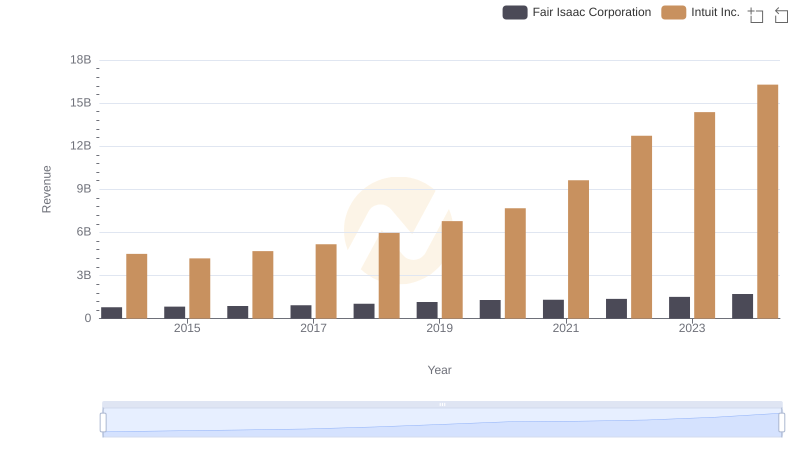

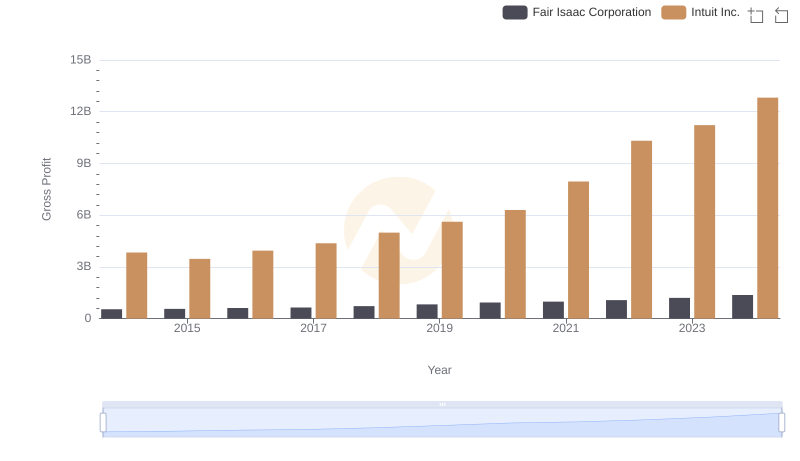

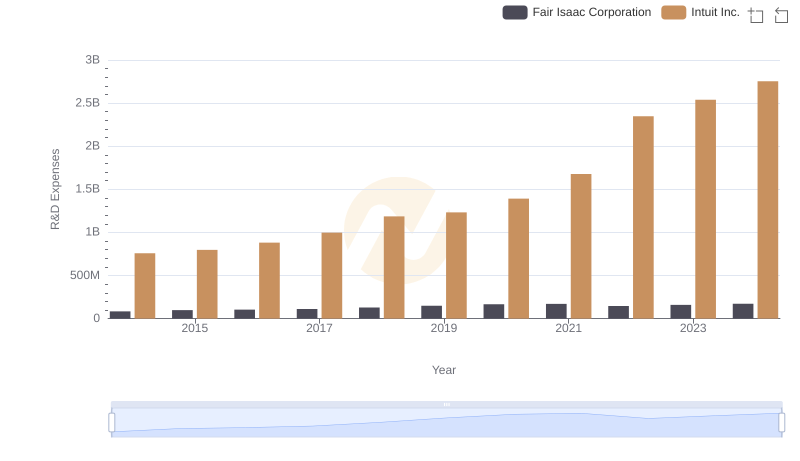

| __timestamp | Fair Isaac Corporation | Intuit Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 249281000 | 668000000 |

| Thursday, January 1, 2015 | 270535000 | 725000000 |

| Friday, January 1, 2016 | 265173000 | 752000000 |

| Sunday, January 1, 2017 | 287123000 | 809000000 |

| Monday, January 1, 2018 | 310699000 | 977000000 |

| Tuesday, January 1, 2019 | 336845000 | 1167000000 |

| Wednesday, January 1, 2020 | 361142000 | 1378000000 |

| Friday, January 1, 2021 | 332462000 | 1683000000 |

| Saturday, January 1, 2022 | 302174000 | 2406000000 |

| Sunday, January 1, 2023 | 311053000 | 3143000000 |

| Monday, January 1, 2024 | 348206000 | 3465000000 |

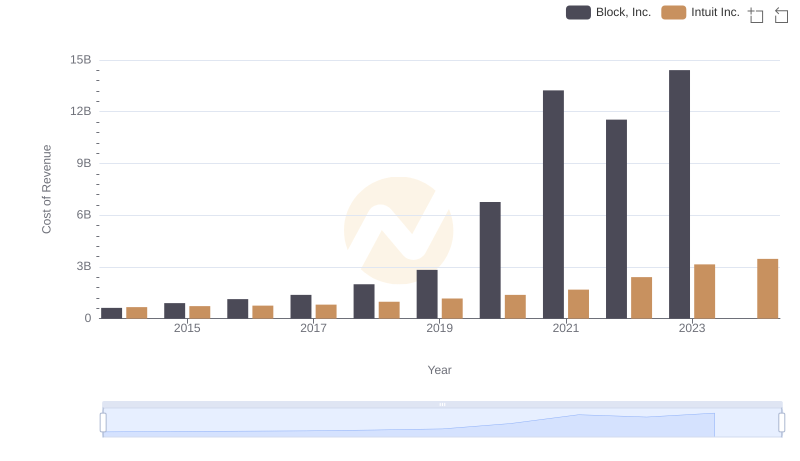

Data in motion

In the ever-evolving landscape of financial technology, understanding cost structures is pivotal. Over the past decade, Intuit Inc. and Fair Isaac Corporation have showcased contrasting trajectories in their cost of revenue. From 2014 to 2024, Intuit's cost of revenue surged by over 400%, reflecting its aggressive expansion and innovation strategies. In contrast, Fair Isaac Corporation's costs grew by approximately 40%, indicating a more stable and controlled growth approach.

These trends highlight the strategic differences between the two giants, offering valuable insights for investors and industry analysts alike.

Revenue Insights: Intuit Inc. and Fair Isaac Corporation Performance Compared

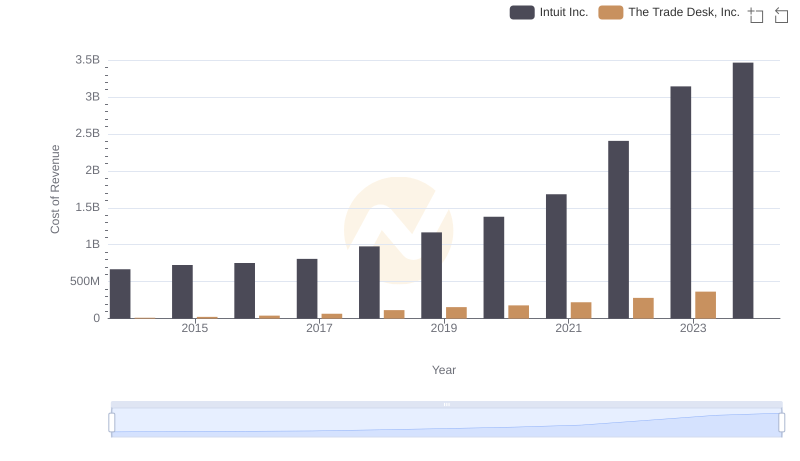

Intuit Inc. vs The Trade Desk, Inc.: Efficiency in Cost of Revenue Explored

Comparing Cost of Revenue Efficiency: Intuit Inc. vs NXP Semiconductors N.V.

Cost Insights: Breaking Down Intuit Inc. and Block, Inc.'s Expenses

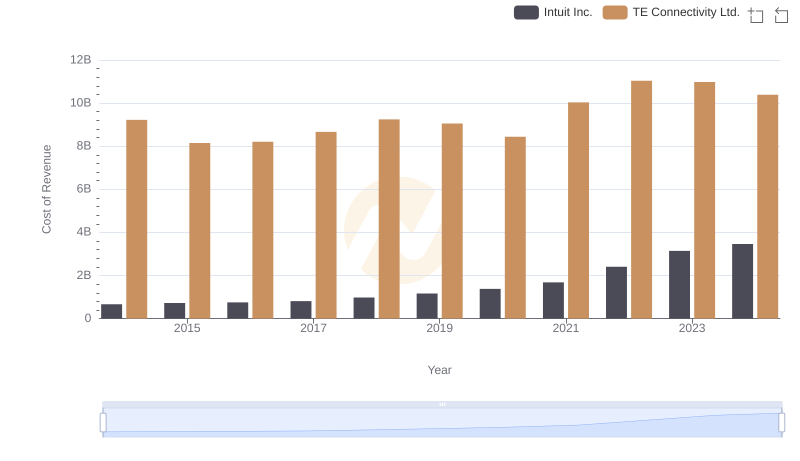

Cost of Revenue: Key Insights for Intuit Inc. and TE Connectivity Ltd.

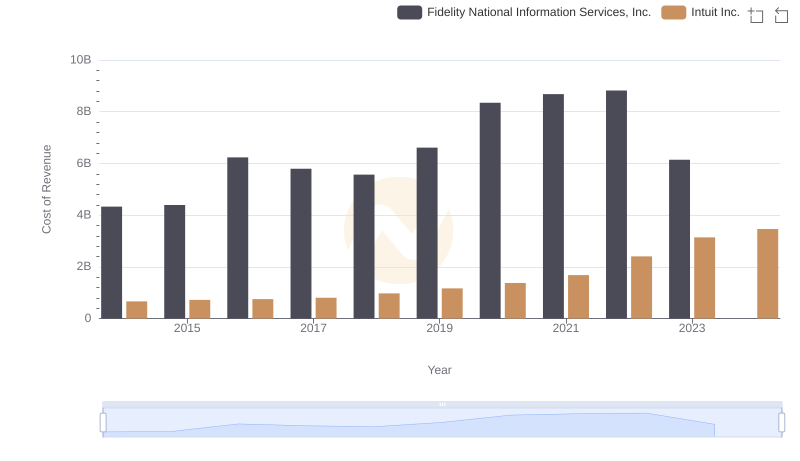

Intuit Inc. vs Fidelity National Information Services, Inc.: Efficiency in Cost of Revenue Explored

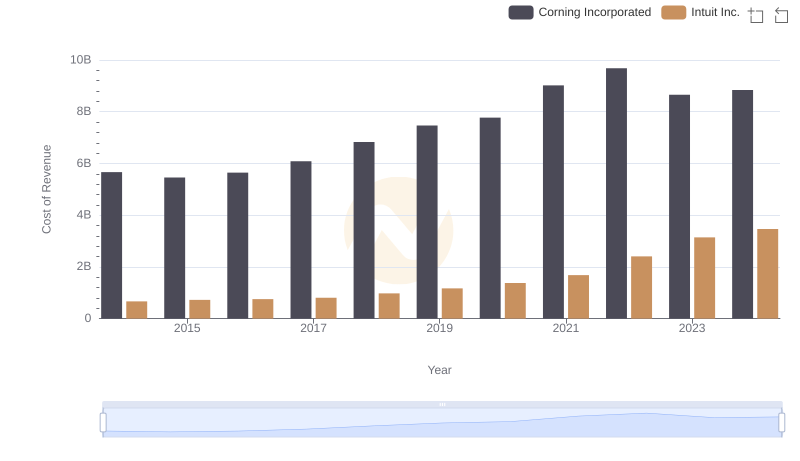

Cost of Revenue Trends: Intuit Inc. vs Corning Incorporated

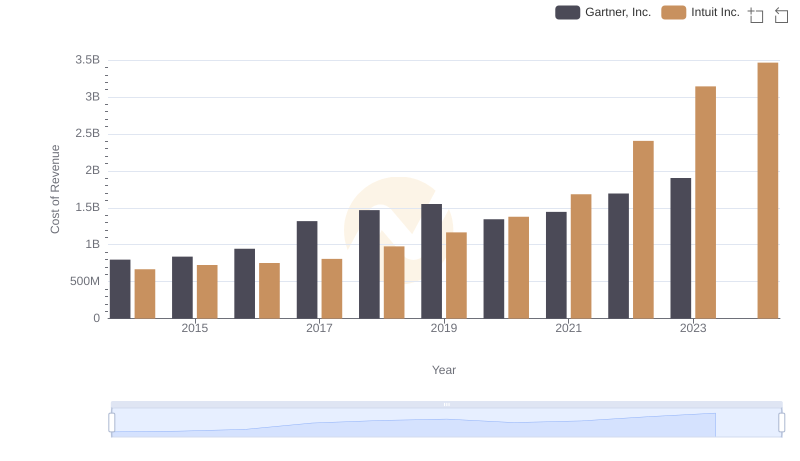

Intuit Inc. vs Gartner, Inc.: Efficiency in Cost of Revenue Explored

Intuit Inc. and Fair Isaac Corporation: A Detailed Gross Profit Analysis

R&D Spending Showdown: Intuit Inc. vs Fair Isaac Corporation

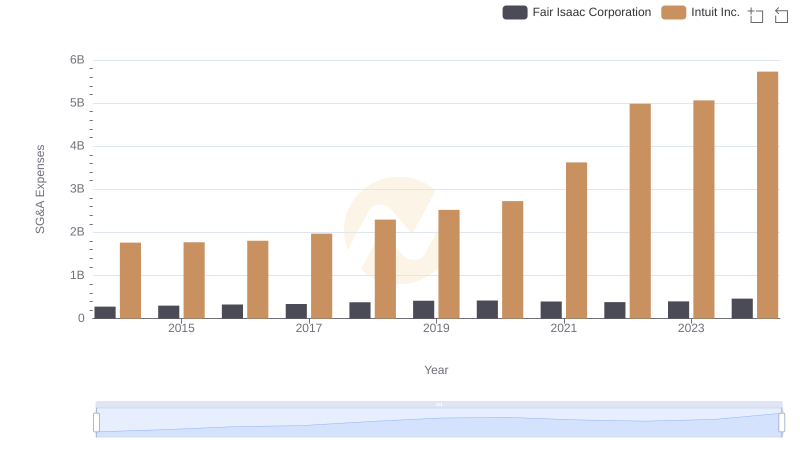

Comparing SG&A Expenses: Intuit Inc. vs Fair Isaac Corporation Trends and Insights

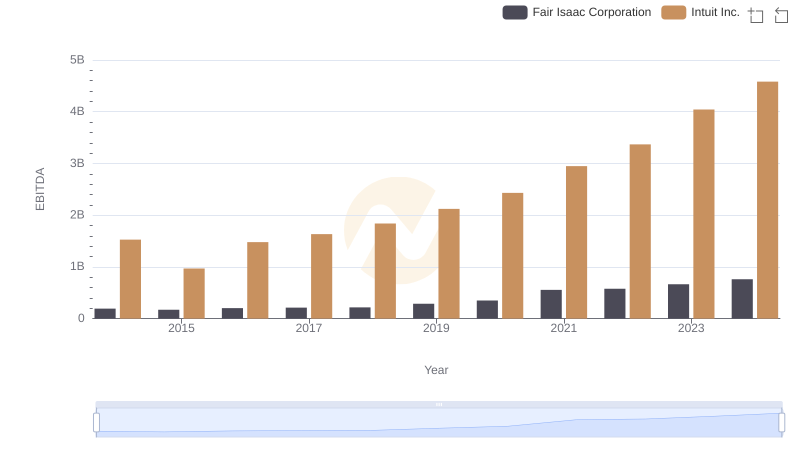

EBITDA Analysis: Evaluating Intuit Inc. Against Fair Isaac Corporation