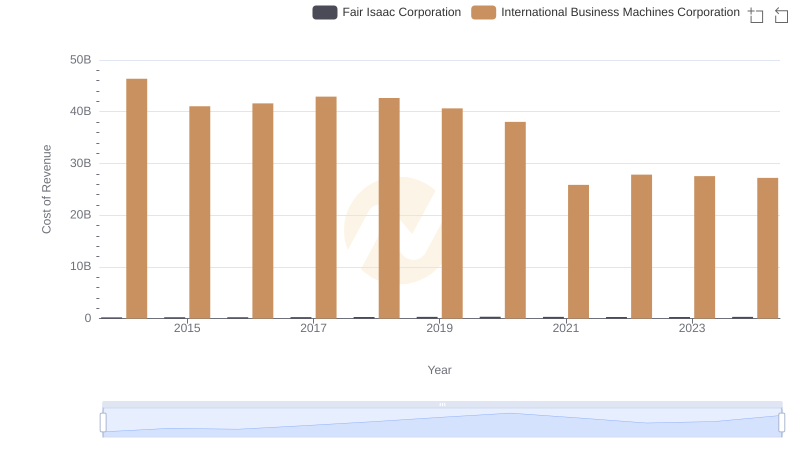

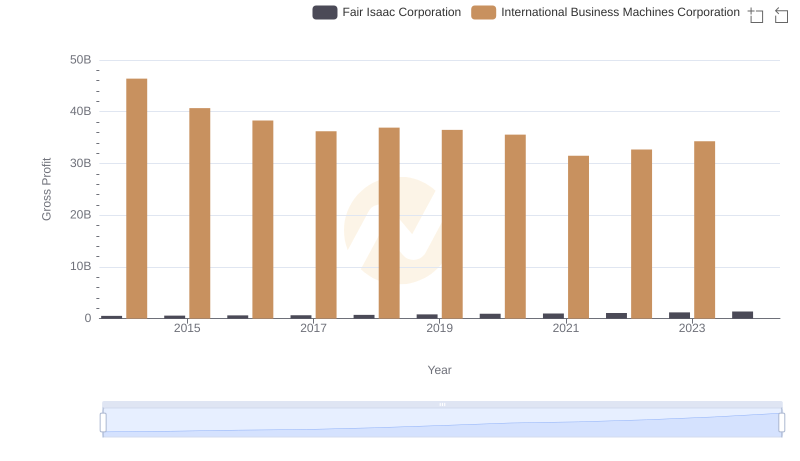

| __timestamp | Fair Isaac Corporation | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 788985000 | 92793000000 |

| Thursday, January 1, 2015 | 838781000 | 81742000000 |

| Friday, January 1, 2016 | 881356000 | 79920000000 |

| Sunday, January 1, 2017 | 932169000 | 79139000000 |

| Monday, January 1, 2018 | 1032475000 | 79591000000 |

| Tuesday, January 1, 2019 | 1160083000 | 57714000000 |

| Wednesday, January 1, 2020 | 1294562000 | 55179000000 |

| Friday, January 1, 2021 | 1316536000 | 57351000000 |

| Saturday, January 1, 2022 | 1377270000 | 60530000000 |

| Sunday, January 1, 2023 | 1513557000 | 61860000000 |

| Monday, January 1, 2024 | 1717526000 | 62753000000 |

Infusing magic into the data realm

In the ever-evolving landscape of technology and analytics, two giants stand out: International Business Machines Corporation (IBM) and Fair Isaac Corporation (FICO). Over the past decade, these companies have showcased contrasting revenue trajectories. IBM, a stalwart in the tech industry, has seen its revenue decline by approximately 32% from 2014 to 2024, reflecting the challenges of adapting to a rapidly changing market. In contrast, FICO, renowned for its analytics and decision management technology, has experienced a remarkable revenue growth of about 118% during the same period. This growth underscores FICO's strategic positioning in the burgeoning field of data analytics. As we look to the future, the question remains: will IBM's legacy and innovation drive a resurgence, or will FICO continue its upward trajectory, capitalizing on the increasing demand for data-driven insights?

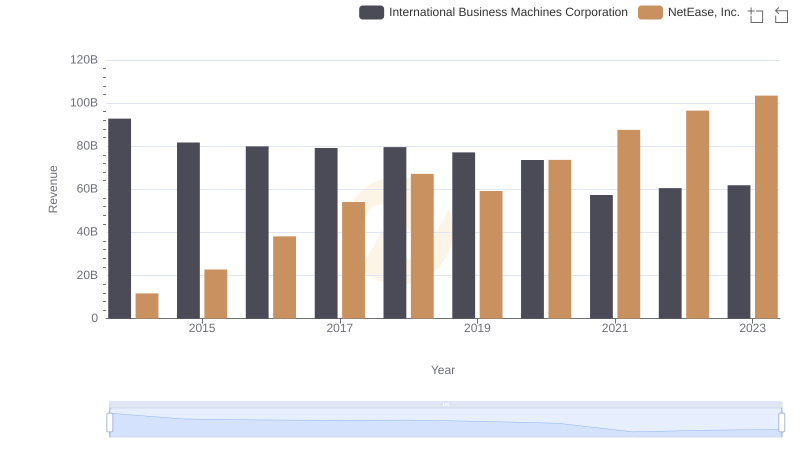

Comparing Revenue Performance: International Business Machines Corporation or NetEase, Inc.?

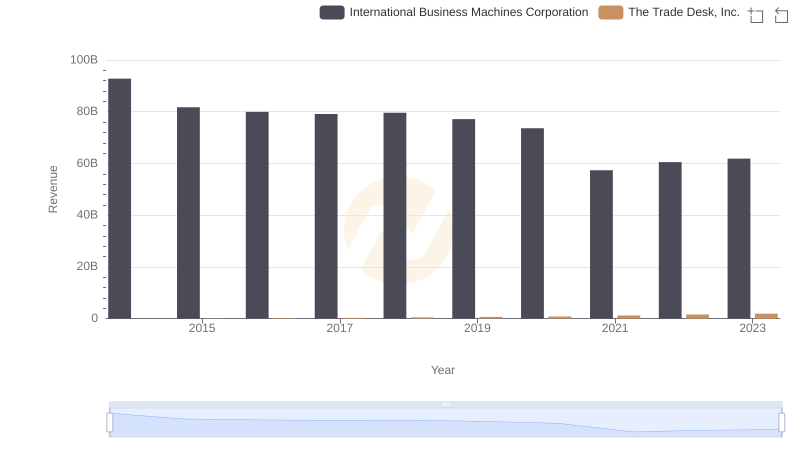

International Business Machines Corporation and The Trade Desk, Inc.: A Comprehensive Revenue Analysis

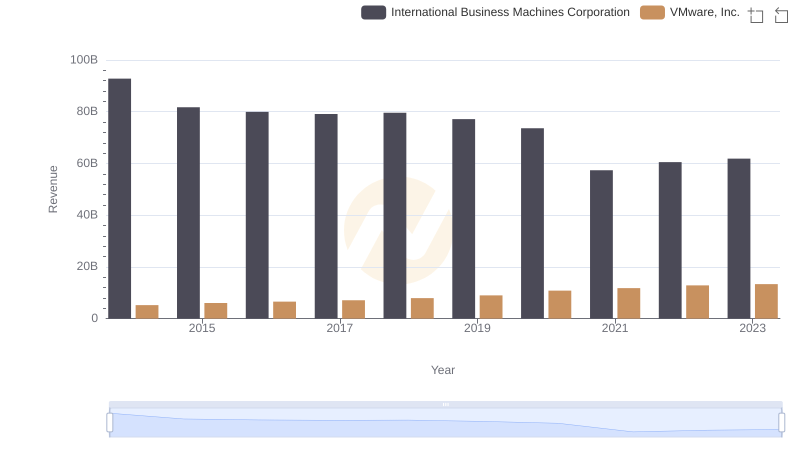

Revenue Insights: International Business Machines Corporation and VMware, Inc. Performance Compared

Comparing Revenue Performance: International Business Machines Corporation or NXP Semiconductors N.V.?

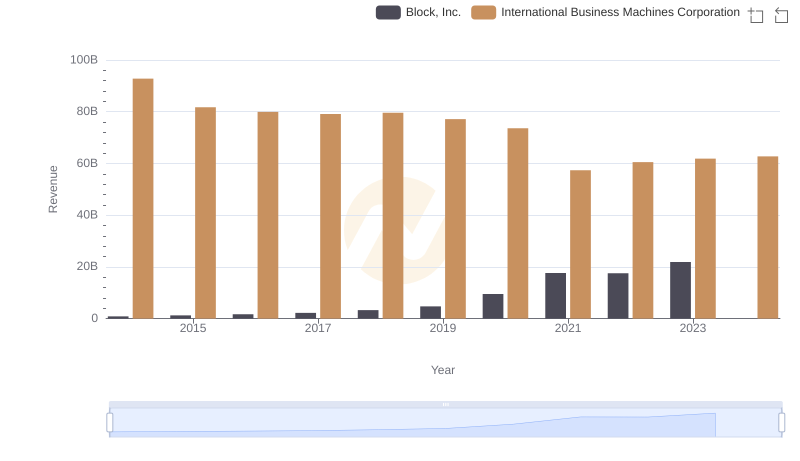

Who Generates More Revenue? International Business Machines Corporation or Block, Inc.

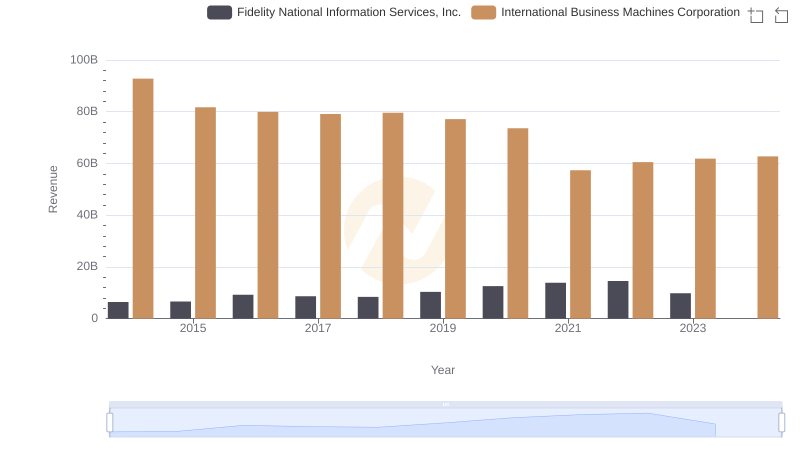

International Business Machines Corporation and Fidelity National Information Services, Inc.: A Comprehensive Revenue Analysis

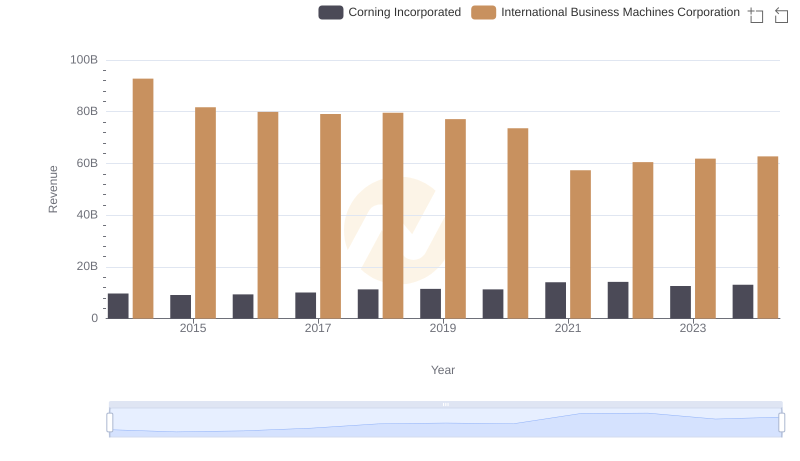

International Business Machines Corporation vs Corning Incorporated: Annual Revenue Growth Compared

Cost of Revenue Trends: International Business Machines Corporation vs Fair Isaac Corporation

Who Generates Higher Gross Profit? International Business Machines Corporation or Fair Isaac Corporation

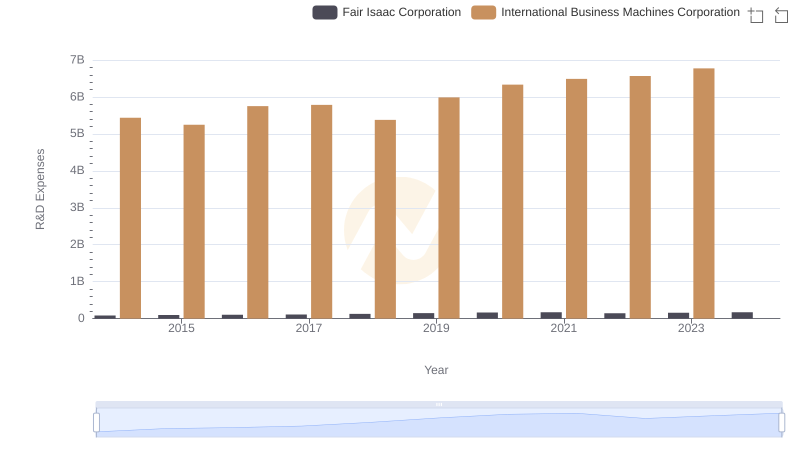

Who Prioritizes Innovation? R&D Spending Compared for International Business Machines Corporation and Fair Isaac Corporation

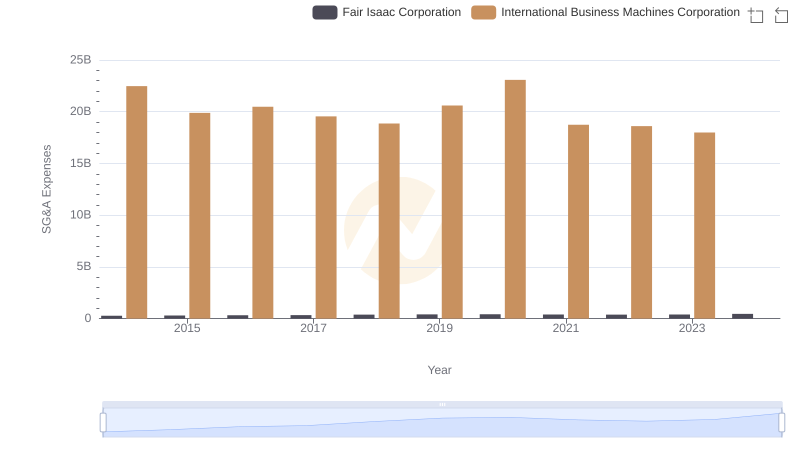

International Business Machines Corporation or Fair Isaac Corporation: Who Manages SG&A Costs Better?

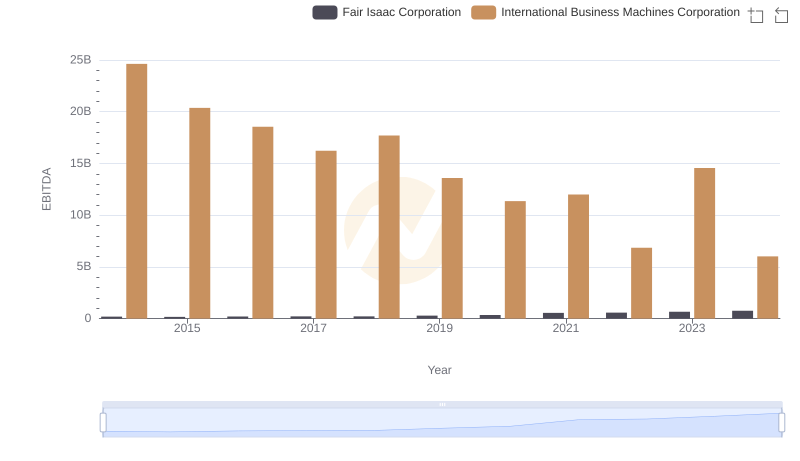

EBITDA Metrics Evaluated: International Business Machines Corporation vs Fair Isaac Corporation