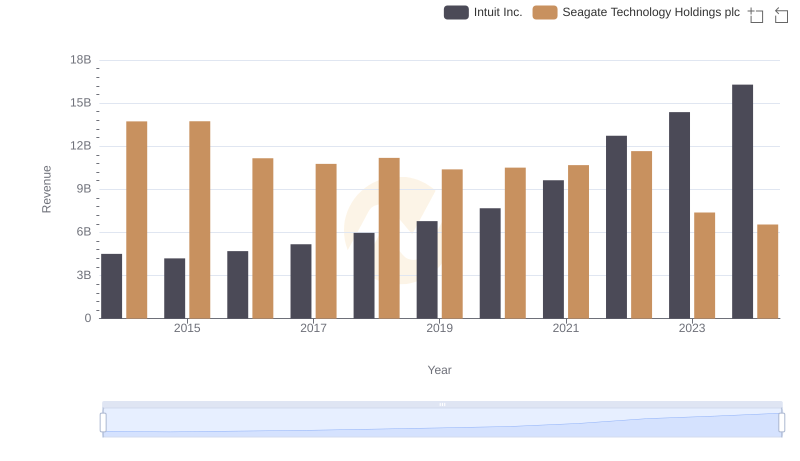

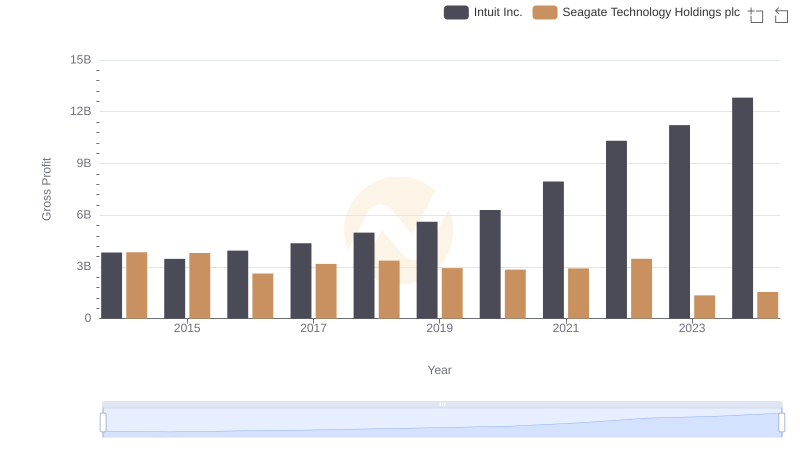

| __timestamp | Intuit Inc. | Seagate Technology Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 668000000 | 9878000000 |

| Thursday, January 1, 2015 | 725000000 | 9930000000 |

| Friday, January 1, 2016 | 752000000 | 8545000000 |

| Sunday, January 1, 2017 | 809000000 | 7597000000 |

| Monday, January 1, 2018 | 977000000 | 7820000000 |

| Tuesday, January 1, 2019 | 1167000000 | 7458000000 |

| Wednesday, January 1, 2020 | 1378000000 | 7667000000 |

| Friday, January 1, 2021 | 1683000000 | 7764000000 |

| Saturday, January 1, 2022 | 2406000000 | 8192000000 |

| Sunday, January 1, 2023 | 3143000000 | 6033000000 |

| Monday, January 1, 2024 | 3465000000 | 5005000000 |

Unleashing insights

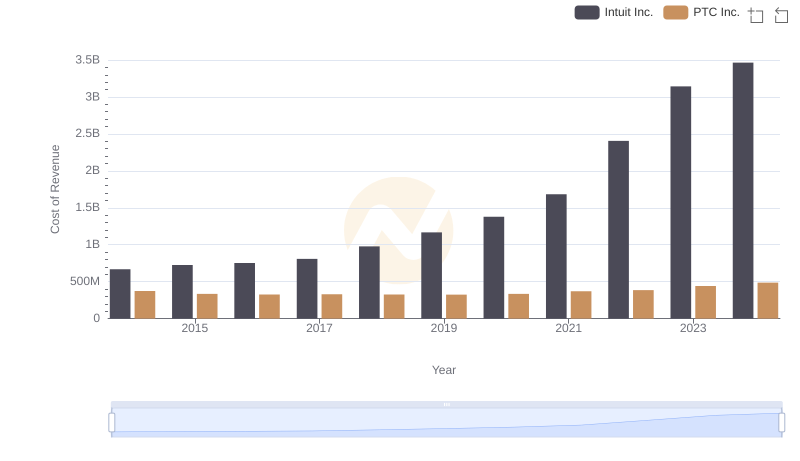

In the ever-evolving landscape of technology, understanding the cost dynamics of industry giants like Intuit Inc. and Seagate Technology Holdings plc is crucial. Over the past decade, Intuit has seen a remarkable increase in its cost of revenue, surging by over 400% from 2014 to 2024. This growth reflects Intuit's strategic investments in innovation and expansion. In contrast, Seagate Technology has experienced a 49% decline in its cost of revenue during the same period, indicating a shift towards more efficient operations or a change in business strategy.

These trends highlight the diverse strategies employed by these tech leaders in managing their operational expenses.

Revenue Showdown: Intuit Inc. vs Seagate Technology Holdings plc

Comparing Cost of Revenue Efficiency: Intuit Inc. vs ON Semiconductor Corporation

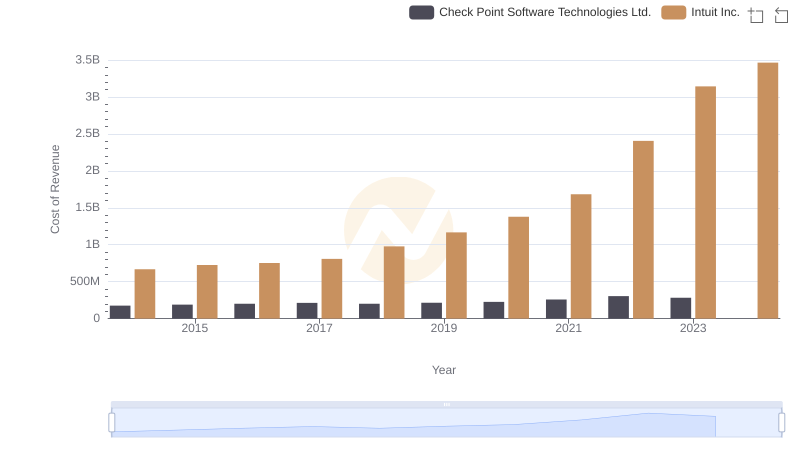

Comparing Cost of Revenue Efficiency: Intuit Inc. vs Check Point Software Technologies Ltd.

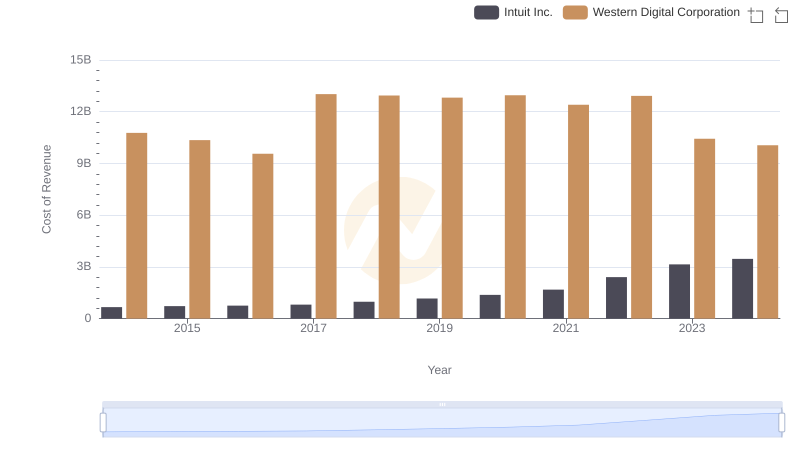

Cost of Revenue Trends: Intuit Inc. vs Western Digital Corporation

Cost of Revenue: Key Insights for Intuit Inc. and PTC Inc.

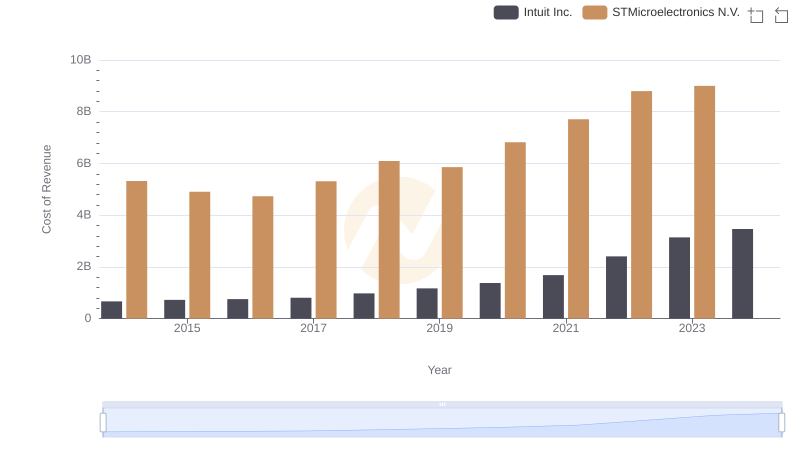

Cost Insights: Breaking Down Intuit Inc. and STMicroelectronics N.V.'s Expenses

Gross Profit Analysis: Comparing Intuit Inc. and Seagate Technology Holdings plc

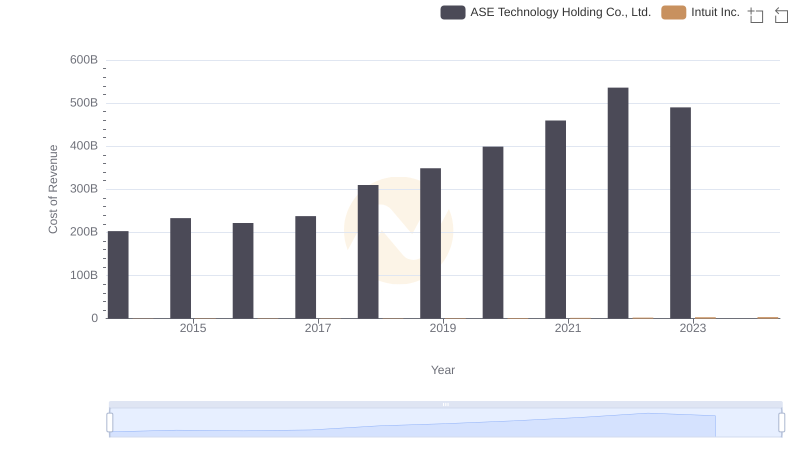

Cost of Revenue Comparison: Intuit Inc. vs ASE Technology Holding Co., Ltd.

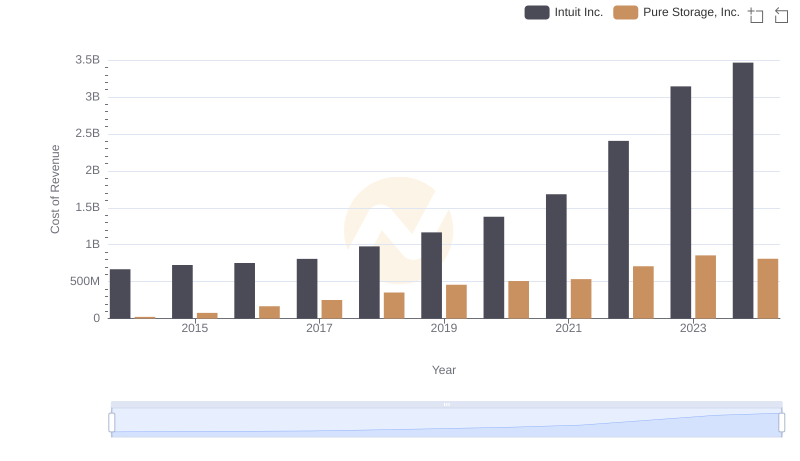

Analyzing Cost of Revenue: Intuit Inc. and Pure Storage, Inc.

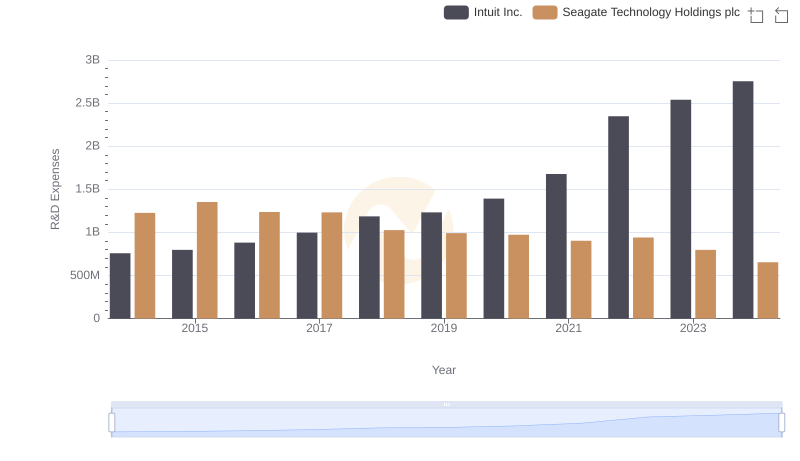

Research and Development Investment: Intuit Inc. vs Seagate Technology Holdings plc

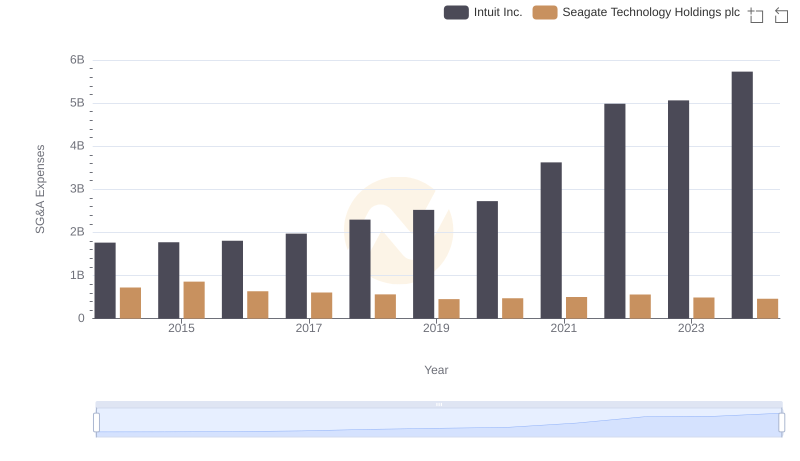

Cost Management Insights: SG&A Expenses for Intuit Inc. and Seagate Technology Holdings plc

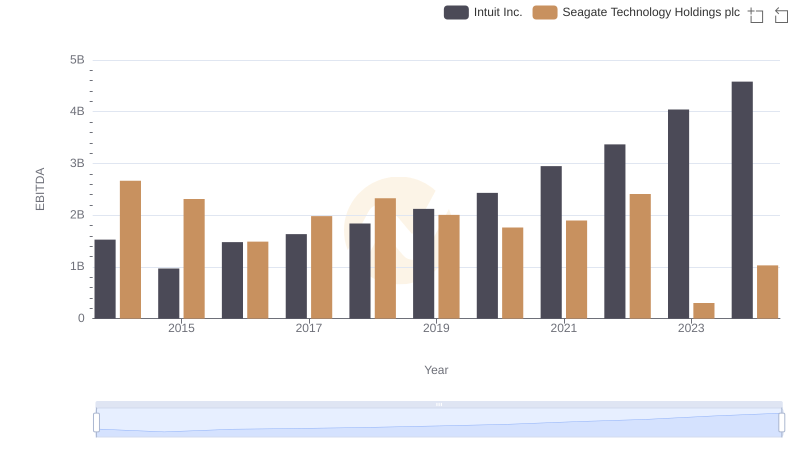

Intuit Inc. vs Seagate Technology Holdings plc: In-Depth EBITDA Performance Comparison