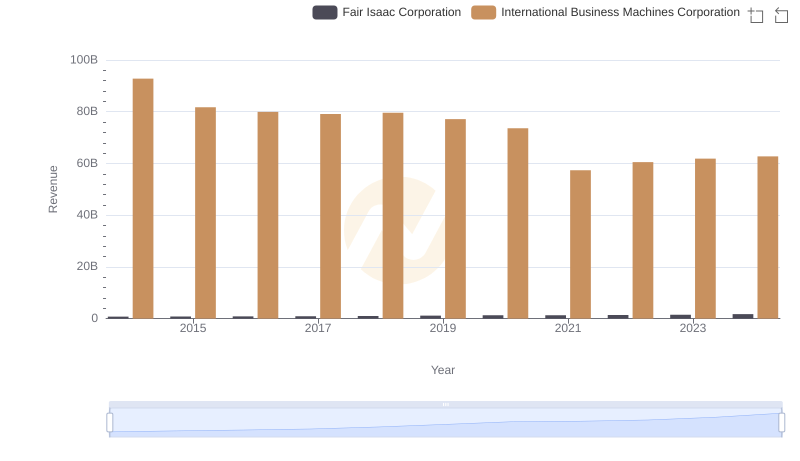

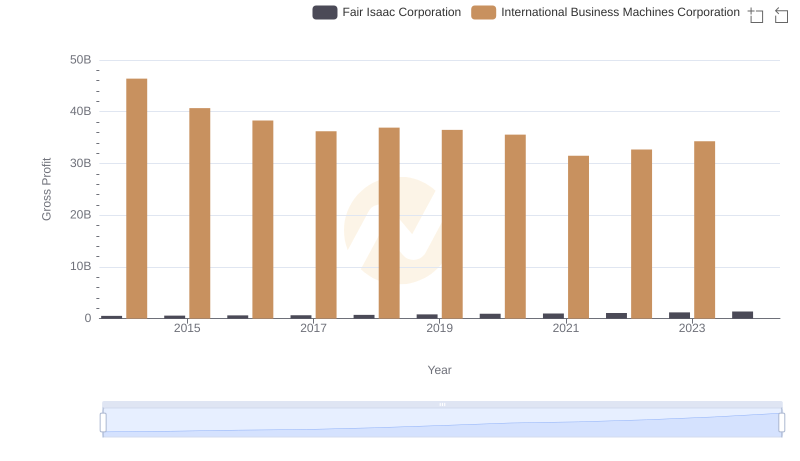

| __timestamp | Fair Isaac Corporation | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 249281000 | 46386000000 |

| Thursday, January 1, 2015 | 270535000 | 41057000000 |

| Friday, January 1, 2016 | 265173000 | 41403000000 |

| Sunday, January 1, 2017 | 287123000 | 42196000000 |

| Monday, January 1, 2018 | 310699000 | 42655000000 |

| Tuesday, January 1, 2019 | 336845000 | 26181000000 |

| Wednesday, January 1, 2020 | 361142000 | 24314000000 |

| Friday, January 1, 2021 | 332462000 | 25865000000 |

| Saturday, January 1, 2022 | 302174000 | 27842000000 |

| Sunday, January 1, 2023 | 311053000 | 27560000000 |

| Monday, January 1, 2024 | 348206000 | 27202000000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of technology and analytics, International Business Machines Corporation (IBM) and Fair Isaac Corporation (FICO) have carved distinct paths. Over the past decade, from 2014 to 2024, IBM's cost of revenue has seen a significant decline of approximately 41%, dropping from 46.4 billion to 27.2 billion. This trend reflects IBM's strategic shift towards more efficient operations and a focus on high-margin services.

Conversely, FICO's cost of revenue has steadily increased by about 40%, from 249 million to 348 million. This growth underscores FICO's expanding footprint in the analytics sector, driven by rising demand for its credit scoring and decision management solutions.

These contrasting trends highlight the dynamic nature of the tech industry, where companies must adapt to changing market demands and technological advancements to maintain their competitive edge.

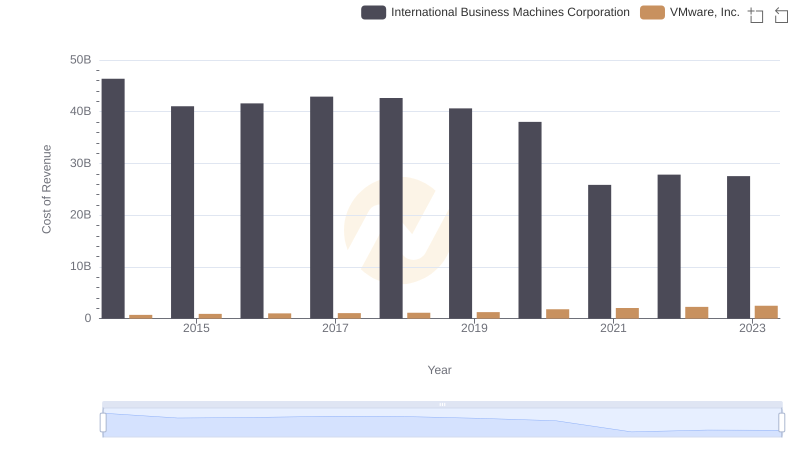

Cost of Revenue Trends: International Business Machines Corporation vs VMware, Inc.

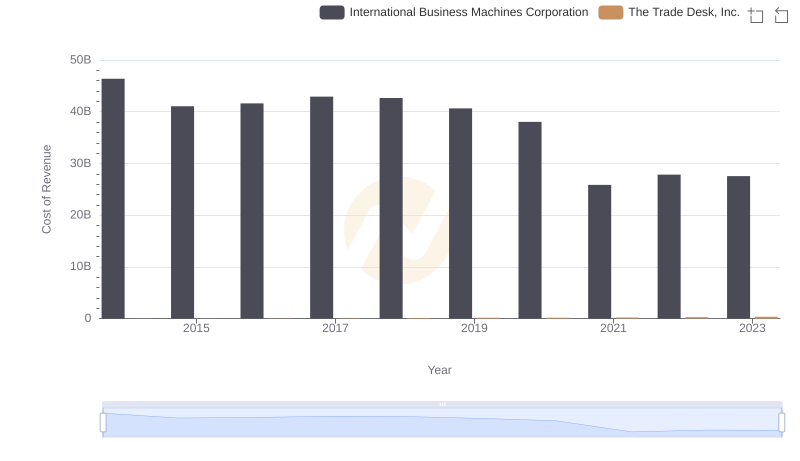

Cost Insights: Breaking Down International Business Machines Corporation and The Trade Desk, Inc.'s Expenses

Revenue Showdown: International Business Machines Corporation vs Fair Isaac Corporation

Cost of Revenue Comparison: International Business Machines Corporation vs NXP Semiconductors N.V.

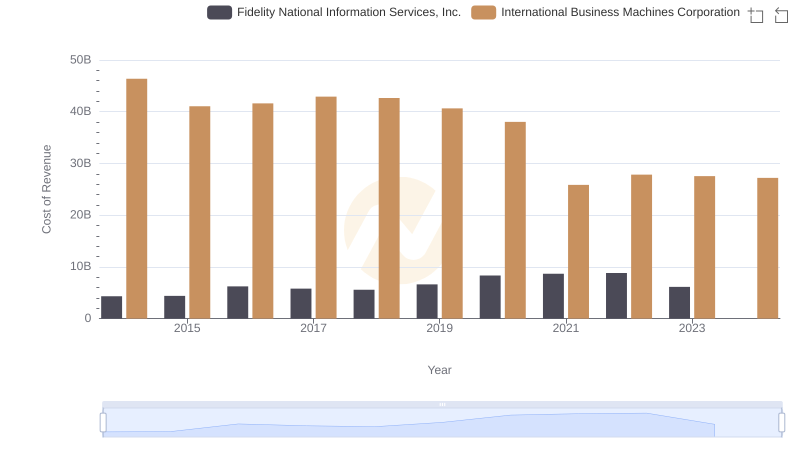

Analyzing Cost of Revenue: International Business Machines Corporation and Fidelity National Information Services, Inc.

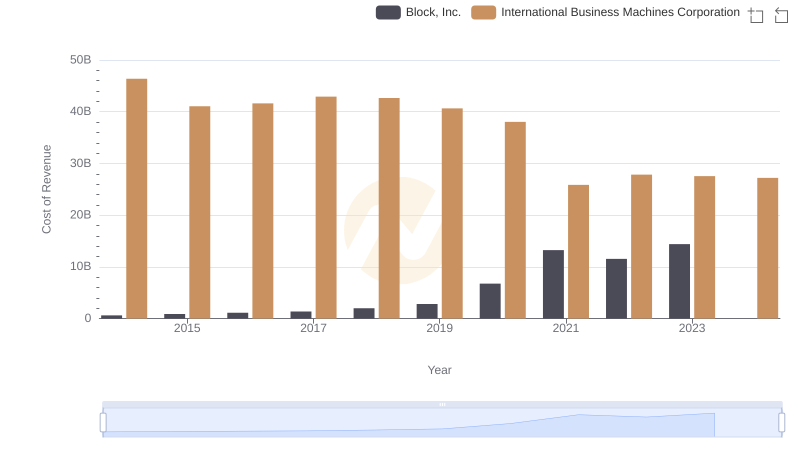

Cost Insights: Breaking Down International Business Machines Corporation and Block, Inc.'s Expenses

Who Generates Higher Gross Profit? International Business Machines Corporation or Fair Isaac Corporation

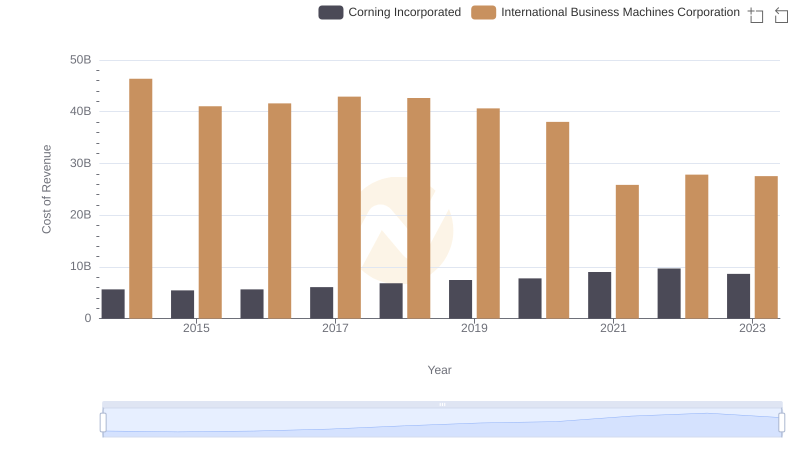

Cost of Revenue: Key Insights for International Business Machines Corporation and Corning Incorporated

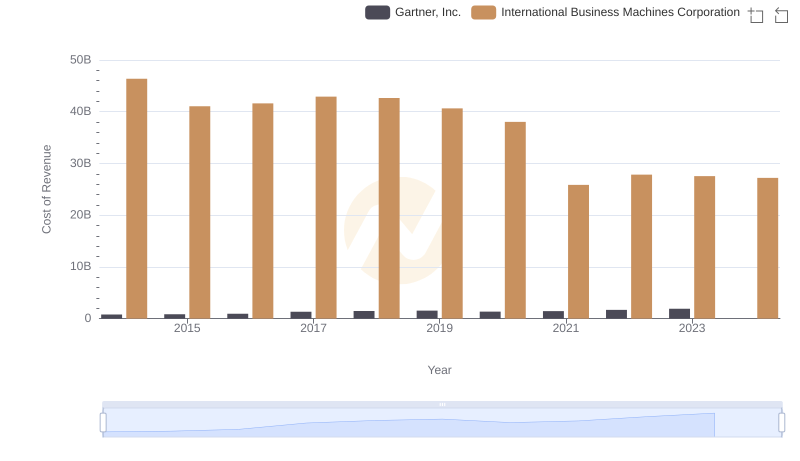

Cost Insights: Breaking Down International Business Machines Corporation and Gartner, Inc.'s Expenses

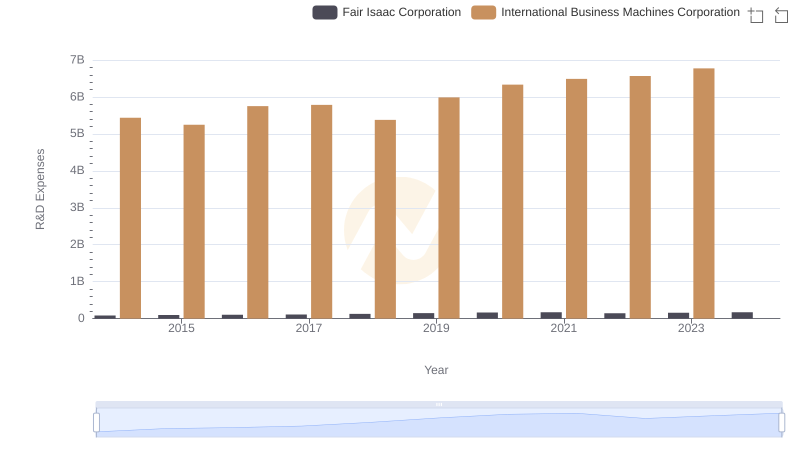

Who Prioritizes Innovation? R&D Spending Compared for International Business Machines Corporation and Fair Isaac Corporation

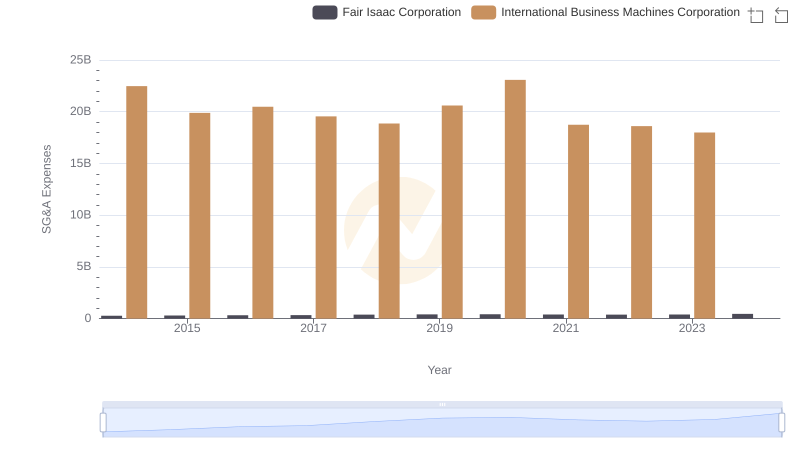

International Business Machines Corporation or Fair Isaac Corporation: Who Manages SG&A Costs Better?

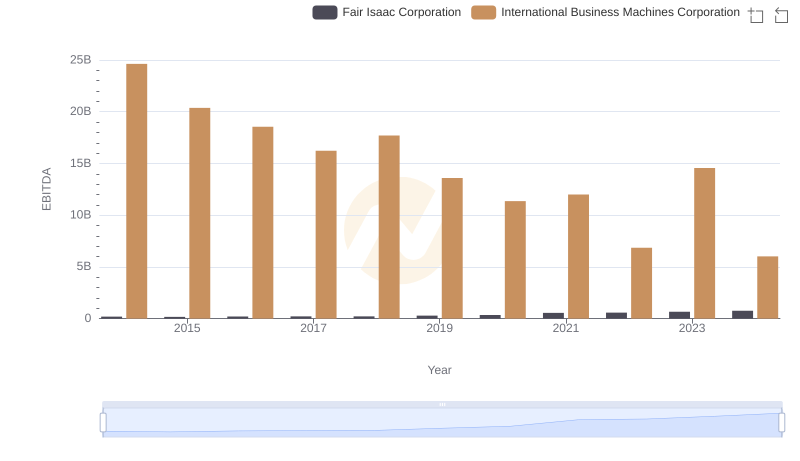

EBITDA Metrics Evaluated: International Business Machines Corporation vs Fair Isaac Corporation