| __timestamp | Equifax Inc. | Rockwell Automation, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1591700000 | 2753900000 |

| Thursday, January 1, 2015 | 1776200000 | 2703100000 |

| Friday, January 1, 2016 | 2031500000 | 2475500000 |

| Sunday, January 1, 2017 | 2151500000 | 2624200000 |

| Monday, January 1, 2018 | 1971700000 | 2872200000 |

| Tuesday, January 1, 2019 | 1985900000 | 2900100000 |

| Wednesday, January 1, 2020 | 2390100000 | 2595200000 |

| Friday, January 1, 2021 | 2943000000 | 2897700000 |

| Saturday, January 1, 2022 | 2945000000 | 3102000000 |

| Sunday, January 1, 2023 | 2930100000 | 3717000000 |

| Monday, January 1, 2024 | 5681100000 | 3193400000 |

Unlocking the unknown

In the ever-evolving landscape of corporate finance, understanding gross profit trends is crucial for investors and analysts alike. Over the past decade, Equifax Inc. and Rockwell Automation, Inc. have showcased intriguing trajectories in their financial performance. From 2014 to 2023, Rockwell Automation consistently outperformed Equifax in terms of gross profit, peaking in 2023 with a remarkable 3.7 billion, a 35% increase from its 2014 figures. Equifax, on the other hand, demonstrated a steady growth, reaching its zenith in 2022 with approximately 2.9 billion, marking an 85% rise from 2014. However, 2024 data for Equifax remains elusive, leaving room for speculation. This comparative analysis not only highlights the resilience and strategic prowess of these industry giants but also underscores the importance of gross profit as a key indicator of financial health.

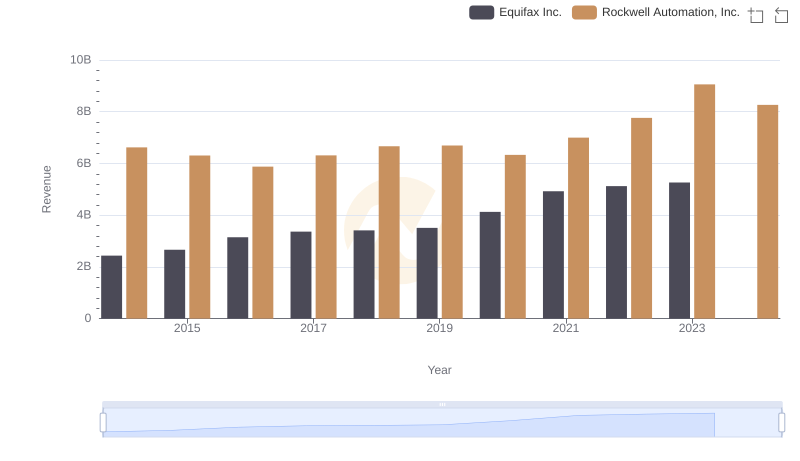

Who Generates More Revenue? Equifax Inc. or Rockwell Automation, Inc.

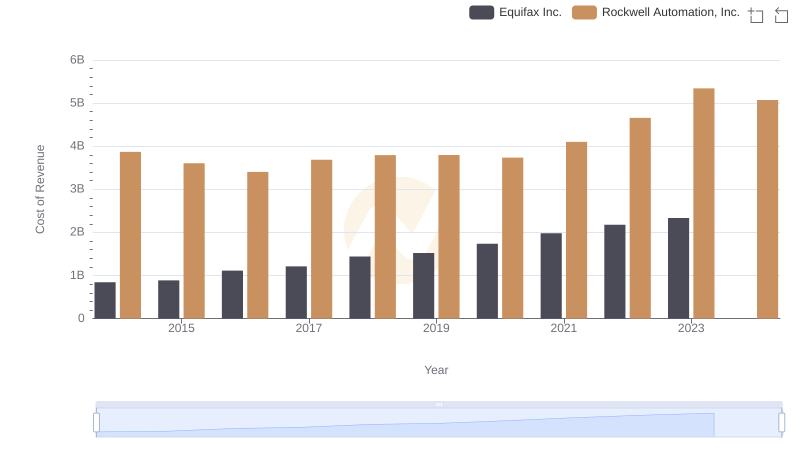

Cost of Revenue Comparison: Equifax Inc. vs Rockwell Automation, Inc.

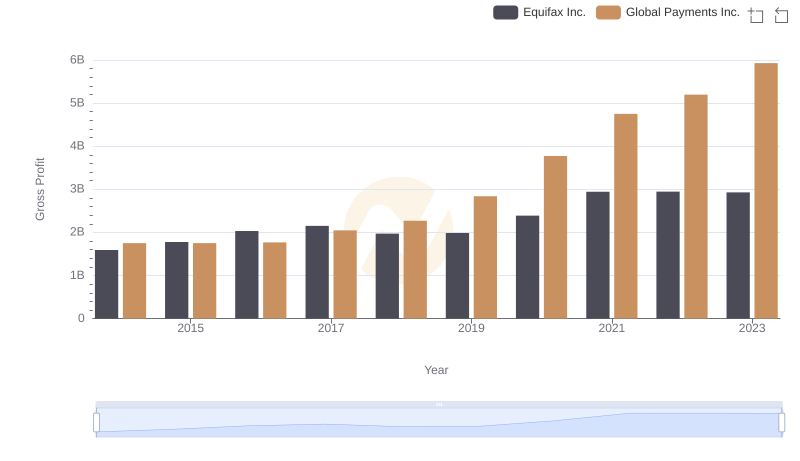

Who Generates Higher Gross Profit? Equifax Inc. or Global Payments Inc.

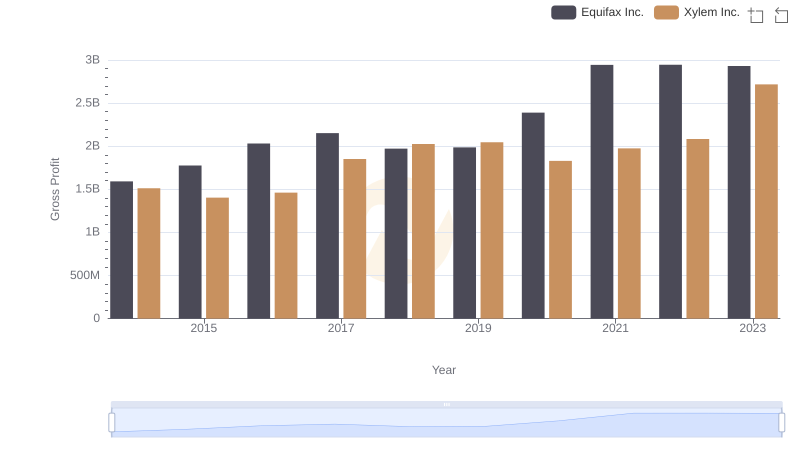

Gross Profit Trends Compared: Equifax Inc. vs Xylem Inc.

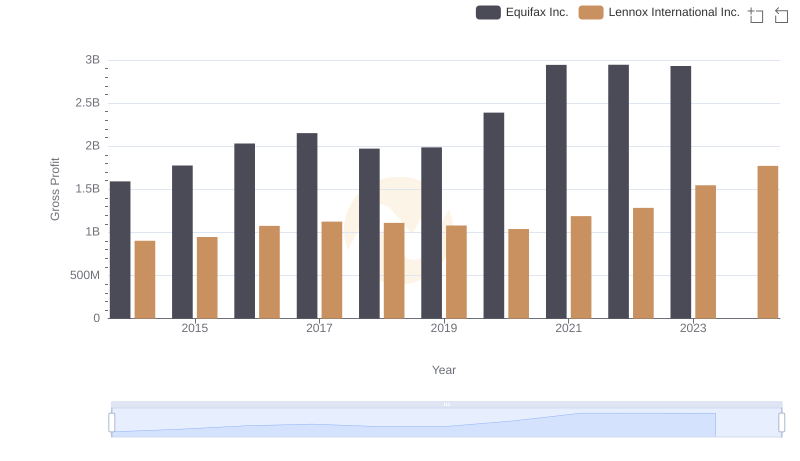

Equifax Inc. vs Lennox International Inc.: A Gross Profit Performance Breakdown

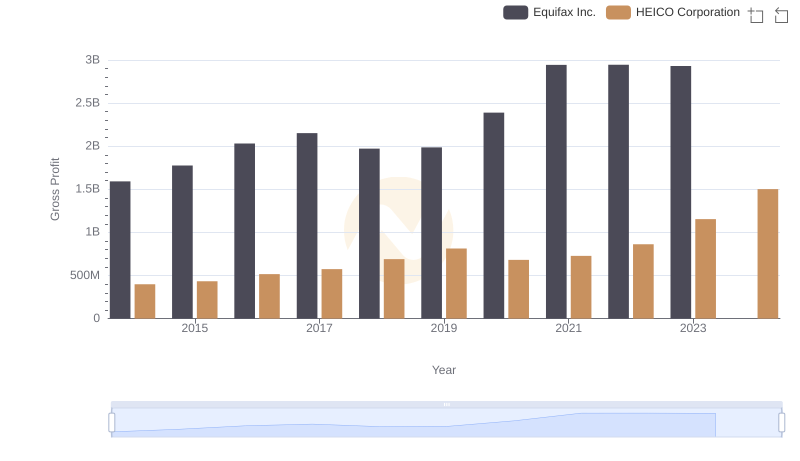

Gross Profit Comparison: Equifax Inc. and HEICO Corporation Trends

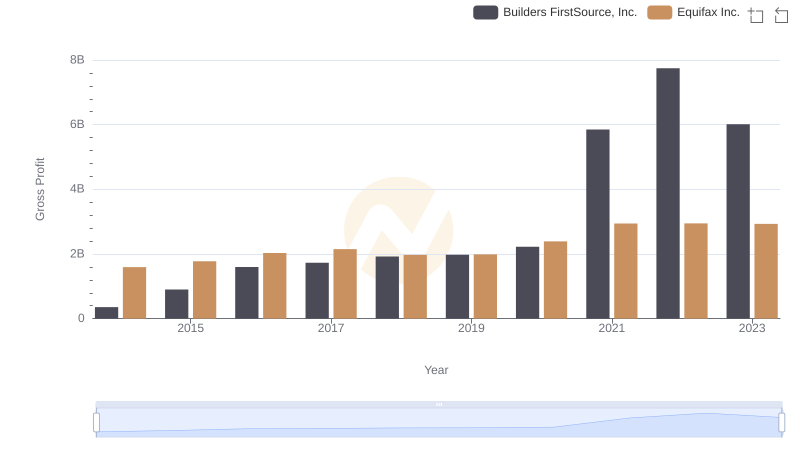

Key Insights on Gross Profit: Equifax Inc. vs Builders FirstSource, Inc.

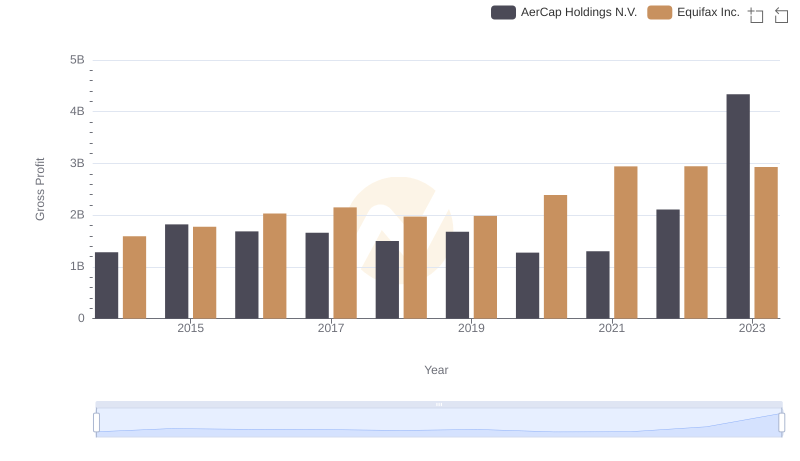

Key Insights on Gross Profit: Equifax Inc. vs AerCap Holdings N.V.

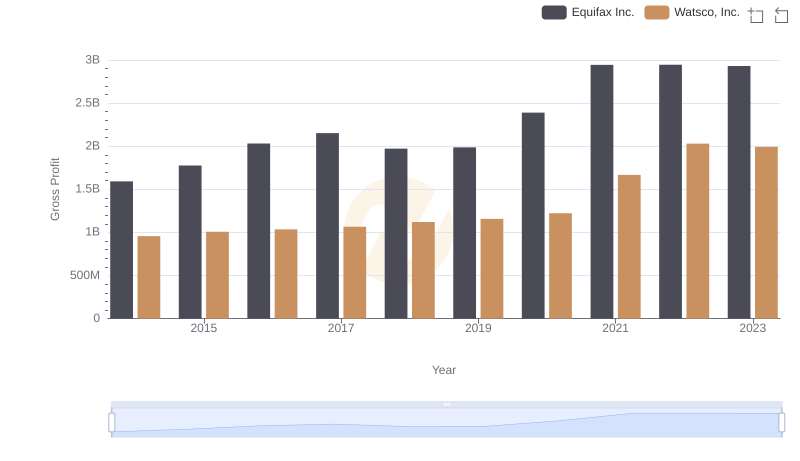

Equifax Inc. vs Watsco, Inc.: A Gross Profit Performance Breakdown

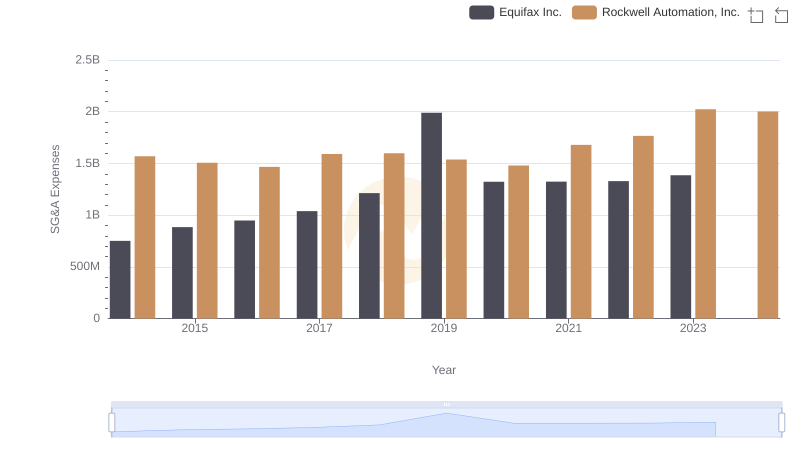

SG&A Efficiency Analysis: Comparing Equifax Inc. and Rockwell Automation, Inc.

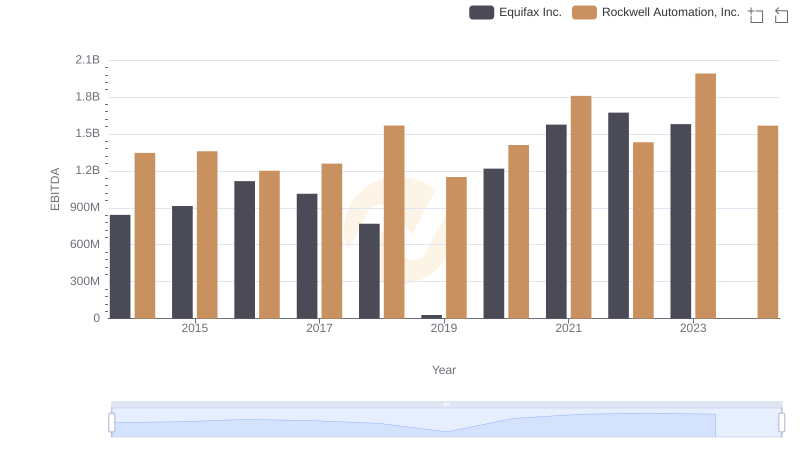

EBITDA Analysis: Evaluating Equifax Inc. Against Rockwell Automation, Inc.