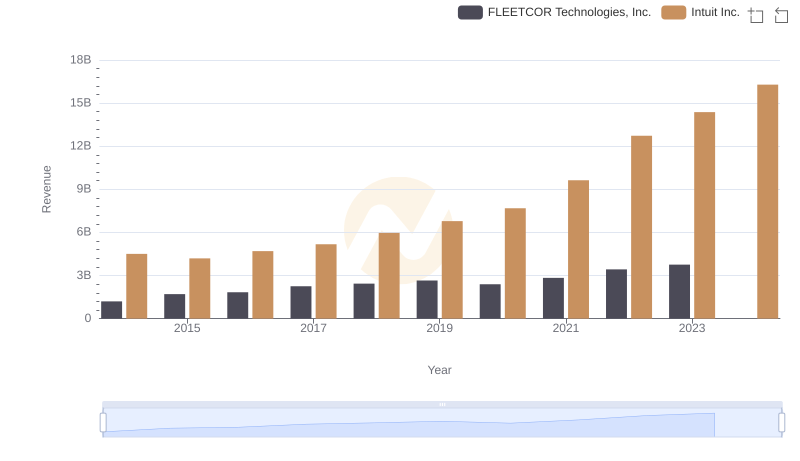

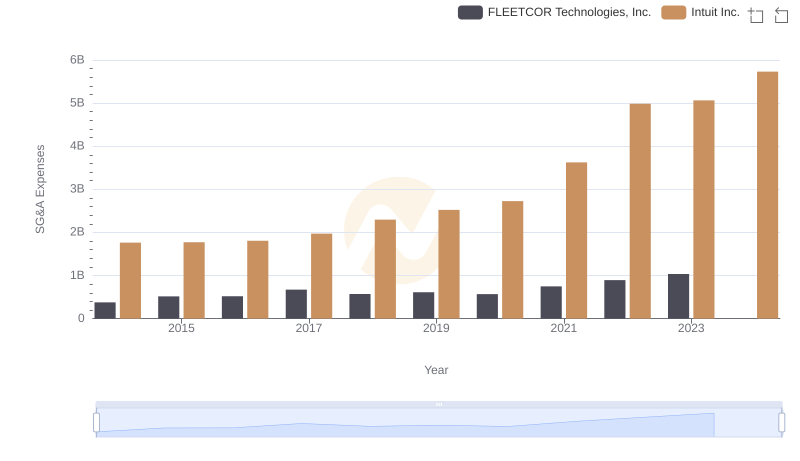

| __timestamp | FLEETCOR Technologies, Inc. | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 669924000 | 1528000000 |

| Thursday, January 1, 2015 | 800796000 | 970000000 |

| Friday, January 1, 2016 | 918071000 | 1480000000 |

| Sunday, January 1, 2017 | 1321756000 | 1634000000 |

| Monday, January 1, 2018 | 1517473000 | 1839000000 |

| Tuesday, January 1, 2019 | 1505547000 | 2121000000 |

| Wednesday, January 1, 2020 | 1237122000 | 2430000000 |

| Friday, January 1, 2021 | 1522895000 | 2948000000 |

| Saturday, January 1, 2022 | 1765920000 | 3369000000 |

| Sunday, January 1, 2023 | 2027494000 | 4043000000 |

| Monday, January 1, 2024 | 2119258000 | 4581000000 |

Data in motion

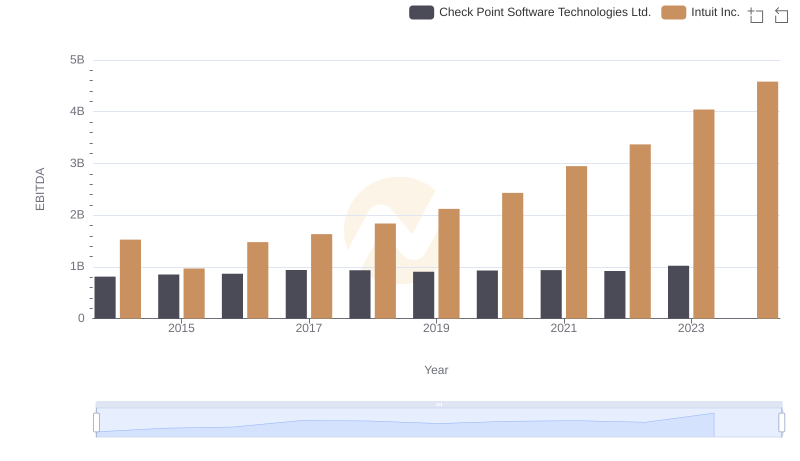

In the ever-evolving landscape of financial technology, Intuit Inc. and FLEETCOR Technologies, Inc. have emerged as formidable players. Over the past decade, Intuit has consistently outperformed FLEETCOR in terms of EBITDA, showcasing a robust growth trajectory. From 2014 to 2023, Intuit's EBITDA surged by approximately 165%, reaching a peak in 2023. In contrast, FLEETCOR's EBITDA grew by about 203% during the same period, albeit from a smaller base, highlighting its aggressive expansion strategy.

The year 2023 marked a significant milestone, with Intuit's EBITDA nearly doubling that of FLEETCOR. However, data for 2024 remains incomplete, leaving room for speculation on future trends. This comparison underscores the dynamic nature of the fintech sector, where strategic decisions and market adaptability play crucial roles in shaping financial outcomes.

Revenue Showdown: Intuit Inc. vs FLEETCOR Technologies, Inc.

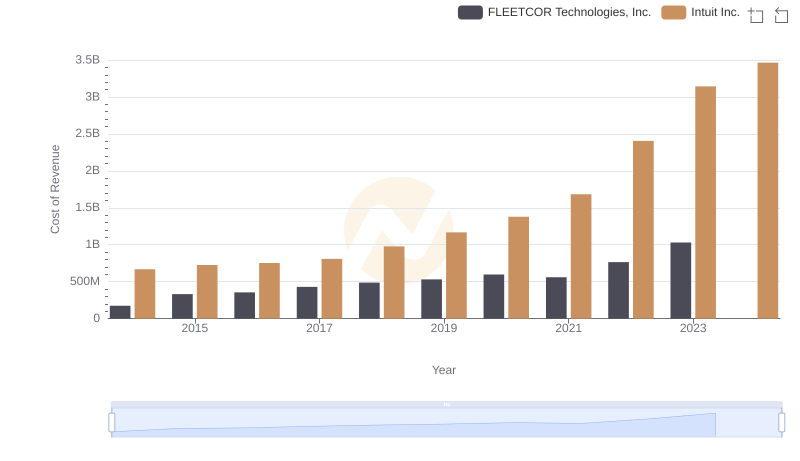

Comparing Cost of Revenue Efficiency: Intuit Inc. vs FLEETCOR Technologies, Inc.

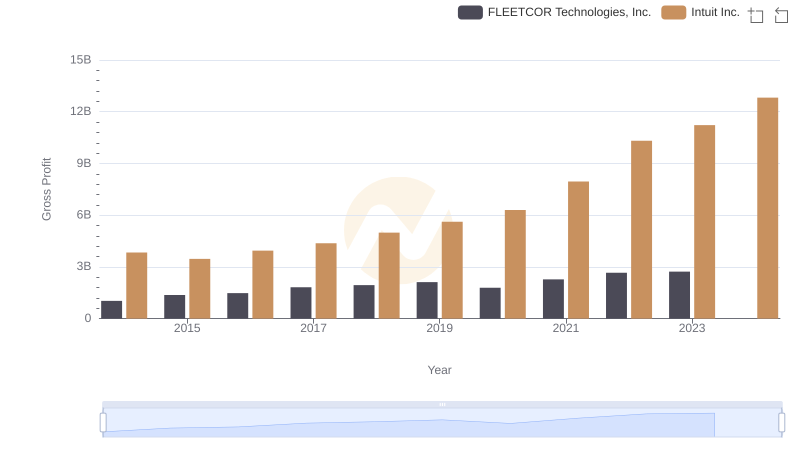

Gross Profit Trends Compared: Intuit Inc. vs FLEETCOR Technologies, Inc.

Intuit Inc. and Teledyne Technologies Incorporated: A Detailed Examination of EBITDA Performance

Professional EBITDA Benchmarking: Intuit Inc. vs Check Point Software Technologies Ltd.

Comparing SG&A Expenses: Intuit Inc. vs FLEETCOR Technologies, Inc. Trends and Insights

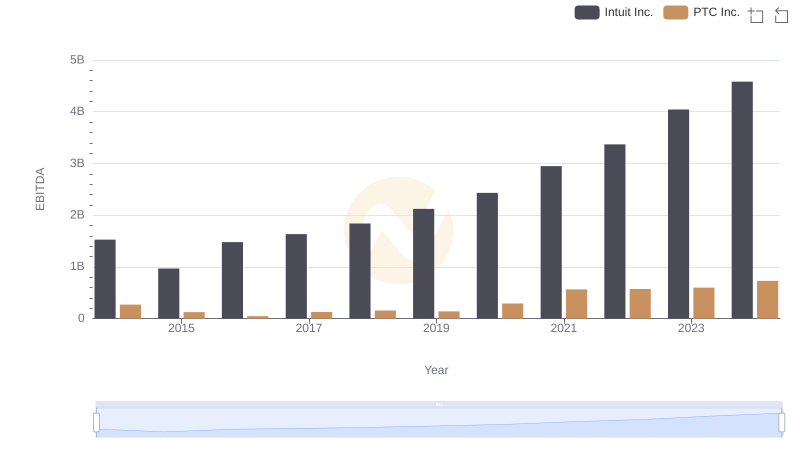

Intuit Inc. vs PTC Inc.: In-Depth EBITDA Performance Comparison

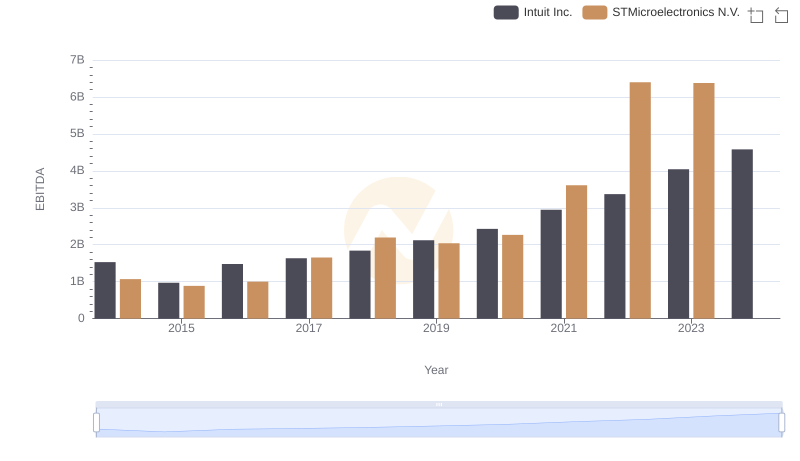

EBITDA Analysis: Evaluating Intuit Inc. Against STMicroelectronics N.V.

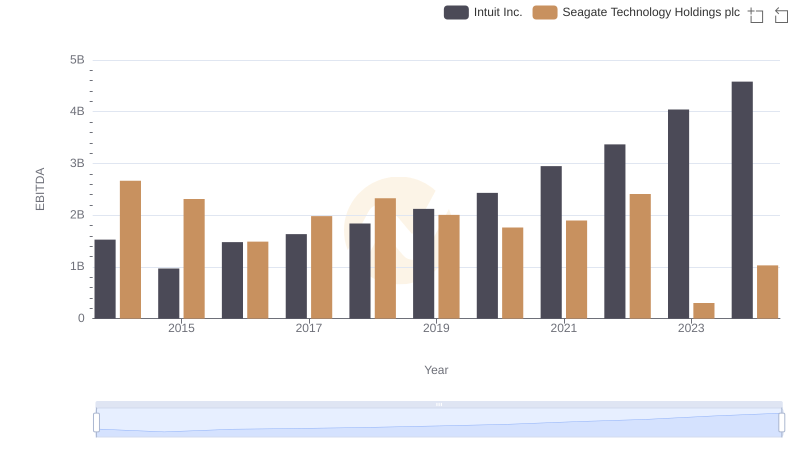

Intuit Inc. vs Seagate Technology Holdings plc: In-Depth EBITDA Performance Comparison

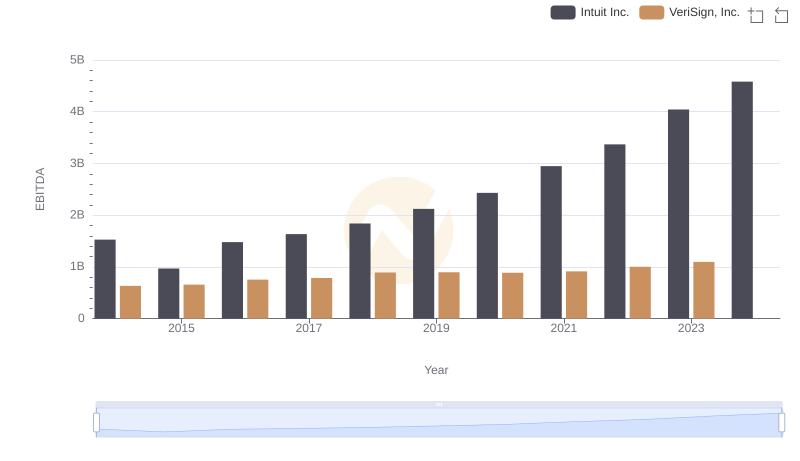

Professional EBITDA Benchmarking: Intuit Inc. vs VeriSign, Inc.

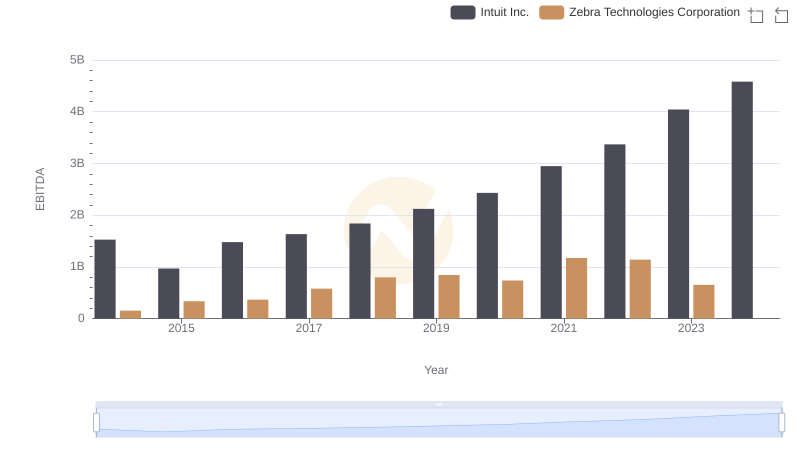

EBITDA Analysis: Evaluating Intuit Inc. Against Zebra Technologies Corporation

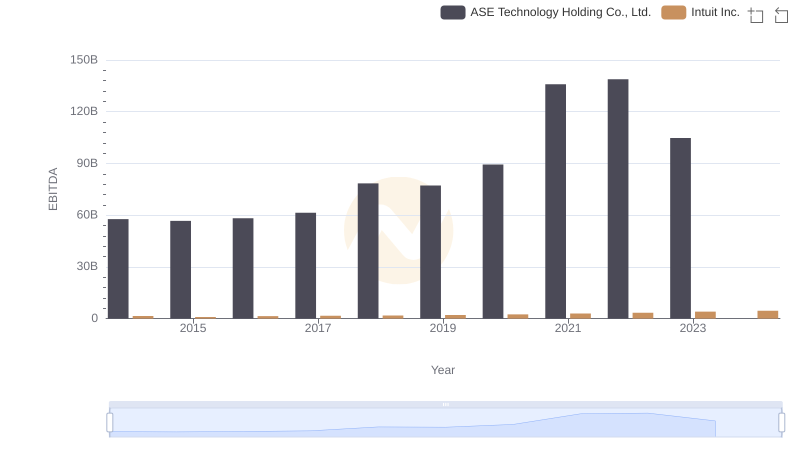

EBITDA Metrics Evaluated: Intuit Inc. vs ASE Technology Holding Co., Ltd.