| __timestamp | International Business Machines Corporation | Sony Group Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 22472000000 | 1728520000000 |

| Thursday, January 1, 2015 | 19894000000 | 1811461000000 |

| Friday, January 1, 2016 | 20279000000 | 1691930000000 |

| Sunday, January 1, 2017 | 19680000000 | 1505956000000 |

| Monday, January 1, 2018 | 19366000000 | 1583197000000 |

| Tuesday, January 1, 2019 | 18724000000 | 1576825000000 |

| Wednesday, January 1, 2020 | 20561000000 | 1502625000000 |

| Friday, January 1, 2021 | 18745000000 | 1469955000000 |

| Saturday, January 1, 2022 | 17483000000 | 1588473000000 |

| Sunday, January 1, 2023 | 17997000000 | 1969170000000 |

| Monday, January 1, 2024 | 29536000000 | 2156156000000 |

Unveiling the hidden dimensions of data

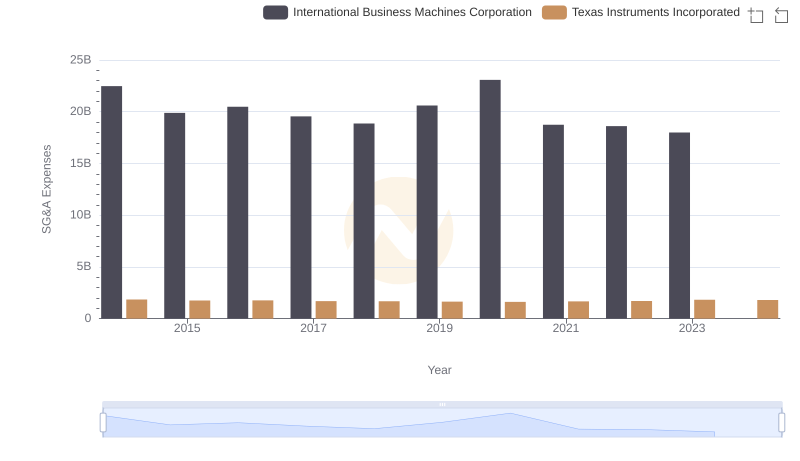

In the competitive world of technology and electronics, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, International Business Machines Corporation (IBM) and Sony Group Corporation have showcased contrasting strategies in this domain. From 2014 to 2024, IBM's SG&A expenses fluctuated, peaking in 2024 with a 30% increase from its lowest point in 2023. Meanwhile, Sony's expenses remained significantly higher, reflecting its expansive global operations. Despite this, Sony managed to reduce its SG&A costs by approximately 15% from 2015 to 2020, before a sharp rise in 2023. This data highlights the strategic differences between a tech giant and a consumer electronics leader, offering insights into their operational efficiencies and market strategies. As businesses navigate the complexities of global markets, understanding these cost structures becomes essential for investors and analysts alike.

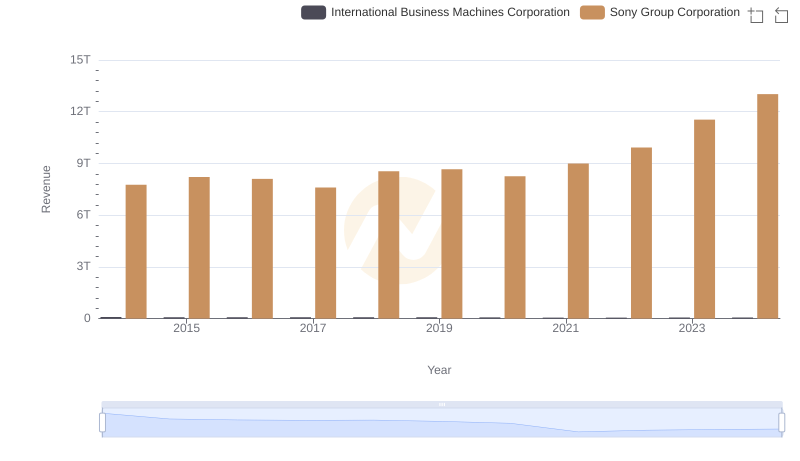

International Business Machines Corporation vs Sony Group Corporation: Annual Revenue Growth Compared

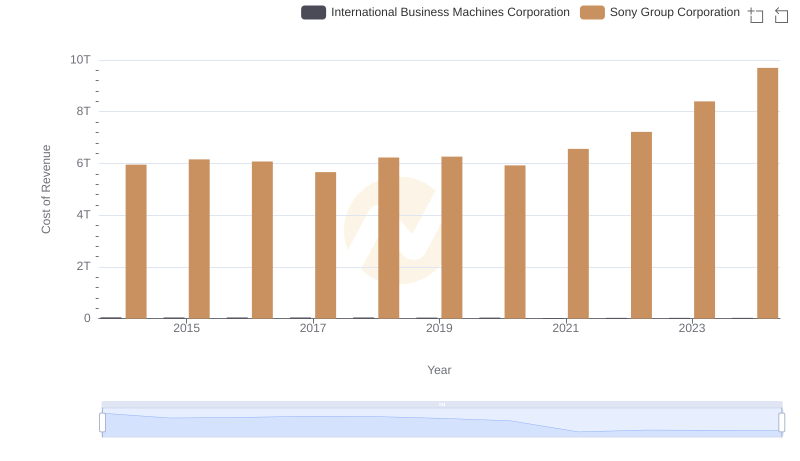

Cost of Revenue: Key Insights for International Business Machines Corporation and Sony Group Corporation

International Business Machines Corporation or Texas Instruments Incorporated: Who Manages SG&A Costs Better?

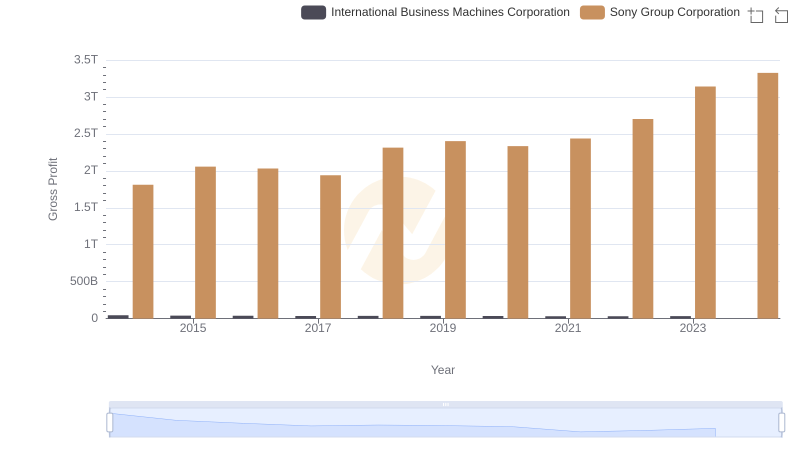

Who Generates Higher Gross Profit? International Business Machines Corporation or Sony Group Corporation

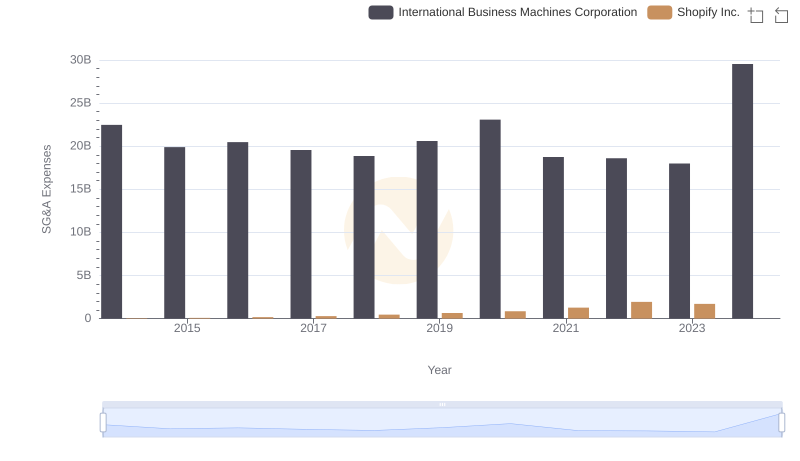

International Business Machines Corporation vs Shopify Inc.: SG&A Expense Trends

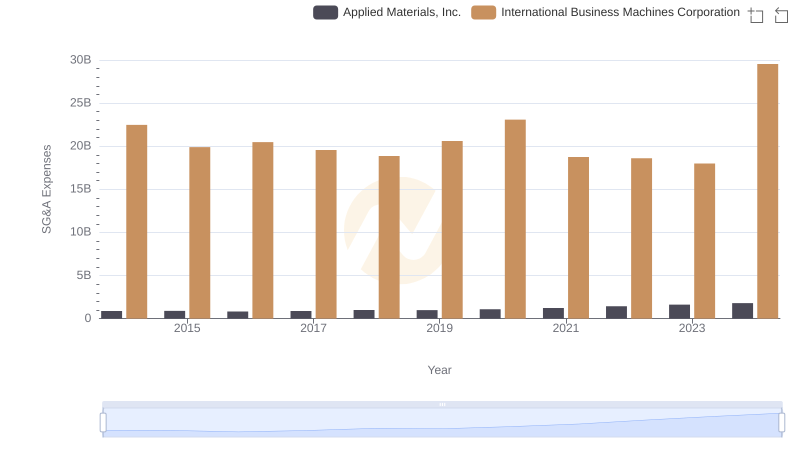

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and Applied Materials, Inc.

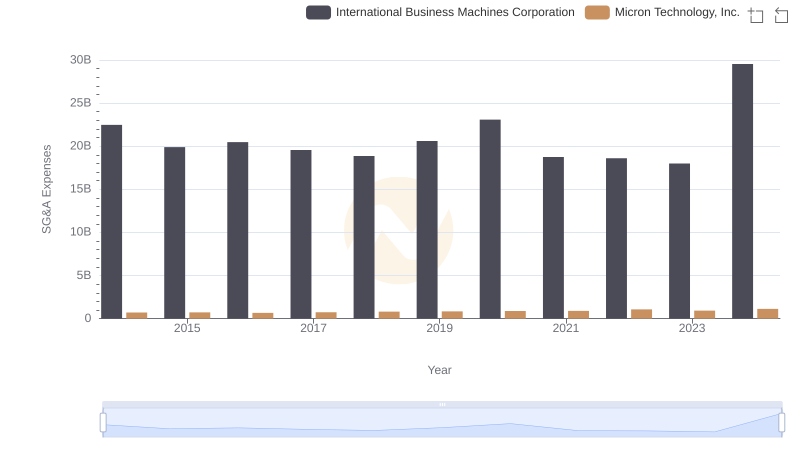

Operational Costs Compared: SG&A Analysis of International Business Machines Corporation and Micron Technology, Inc.

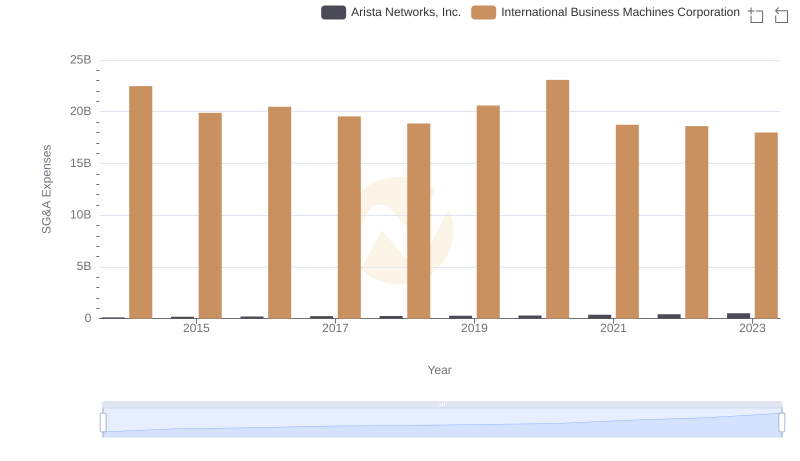

Comparing SG&A Expenses: International Business Machines Corporation vs Arista Networks, Inc. Trends and Insights

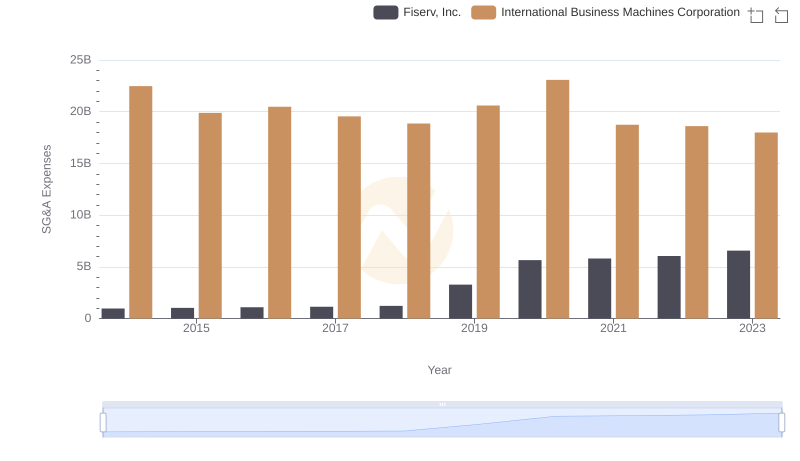

Comparing SG&A Expenses: International Business Machines Corporation vs Fiserv, Inc. Trends and Insights

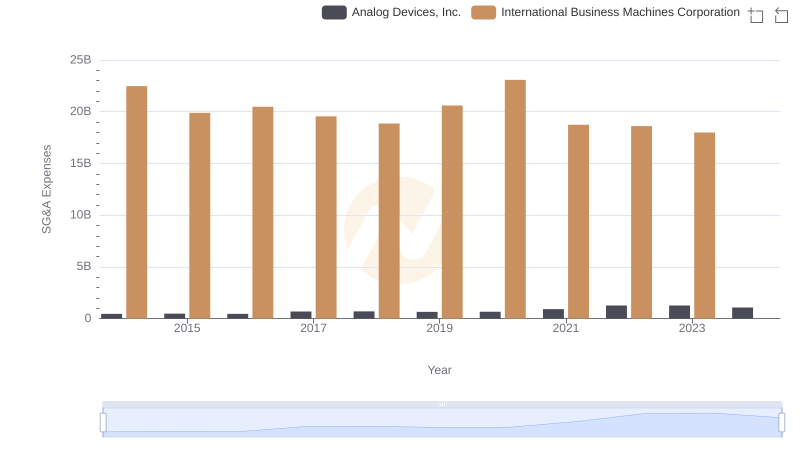

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and Analog Devices, Inc.