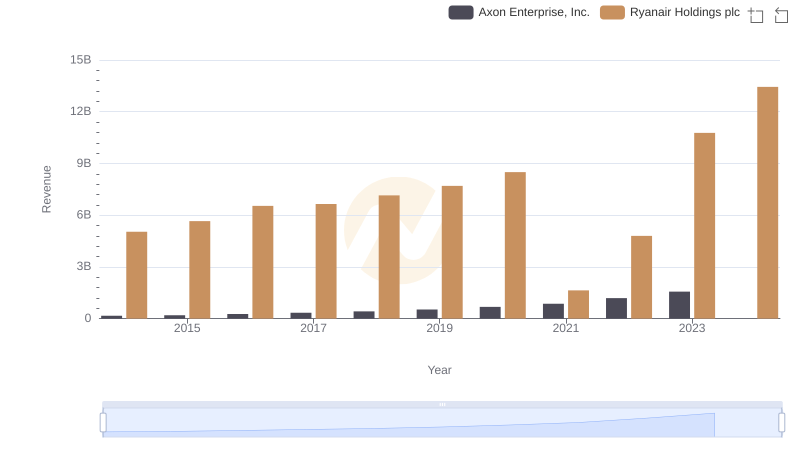

| __timestamp | Axon Enterprise, Inc. | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 62977000 | 3838100000 |

| Thursday, January 1, 2015 | 69245000 | 3999600000 |

| Friday, January 1, 2016 | 97709000 | 4355900000 |

| Sunday, January 1, 2017 | 136710000 | 4294000000 |

| Monday, January 1, 2018 | 161485000 | 4512300000 |

| Tuesday, January 1, 2019 | 223574000 | 5492800000 |

| Wednesday, January 1, 2020 | 264672000 | 6039900000 |

| Friday, January 1, 2021 | 322471000 | 1702700000 |

| Saturday, January 1, 2022 | 461297000 | 4009800000 |

| Sunday, January 1, 2023 | 608009000 | 7735000000 |

| Monday, January 1, 2024 | 9566400000 |

Igniting the spark of knowledge

In the ever-evolving landscape of global business, understanding cost efficiency is crucial. This comparison between Axon Enterprise, Inc. and Ryanair Holdings plc offers a fascinating glimpse into how two distinct industries manage their cost of revenue. From 2014 to 2023, Axon, a leader in public safety technology, saw its cost of revenue grow by nearly 866%, reflecting its rapid expansion and innovation-driven strategy. Meanwhile, Ryanair, Europe's largest airline, experienced a 102% increase, showcasing its resilience and adaptability in the volatile aviation sector.

This analysis underscores the diverse challenges and strategies in managing costs across different sectors.

Axon Enterprise, Inc. and Ryanair Holdings plc: A Comprehensive Revenue Analysis

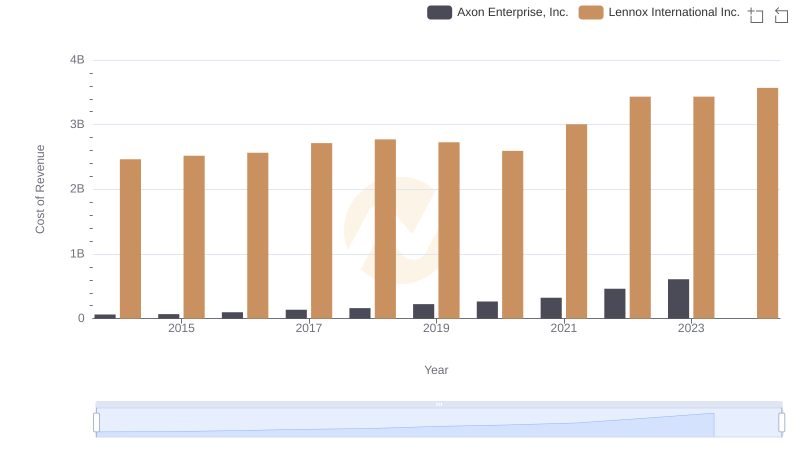

Cost of Revenue Trends: Axon Enterprise, Inc. vs Lennox International Inc.

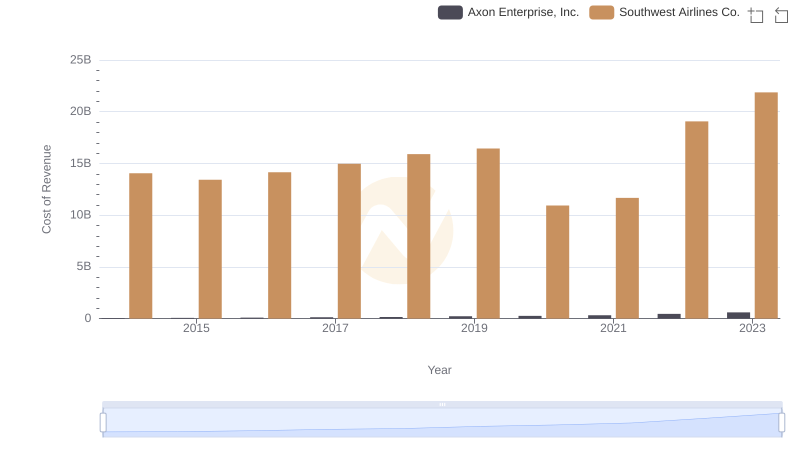

Cost of Revenue Trends: Axon Enterprise, Inc. vs Southwest Airlines Co.

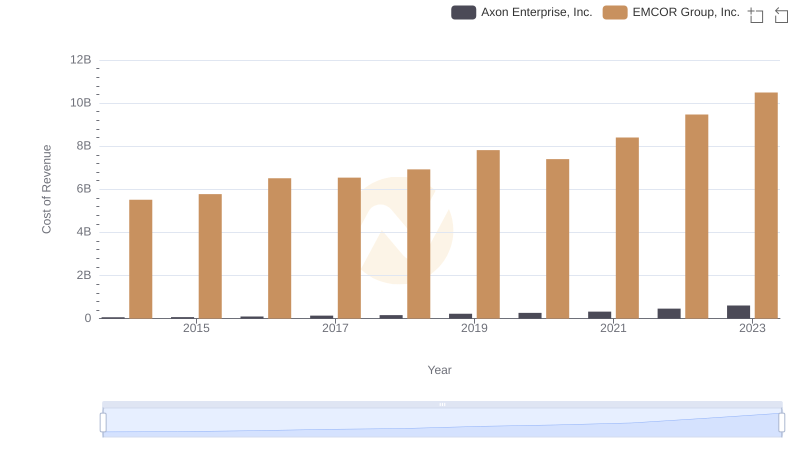

Cost of Revenue Comparison: Axon Enterprise, Inc. vs EMCOR Group, Inc.

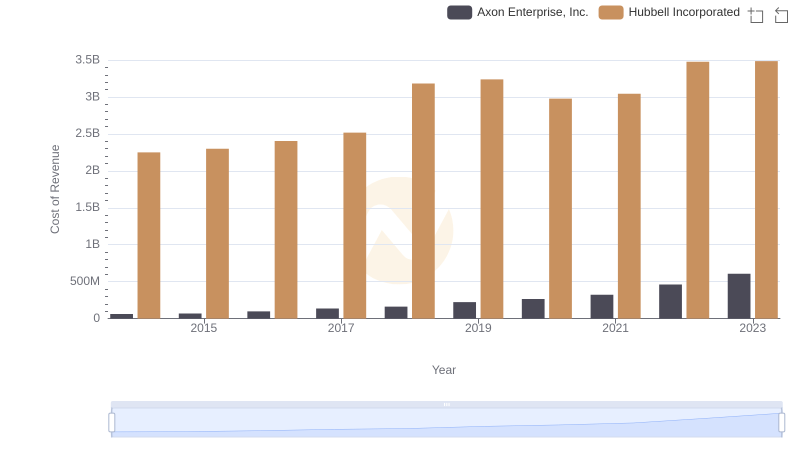

Analyzing Cost of Revenue: Axon Enterprise, Inc. and Hubbell Incorporated

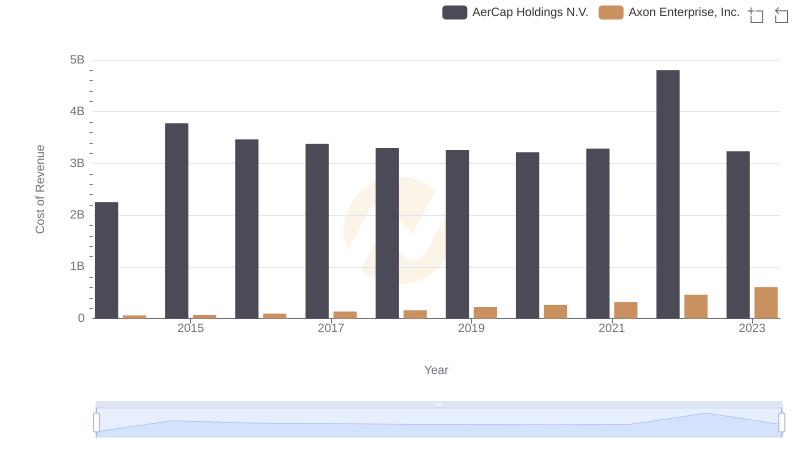

Cost of Revenue: Key Insights for Axon Enterprise, Inc. and AerCap Holdings N.V.

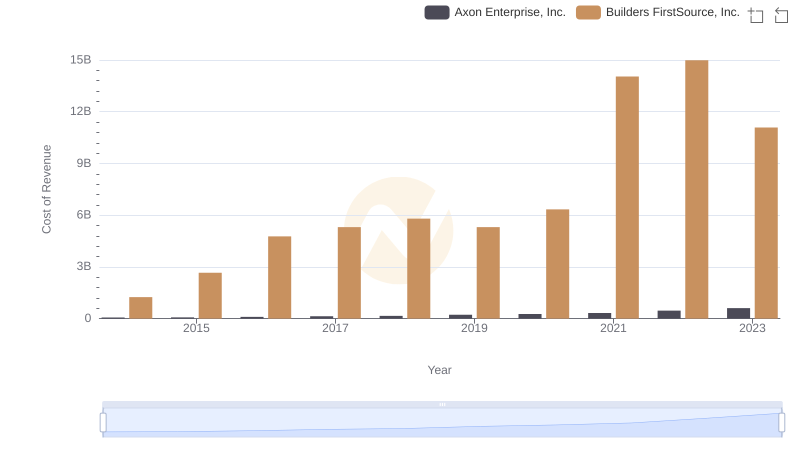

Axon Enterprise, Inc. vs Builders FirstSource, Inc.: Efficiency in Cost of Revenue Explored

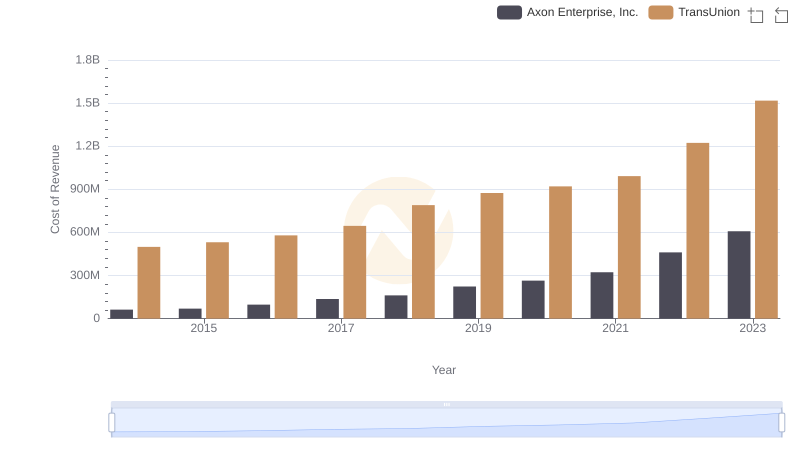

Cost Insights: Breaking Down Axon Enterprise, Inc. and TransUnion's Expenses

Cost of Revenue Trends: Axon Enterprise, Inc. vs Stanley Black & Decker, Inc.

Cost of Revenue: Key Insights for Axon Enterprise, Inc. and Snap-on Incorporated