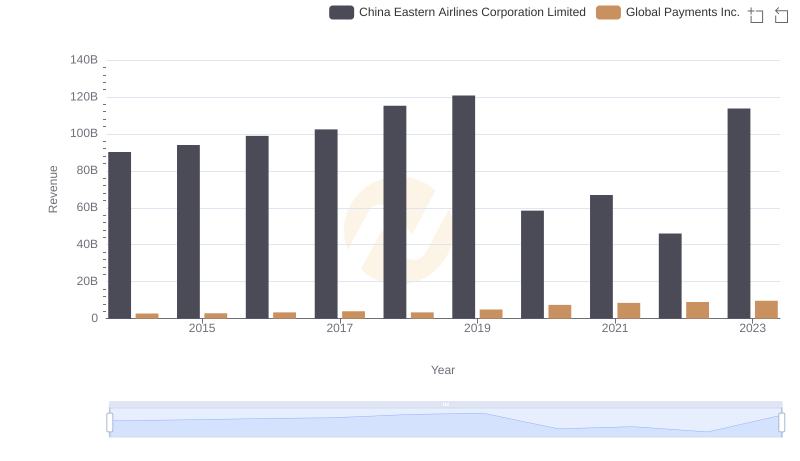

| __timestamp | China Eastern Airlines Corporation Limited | Global Payments Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 78741000000 | 1022107000 |

| Thursday, January 1, 2015 | 77237000000 | 1147639000 |

| Friday, January 1, 2016 | 82676000000 | 1603532000 |

| Sunday, January 1, 2017 | 91592000000 | 1928037000 |

| Monday, January 1, 2018 | 103476000000 | 1095014000 |

| Tuesday, January 1, 2019 | 108865000000 | 2073803000 |

| Wednesday, January 1, 2020 | 72523000000 | 3650727000 |

| Friday, January 1, 2021 | 81828000000 | 3773725000 |

| Saturday, January 1, 2022 | 74599000000 | 3778617000 |

| Sunday, January 1, 2023 | 112461000000 | 3727521000 |

| Monday, January 1, 2024 | 3760116000 |

In pursuit of knowledge

In the ever-evolving landscape of global commerce, understanding cost structures is pivotal. This analysis juxtaposes the cost of revenue trends of two industry titans: Global Payments Inc., a leader in payment technology services, and China Eastern Airlines Corporation Limited, a major player in the aviation sector. From 2014 to 2023, China Eastern Airlines consistently reported a cost of revenue approximately 37 times higher than Global Payments. Notably, 2020 marked a significant dip for China Eastern, with costs plummeting by 33% compared to the previous year, likely reflecting the pandemic's impact on air travel. Conversely, Global Payments saw a steady increase, peaking in 2022 with a 270% rise from 2014. This divergence underscores the contrasting operational dynamics and market challenges faced by these companies. As the world economy rebounds, monitoring these trends offers valuable insights into sector-specific resilience and adaptability.

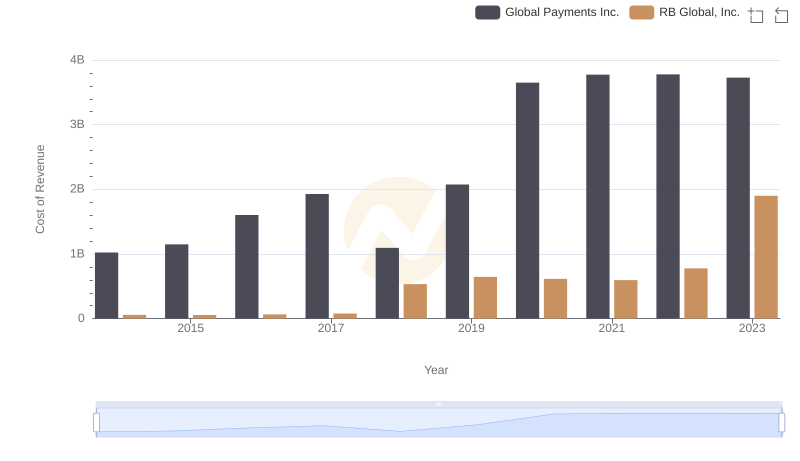

Cost of Revenue: Key Insights for Global Payments Inc. and RB Global, Inc.

Who Generates More Revenue? Global Payments Inc. or China Eastern Airlines Corporation Limited

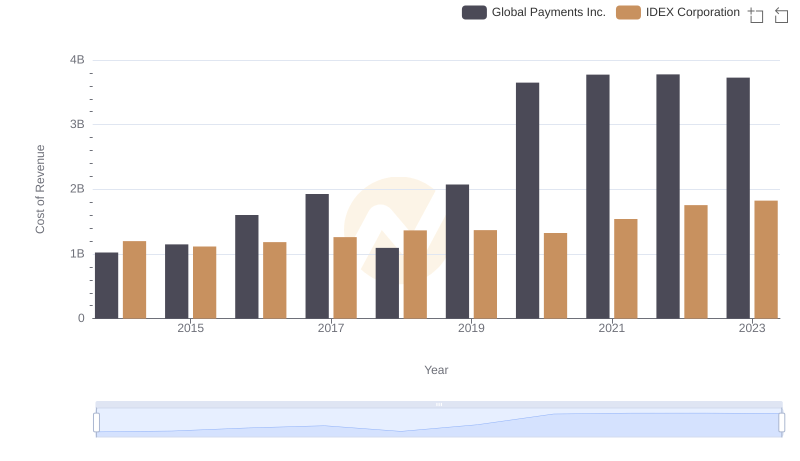

Comparing Cost of Revenue Efficiency: Global Payments Inc. vs IDEX Corporation

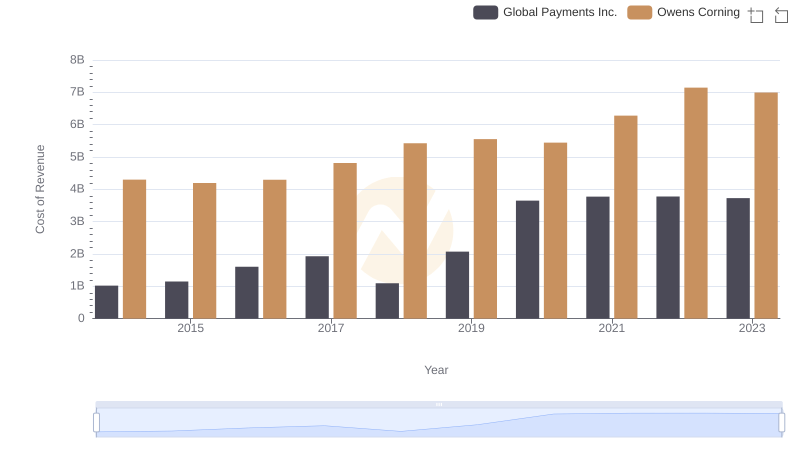

Cost of Revenue Trends: Global Payments Inc. vs Owens Corning

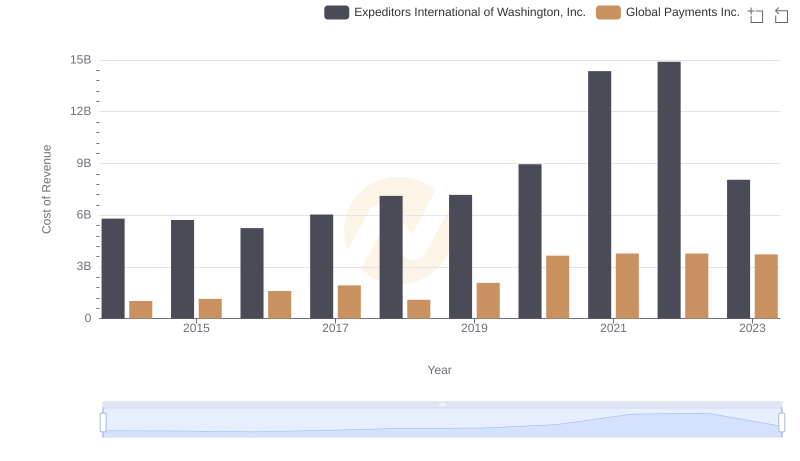

Analyzing Cost of Revenue: Global Payments Inc. and Expeditors International of Washington, Inc.

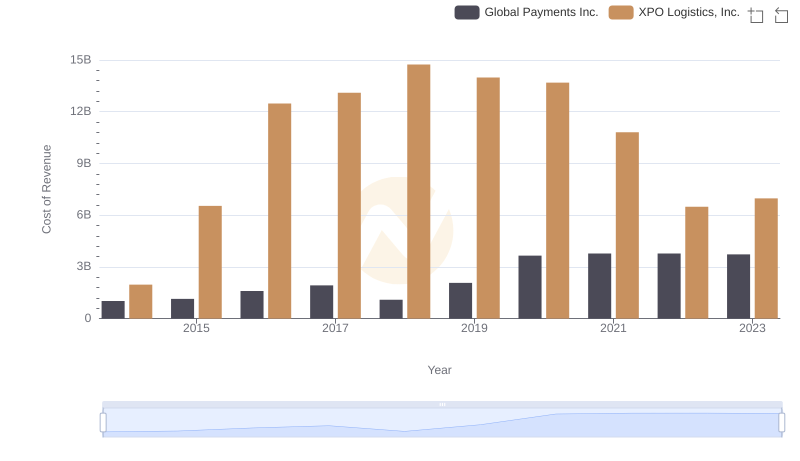

Cost of Revenue Comparison: Global Payments Inc. vs XPO Logistics, Inc.

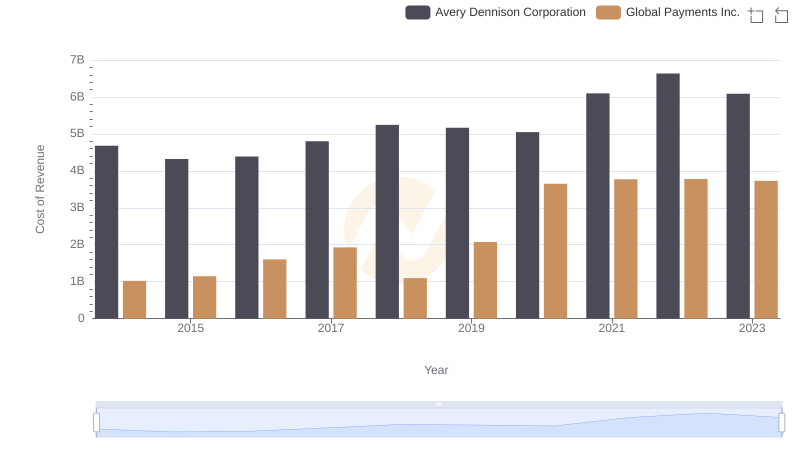

Cost of Revenue Comparison: Global Payments Inc. vs Avery Dennison Corporation

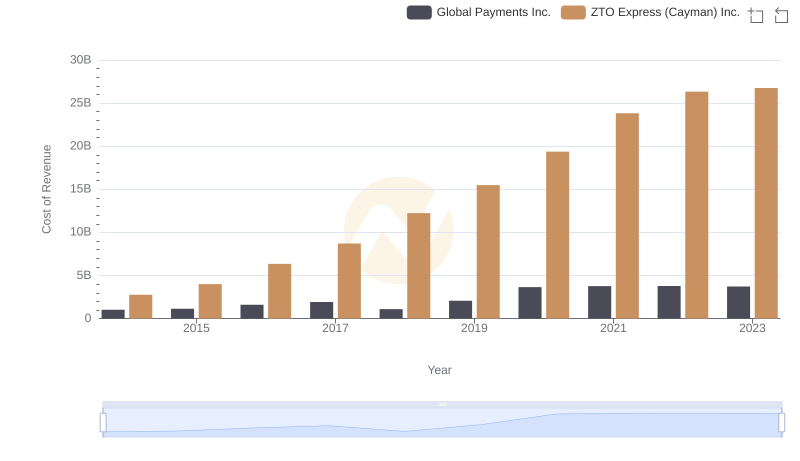

Analyzing Cost of Revenue: Global Payments Inc. and ZTO Express (Cayman) Inc.

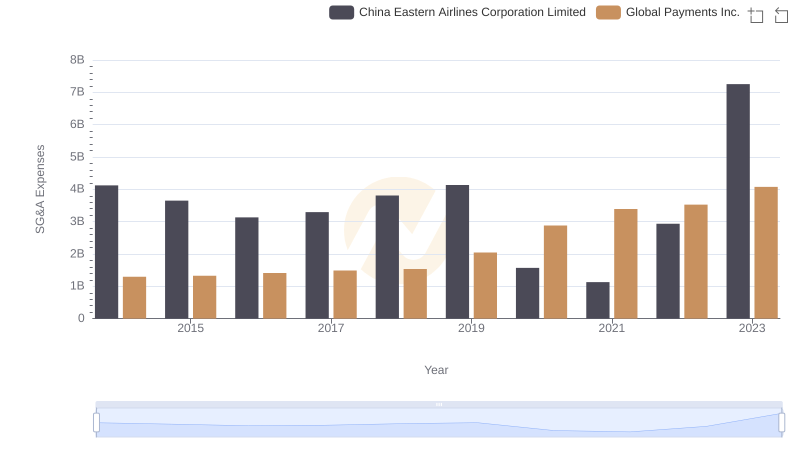

Global Payments Inc. vs China Eastern Airlines Corporation Limited: SG&A Expense Trends

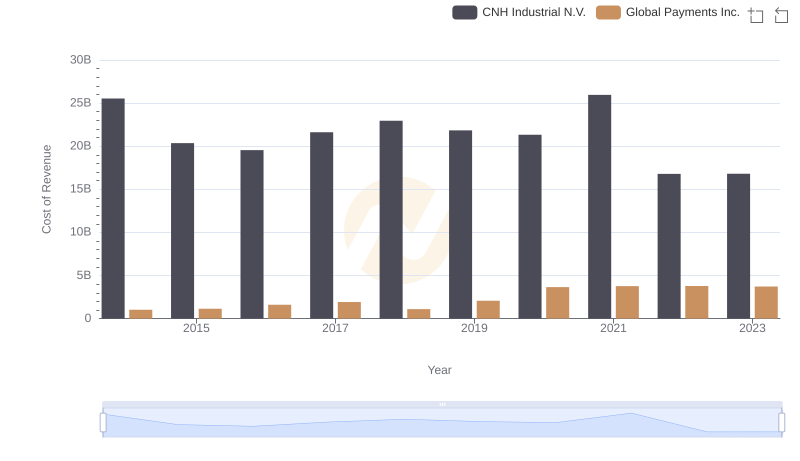

Cost of Revenue Comparison: Global Payments Inc. vs CNH Industrial N.V.

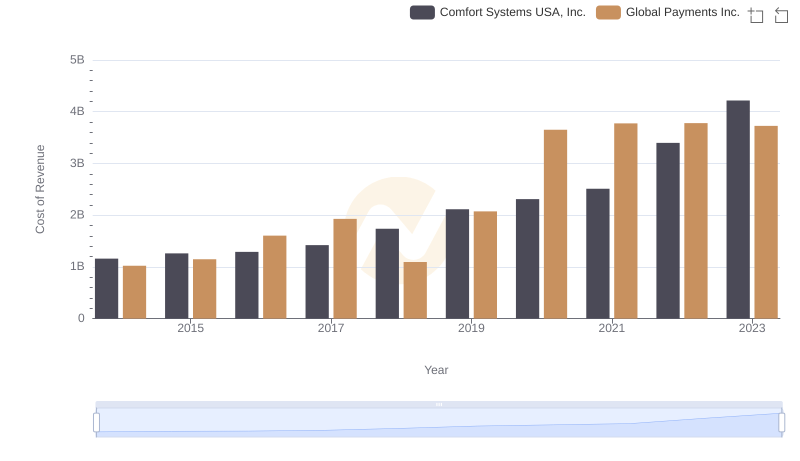

Comparing Cost of Revenue Efficiency: Global Payments Inc. vs Comfort Systems USA, Inc.

Comparing Cost of Revenue Efficiency: Global Payments Inc. vs AECOM