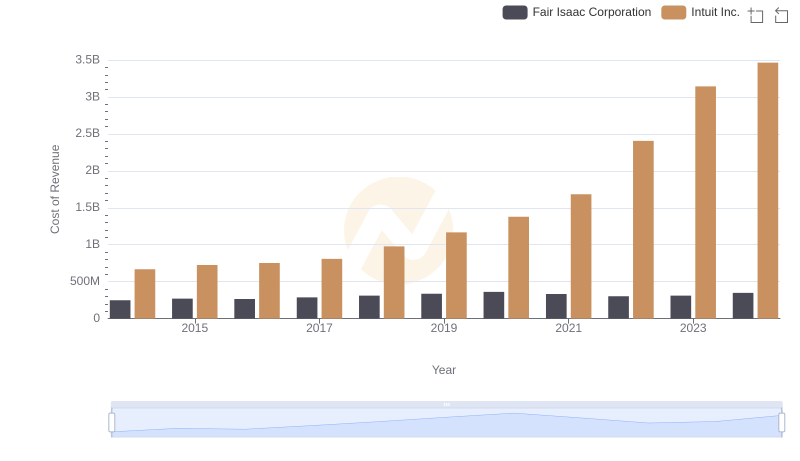

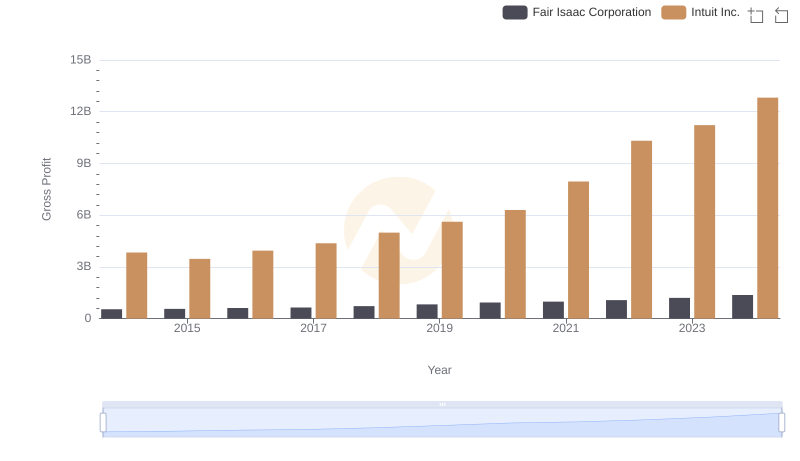

| __timestamp | Fair Isaac Corporation | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 788985000 | 4506000000 |

| Thursday, January 1, 2015 | 838781000 | 4192000000 |

| Friday, January 1, 2016 | 881356000 | 4694000000 |

| Sunday, January 1, 2017 | 932169000 | 5177000000 |

| Monday, January 1, 2018 | 1032475000 | 5964000000 |

| Tuesday, January 1, 2019 | 1160083000 | 6784000000 |

| Wednesday, January 1, 2020 | 1294562000 | 7679000000 |

| Friday, January 1, 2021 | 1316536000 | 9633000000 |

| Saturday, January 1, 2022 | 1377270000 | 12726000000 |

| Sunday, January 1, 2023 | 1513557000 | 14368000000 |

| Monday, January 1, 2024 | 1717526000 | 16285000000 |

Cracking the code

In the ever-evolving landscape of financial technology, Intuit Inc. and Fair Isaac Corporation have emerged as key players. Over the past decade, Intuit has demonstrated a remarkable revenue growth trajectory, increasing its annual revenue by approximately 260% from 2014 to 2024. This growth is indicative of Intuit's strategic innovations and market expansion.

Conversely, Fair Isaac Corporation, known for its FICO credit scoring model, has also shown steady growth, with a revenue increase of about 118% over the same period. While Intuit's revenue in 2024 is nearly ten times that of Fair Isaac, both companies have successfully navigated the competitive fintech landscape.

This comparison highlights the diverse strategies employed by these industry giants, with Intuit focusing on broadening its product offerings and Fair Isaac enhancing its core services. As we look to the future, these trends offer valuable insights into the dynamic nature of the fintech sector.

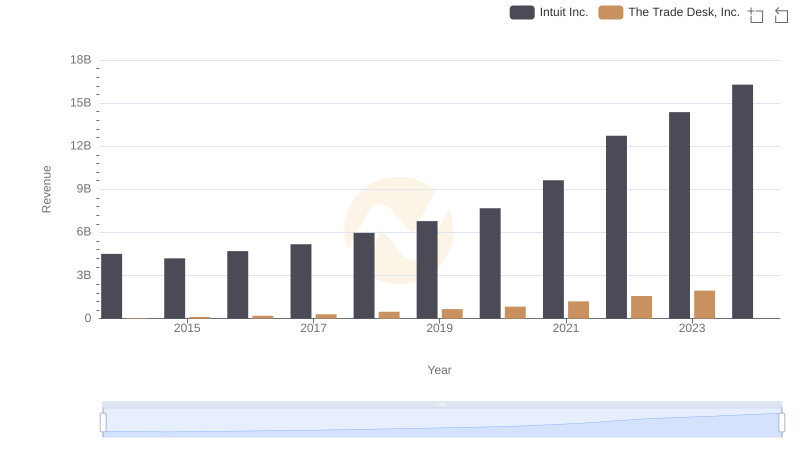

Revenue Insights: Intuit Inc. and The Trade Desk, Inc. Performance Compared

Intuit Inc. and NXP Semiconductors N.V.: A Comprehensive Revenue Analysis

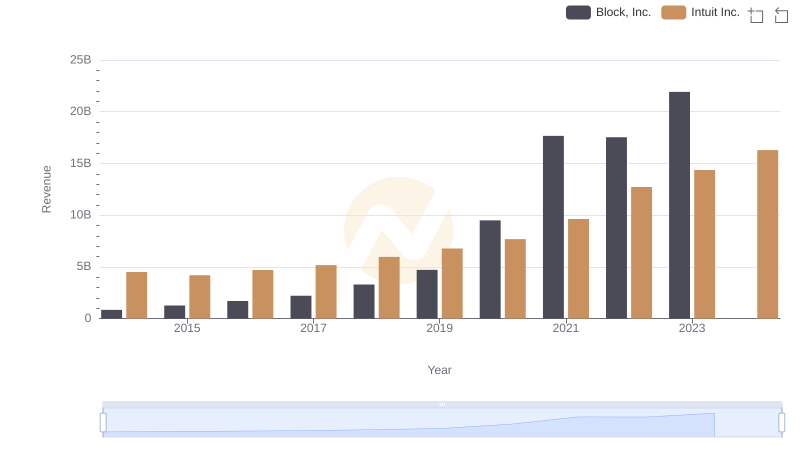

Breaking Down Revenue Trends: Intuit Inc. vs Block, Inc.

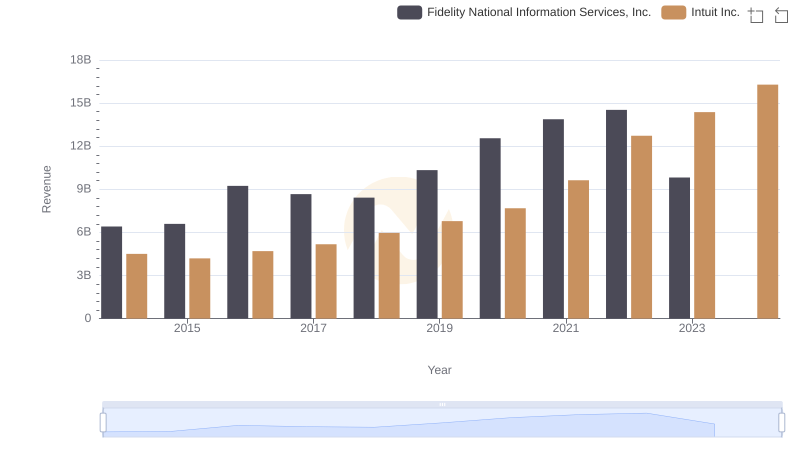

Revenue Insights: Intuit Inc. and Fidelity National Information Services, Inc. Performance Compared

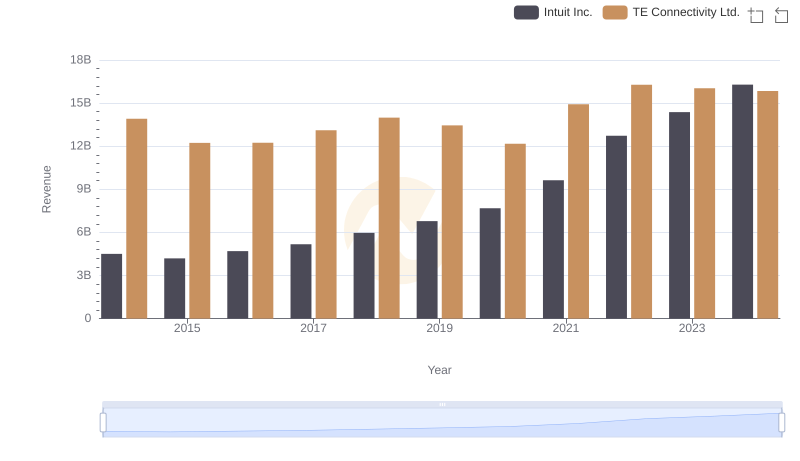

Annual Revenue Comparison: Intuit Inc. vs TE Connectivity Ltd.

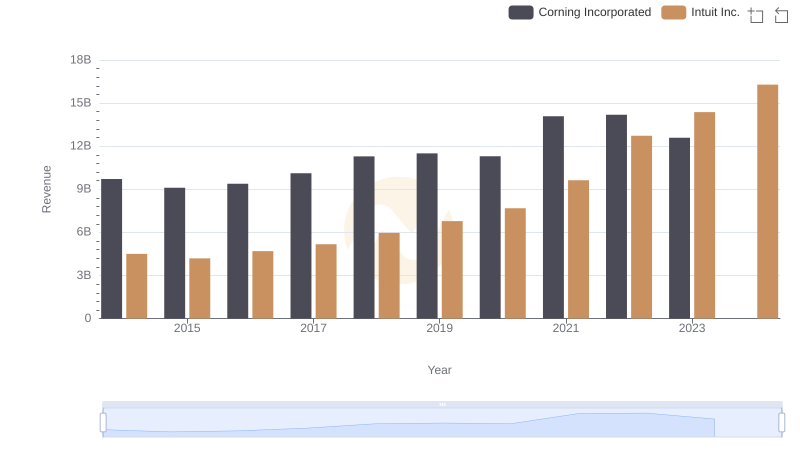

Intuit Inc. vs Corning Incorporated: Examining Key Revenue Metrics

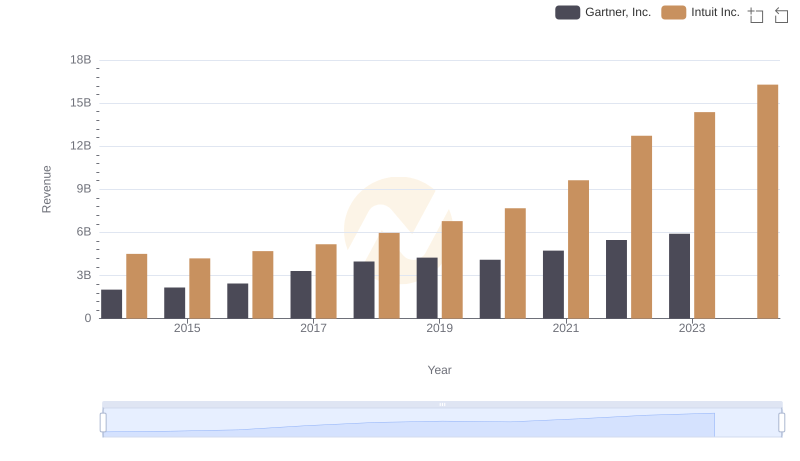

Intuit Inc. and Gartner, Inc.: A Comprehensive Revenue Analysis

Cost of Revenue Comparison: Intuit Inc. vs Fair Isaac Corporation

Intuit Inc. and Fair Isaac Corporation: A Detailed Gross Profit Analysis

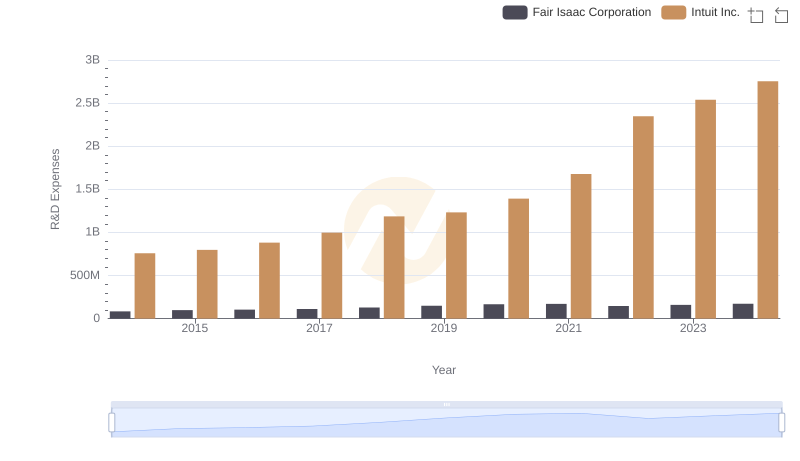

R&D Spending Showdown: Intuit Inc. vs Fair Isaac Corporation

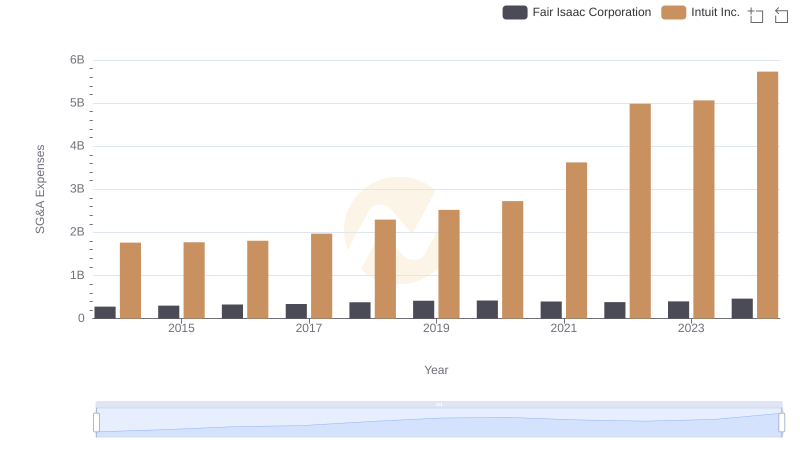

Comparing SG&A Expenses: Intuit Inc. vs Fair Isaac Corporation Trends and Insights

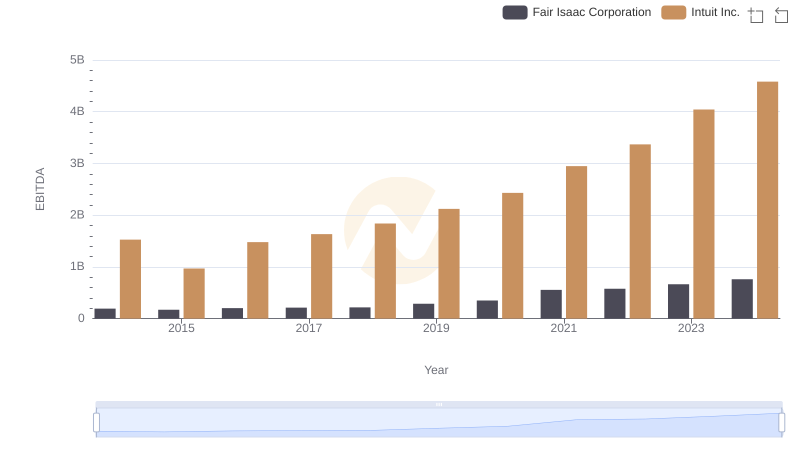

EBITDA Analysis: Evaluating Intuit Inc. Against Fair Isaac Corporation