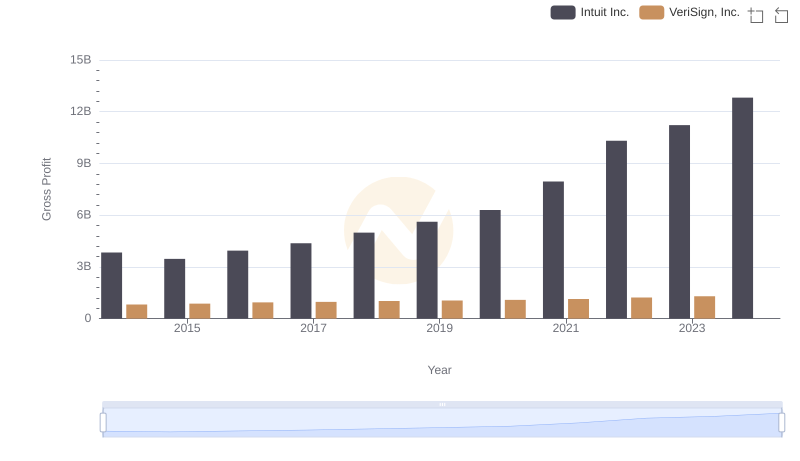

| __timestamp | Intuit Inc. | VeriSign, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 668000000 | 188425000 |

| Thursday, January 1, 2015 | 725000000 | 192788000 |

| Friday, January 1, 2016 | 752000000 | 198242000 |

| Sunday, January 1, 2017 | 809000000 | 193326000 |

| Monday, January 1, 2018 | 977000000 | 192134000 |

| Tuesday, January 1, 2019 | 1167000000 | 180467000 |

| Wednesday, January 1, 2020 | 1378000000 | 180177000 |

| Friday, January 1, 2021 | 1683000000 | 191933000 |

| Saturday, January 1, 2022 | 2406000000 | 200700000 |

| Sunday, January 1, 2023 | 3143000000 | 197300000 |

| Monday, January 1, 2024 | 3465000000 | 191400000 |

In pursuit of knowledge

In the ever-evolving landscape of technology, cost efficiency is a critical metric for success. From 2014 to 2023, Intuit Inc. and VeriSign, Inc. have showcased contrasting trajectories in their cost of revenue. Intuit Inc., a leader in financial software, has seen its cost of revenue soar by over 400%, reflecting its aggressive growth and expansion strategies. In contrast, VeriSign, Inc., a key player in domain name registry services, has maintained a relatively stable cost of revenue, with fluctuations of less than 10% annually.

This divergence highlights Intuit's dynamic approach to scaling its operations, while VeriSign's steady path underscores its focus on maintaining operational efficiency. As we look to the future, the missing data for 2024 suggests a potential shift in strategies or market conditions. Stay tuned as these industry giants continue to navigate the complexities of cost management.

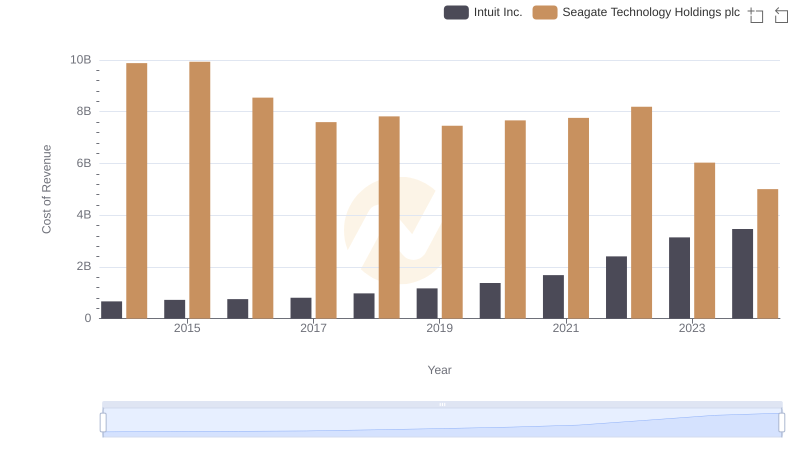

Cost Insights: Breaking Down Intuit Inc. and Seagate Technology Holdings plc's Expenses

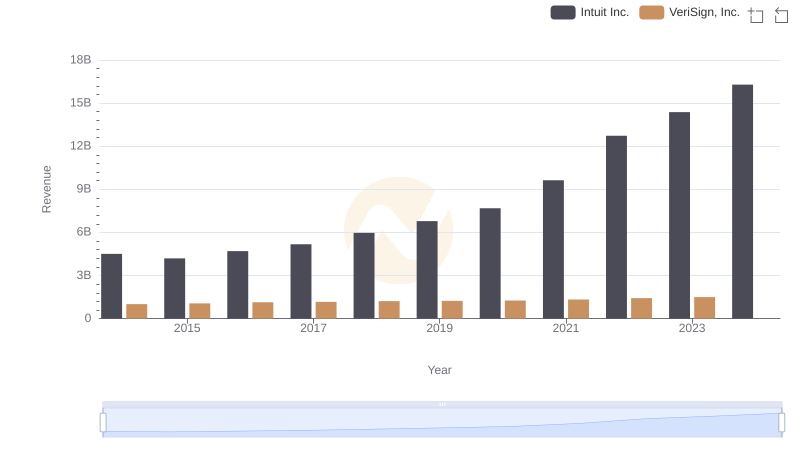

Who Generates More Revenue? Intuit Inc. or VeriSign, Inc.

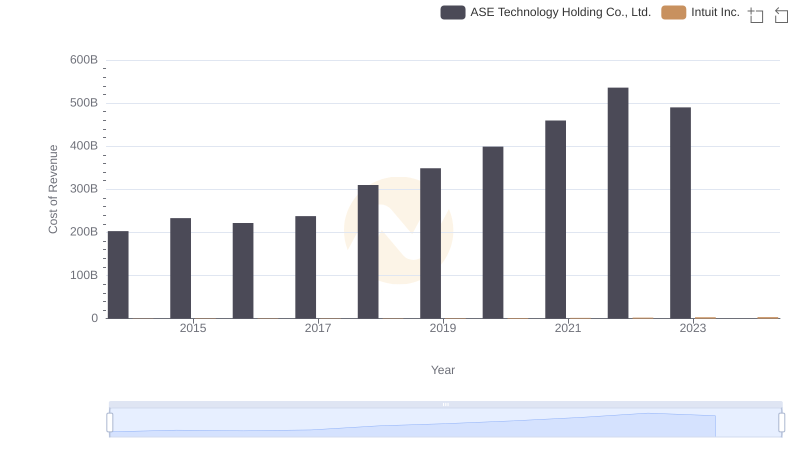

Cost of Revenue Comparison: Intuit Inc. vs ASE Technology Holding Co., Ltd.

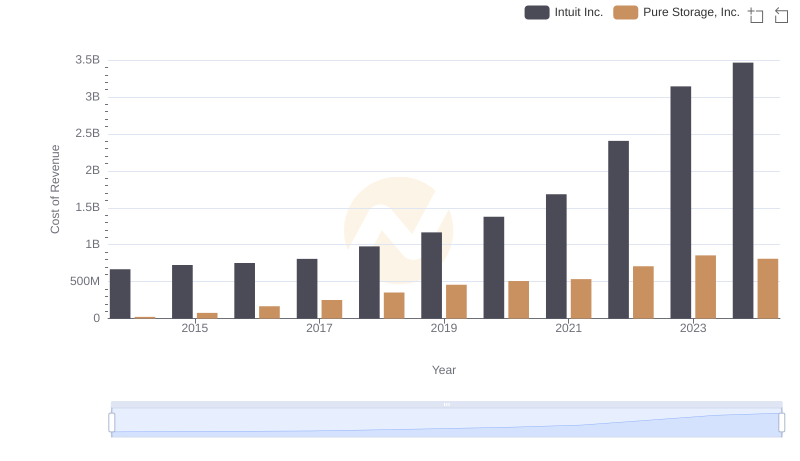

Analyzing Cost of Revenue: Intuit Inc. and Pure Storage, Inc.

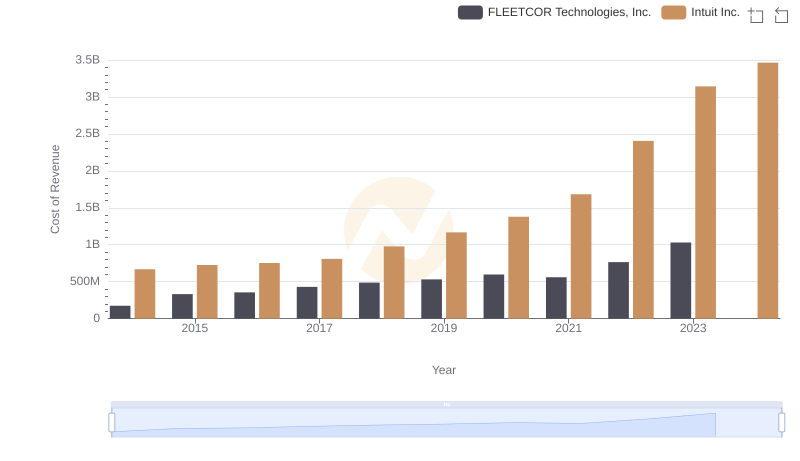

Comparing Cost of Revenue Efficiency: Intuit Inc. vs FLEETCOR Technologies, Inc.

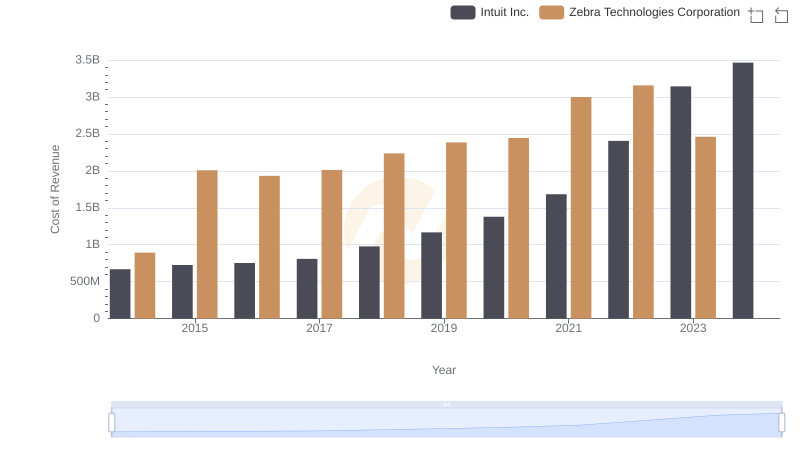

Cost of Revenue: Key Insights for Intuit Inc. and Zebra Technologies Corporation

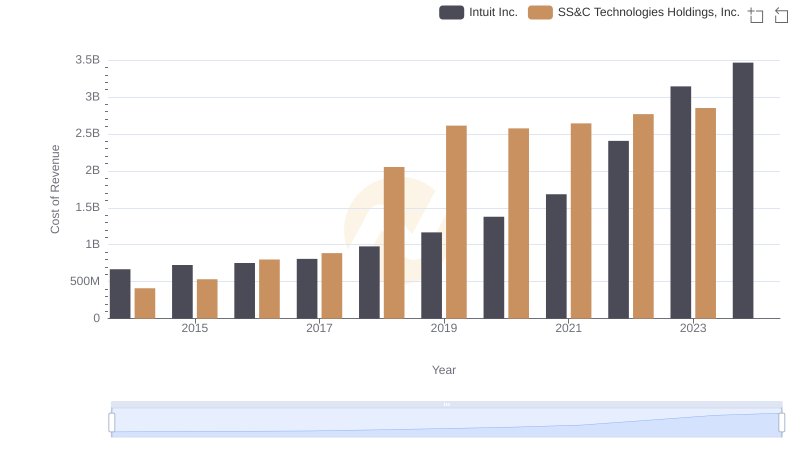

Cost of Revenue Trends: Intuit Inc. vs SS&C Technologies Holdings, Inc.

Gross Profit Comparison: Intuit Inc. and VeriSign, Inc. Trends

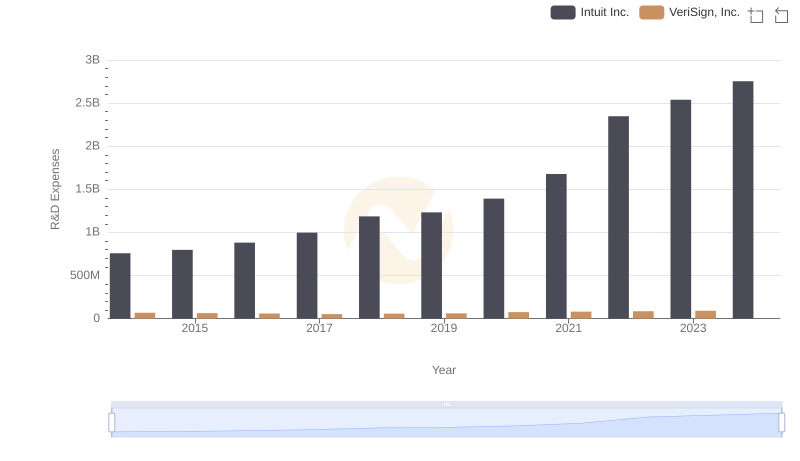

R&D Spending Showdown: Intuit Inc. vs VeriSign, Inc.

Cost of Revenue Comparison: Intuit Inc. vs Teradyne, Inc.

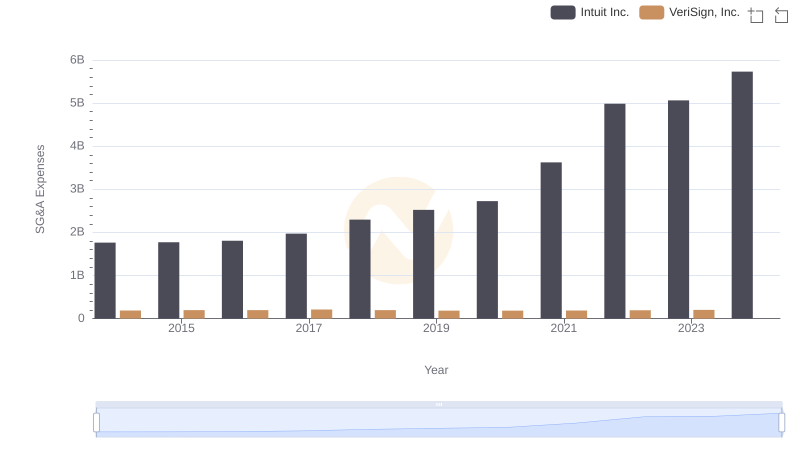

Intuit Inc. vs VeriSign, Inc.: SG&A Expense Trends

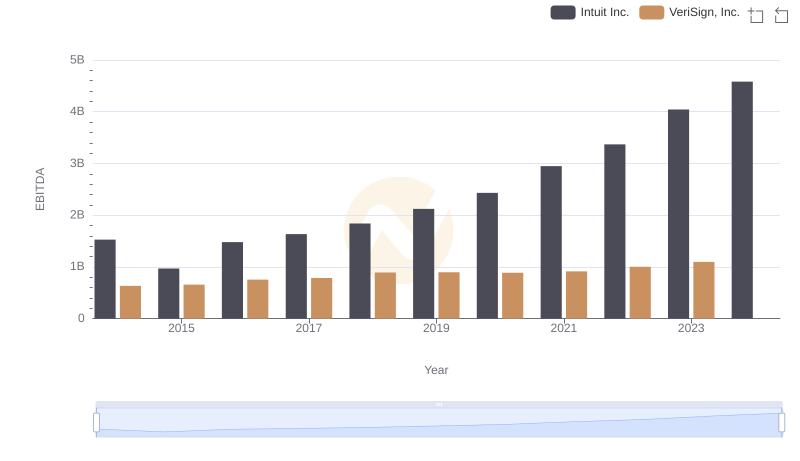

Professional EBITDA Benchmarking: Intuit Inc. vs VeriSign, Inc.