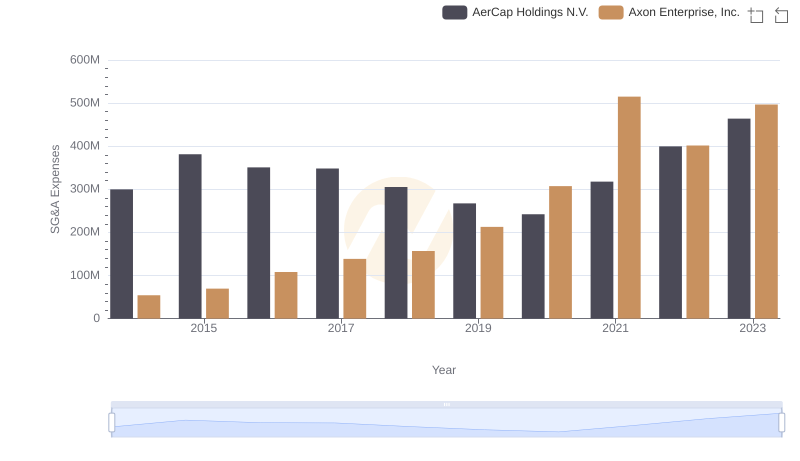

| __timestamp | AerCap Holdings N.V. | Axon Enterprise, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1282919000 | 101548000 |

| Thursday, January 1, 2015 | 1822255000 | 128647000 |

| Friday, January 1, 2016 | 1686404000 | 170536000 |

| Sunday, January 1, 2017 | 1660054000 | 207088000 |

| Monday, January 1, 2018 | 1500345000 | 258583000 |

| Tuesday, January 1, 2019 | 1678249000 | 307286000 |

| Wednesday, January 1, 2020 | 1276496000 | 416331000 |

| Friday, January 1, 2021 | 1301517000 | 540910000 |

| Saturday, January 1, 2022 | 2109708000 | 728638000 |

| Sunday, January 1, 2023 | 4337648000 | 955382000 |

Infusing magic into the data realm

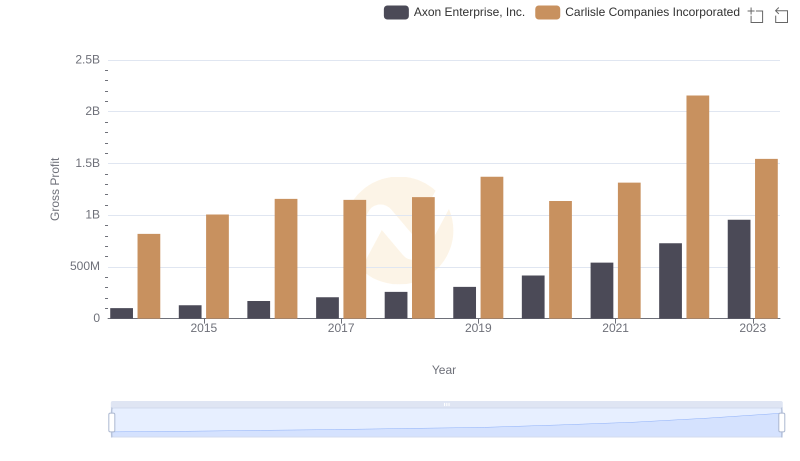

In the ever-evolving landscape of global business, understanding the financial health of companies is crucial. This analysis delves into the gross profit trends of two industry giants: Axon Enterprise, Inc. and AerCap Holdings N.V., from 2014 to 2023.

AerCap, a leader in aircraft leasing, has shown a remarkable growth trajectory. From 2014 to 2023, its gross profit surged by over 238%, peaking in 2023. This growth underscores AerCap's strategic prowess in navigating the aviation industry's challenges.

Axon, renowned for its public safety technologies, has also demonstrated impressive growth. Its gross profit increased by approximately 840% over the same period, reflecting its expanding market influence and innovation-driven strategy.

Both companies exemplify resilience and strategic growth, albeit in different sectors. Their financial journeys offer valuable insights into the dynamics of their respective industries.

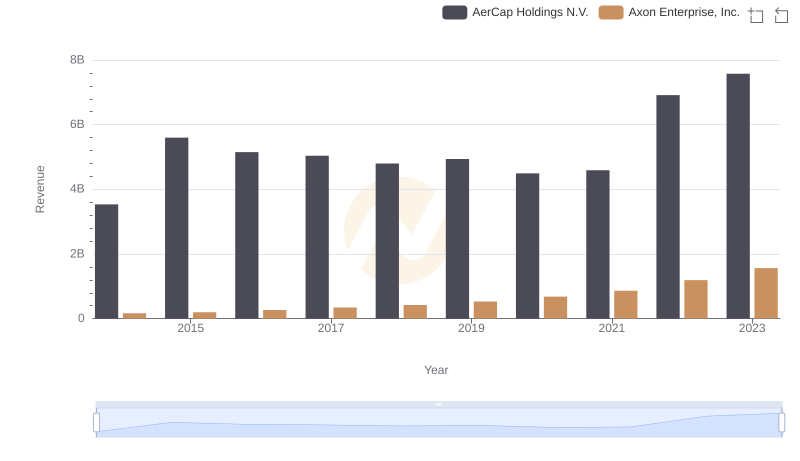

Comparing Revenue Performance: Axon Enterprise, Inc. or AerCap Holdings N.V.?

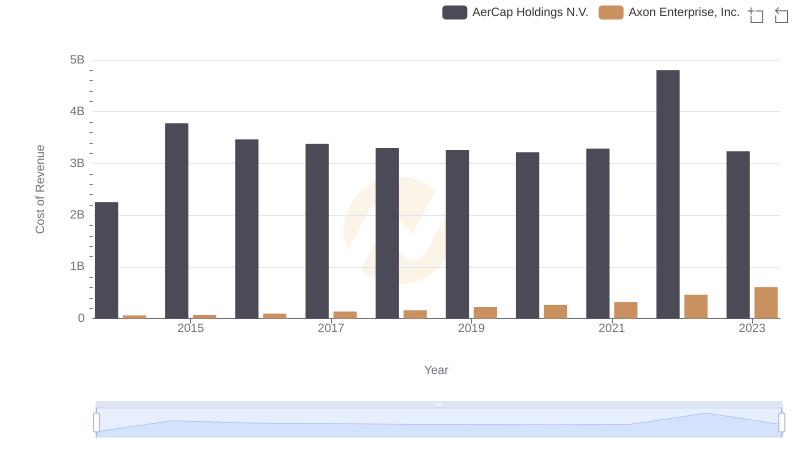

Cost of Revenue: Key Insights for Axon Enterprise, Inc. and AerCap Holdings N.V.

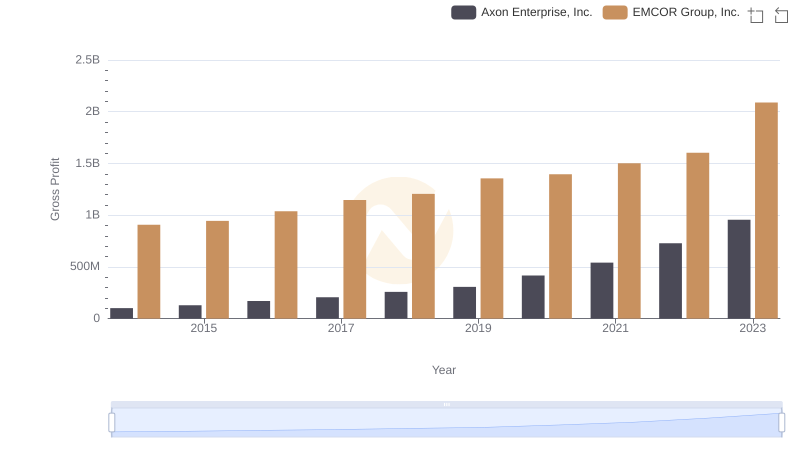

Key Insights on Gross Profit: Axon Enterprise, Inc. vs EMCOR Group, Inc.

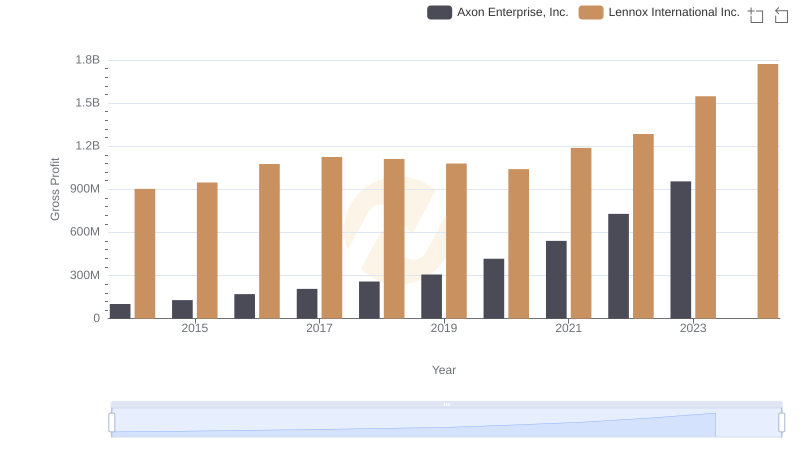

Gross Profit Analysis: Comparing Axon Enterprise, Inc. and Lennox International Inc.

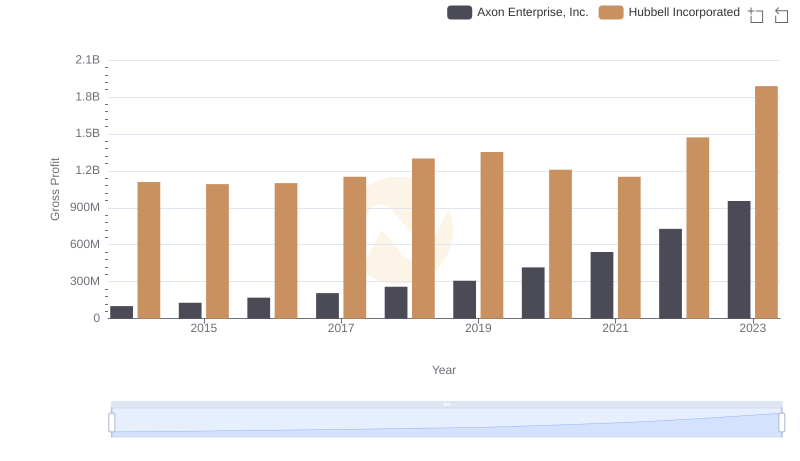

Key Insights on Gross Profit: Axon Enterprise, Inc. vs Hubbell Incorporated

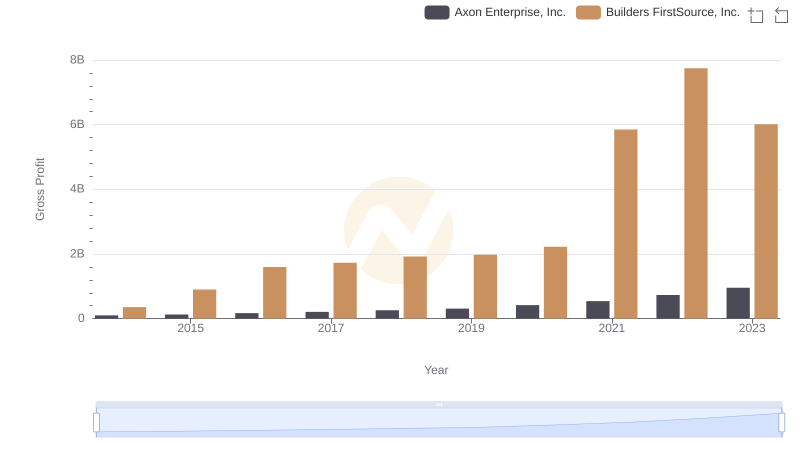

Gross Profit Trends Compared: Axon Enterprise, Inc. vs Builders FirstSource, Inc.

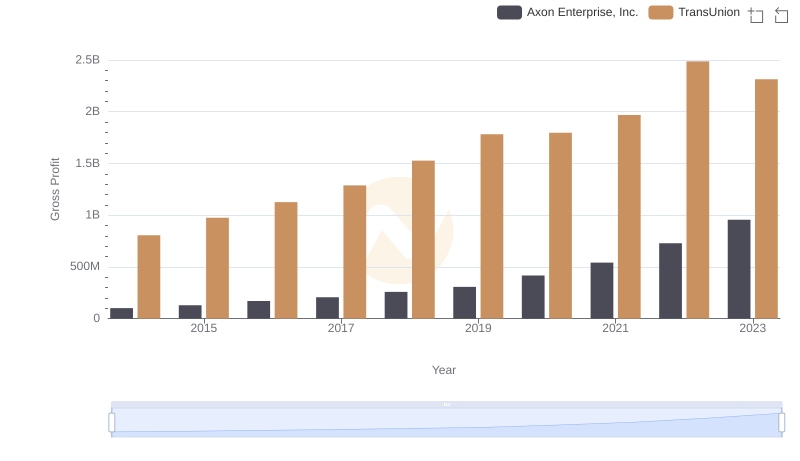

Gross Profit Comparison: Axon Enterprise, Inc. and TransUnion Trends

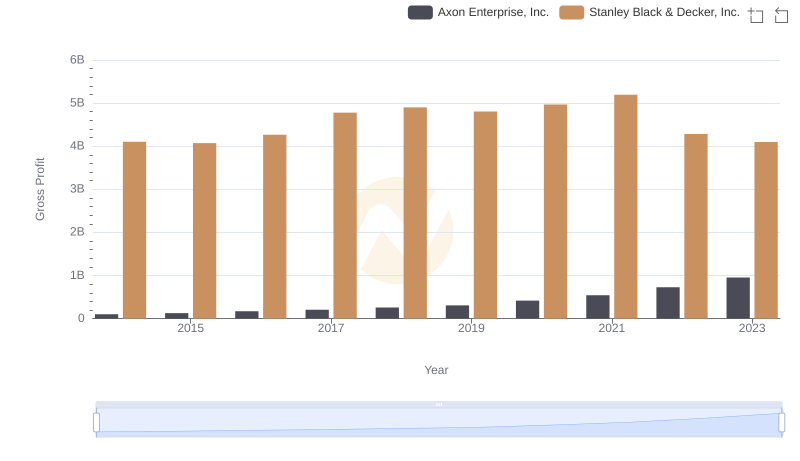

Axon Enterprise, Inc. and Stanley Black & Decker, Inc.: A Detailed Gross Profit Analysis

Comparing SG&A Expenses: Axon Enterprise, Inc. vs AerCap Holdings N.V. Trends and Insights

Gross Profit Trends Compared: Axon Enterprise, Inc. vs Carlisle Companies Incorporated