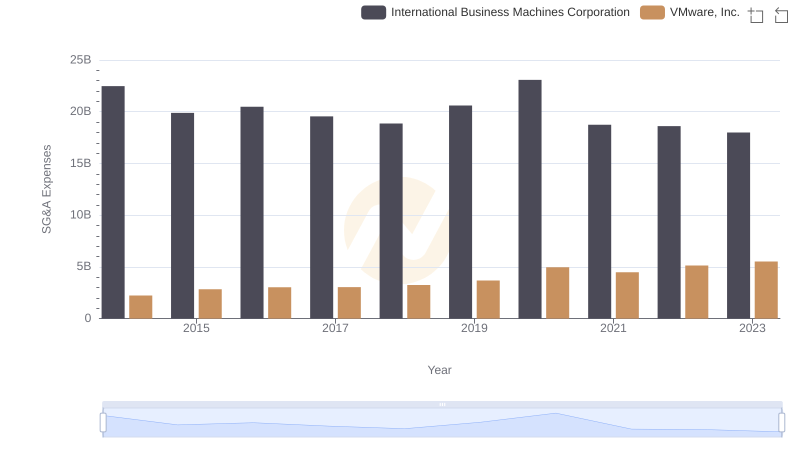

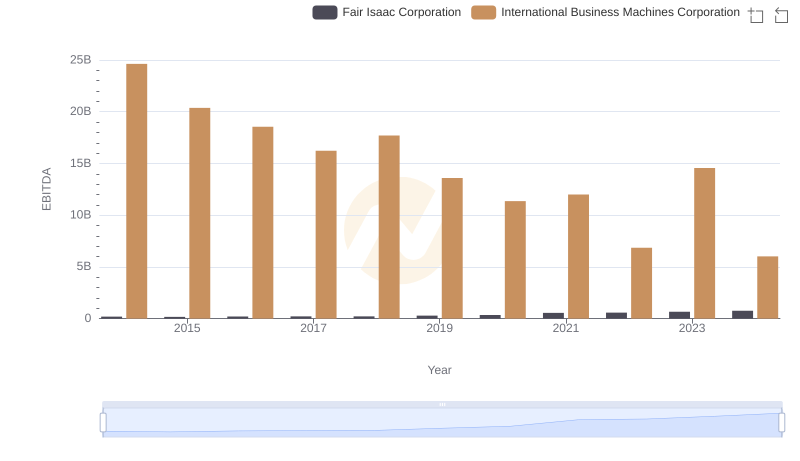

| __timestamp | Fair Isaac Corporation | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 278203000 | 22472000000 |

| Thursday, January 1, 2015 | 300002000 | 19894000000 |

| Friday, January 1, 2016 | 328940000 | 20279000000 |

| Sunday, January 1, 2017 | 339796000 | 19680000000 |

| Monday, January 1, 2018 | 380362000 | 19366000000 |

| Tuesday, January 1, 2019 | 414086000 | 18724000000 |

| Wednesday, January 1, 2020 | 420930000 | 20561000000 |

| Friday, January 1, 2021 | 396281000 | 18745000000 |

| Saturday, January 1, 2022 | 383863000 | 17483000000 |

| Sunday, January 1, 2023 | 400565000 | 17997000000 |

| Monday, January 1, 2024 | 462834000 | 29536000000 |

Igniting the spark of knowledge

In the competitive landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, International Business Machines Corporation (IBM) and Fair Isaac Corporation (FICO) have demonstrated contrasting approaches to SG&A management. From 2014 to 2024, IBM's SG&A expenses have fluctuated, peaking in 2024 with a 30% increase from 2014. In contrast, FICO has shown a more consistent upward trend, with a 66% rise over the same period.

While IBM's expenses are significantly higher, reflecting its larger scale, FICO's efficient cost management is noteworthy. By 2023, FICO's SG&A expenses were only about 2% of IBM's, highlighting its lean operational model. This analysis underscores the importance of strategic cost management in enhancing financial performance and competitiveness.

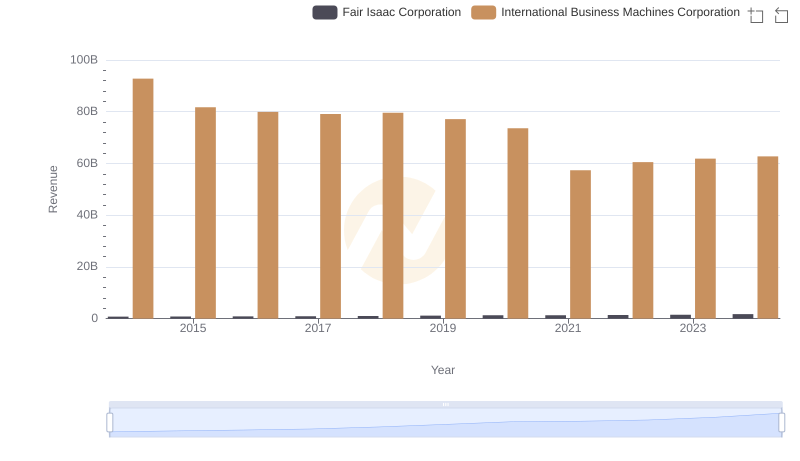

Revenue Showdown: International Business Machines Corporation vs Fair Isaac Corporation

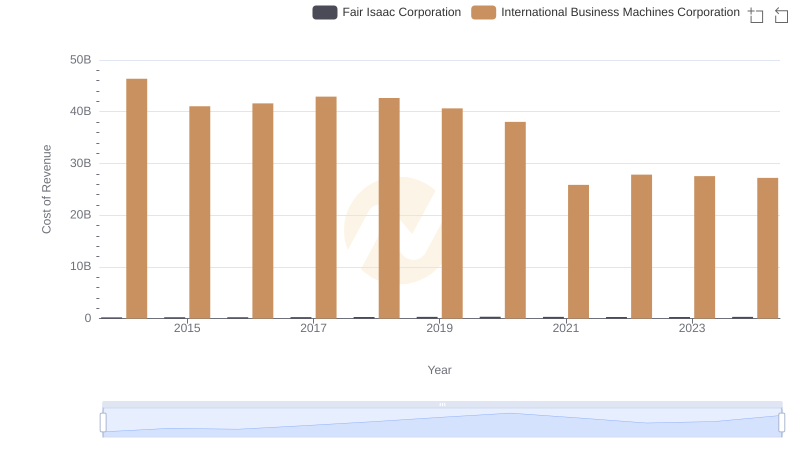

Cost of Revenue Trends: International Business Machines Corporation vs Fair Isaac Corporation

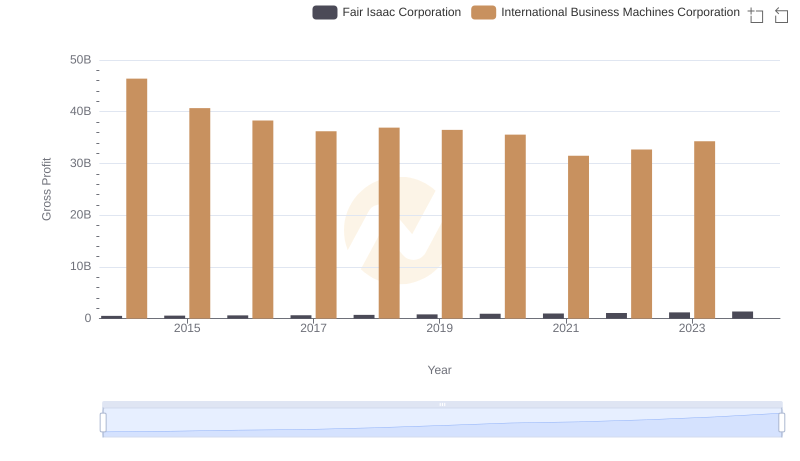

Who Generates Higher Gross Profit? International Business Machines Corporation or Fair Isaac Corporation

Breaking Down SG&A Expenses: International Business Machines Corporation vs VMware, Inc.

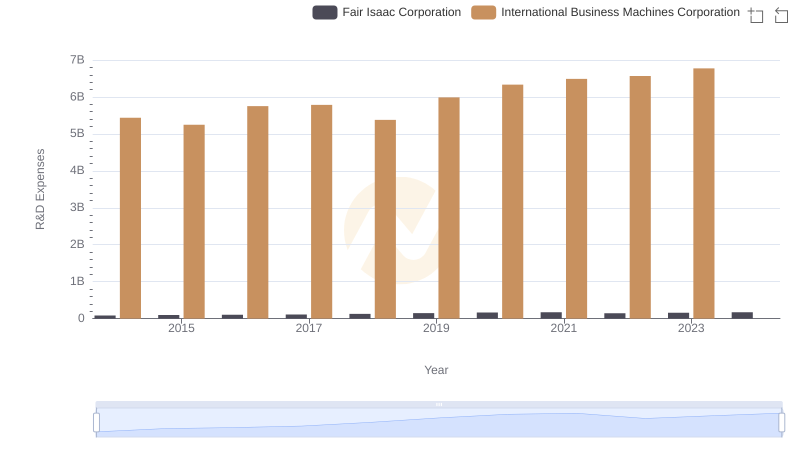

Who Prioritizes Innovation? R&D Spending Compared for International Business Machines Corporation and Fair Isaac Corporation

Selling, General, and Administrative Costs: International Business Machines Corporation vs NXP Semiconductors N.V.

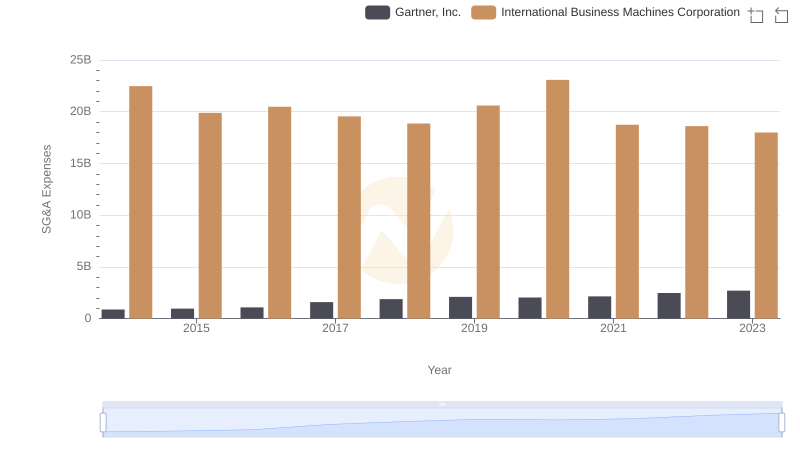

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and Gartner, Inc.

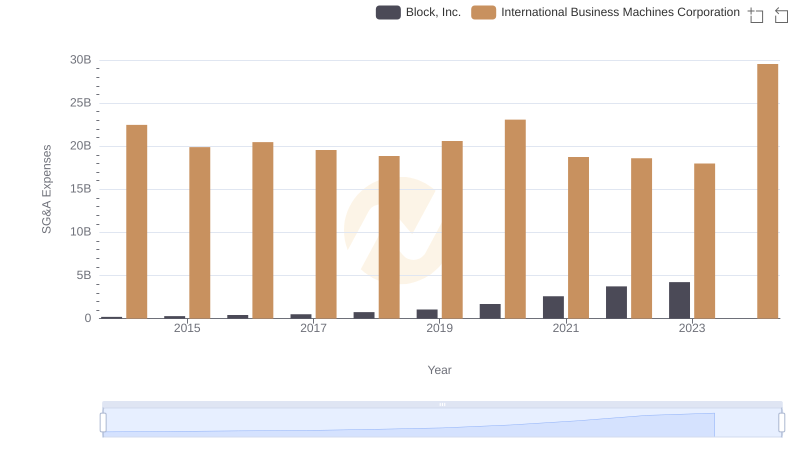

International Business Machines Corporation vs Block, Inc.: SG&A Expense Trends

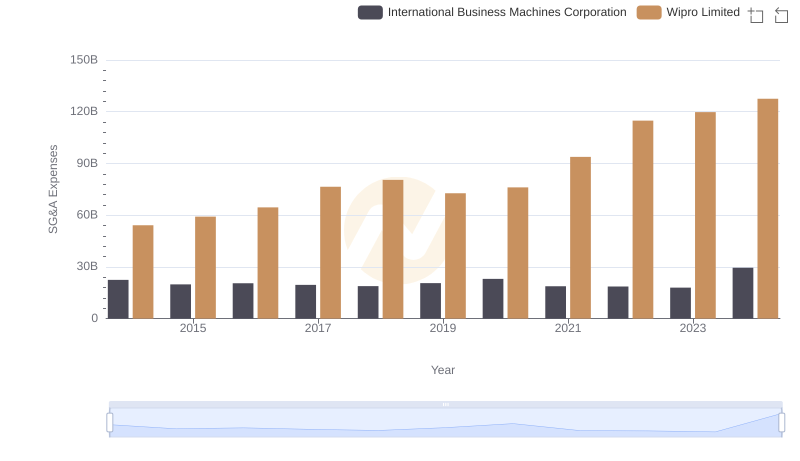

Selling, General, and Administrative Costs: International Business Machines Corporation vs Wipro Limited

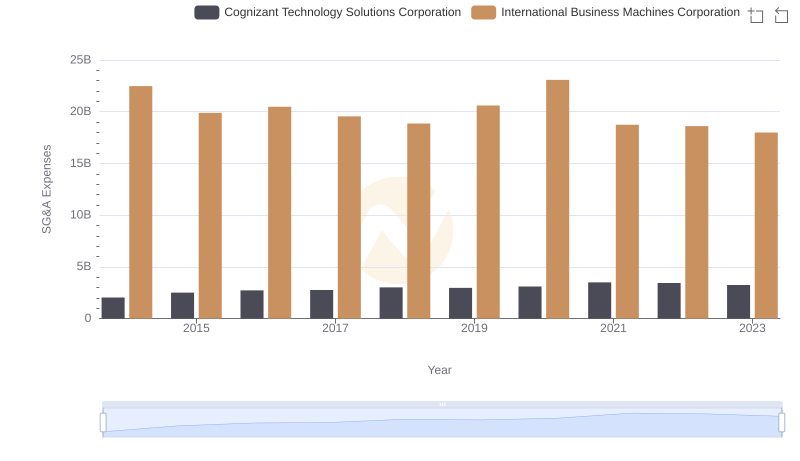

Who Optimizes SG&A Costs Better? International Business Machines Corporation or Cognizant Technology Solutions Corporation

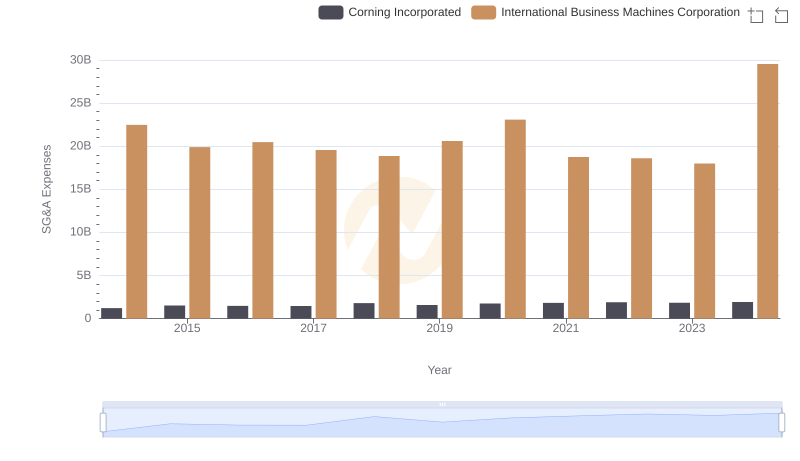

Selling, General, and Administrative Costs: International Business Machines Corporation vs Corning Incorporated

EBITDA Metrics Evaluated: International Business Machines Corporation vs Fair Isaac Corporation