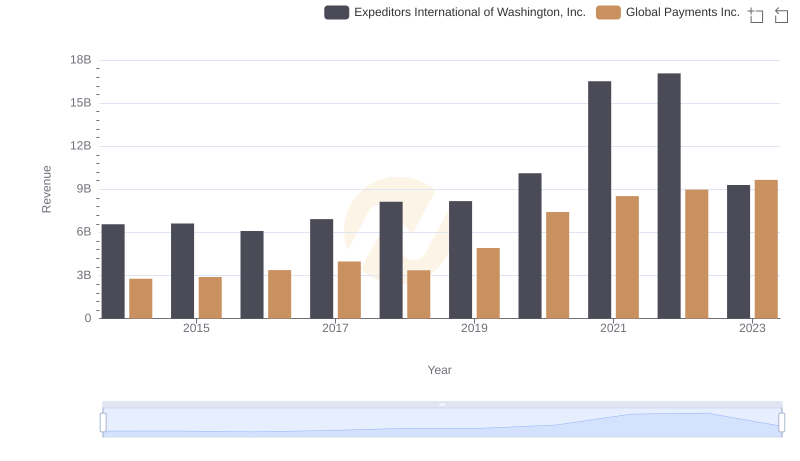

| __timestamp | Expeditors International of Washington, Inc. | Global Payments Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 5800725000 | 1022107000 |

| Thursday, January 1, 2015 | 5720848000 | 1147639000 |

| Friday, January 1, 2016 | 5247244000 | 1603532000 |

| Sunday, January 1, 2017 | 6037921000 | 1928037000 |

| Monday, January 1, 2018 | 7118083000 | 1095014000 |

| Tuesday, January 1, 2019 | 7178405000 | 2073803000 |

| Wednesday, January 1, 2020 | 8953716000 | 3650727000 |

| Friday, January 1, 2021 | 14358105000 | 3773725000 |

| Saturday, January 1, 2022 | 14900154000 | 3778617000 |

| Sunday, January 1, 2023 | 8054634000 | 3727521000 |

| Monday, January 1, 2024 | 0 | 3760116000 |

Unveiling the hidden dimensions of data

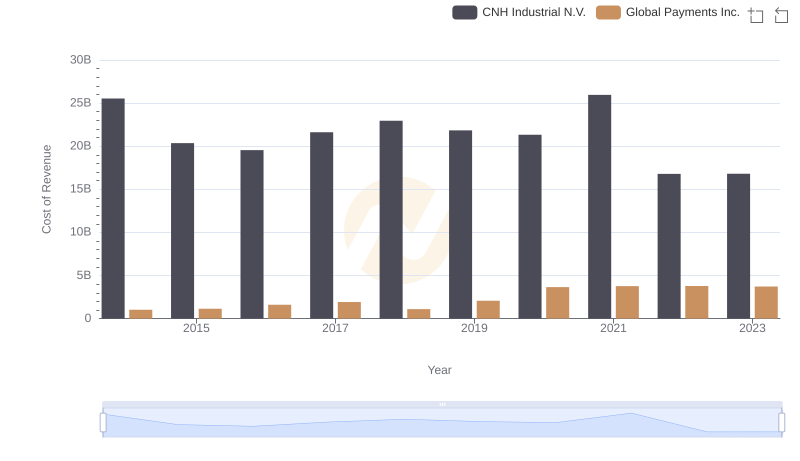

In the ever-evolving landscape of global commerce, understanding the cost of revenue is crucial for assessing a company's financial health. This analysis delves into the cost of revenue trends for two industry titans: Expeditors International of Washington, Inc. and Global Payments Inc., from 2014 to 2023.

Expeditors International, a leader in logistics, saw its cost of revenue soar by approximately 158% over the decade, peaking in 2022. This surge reflects the growing demand for efficient supply chain solutions. Meanwhile, Global Payments Inc., a key player in the financial services sector, experienced a steady increase of around 265% in its cost of revenue, highlighting the expanding digital payment landscape.

The data reveals a fascinating narrative of growth and adaptation, underscoring the dynamic nature of these industries. As we move forward, these trends offer valuable insights into the strategic priorities of these companies.

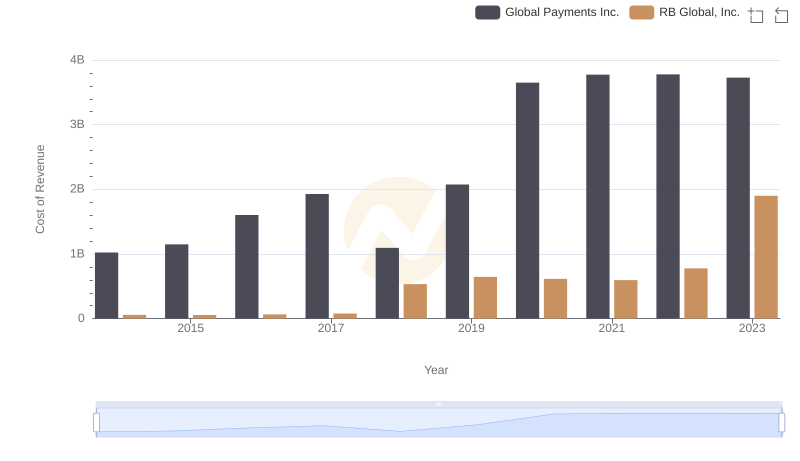

Cost of Revenue: Key Insights for Global Payments Inc. and RB Global, Inc.

Global Payments Inc. or Expeditors International of Washington, Inc.: Who Leads in Yearly Revenue?

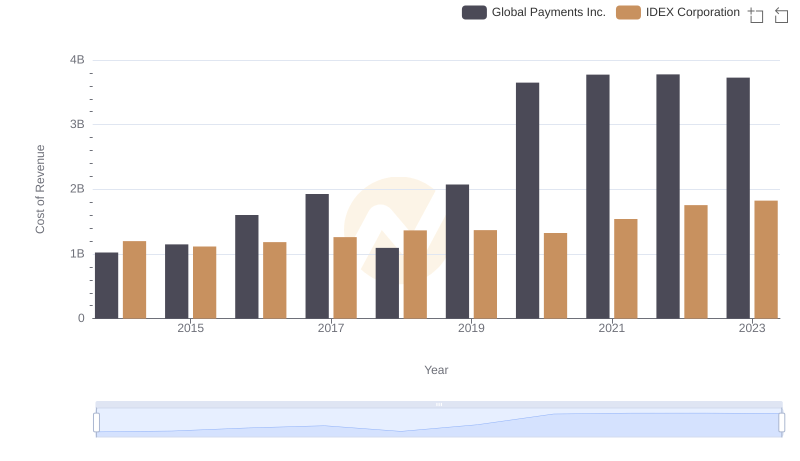

Comparing Cost of Revenue Efficiency: Global Payments Inc. vs IDEX Corporation

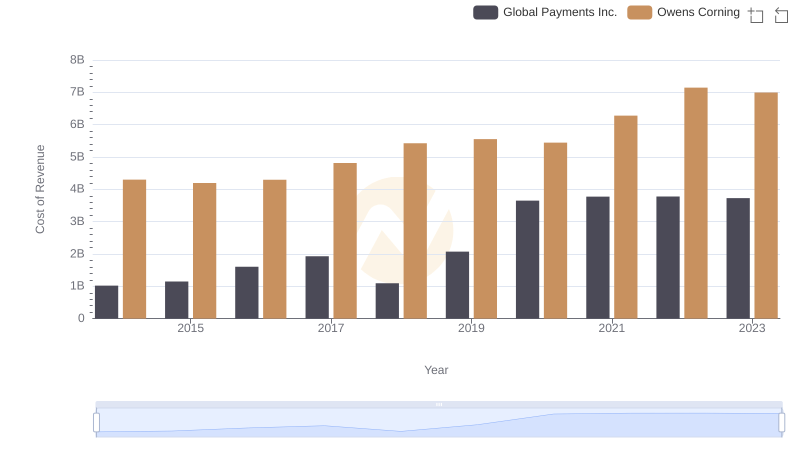

Cost of Revenue Trends: Global Payments Inc. vs Owens Corning

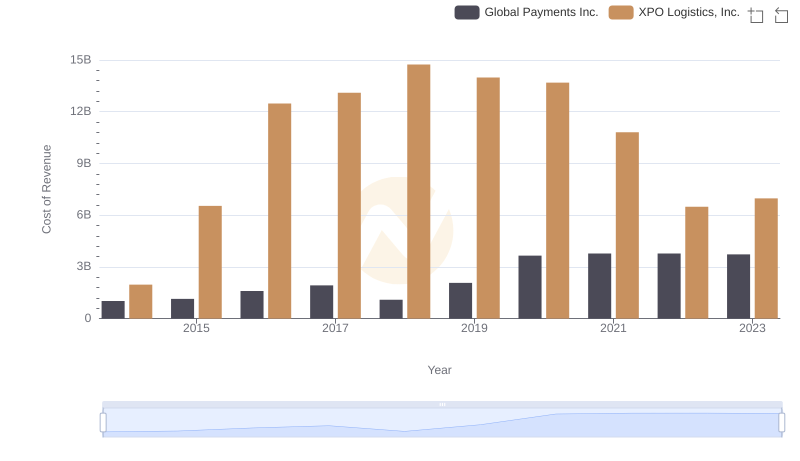

Cost of Revenue Comparison: Global Payments Inc. vs XPO Logistics, Inc.

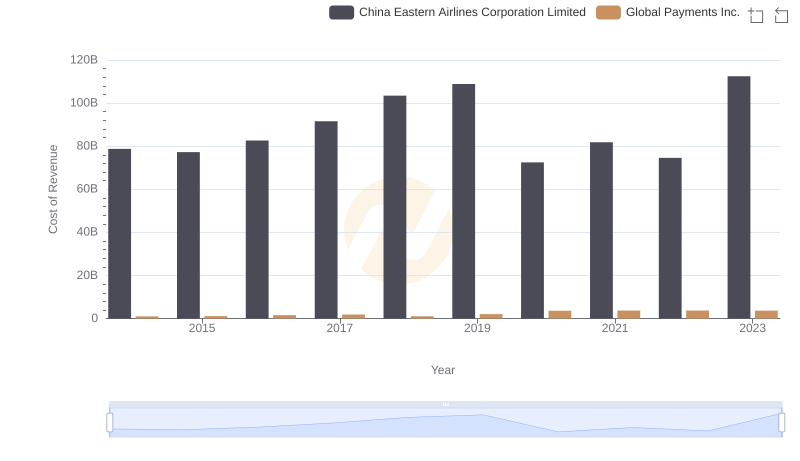

Cost of Revenue Trends: Global Payments Inc. vs China Eastern Airlines Corporation Limited

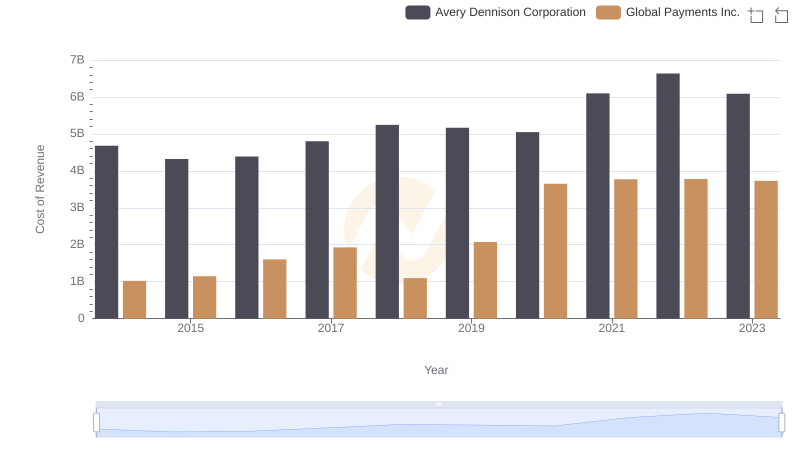

Cost of Revenue Comparison: Global Payments Inc. vs Avery Dennison Corporation

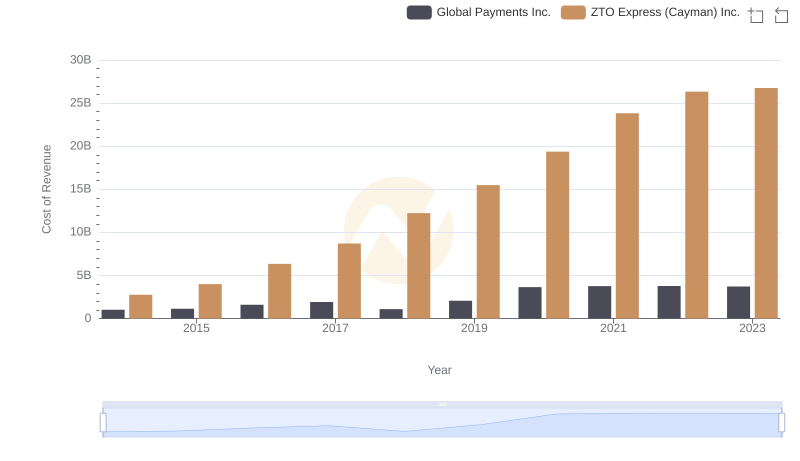

Analyzing Cost of Revenue: Global Payments Inc. and ZTO Express (Cayman) Inc.

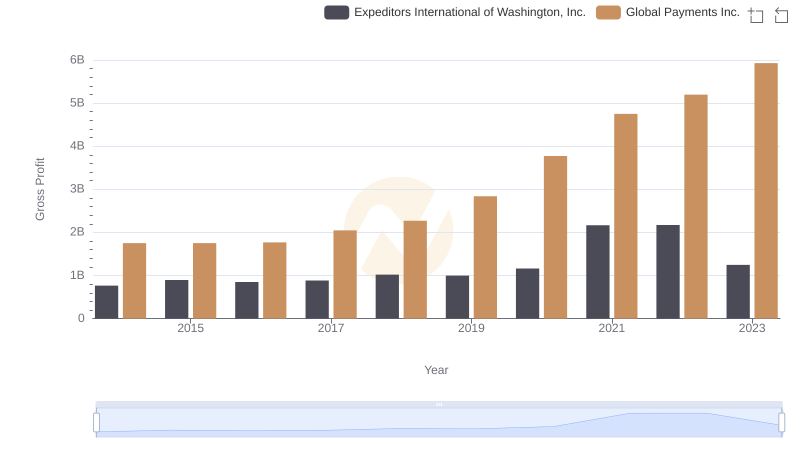

Gross Profit Trends Compared: Global Payments Inc. vs Expeditors International of Washington, Inc.

Cost of Revenue Comparison: Global Payments Inc. vs CNH Industrial N.V.

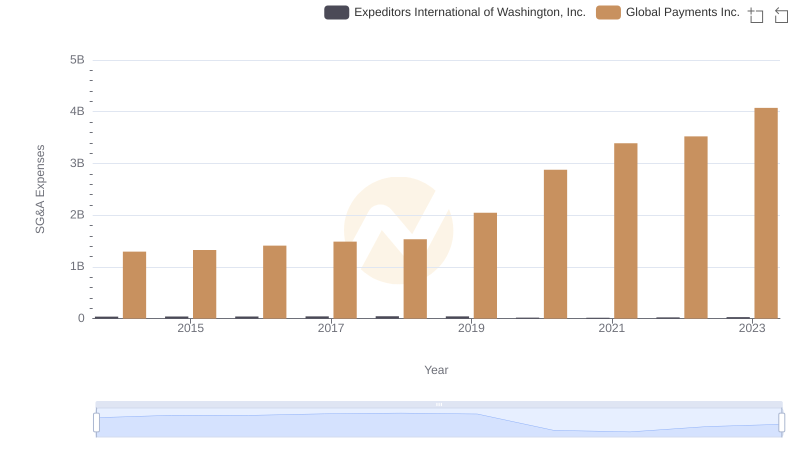

Breaking Down SG&A Expenses: Global Payments Inc. vs Expeditors International of Washington, Inc.

Professional EBITDA Benchmarking: Global Payments Inc. vs Expeditors International of Washington, Inc.