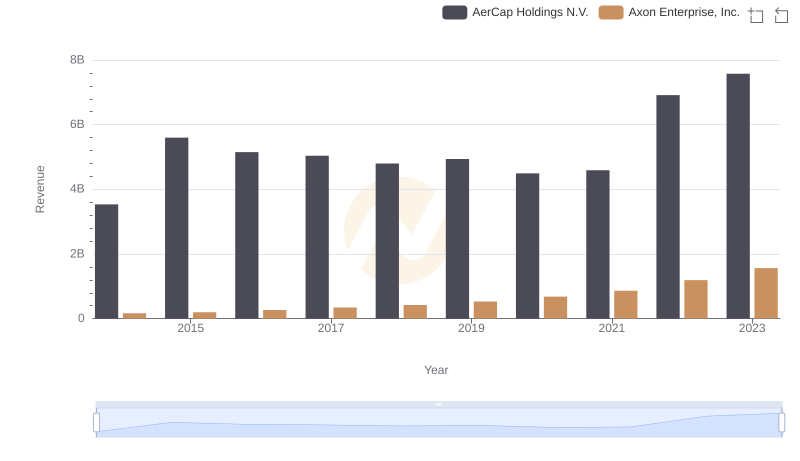

| __timestamp | AerCap Holdings N.V. | Axon Enterprise, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2252878000 | 62977000 |

| Thursday, January 1, 2015 | 3776407000 | 69245000 |

| Friday, January 1, 2016 | 3465727000 | 97709000 |

| Sunday, January 1, 2017 | 3377439000 | 136710000 |

| Monday, January 1, 2018 | 3299635000 | 161485000 |

| Tuesday, January 1, 2019 | 3259091000 | 223574000 |

| Wednesday, January 1, 2020 | 3217133000 | 264672000 |

| Friday, January 1, 2021 | 3287413000 | 322471000 |

| Saturday, January 1, 2022 | 4805277000 | 461297000 |

| Sunday, January 1, 2023 | 3237016000 | 608009000 |

Unleashing insights

In the evolving landscape of corporate finance, understanding cost structures is crucial. From 2014 to 2023, AerCap Holdings N.V. and Axon Enterprise, Inc. have shown distinct trajectories in their cost of revenue. AerCap, a leader in aircraft leasing, consistently reported higher costs, peaking in 2022 with a 45% increase from 2014. Meanwhile, Axon, known for its public safety technologies, saw a remarkable 866% surge over the same period, reflecting its aggressive growth strategy. Notably, Axon's cost of revenue in 2023 was nearly 10 times its 2014 figure, highlighting its expanding market footprint. These trends underscore the dynamic nature of these industries, with AerCap's costs stabilizing post-2022 and Axon's continuing upward trajectory. Investors and analysts should consider these patterns when evaluating future prospects.

Comparing Revenue Performance: Axon Enterprise, Inc. or AerCap Holdings N.V.?

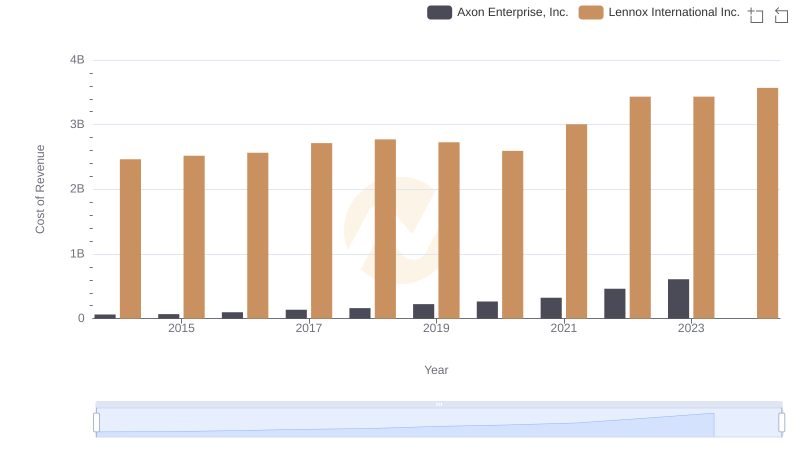

Cost of Revenue Trends: Axon Enterprise, Inc. vs Lennox International Inc.

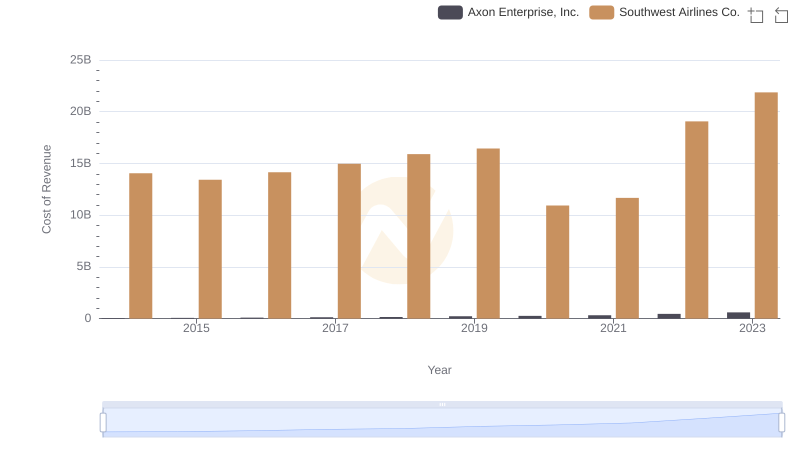

Cost of Revenue Trends: Axon Enterprise, Inc. vs Southwest Airlines Co.

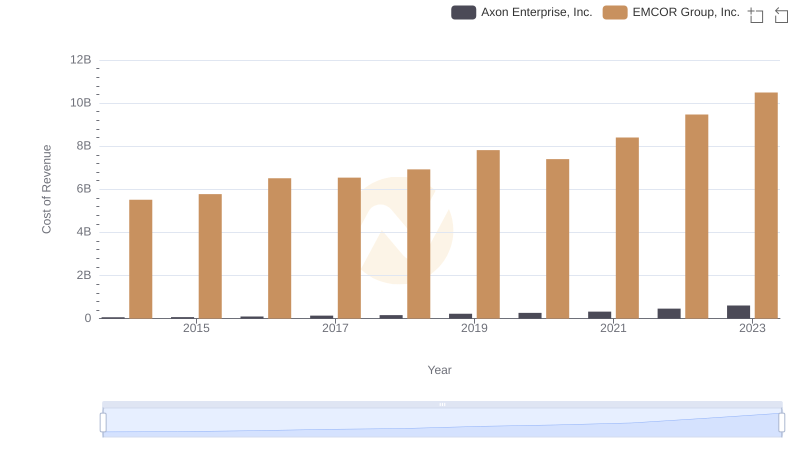

Cost of Revenue Comparison: Axon Enterprise, Inc. vs EMCOR Group, Inc.

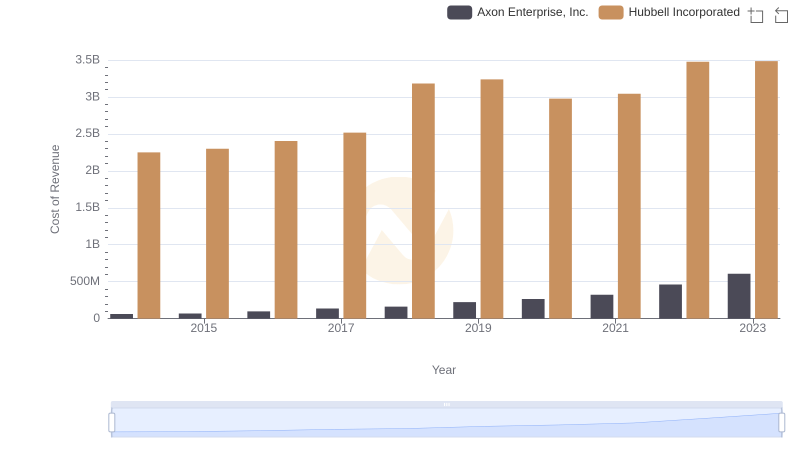

Analyzing Cost of Revenue: Axon Enterprise, Inc. and Hubbell Incorporated

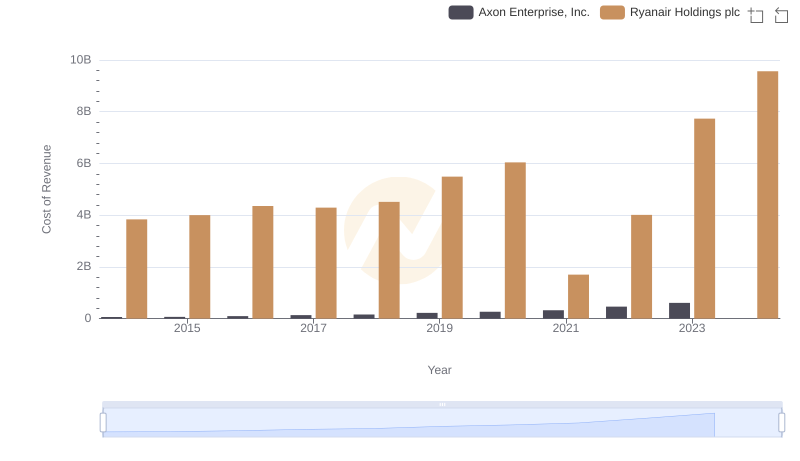

Comparing Cost of Revenue Efficiency: Axon Enterprise, Inc. vs Ryanair Holdings plc

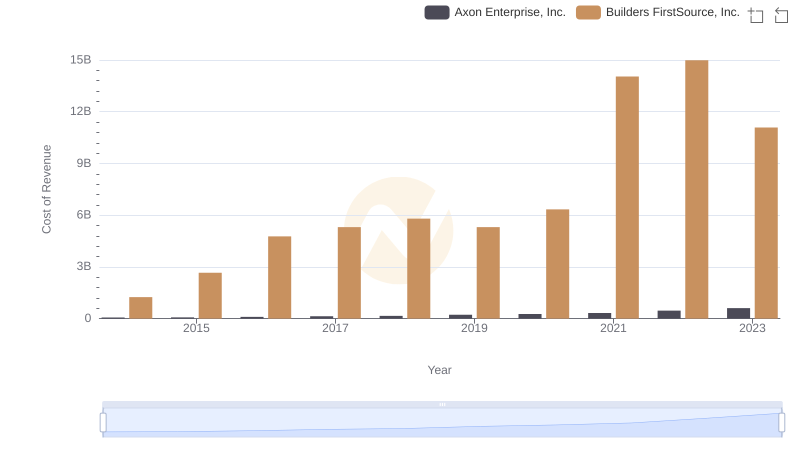

Axon Enterprise, Inc. vs Builders FirstSource, Inc.: Efficiency in Cost of Revenue Explored

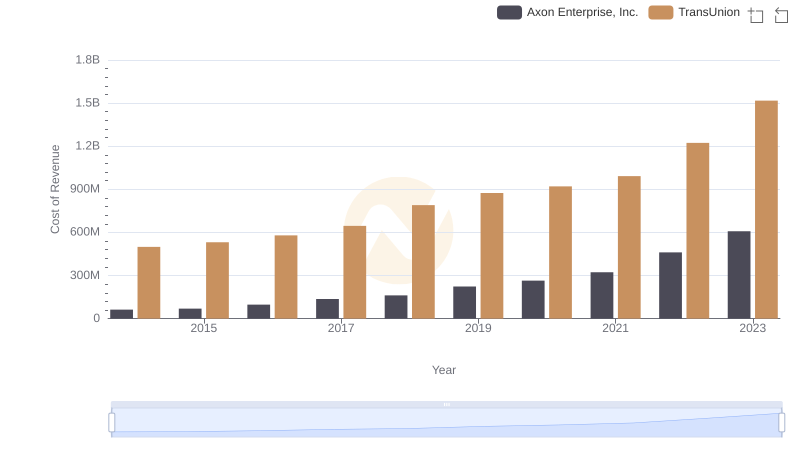

Cost Insights: Breaking Down Axon Enterprise, Inc. and TransUnion's Expenses

Cost of Revenue Trends: Axon Enterprise, Inc. vs Stanley Black & Decker, Inc.

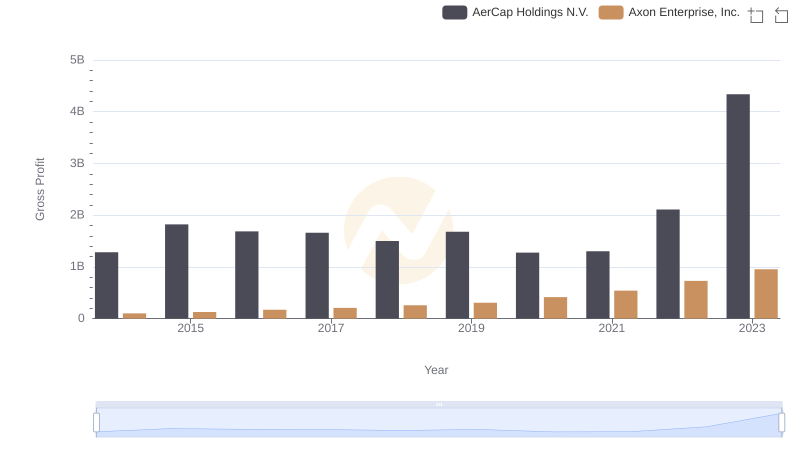

Key Insights on Gross Profit: Axon Enterprise, Inc. vs AerCap Holdings N.V.

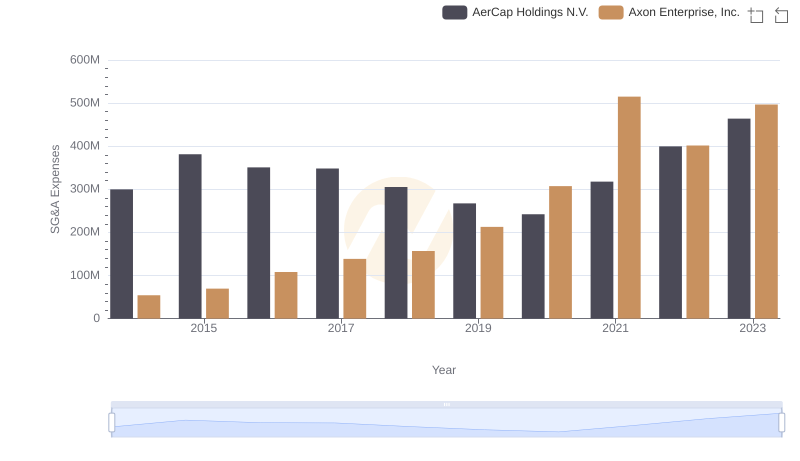

Comparing SG&A Expenses: Axon Enterprise, Inc. vs AerCap Holdings N.V. Trends and Insights