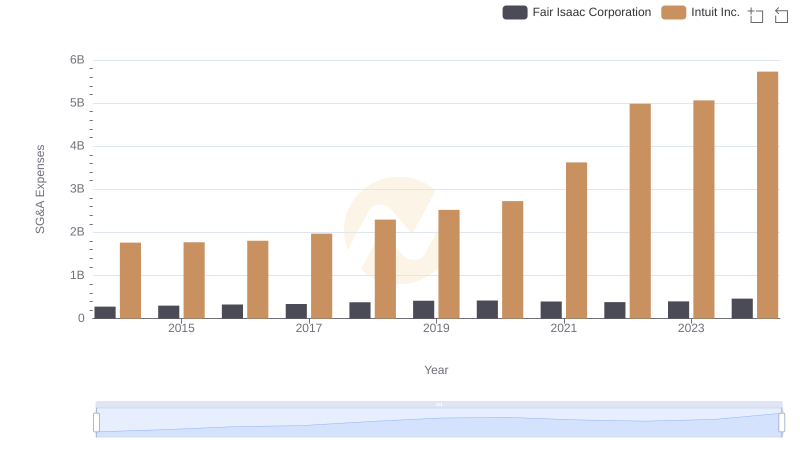

| __timestamp | Fair Isaac Corporation | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 194313000 | 1528000000 |

| Thursday, January 1, 2015 | 172277000 | 970000000 |

| Friday, January 1, 2016 | 202993000 | 1480000000 |

| Sunday, January 1, 2017 | 213494000 | 1634000000 |

| Monday, January 1, 2018 | 218425000 | 1839000000 |

| Tuesday, January 1, 2019 | 287436000 | 2121000000 |

| Wednesday, January 1, 2020 | 349555000 | 2430000000 |

| Friday, January 1, 2021 | 554928000 | 2948000000 |

| Saturday, January 1, 2022 | 576663000 | 3369000000 |

| Sunday, January 1, 2023 | 663808000 | 4043000000 |

| Monday, January 1, 2024 | 761490000 | 4581000000 |

In pursuit of knowledge

In the ever-evolving landscape of financial technology, Intuit Inc. and Fair Isaac Corporation have emerged as formidable players. Over the past decade, from 2014 to 2024, these companies have demonstrated remarkable growth in their EBITDA, a key indicator of financial health and operational efficiency.

Intuit Inc. has consistently outperformed Fair Isaac Corporation, with its EBITDA growing by approximately 200% from 2014 to 2024. In 2014, Intuit's EBITDA was nearly 8 times that of Fair Isaac, and by 2024, this ratio increased to about 6 times, reflecting Intuit's robust financial strategies and market adaptability.

Fair Isaac, while trailing, has shown a commendable growth trajectory, with its EBITDA increasing by over 290% during the same period. This growth underscores Fair Isaac's strategic initiatives in credit scoring and analytics.

The data highlights Intuit's dominance in the sector, yet Fair Isaac's steady growth suggests a promising future. Investors and stakeholders should watch these trends closely as they navigate the competitive fintech landscape.

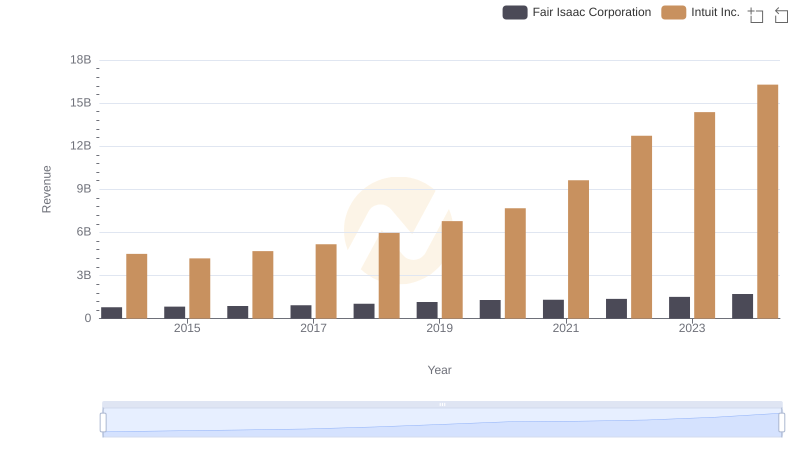

Revenue Insights: Intuit Inc. and Fair Isaac Corporation Performance Compared

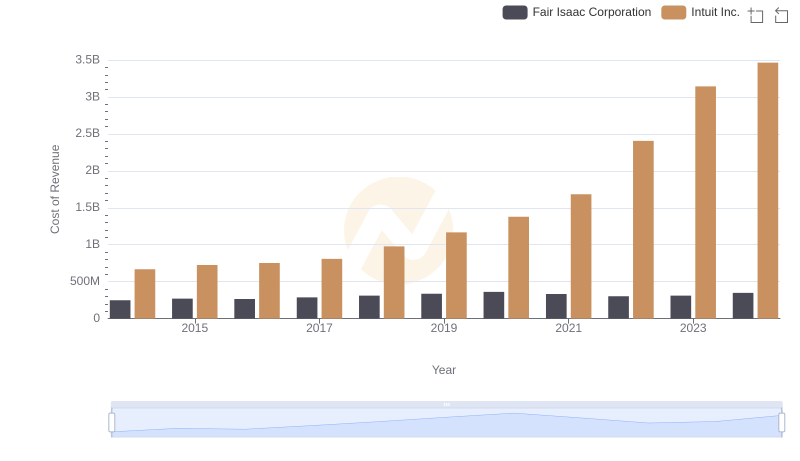

Cost of Revenue Comparison: Intuit Inc. vs Fair Isaac Corporation

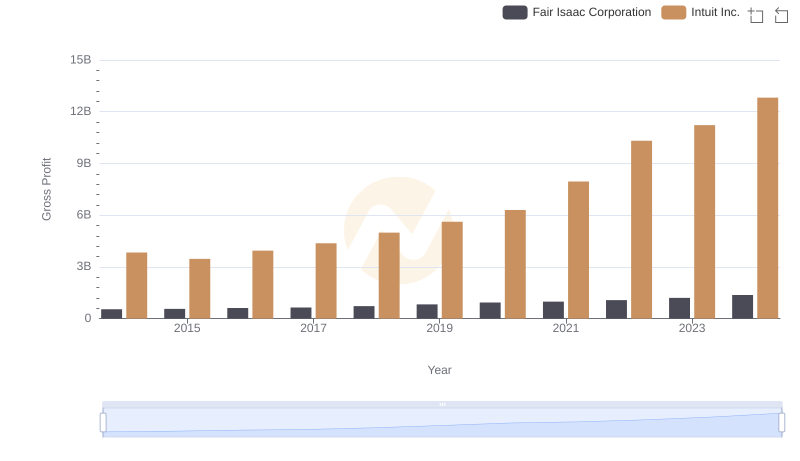

Intuit Inc. and Fair Isaac Corporation: A Detailed Gross Profit Analysis

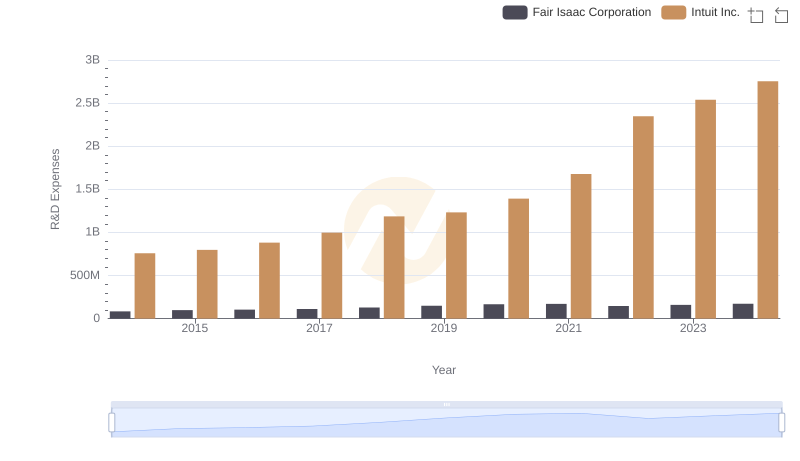

R&D Spending Showdown: Intuit Inc. vs Fair Isaac Corporation

Comparing SG&A Expenses: Intuit Inc. vs Fair Isaac Corporation Trends and Insights

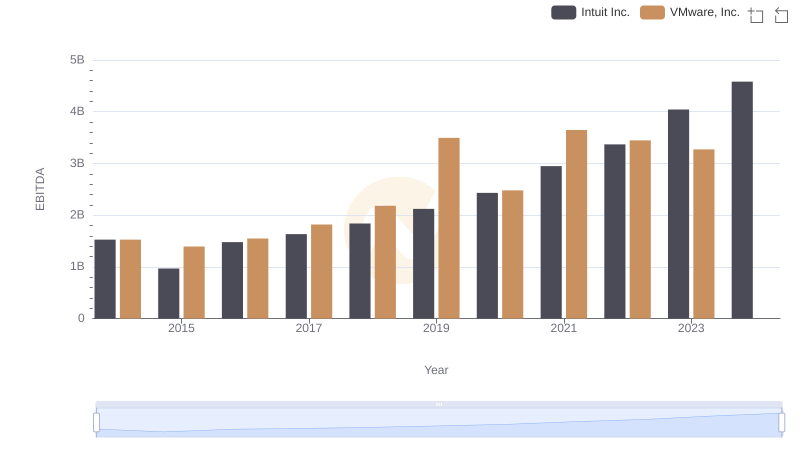

EBITDA Analysis: Evaluating Intuit Inc. Against VMware, Inc.

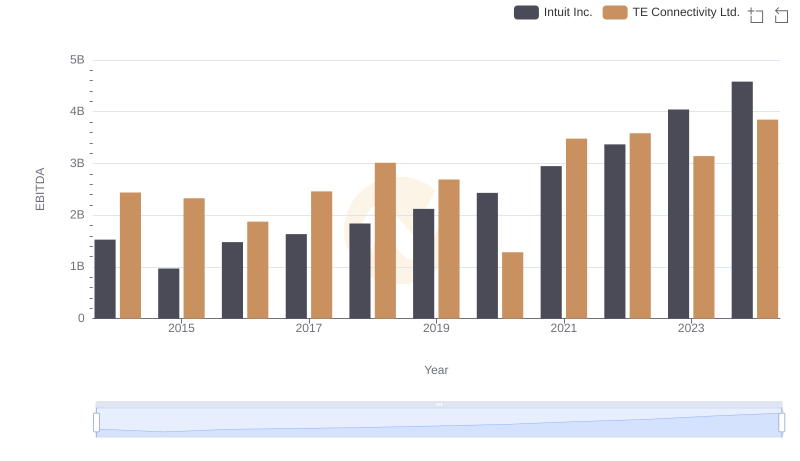

Intuit Inc. vs TE Connectivity Ltd.: In-Depth EBITDA Performance Comparison

Professional EBITDA Benchmarking: Intuit Inc. vs NXP Semiconductors N.V.

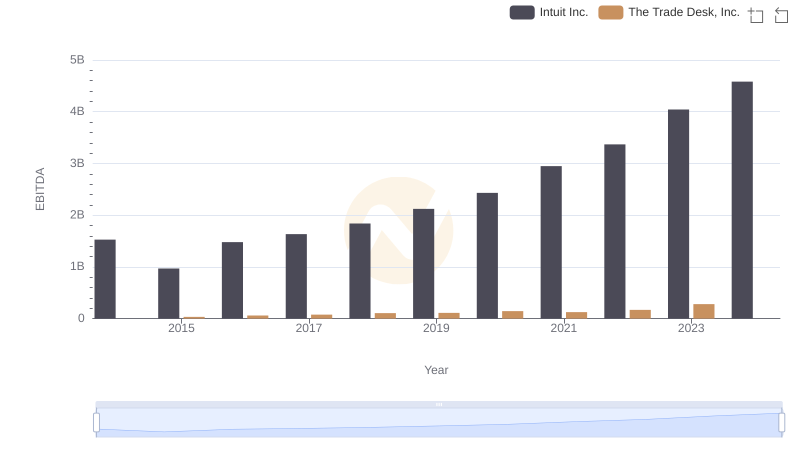

EBITDA Metrics Evaluated: Intuit Inc. vs The Trade Desk, Inc.

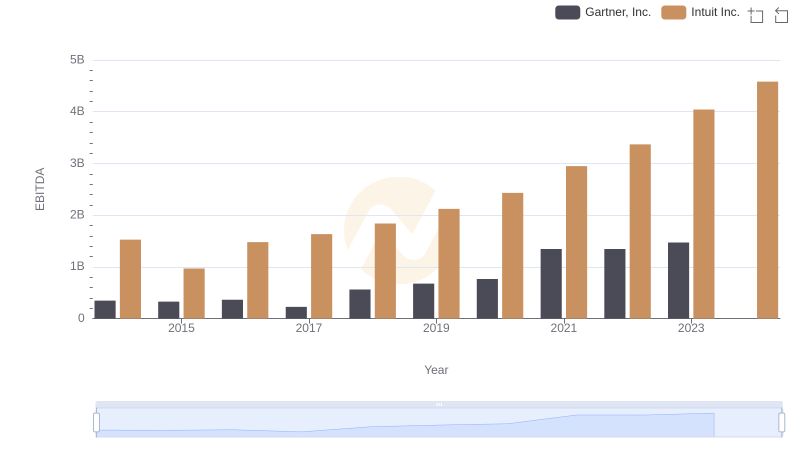

A Professional Review of EBITDA: Intuit Inc. Compared to Gartner, Inc.

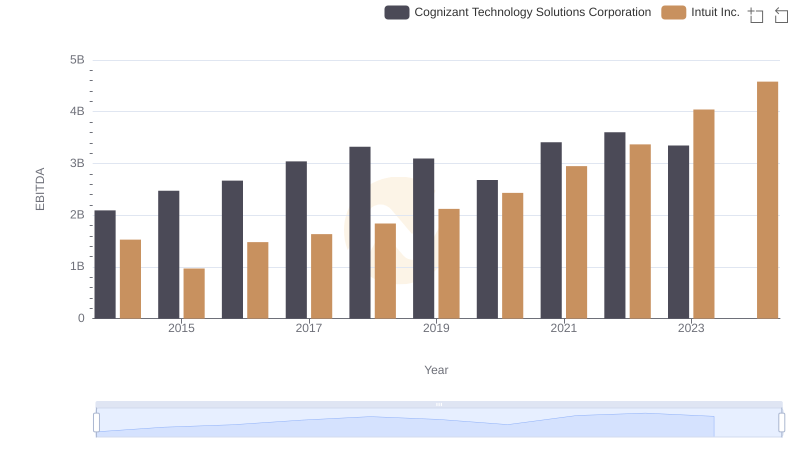

Comparative EBITDA Analysis: Intuit Inc. vs Cognizant Technology Solutions Corporation

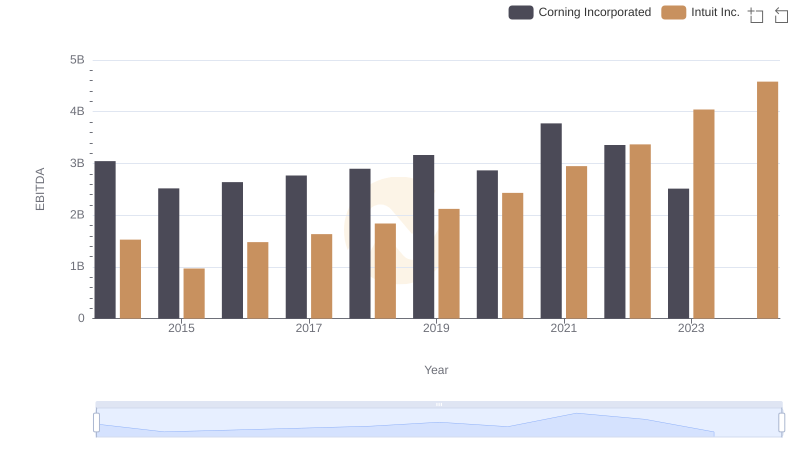

EBITDA Metrics Evaluated: Intuit Inc. vs Corning Incorporated