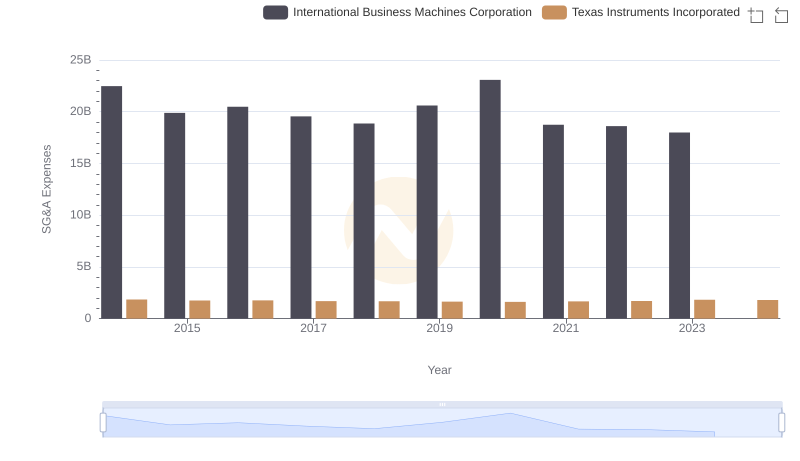

International Business Machines Corporation or Texas Instruments Incorporated: Who Manages SG&A Costs Better?

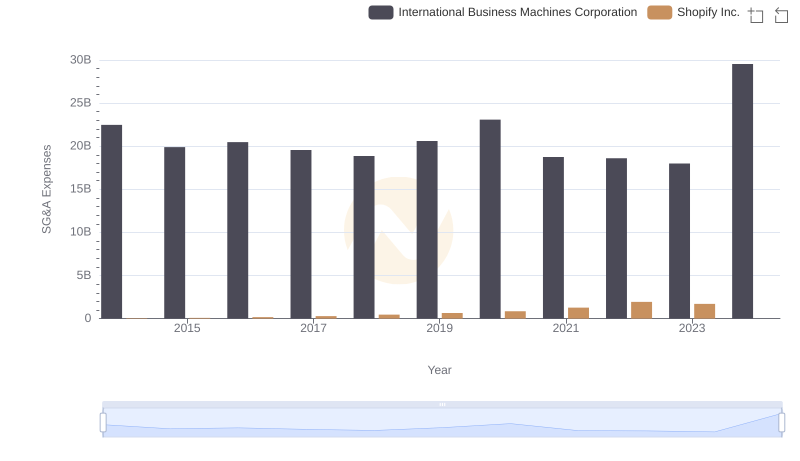

International Business Machines Corporation vs Shopify Inc.: SG&A Expense Trends

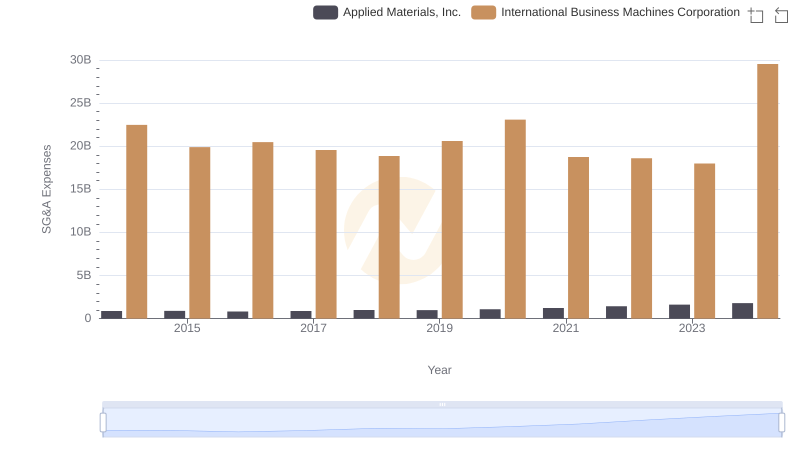

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and Applied Materials, Inc.

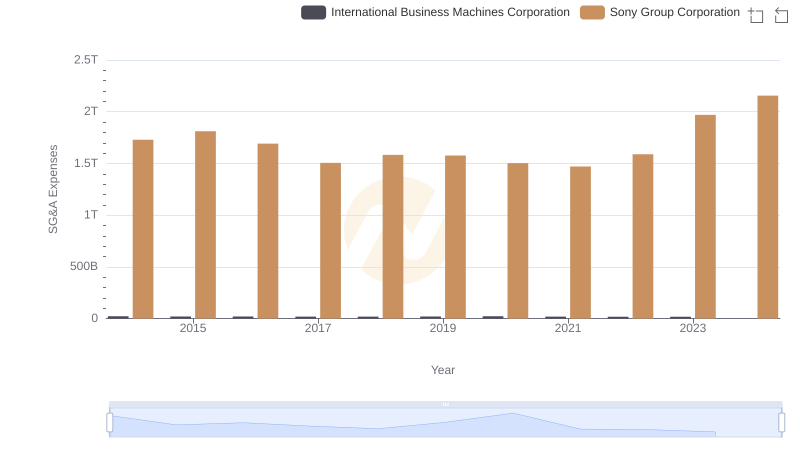

Who Optimizes SG&A Costs Better? International Business Machines Corporation or Sony Group Corporation