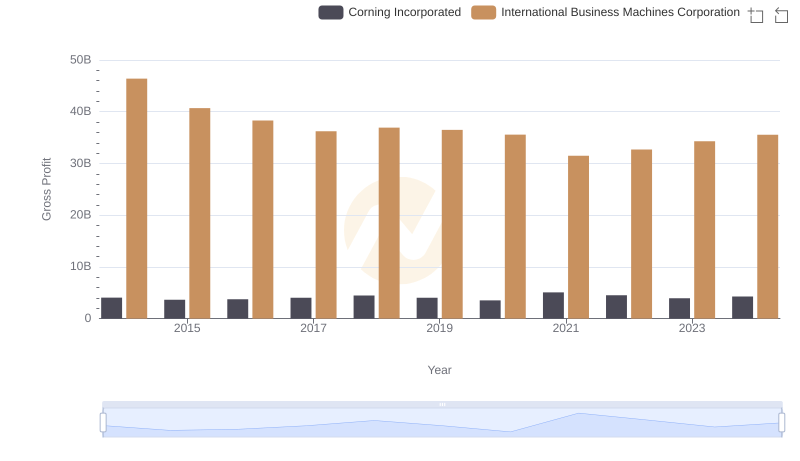

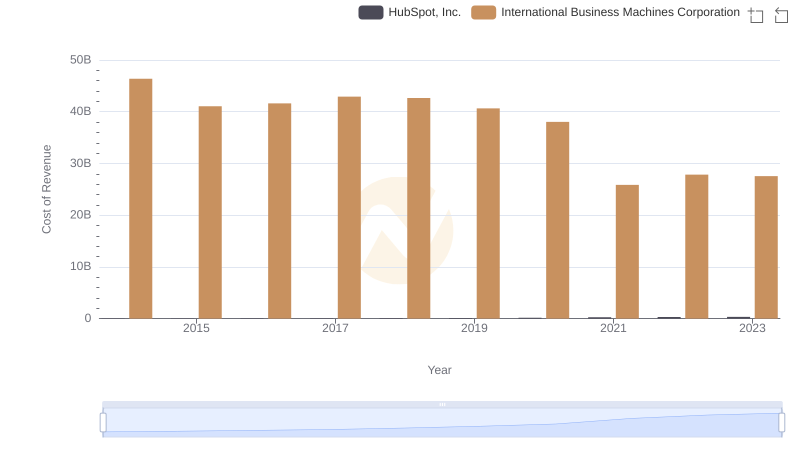

| __timestamp | Corning Incorporated | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 5663000000 | 46386000000 |

| Thursday, January 1, 2015 | 5458000000 | 41057000000 |

| Friday, January 1, 2016 | 5644000000 | 41403000000 |

| Sunday, January 1, 2017 | 6084000000 | 42196000000 |

| Monday, January 1, 2018 | 6829000000 | 42655000000 |

| Tuesday, January 1, 2019 | 7468000000 | 26181000000 |

| Wednesday, January 1, 2020 | 7772000000 | 24314000000 |

| Friday, January 1, 2021 | 9019000000 | 25865000000 |

| Saturday, January 1, 2022 | 9683000000 | 27842000000 |

| Sunday, January 1, 2023 | 8657000000 | 27560000000 |

| Monday, January 1, 2024 | 8842000000 | 27202000000 |

Infusing magic into the data realm

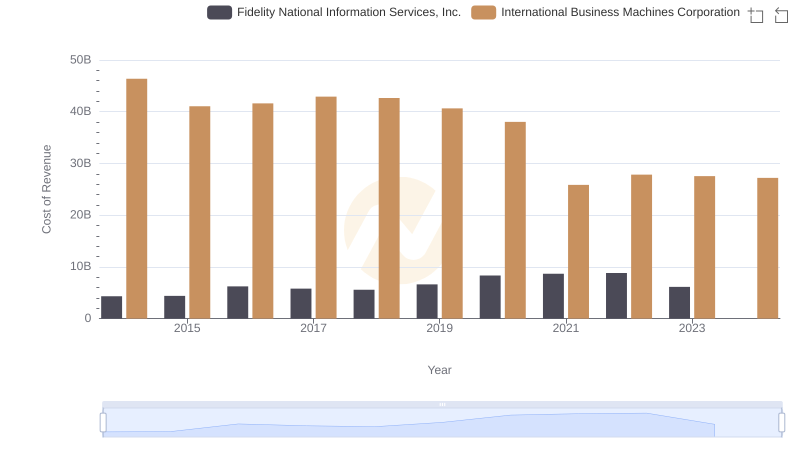

In the ever-evolving landscape of technology and manufacturing, understanding the cost of revenue is crucial for assessing a company's financial health. Over the past decade, International Business Machines Corporation (IBM) and Corning Incorporated have showcased distinct trends in their cost of revenue. From 2014 to 2024, IBM's cost of revenue has seen a significant decline, dropping from approximately $46 billion in 2014 to around $27 billion in 2024. This represents a reduction of nearly 41%, reflecting IBM's strategic shift towards more efficient operations and cost management.

Conversely, Corning Incorporated has experienced a steady increase in its cost of revenue, rising from about $5.7 billion in 2014 to nearly $8.8 billion in 2024, marking a 54% increase. This growth aligns with Corning's expansion in the materials science sector, driven by innovation and increased production capacity. These contrasting trends highlight the diverse strategies and market dynamics influencing these industry giants.

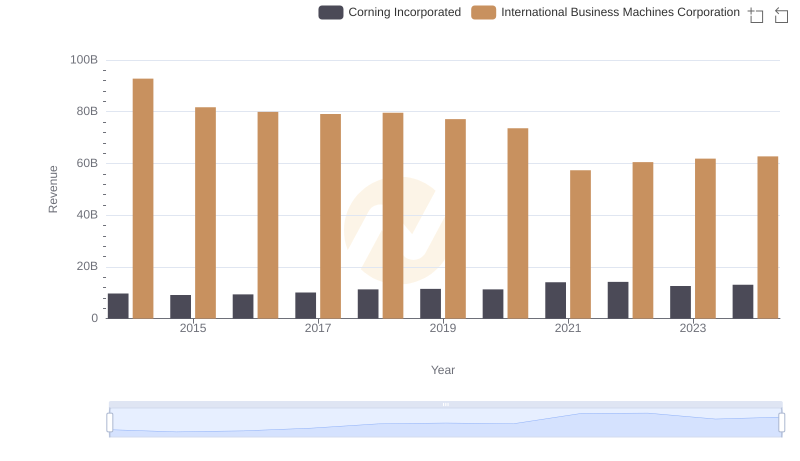

International Business Machines Corporation vs Corning Incorporated: Annual Revenue Growth Compared

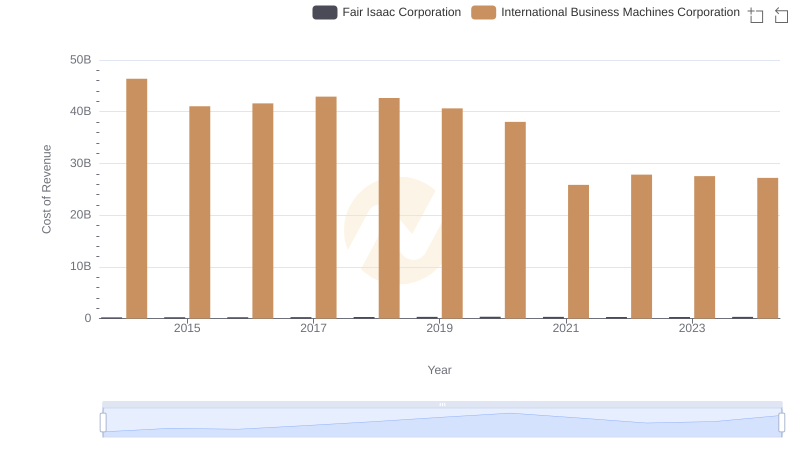

Cost of Revenue Trends: International Business Machines Corporation vs Fair Isaac Corporation

Analyzing Cost of Revenue: International Business Machines Corporation and Fidelity National Information Services, Inc.

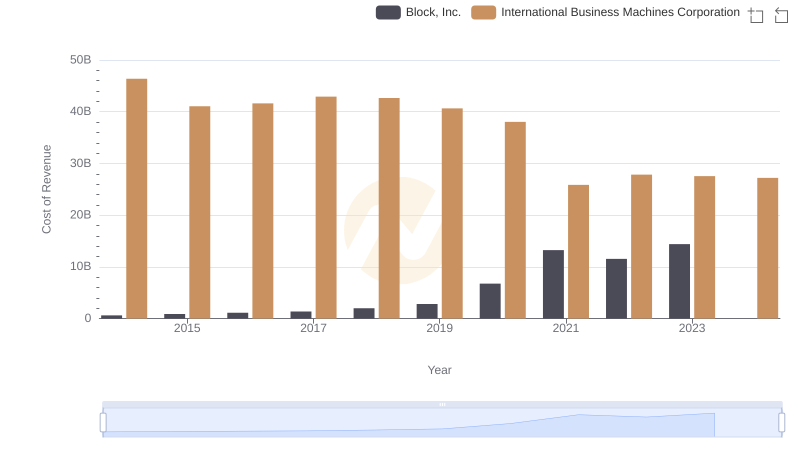

Cost Insights: Breaking Down International Business Machines Corporation and Block, Inc.'s Expenses

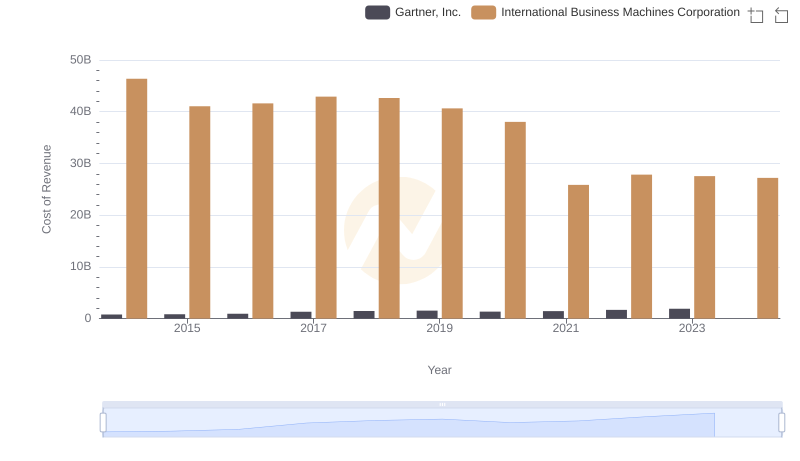

Cost Insights: Breaking Down International Business Machines Corporation and Gartner, Inc.'s Expenses

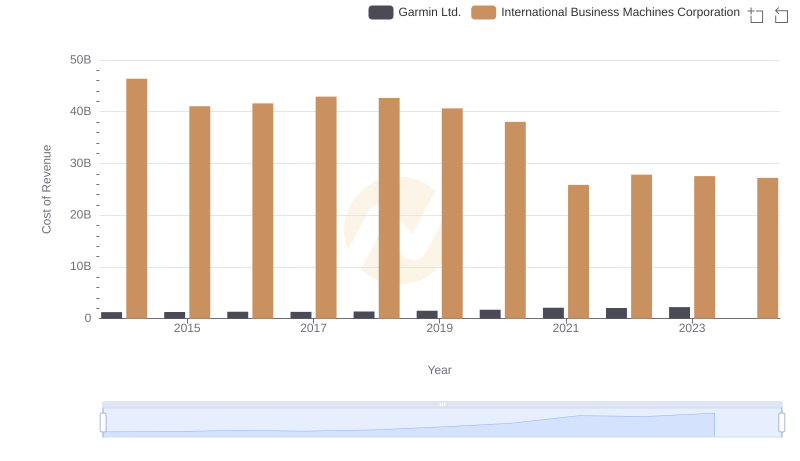

Cost of Revenue Comparison: International Business Machines Corporation vs Garmin Ltd.

Key Insights on Gross Profit: International Business Machines Corporation vs Corning Incorporated

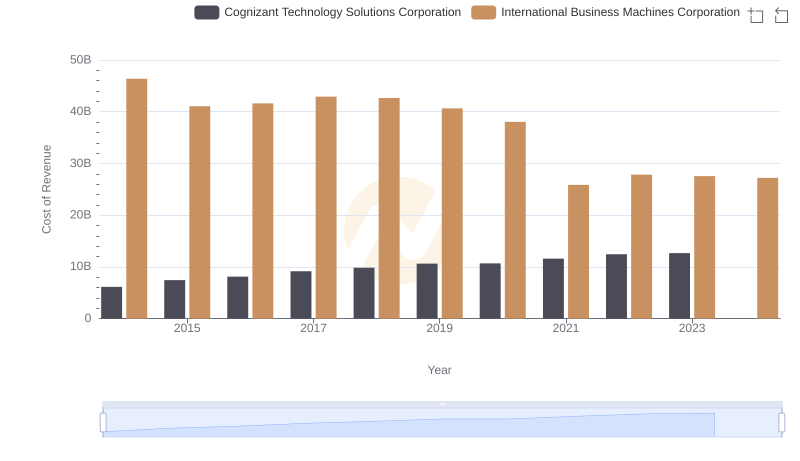

Analyzing Cost of Revenue: International Business Machines Corporation and Cognizant Technology Solutions Corporation

Cost of Revenue Trends: International Business Machines Corporation vs HubSpot, Inc.

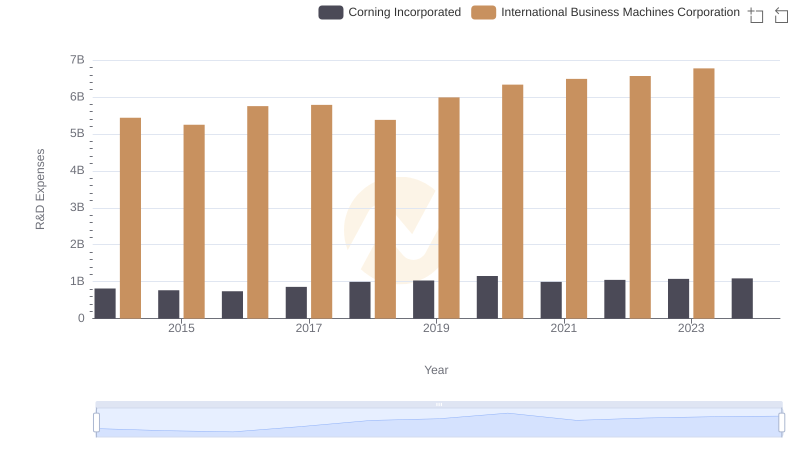

Research and Development: Comparing Key Metrics for International Business Machines Corporation and Corning Incorporated

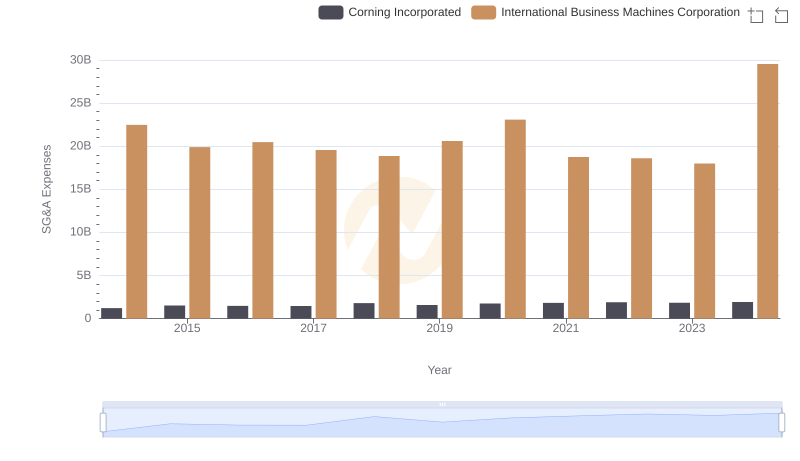

Selling, General, and Administrative Costs: International Business Machines Corporation vs Corning Incorporated

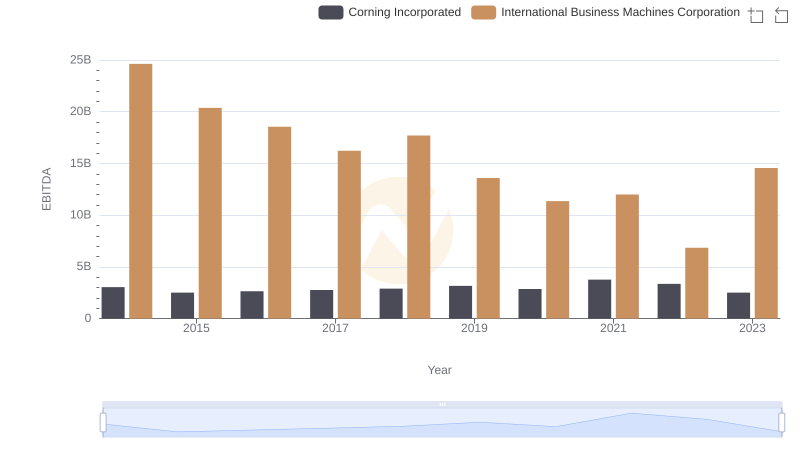

Comprehensive EBITDA Comparison: International Business Machines Corporation vs Corning Incorporated