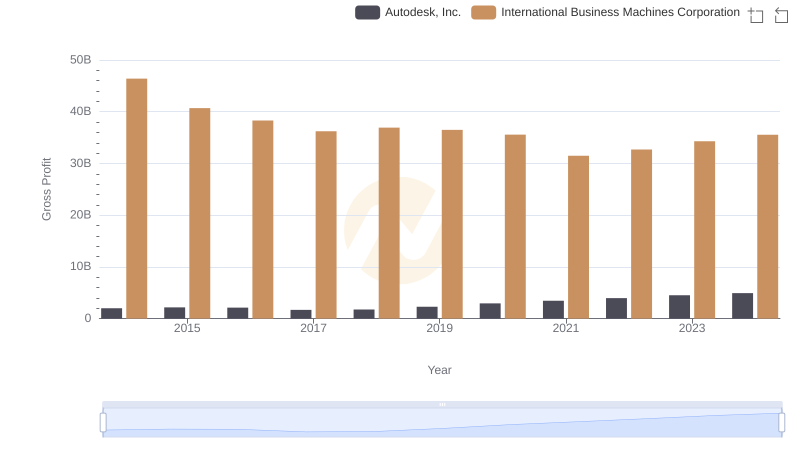

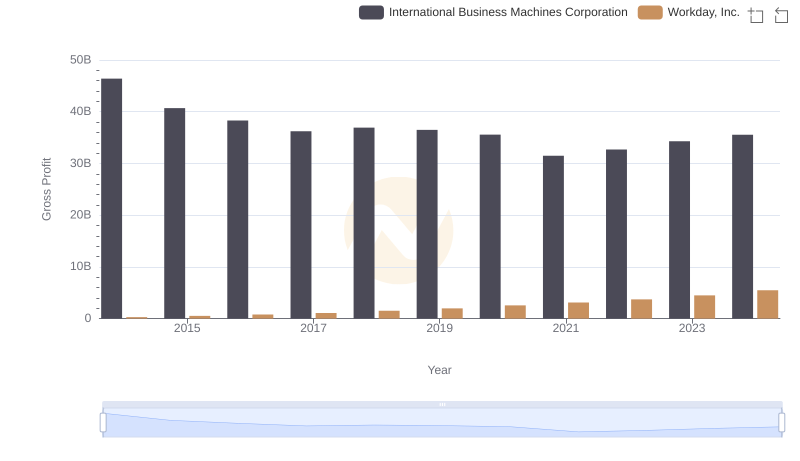

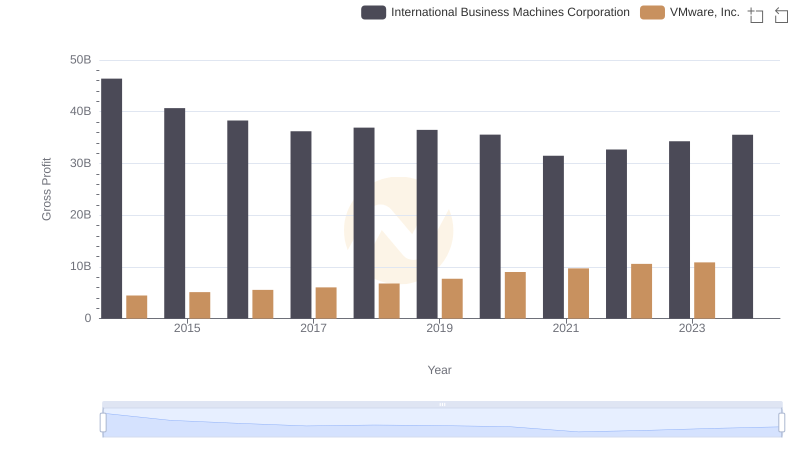

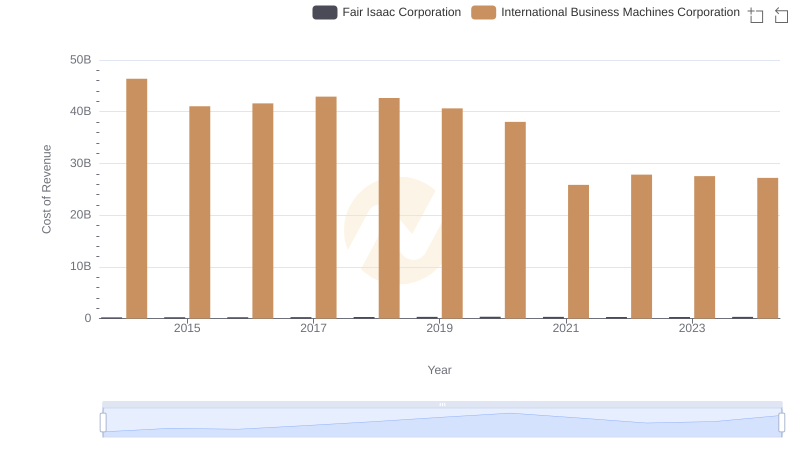

| __timestamp | Fair Isaac Corporation | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 539704000 | 46407000000 |

| Thursday, January 1, 2015 | 568246000 | 40684000000 |

| Friday, January 1, 2016 | 616183000 | 38516000000 |

| Sunday, January 1, 2017 | 645046000 | 36943000000 |

| Monday, January 1, 2018 | 721776000 | 36936000000 |

| Tuesday, January 1, 2019 | 823238000 | 31533000000 |

| Wednesday, January 1, 2020 | 933420000 | 30865000000 |

| Friday, January 1, 2021 | 984074000 | 31486000000 |

| Saturday, January 1, 2022 | 1075096000 | 32687000000 |

| Sunday, January 1, 2023 | 1202504000 | 34300000000 |

| Monday, January 1, 2024 | 1369320000 | 35551000000 |

Data in motion

In the world of technology and analytics, two titans stand out: International Business Machines Corporation (IBM) and Fair Isaac Corporation (FICO). Over the past decade, these companies have showcased their prowess in generating gross profit, albeit on different scales. From 2014 to 2024, IBM consistently outperformed FICO, with gross profits averaging around 36 billion annually, dwarfing FICO's average of 861 million. However, FICO's growth trajectory is noteworthy, with a 154% increase in gross profit from 2014 to 2024, compared to IBM's 23% decline over the same period. This trend highlights FICO's agile adaptation in the rapidly evolving tech landscape, while IBM's sheer scale remains its strength. As we look to the future, the question remains: will FICO's growth continue to outpace IBM's vast but steady profits?

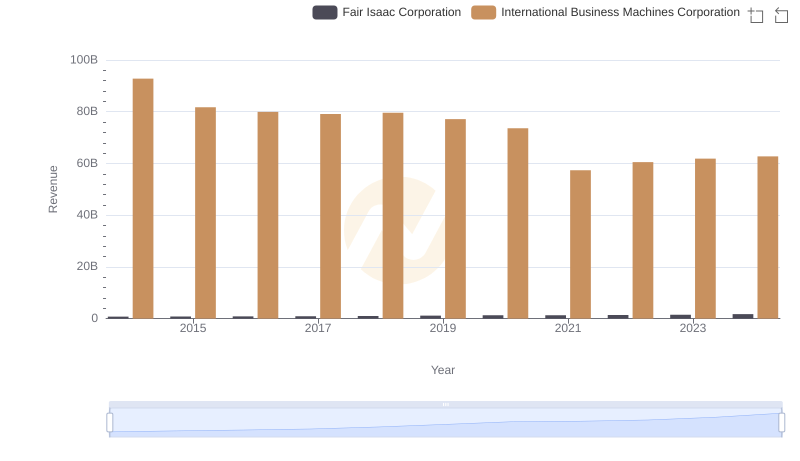

Revenue Showdown: International Business Machines Corporation vs Fair Isaac Corporation

Key Insights on Gross Profit: International Business Machines Corporation vs Autodesk, Inc.

Key Insights on Gross Profit: International Business Machines Corporation vs Workday, Inc.

Gross Profit Analysis: Comparing International Business Machines Corporation and VMware, Inc.

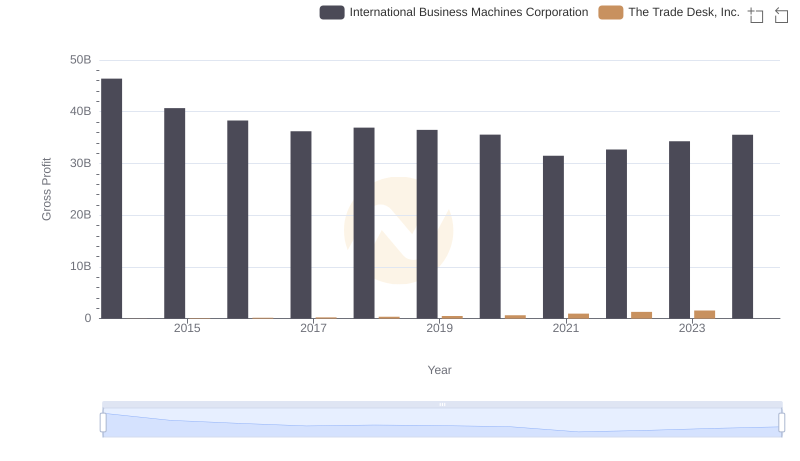

Key Insights on Gross Profit: International Business Machines Corporation vs The Trade Desk, Inc.

Cost of Revenue Trends: International Business Machines Corporation vs Fair Isaac Corporation

Gross Profit Comparison: International Business Machines Corporation and NXP Semiconductors N.V. Trends

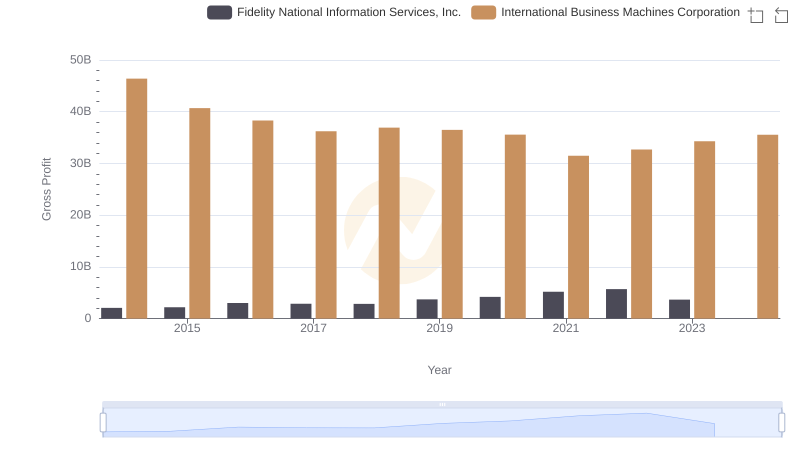

Who Generates Higher Gross Profit? International Business Machines Corporation or Fidelity National Information Services, Inc.

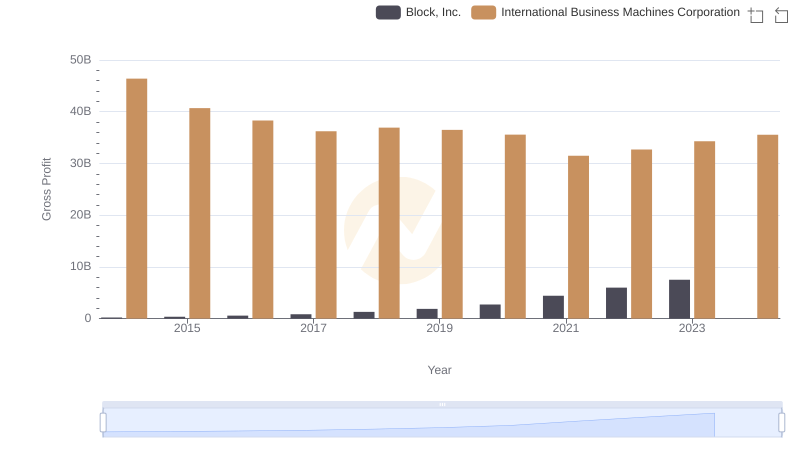

Who Generates Higher Gross Profit? International Business Machines Corporation or Block, Inc.

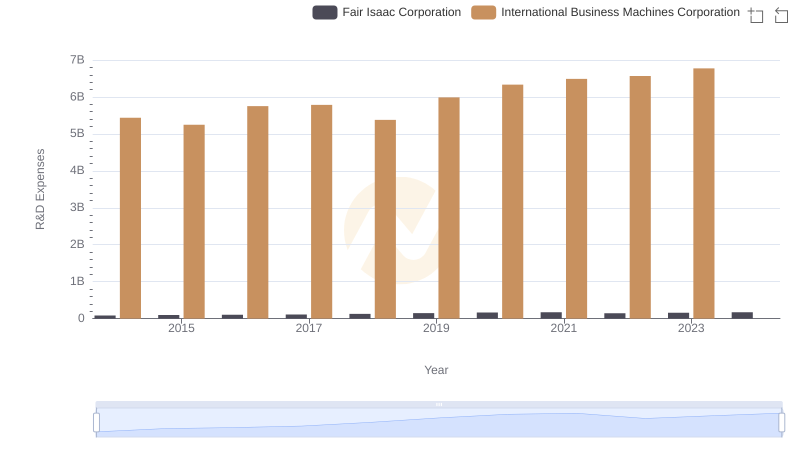

Who Prioritizes Innovation? R&D Spending Compared for International Business Machines Corporation and Fair Isaac Corporation

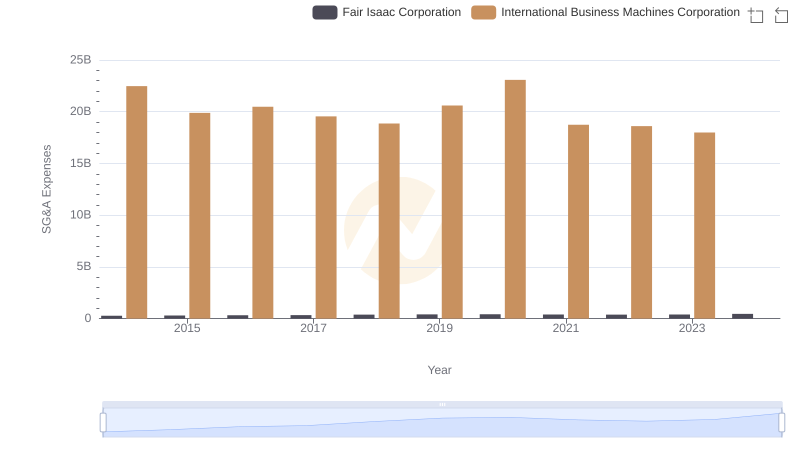

International Business Machines Corporation or Fair Isaac Corporation: Who Manages SG&A Costs Better?

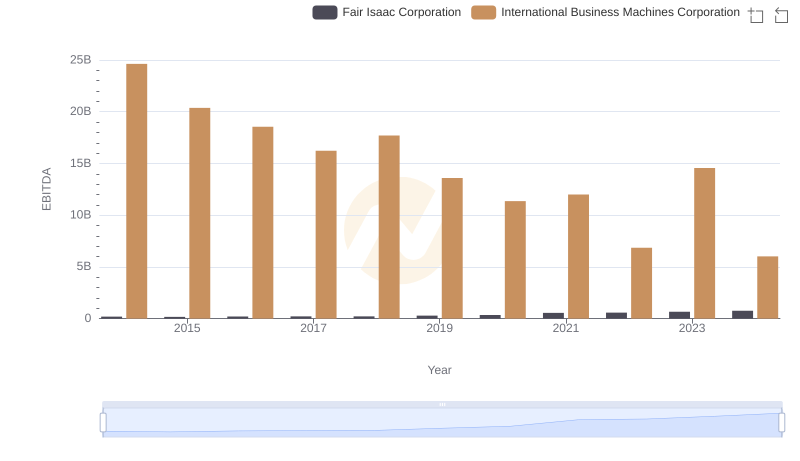

EBITDA Metrics Evaluated: International Business Machines Corporation vs Fair Isaac Corporation