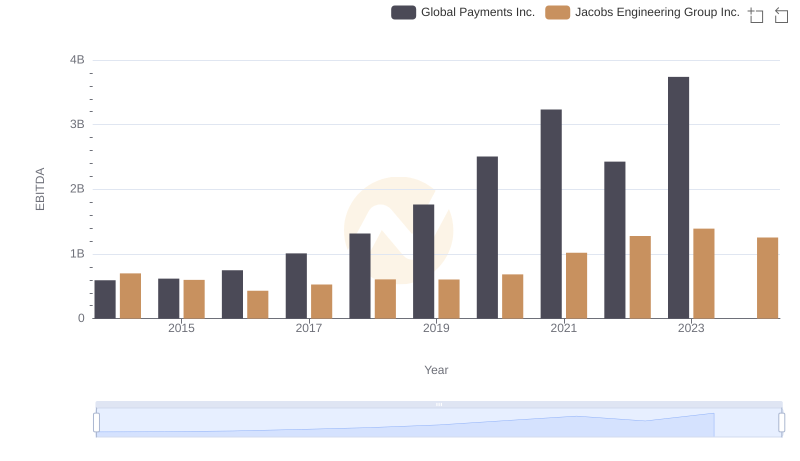

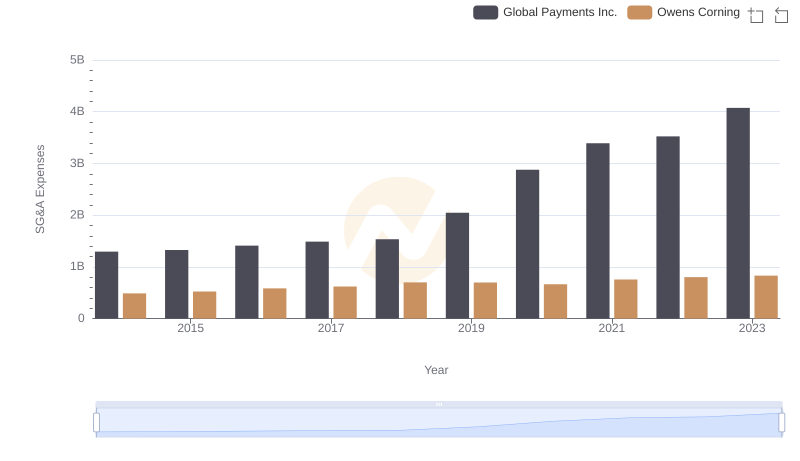

| __timestamp | Global Payments Inc. | Owens Corning |

|---|---|---|

| Wednesday, January 1, 2014 | 594102000 | 650000000 |

| Thursday, January 1, 2015 | 618109000 | 853000000 |

| Friday, January 1, 2016 | 748136000 | 1041000000 |

| Sunday, January 1, 2017 | 1010019000 | 1134000000 |

| Monday, January 1, 2018 | 1315968000 | 1266000000 |

| Tuesday, January 1, 2019 | 1764994000 | 1178000000 |

| Wednesday, January 1, 2020 | 2508393000 | 341000000 |

| Friday, January 1, 2021 | 3233589000 | 1909000000 |

| Saturday, January 1, 2022 | 2427684000 | 2200000000 |

| Sunday, January 1, 2023 | 3606789000 | 2166000000 |

| Monday, January 1, 2024 | 2333605000 |

In pursuit of knowledge

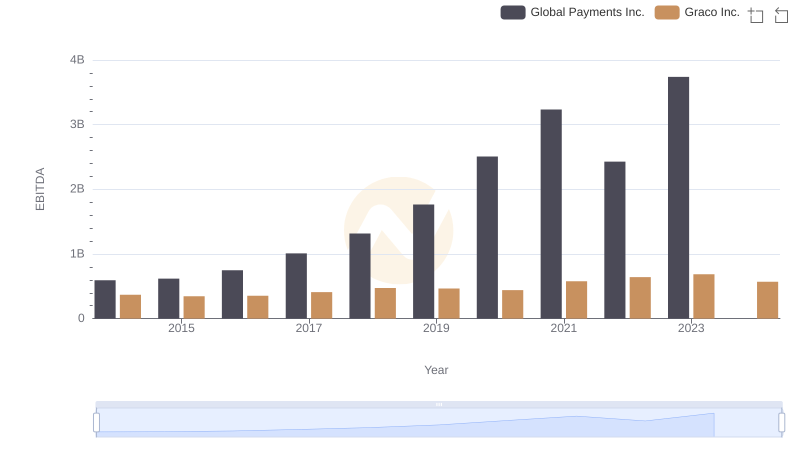

In the ever-evolving landscape of corporate finance, EBITDA serves as a crucial metric for evaluating a company's operational performance. Over the past decade, Global Payments Inc. and Owens Corning have demonstrated distinct trajectories in their EBITDA growth. From 2014 to 2023, Global Payments Inc. has seen a remarkable increase of over 530%, peaking in 2023 with an EBITDA of approximately $3.74 billion. This growth underscores the company's strategic expansions and robust market positioning.

Conversely, Owens Corning, a leader in building materials, experienced a more modest growth of around 233% during the same period, reaching its highest EBITDA in 2022. Despite a dip in 2020, Owens Corning's resilience is evident in its recovery and subsequent growth. This comparative analysis highlights the dynamic nature of these industries and the strategic maneuvers that drive financial success.

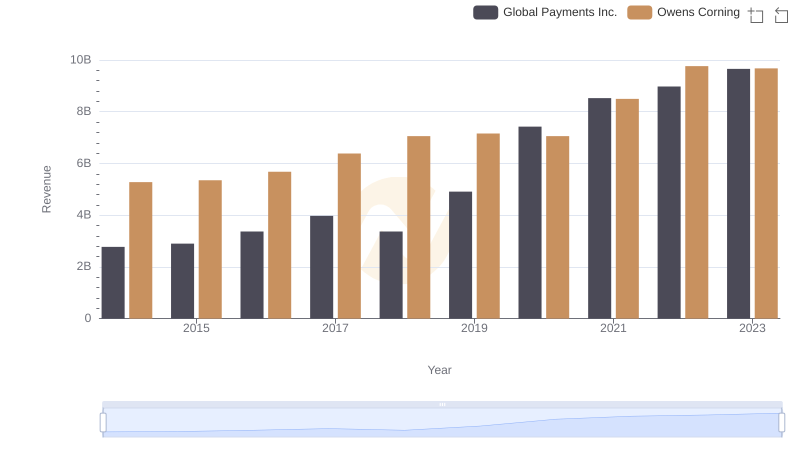

Global Payments Inc. or Owens Corning: Who Leads in Yearly Revenue?

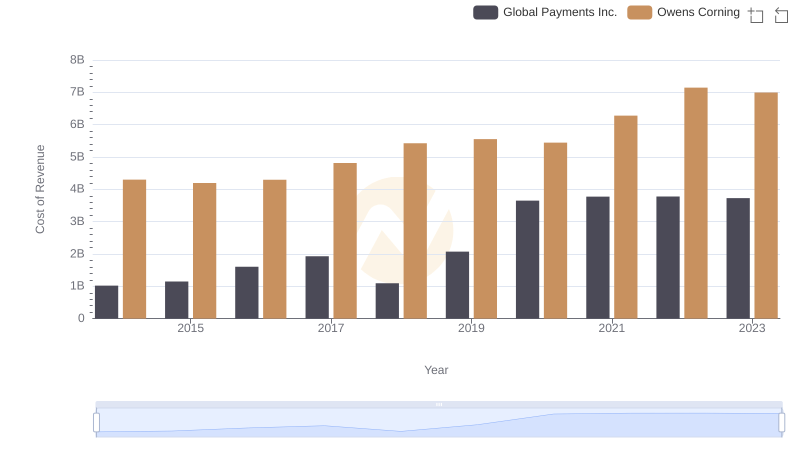

Cost of Revenue Trends: Global Payments Inc. vs Owens Corning

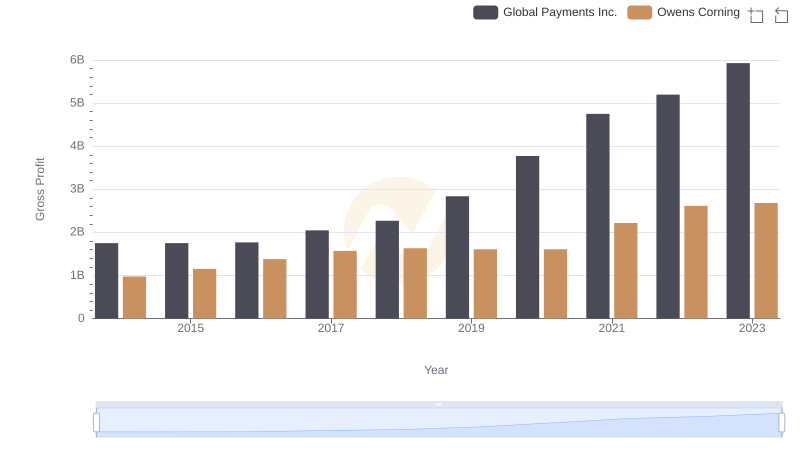

Global Payments Inc. and Owens Corning: A Detailed Gross Profit Analysis

EBITDA Analysis: Evaluating Global Payments Inc. Against Jacobs Engineering Group Inc.

Global Payments Inc. and Owens Corning: SG&A Spending Patterns Compared

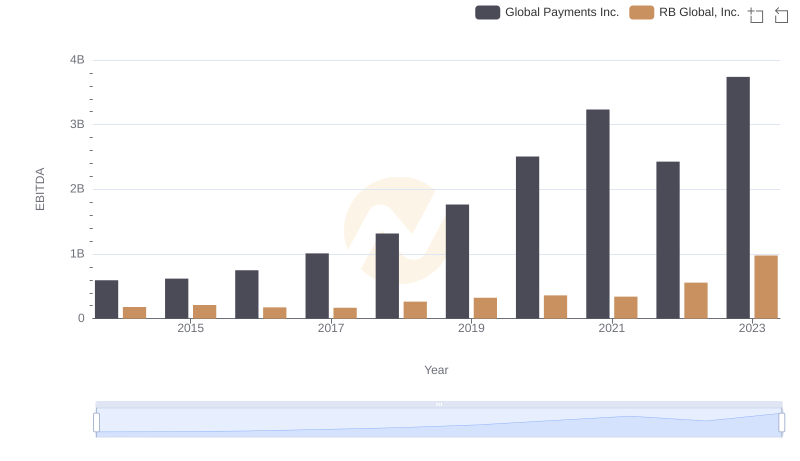

Comprehensive EBITDA Comparison: Global Payments Inc. vs RB Global, Inc.

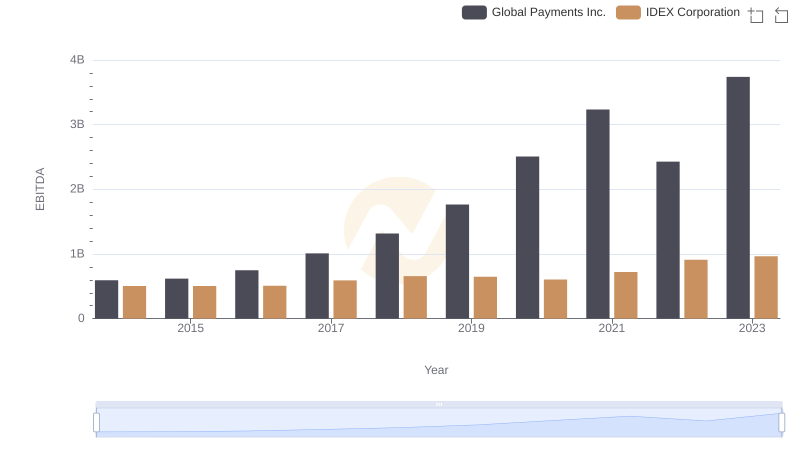

Global Payments Inc. vs IDEX Corporation: In-Depth EBITDA Performance Comparison

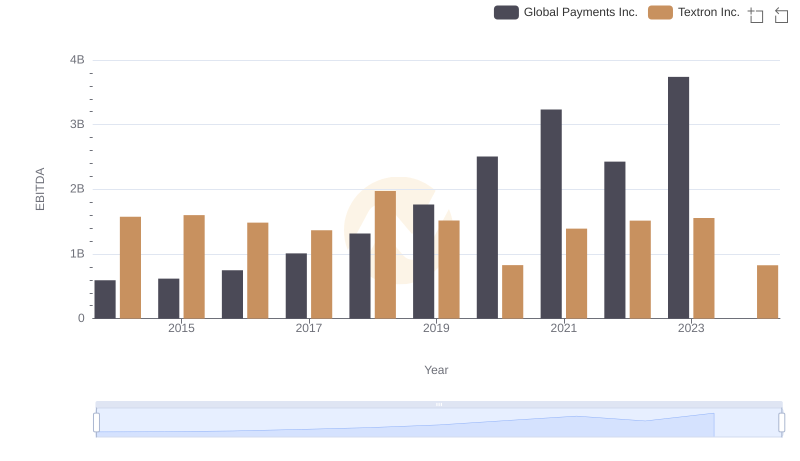

EBITDA Analysis: Evaluating Global Payments Inc. Against Textron Inc.

Professional EBITDA Benchmarking: Global Payments Inc. vs Expeditors International of Washington, Inc.

Global Payments Inc. and ZTO Express (Cayman) Inc.: A Detailed Examination of EBITDA Performance

A Side-by-Side Analysis of EBITDA: Global Payments Inc. and Graco Inc.