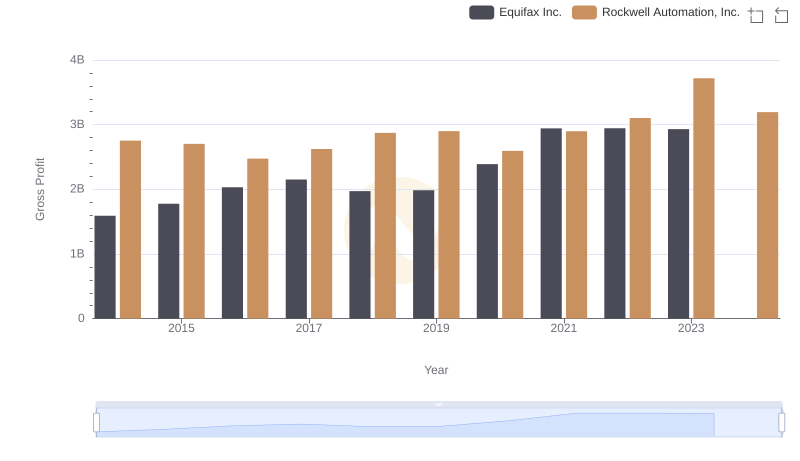

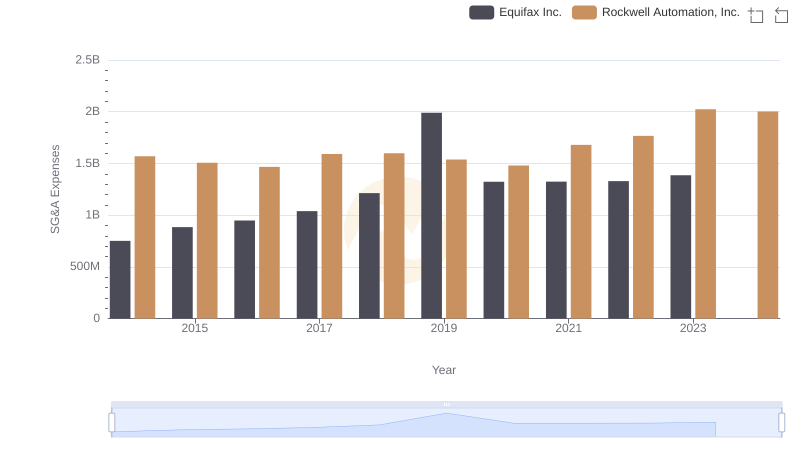

| __timestamp | Equifax Inc. | Rockwell Automation, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 844700000 | 3869600000 |

| Thursday, January 1, 2015 | 887400000 | 3604800000 |

| Friday, January 1, 2016 | 1113400000 | 3404000000 |

| Sunday, January 1, 2017 | 1210700000 | 3687100000 |

| Monday, January 1, 2018 | 1440400000 | 3793800000 |

| Tuesday, January 1, 2019 | 1521700000 | 3794700000 |

| Wednesday, January 1, 2020 | 1737400000 | 3734600000 |

| Friday, January 1, 2021 | 1980900000 | 4099700000 |

| Saturday, January 1, 2022 | 2177200000 | 4658400000 |

| Sunday, January 1, 2023 | 2335100000 | 5341000000 |

| Monday, January 1, 2024 | 0 | 5070800000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of American industry, Equifax Inc. and Rockwell Automation, Inc. stand as titans in their respective fields. Over the past decade, from 2014 to 2023, these companies have showcased distinct trajectories in their cost of revenue. Equifax, a leader in consumer credit reporting, has seen its cost of revenue grow by approximately 176%, reflecting its expanding operations and market reach. Meanwhile, Rockwell Automation, a pioneer in industrial automation, has experienced a 38% increase, underscoring its commitment to innovation and efficiency.

The data reveals a fascinating divergence: while Equifax's costs surged, Rockwell Automation maintained a steadier pace, with its cost of revenue consistently outpacing Equifax's by a factor of three to four. This comparison not only highlights the differing business models but also the strategic priorities of these industry leaders. As we look to the future, the missing data for Equifax in 2024 leaves room for speculation and anticipation.

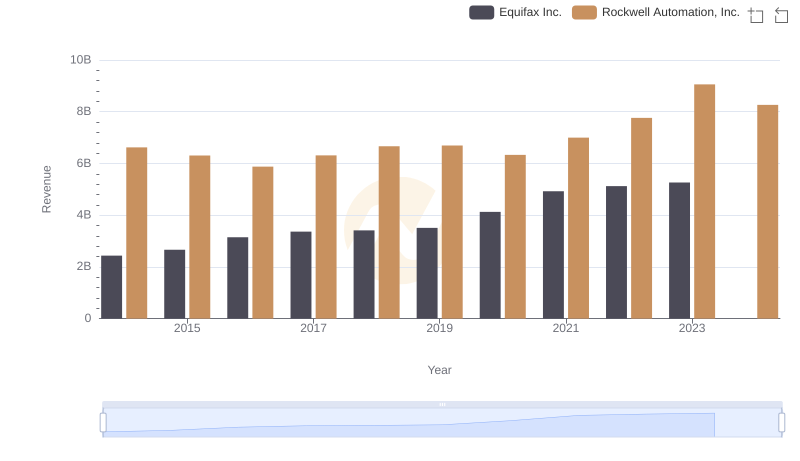

Who Generates More Revenue? Equifax Inc. or Rockwell Automation, Inc.

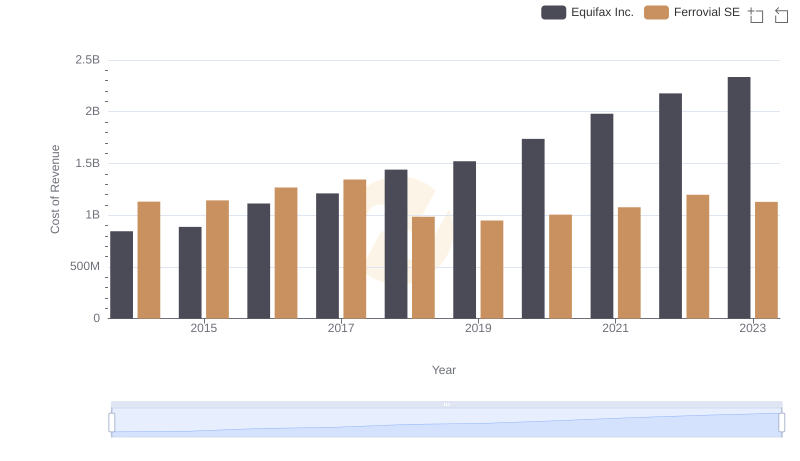

Comparing Cost of Revenue Efficiency: Equifax Inc. vs Ferrovial SE

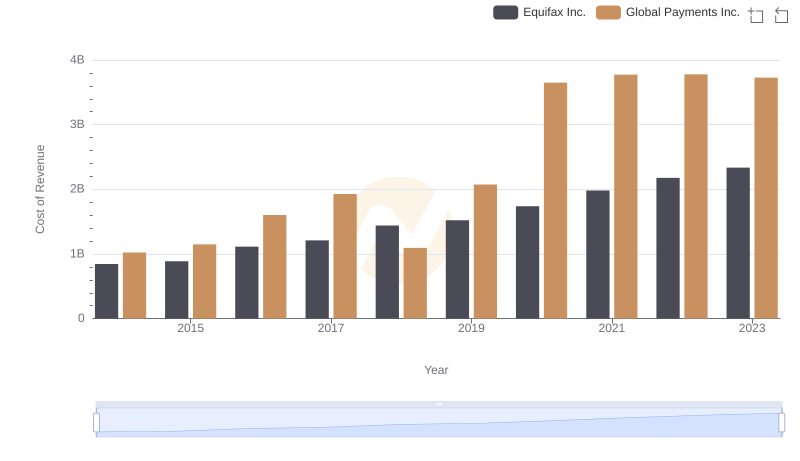

Comparing Cost of Revenue Efficiency: Equifax Inc. vs Global Payments Inc.

Gross Profit Analysis: Comparing Equifax Inc. and Rockwell Automation, Inc.

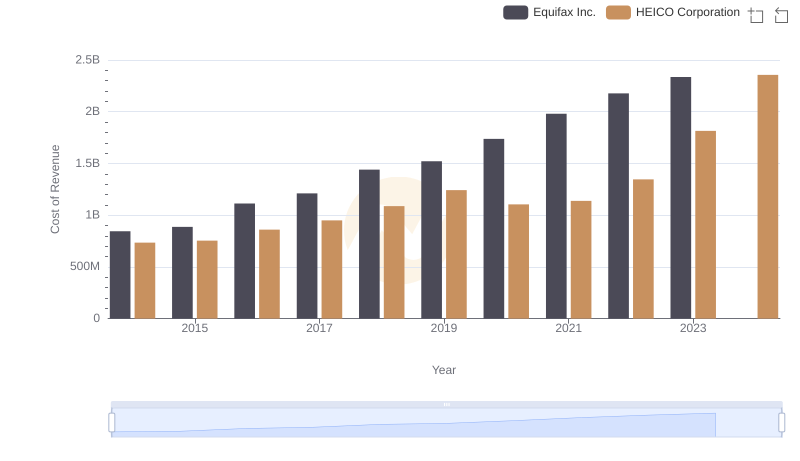

Equifax Inc. vs HEICO Corporation: Efficiency in Cost of Revenue Explored

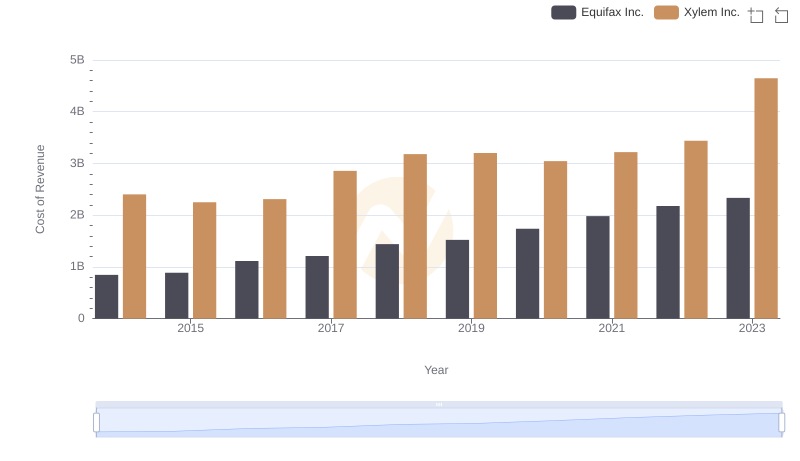

Analyzing Cost of Revenue: Equifax Inc. and Xylem Inc.

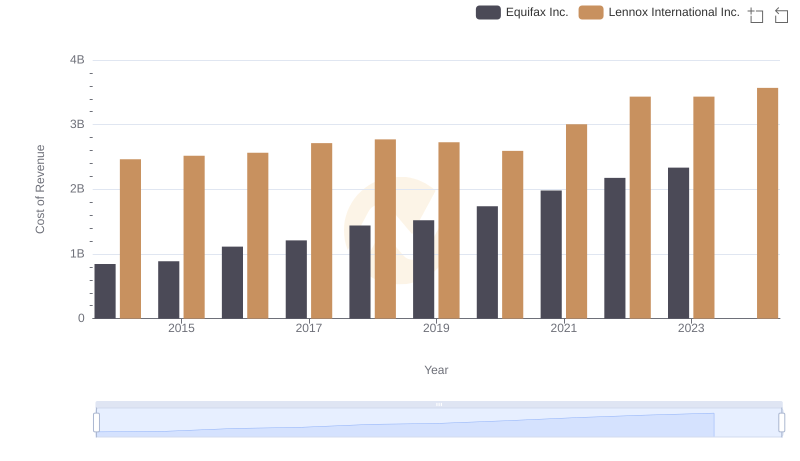

Cost of Revenue Comparison: Equifax Inc. vs Lennox International Inc.

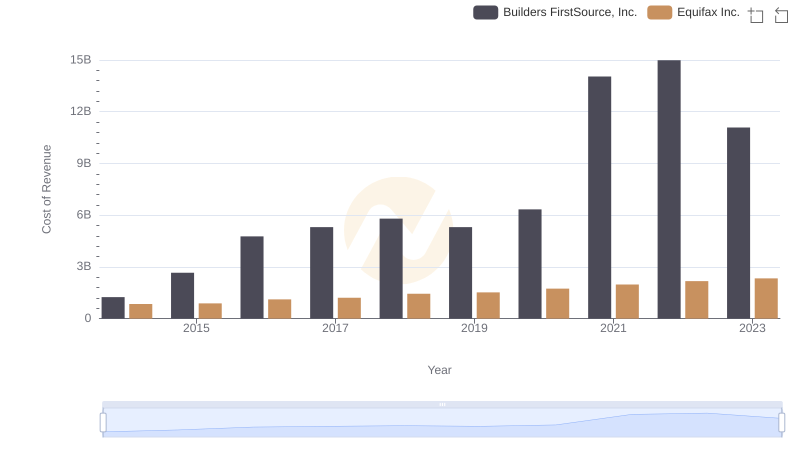

Cost Insights: Breaking Down Equifax Inc. and Builders FirstSource, Inc.'s Expenses

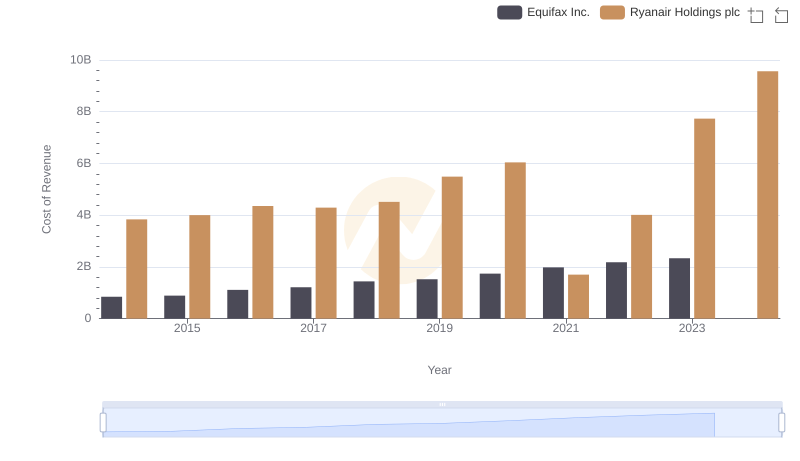

Equifax Inc. vs Ryanair Holdings plc: Efficiency in Cost of Revenue Explored

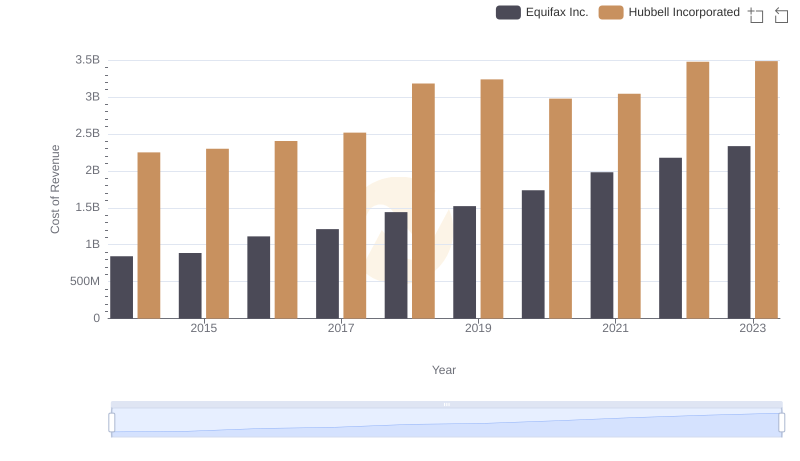

Cost Insights: Breaking Down Equifax Inc. and Hubbell Incorporated's Expenses

SG&A Efficiency Analysis: Comparing Equifax Inc. and Rockwell Automation, Inc.

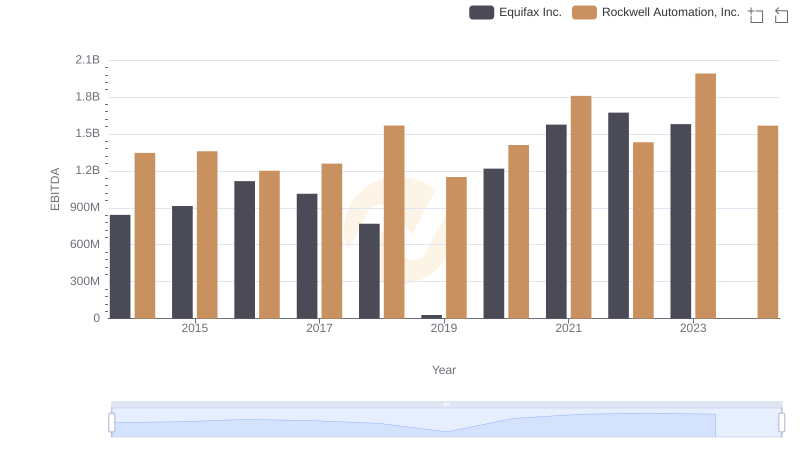

EBITDA Analysis: Evaluating Equifax Inc. Against Rockwell Automation, Inc.