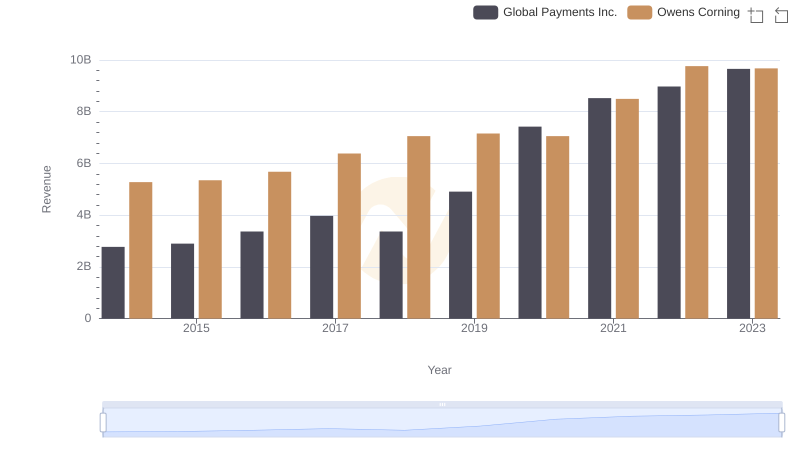

| __timestamp | Global Payments Inc. | Owens Corning |

|---|---|---|

| Wednesday, January 1, 2014 | 1022107000 | 4300000000 |

| Thursday, January 1, 2015 | 1147639000 | 4197000000 |

| Friday, January 1, 2016 | 1603532000 | 4296000000 |

| Sunday, January 1, 2017 | 1928037000 | 4812000000 |

| Monday, January 1, 2018 | 1095014000 | 5425000000 |

| Tuesday, January 1, 2019 | 2073803000 | 5551000000 |

| Wednesday, January 1, 2020 | 3650727000 | 5445000000 |

| Friday, January 1, 2021 | 3773725000 | 6281000000 |

| Saturday, January 1, 2022 | 3778617000 | 7145000000 |

| Sunday, January 1, 2023 | 3727521000 | 6994000000 |

| Monday, January 1, 2024 | 3760116000 |

Unlocking the unknown

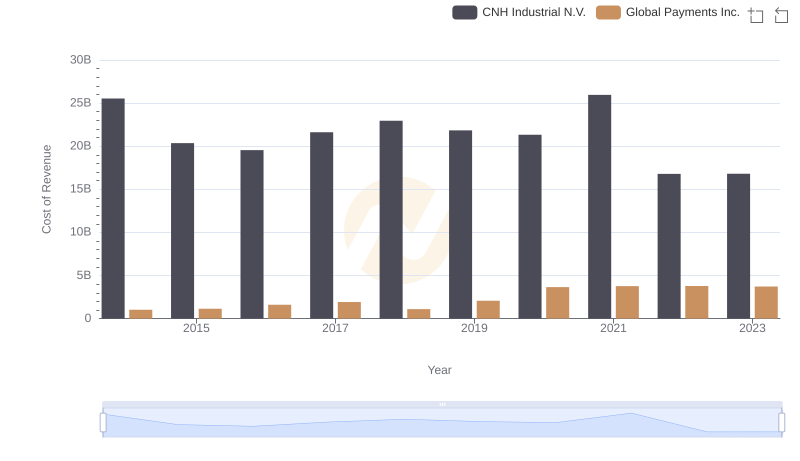

In the ever-evolving landscape of American industry, Global Payments Inc. and Owens Corning stand as titans in their respective fields. From 2014 to 2023, these companies have showcased distinct trajectories in their cost of revenue, reflecting broader economic trends and strategic shifts.

Global Payments Inc., a leader in payment technology services, has seen its cost of revenue grow by approximately 265% over the past decade. This surge, peaking in 2022, underscores the company's aggressive expansion and adaptation to the digital economy.

Conversely, Owens Corning, a stalwart in the building materials sector, experienced a steadier increase of around 63% in the same period. The peak in 2022 highlights the construction boom and increased demand for sustainable materials.

These trends not only reflect the companies' internal strategies but also mirror broader economic shifts, offering valuable insights for investors and industry analysts alike.

Global Payments Inc. or Owens Corning: Who Leads in Yearly Revenue?

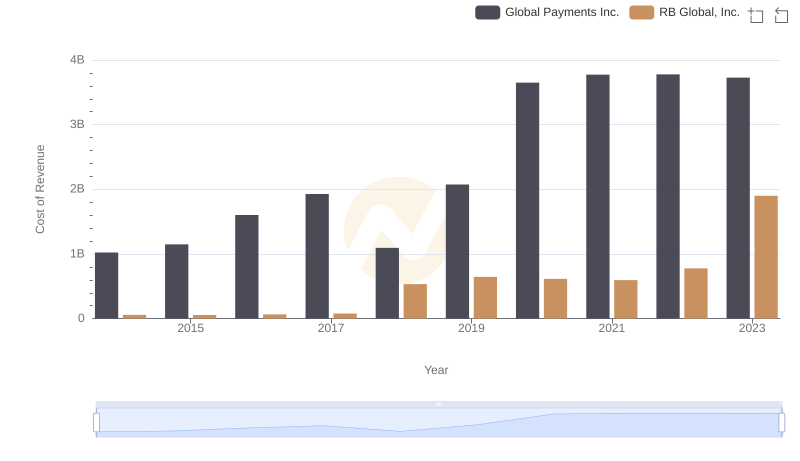

Cost of Revenue: Key Insights for Global Payments Inc. and RB Global, Inc.

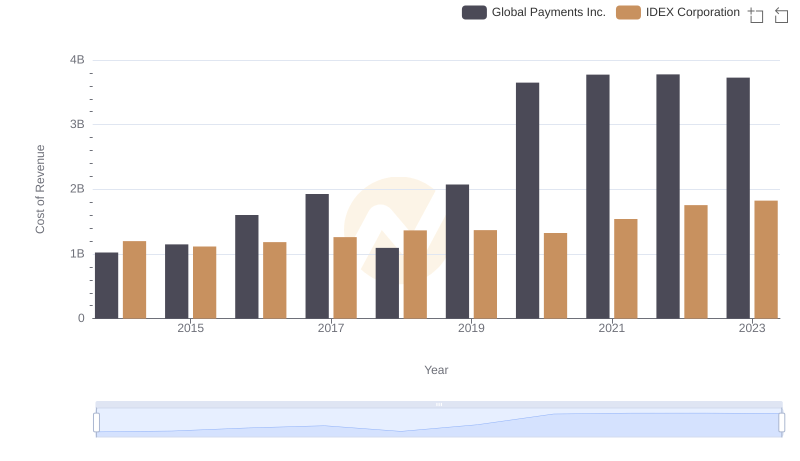

Comparing Cost of Revenue Efficiency: Global Payments Inc. vs IDEX Corporation

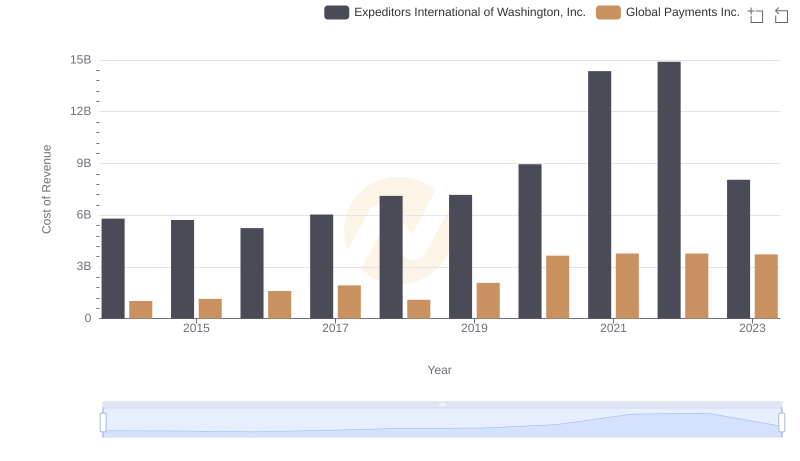

Analyzing Cost of Revenue: Global Payments Inc. and Expeditors International of Washington, Inc.

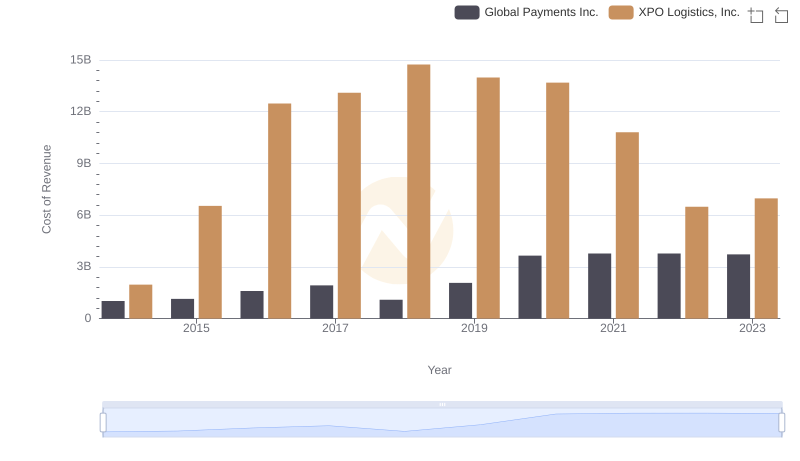

Cost of Revenue Comparison: Global Payments Inc. vs XPO Logistics, Inc.

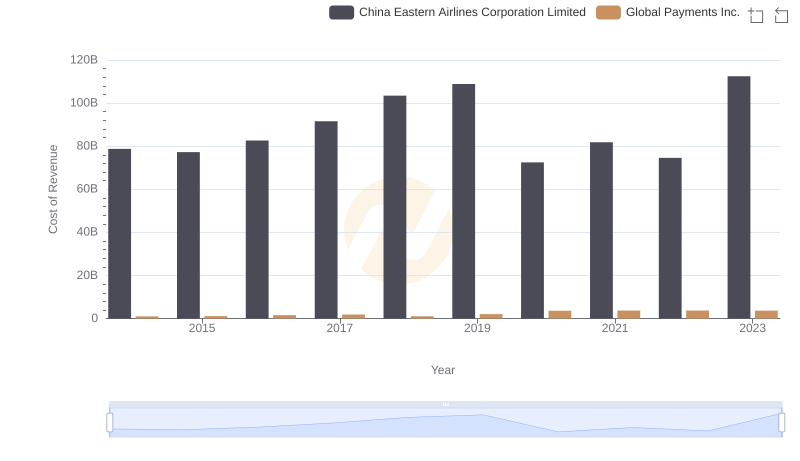

Cost of Revenue Trends: Global Payments Inc. vs China Eastern Airlines Corporation Limited

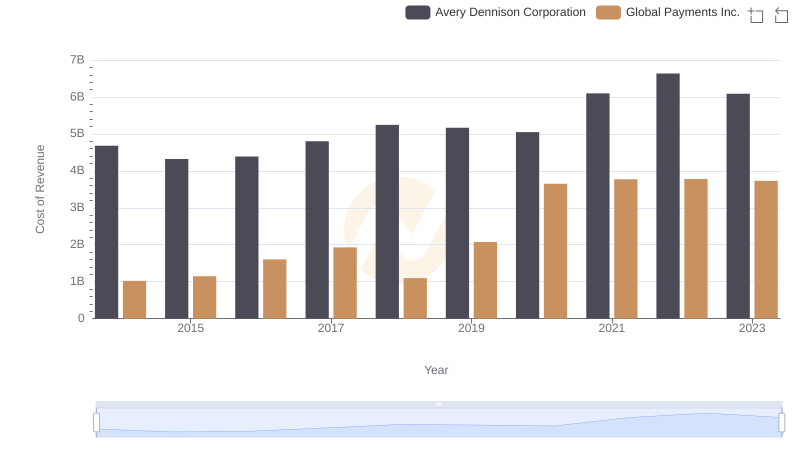

Cost of Revenue Comparison: Global Payments Inc. vs Avery Dennison Corporation

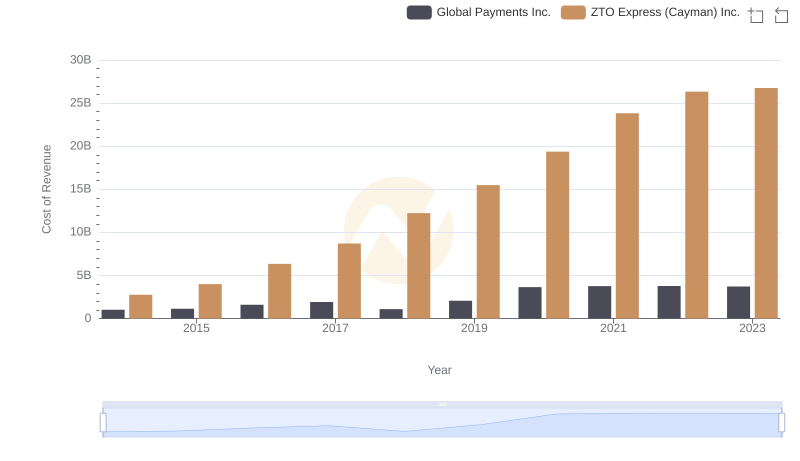

Analyzing Cost of Revenue: Global Payments Inc. and ZTO Express (Cayman) Inc.

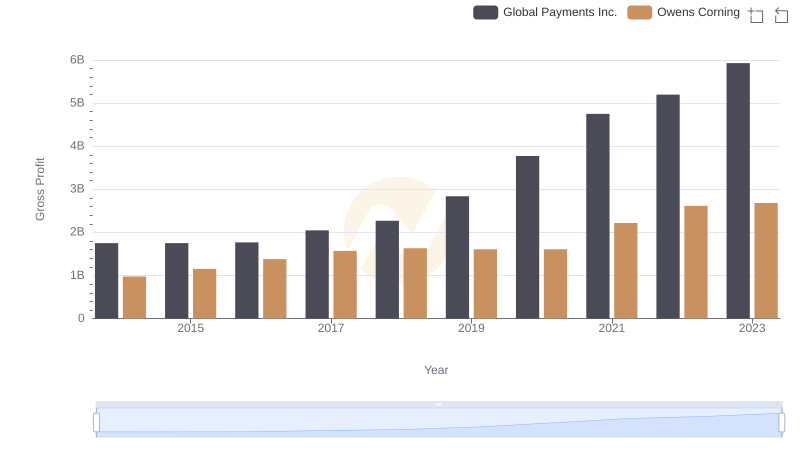

Global Payments Inc. and Owens Corning: A Detailed Gross Profit Analysis

Cost of Revenue Comparison: Global Payments Inc. vs CNH Industrial N.V.

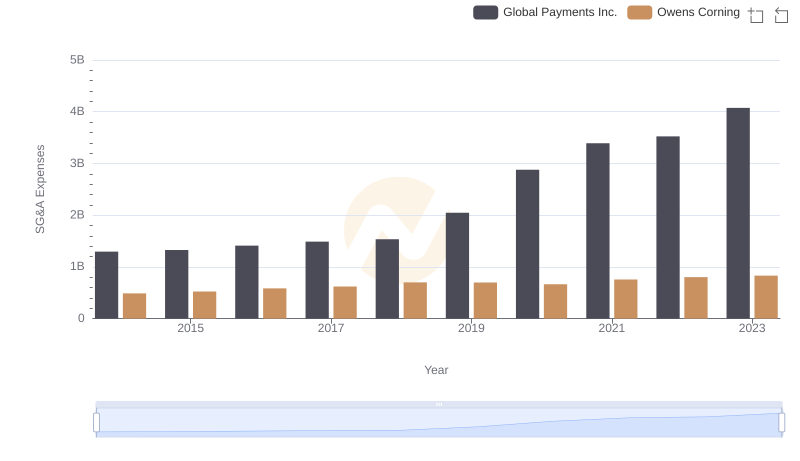

Global Payments Inc. and Owens Corning: SG&A Spending Patterns Compared

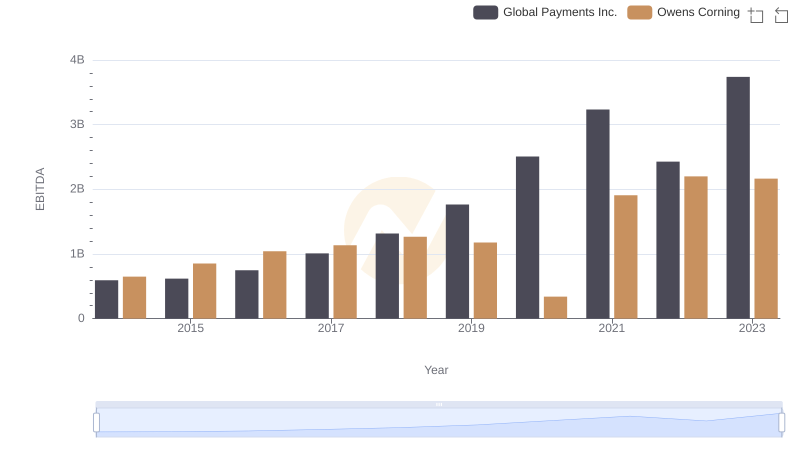

EBITDA Analysis: Evaluating Global Payments Inc. Against Owens Corning