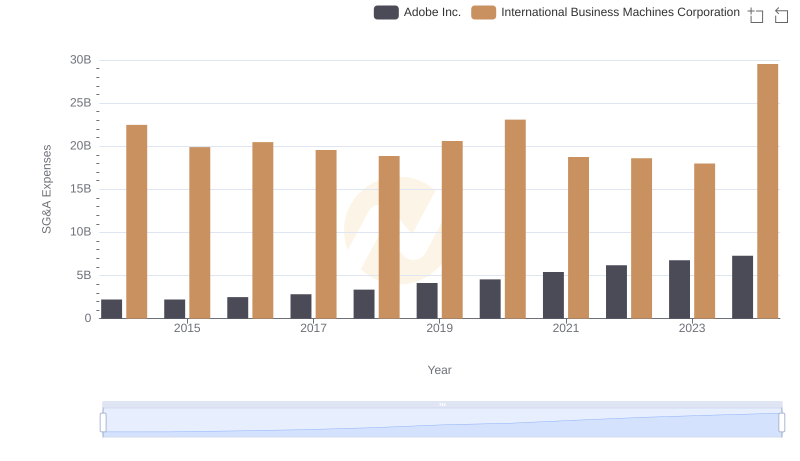

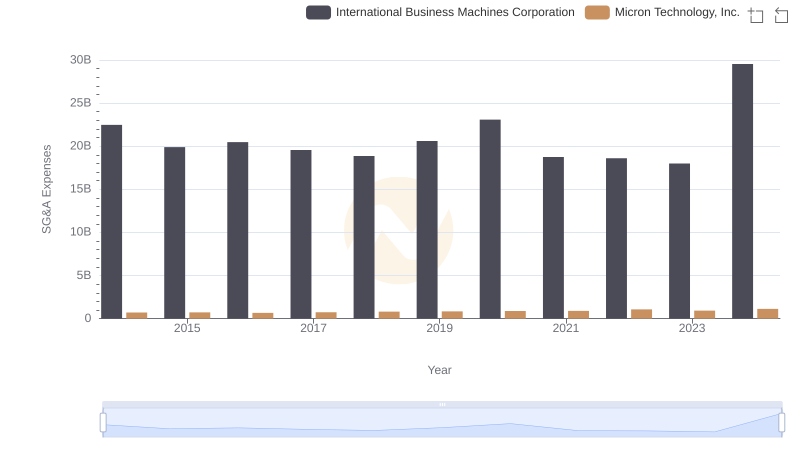

| __timestamp | Applied Materials, Inc. | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 890000000 | 22472000000 |

| Thursday, January 1, 2015 | 897000000 | 19894000000 |

| Friday, January 1, 2016 | 819000000 | 20279000000 |

| Sunday, January 1, 2017 | 890000000 | 19680000000 |

| Monday, January 1, 2018 | 1002000000 | 19366000000 |

| Tuesday, January 1, 2019 | 982000000 | 18724000000 |

| Wednesday, January 1, 2020 | 1093000000 | 20561000000 |

| Friday, January 1, 2021 | 1229000000 | 18745000000 |

| Saturday, January 1, 2022 | 1438000000 | 17483000000 |

| Sunday, January 1, 2023 | 1628000000 | 17997000000 |

| Monday, January 1, 2024 | 1797000000 | 29536000000 |

Igniting the spark of knowledge

In the ever-evolving landscape of technology, understanding the efficiency of Selling, General, and Administrative (SG&A) expenses is crucial for evaluating corporate performance. This analysis juxtaposes two industry titans: International Business Machines Corporation (IBM) and Applied Materials, Inc. (AMAT), from 2014 to 2024.

Over the past decade, IBM's SG&A expenses have shown a significant fluctuation, peaking in 2024 with a 48% increase from 2019. In contrast, AMAT has demonstrated a steady upward trend, with a 95% rise in SG&A expenses over the same period. This suggests a strategic expansion and investment in operational capabilities.

While IBM's higher SG&A expenses reflect its expansive global operations, AMAT's consistent growth indicates a focused approach to scaling its business. Investors and analysts should consider these trends when evaluating the companies' financial health and strategic direction.

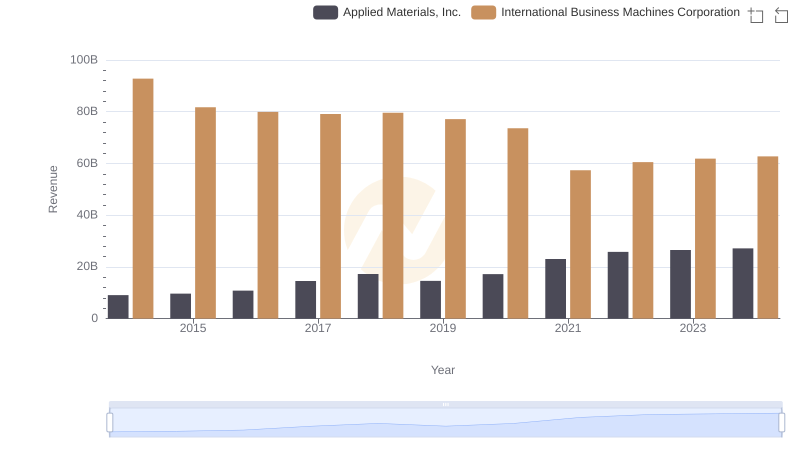

Comparing Revenue Performance: International Business Machines Corporation or Applied Materials, Inc.?

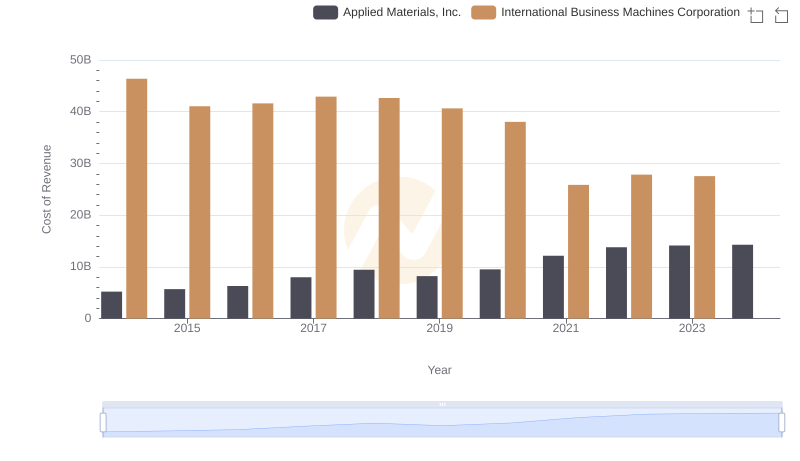

Cost of Revenue: Key Insights for International Business Machines Corporation and Applied Materials, Inc.

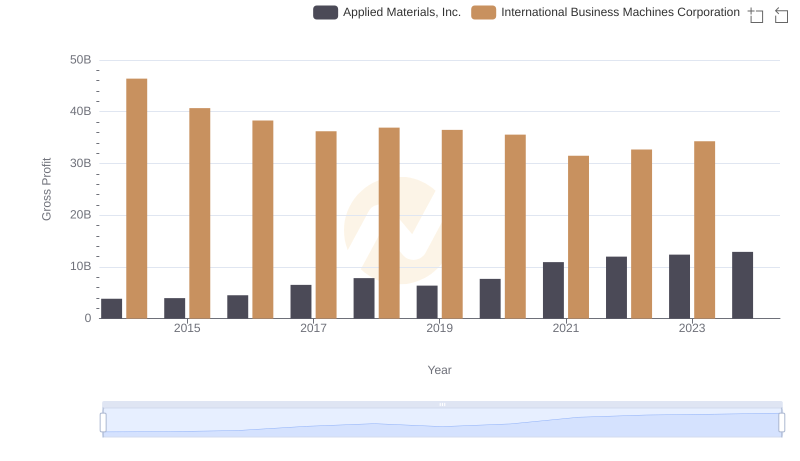

Gross Profit Analysis: Comparing International Business Machines Corporation and Applied Materials, Inc.

Comparing SG&A Expenses: International Business Machines Corporation vs Adobe Inc. Trends and Insights

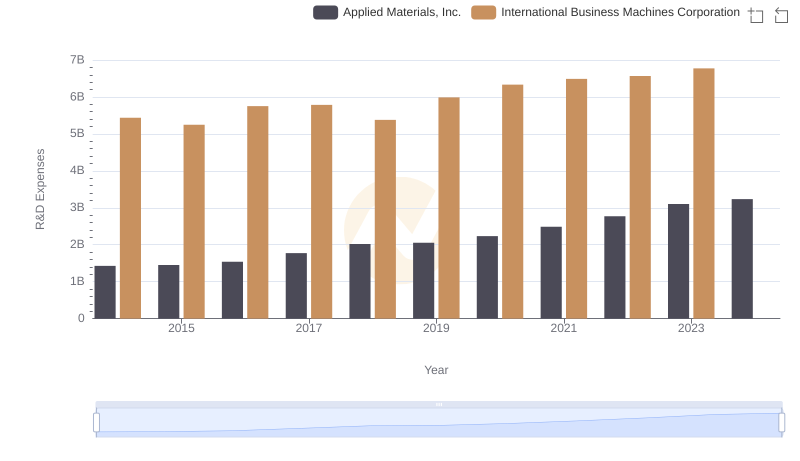

R&D Spending Showdown: International Business Machines Corporation vs Applied Materials, Inc.

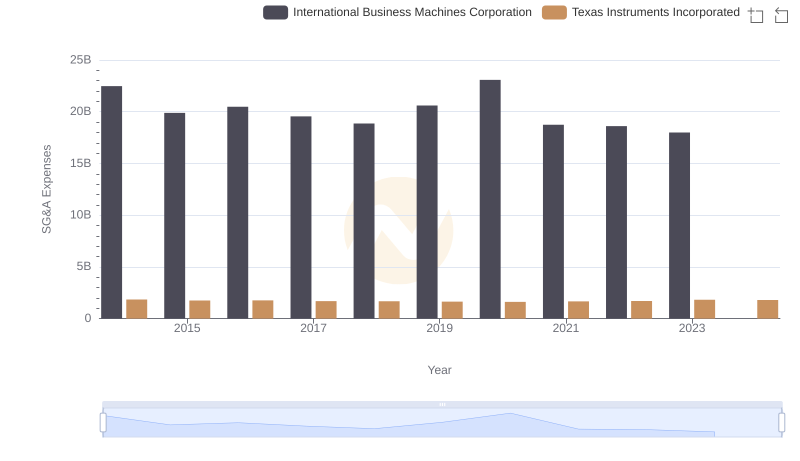

International Business Machines Corporation or Texas Instruments Incorporated: Who Manages SG&A Costs Better?

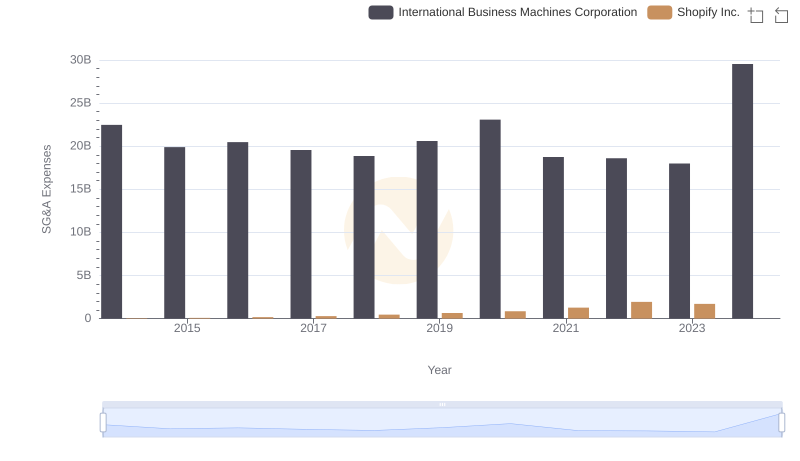

International Business Machines Corporation vs Shopify Inc.: SG&A Expense Trends

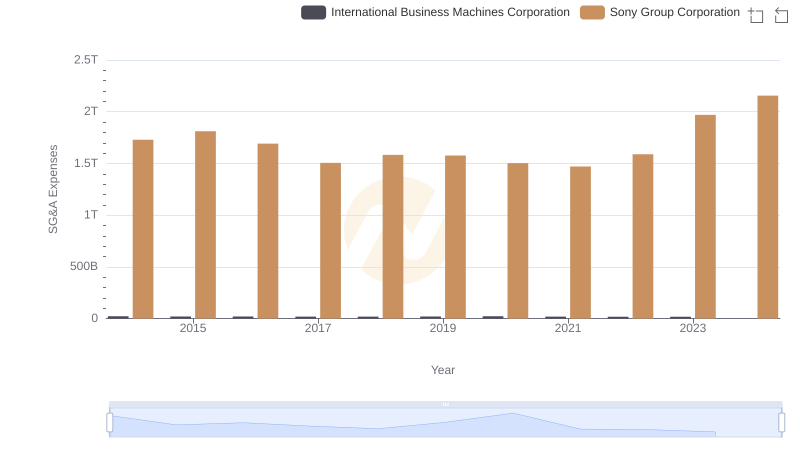

Who Optimizes SG&A Costs Better? International Business Machines Corporation or Sony Group Corporation

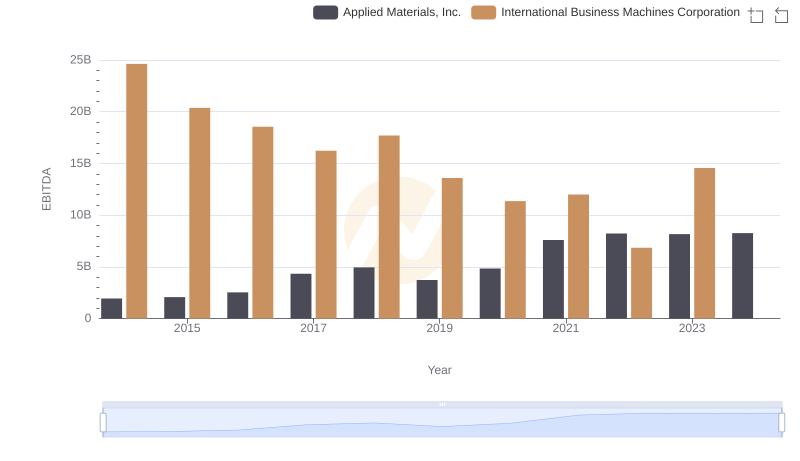

EBITDA Performance Review: International Business Machines Corporation vs Applied Materials, Inc.

Operational Costs Compared: SG&A Analysis of International Business Machines Corporation and Micron Technology, Inc.

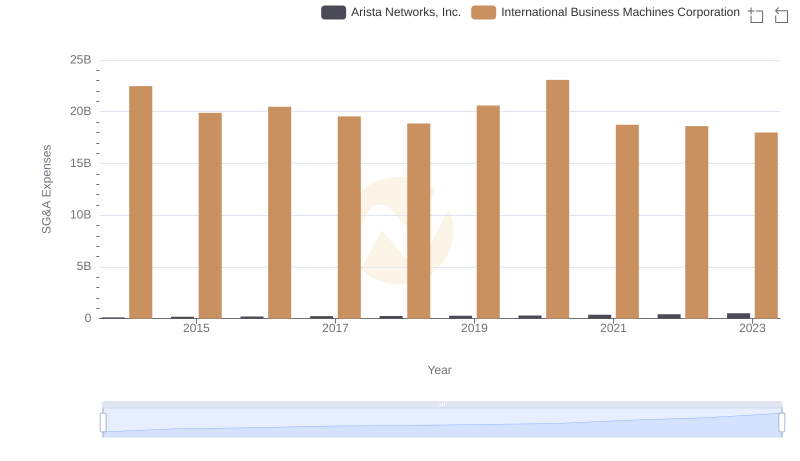

Comparing SG&A Expenses: International Business Machines Corporation vs Arista Networks, Inc. Trends and Insights