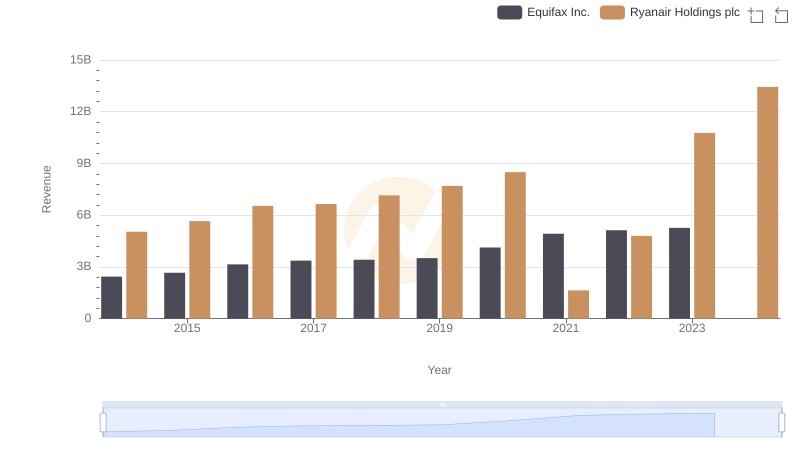

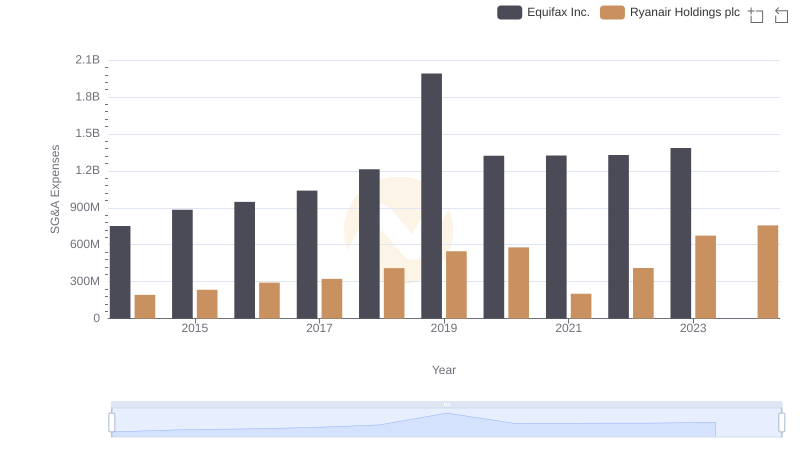

| __timestamp | Equifax Inc. | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 844700000 | 3838100000 |

| Thursday, January 1, 2015 | 887400000 | 3999600000 |

| Friday, January 1, 2016 | 1113400000 | 4355900000 |

| Sunday, January 1, 2017 | 1210700000 | 4294000000 |

| Monday, January 1, 2018 | 1440400000 | 4512300000 |

| Tuesday, January 1, 2019 | 1521700000 | 5492800000 |

| Wednesday, January 1, 2020 | 1737400000 | 6039900000 |

| Friday, January 1, 2021 | 1980900000 | 1702700000 |

| Saturday, January 1, 2022 | 2177200000 | 4009800000 |

| Sunday, January 1, 2023 | 2335100000 | 7735000000 |

| Monday, January 1, 2024 | 0 | 9566400000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of global business, cost efficiency remains a pivotal factor for success. This analysis delves into the cost of revenue trends for Equifax Inc. and Ryanair Holdings plc from 2014 to 2023. Over this decade, Ryanair consistently outpaced Equifax in cost of revenue, with a staggering 90% increase from 2014 to 2023, peaking at approximately $7.7 billion in 2023. In contrast, Equifax's cost of revenue grew by 176%, reaching around $2.3 billion in the same year.

Interestingly, Ryanair's cost efficiency took a hit in 2021, dropping to $1.7 billion, likely due to the pandemic's impact on the airline industry. Meanwhile, Equifax showed a steady upward trend, reflecting its resilience and adaptability. This comparison highlights the diverse challenges and strategies in managing costs across different industries, offering valuable insights for investors and business strategists alike.

Revenue Showdown: Equifax Inc. vs Ryanair Holdings plc

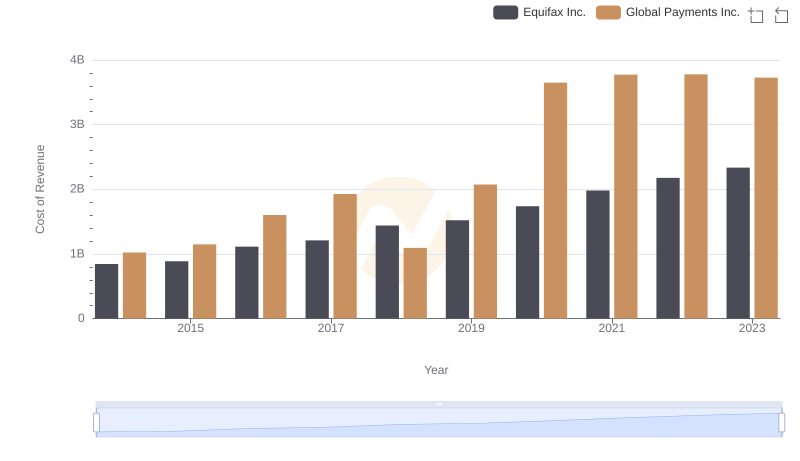

Comparing Cost of Revenue Efficiency: Equifax Inc. vs Global Payments Inc.

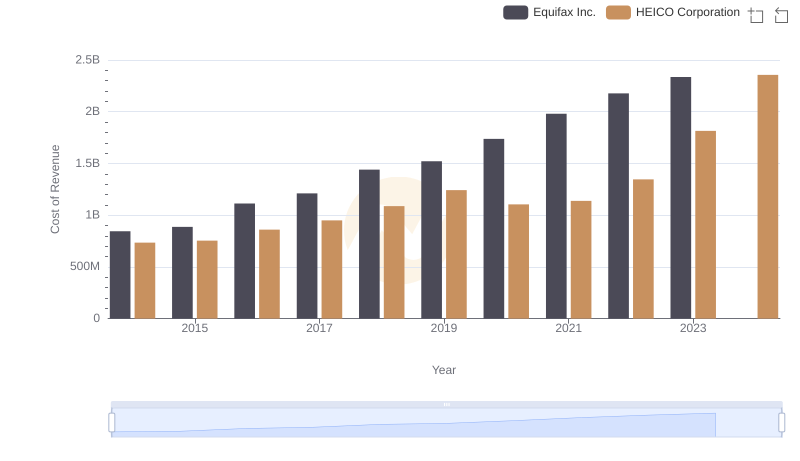

Equifax Inc. vs HEICO Corporation: Efficiency in Cost of Revenue Explored

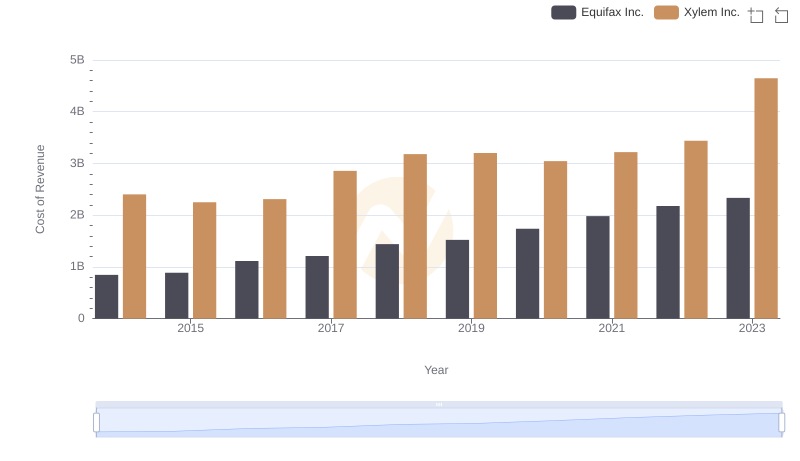

Analyzing Cost of Revenue: Equifax Inc. and Xylem Inc.

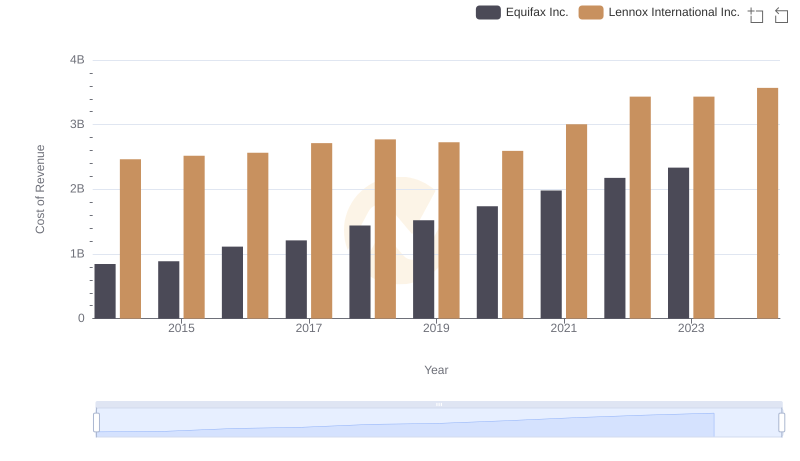

Cost of Revenue Comparison: Equifax Inc. vs Lennox International Inc.

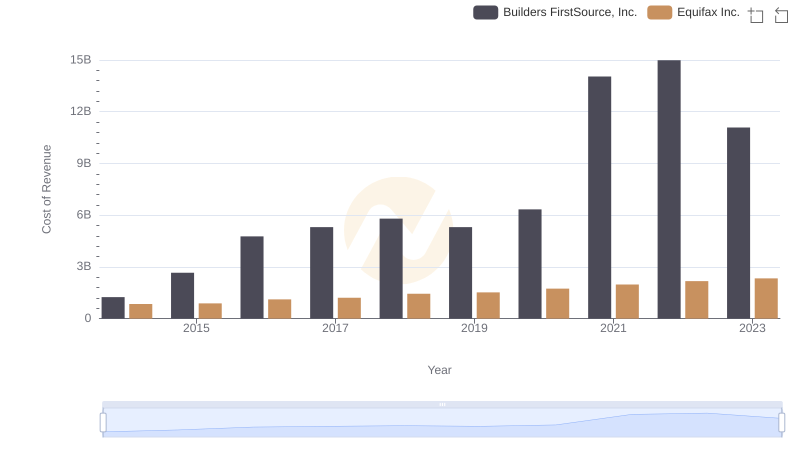

Cost Insights: Breaking Down Equifax Inc. and Builders FirstSource, Inc.'s Expenses

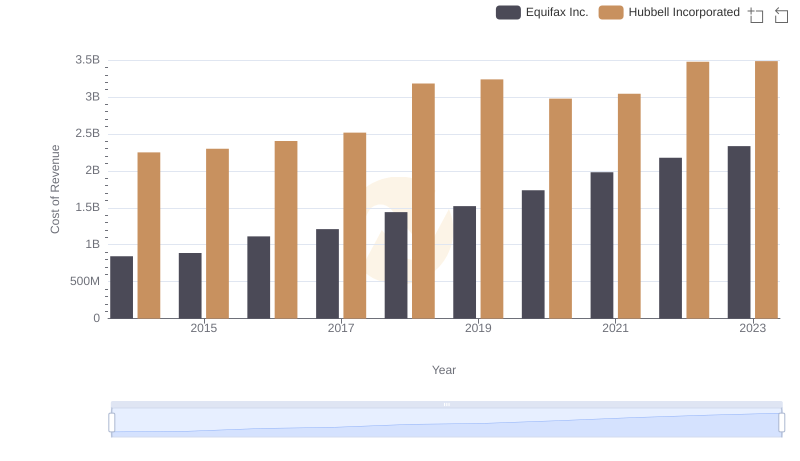

Cost Insights: Breaking Down Equifax Inc. and Hubbell Incorporated's Expenses

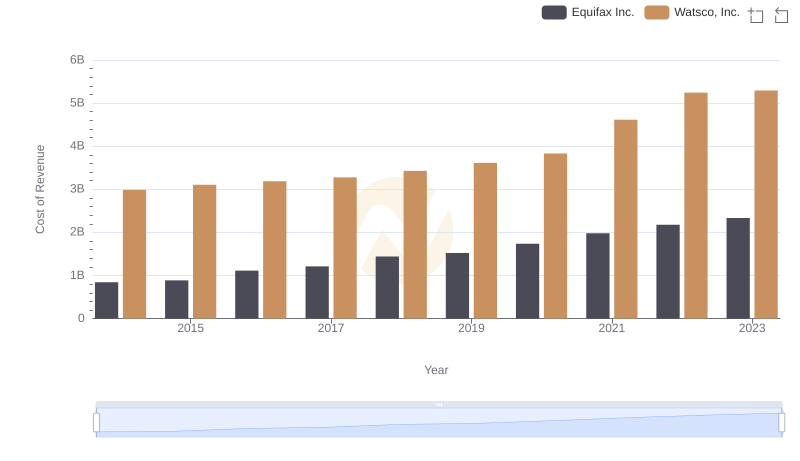

Cost of Revenue: Key Insights for Equifax Inc. and Watsco, Inc.

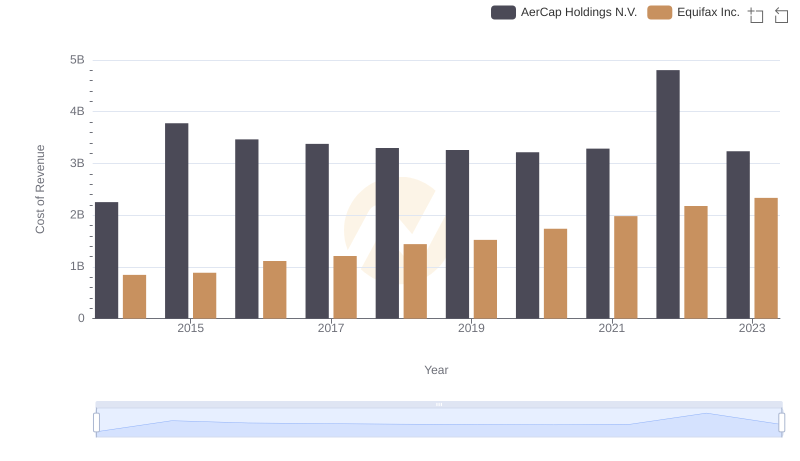

Analyzing Cost of Revenue: Equifax Inc. and AerCap Holdings N.V.

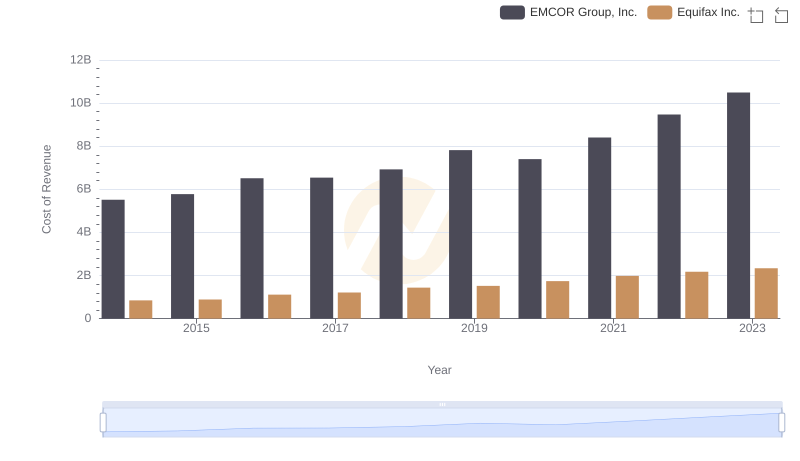

Equifax Inc. vs EMCOR Group, Inc.: Efficiency in Cost of Revenue Explored

Operational Costs Compared: SG&A Analysis of Equifax Inc. and Ryanair Holdings plc