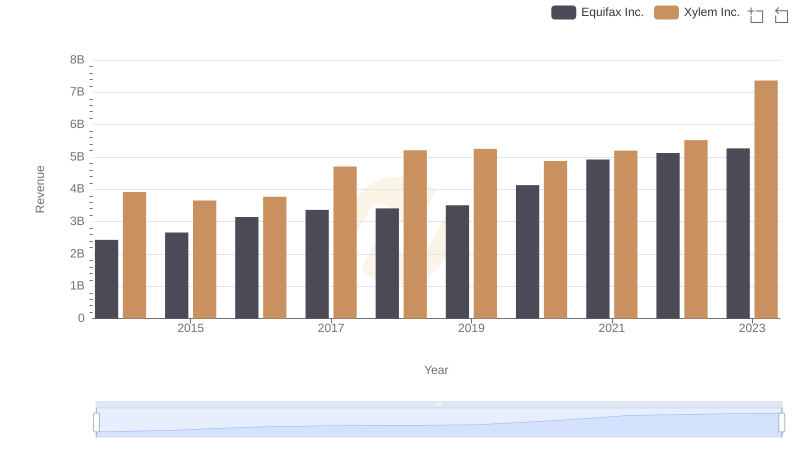

| __timestamp | Equifax Inc. | Xylem Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 844700000 | 2403000000 |

| Thursday, January 1, 2015 | 887400000 | 2249000000 |

| Friday, January 1, 2016 | 1113400000 | 2310000000 |

| Sunday, January 1, 2017 | 1210700000 | 2856000000 |

| Monday, January 1, 2018 | 1440400000 | 3181000000 |

| Tuesday, January 1, 2019 | 1521700000 | 3203000000 |

| Wednesday, January 1, 2020 | 1737400000 | 3046000000 |

| Friday, January 1, 2021 | 1980900000 | 3220000000 |

| Saturday, January 1, 2022 | 2177200000 | 3438000000 |

| Sunday, January 1, 2023 | 2335100000 | 4647000000 |

| Monday, January 1, 2024 | 0 |

Cracking the code

In the ever-evolving landscape of corporate finance, understanding the cost of revenue is crucial for assessing a company's efficiency and profitability. This analysis delves into the cost of revenue trends for Equifax Inc. and Xylem Inc. from 2014 to 2023. Over this period, Equifax Inc. saw a steady increase in its cost of revenue, rising by approximately 176% from 2014 to 2023. Meanwhile, Xylem Inc. experienced a more dramatic surge, with its cost of revenue growing by nearly 93% in the same timeframe.

These trends highlight the dynamic nature of financial management in these industries, offering valuable insights for investors and analysts alike.

Annual Revenue Comparison: Equifax Inc. vs Xylem Inc.

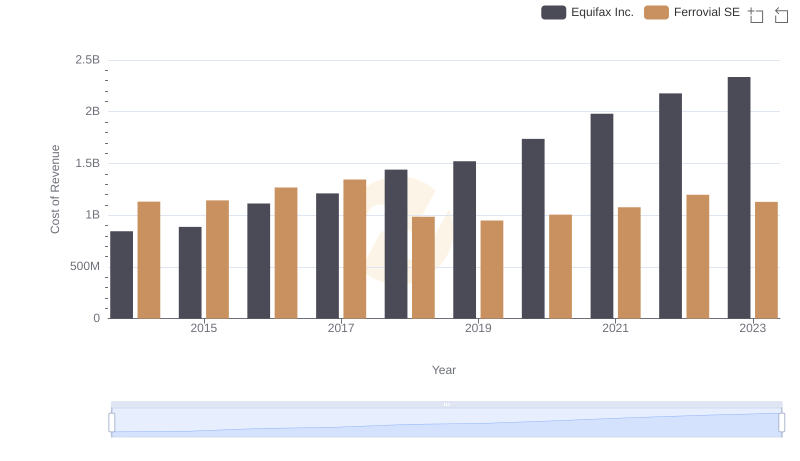

Comparing Cost of Revenue Efficiency: Equifax Inc. vs Ferrovial SE

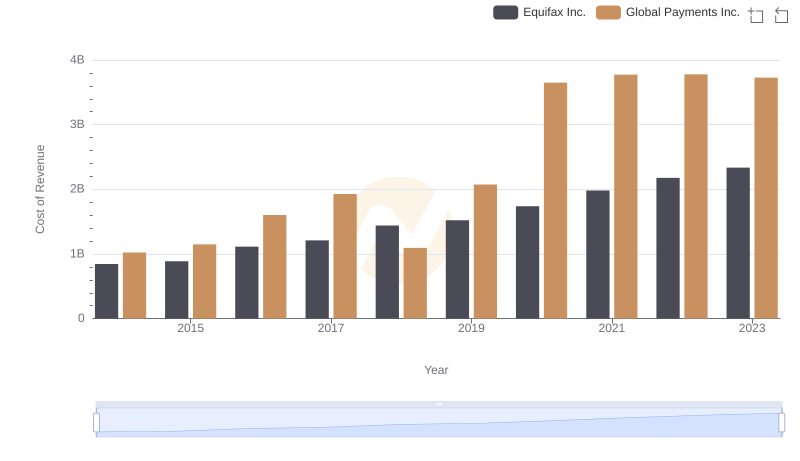

Comparing Cost of Revenue Efficiency: Equifax Inc. vs Global Payments Inc.

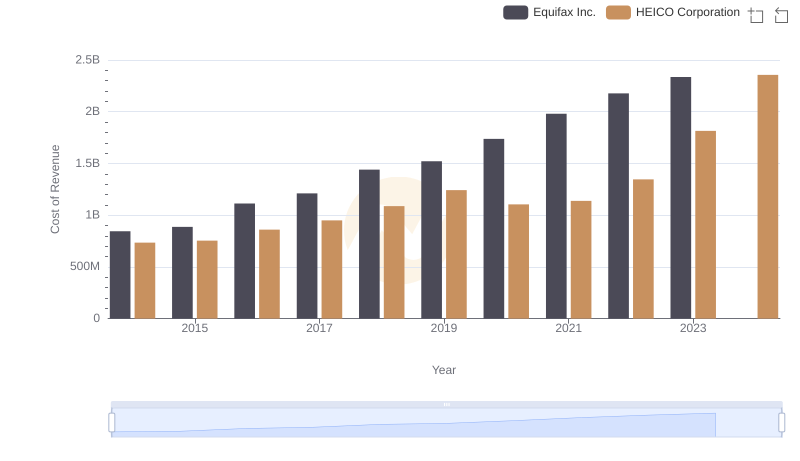

Equifax Inc. vs HEICO Corporation: Efficiency in Cost of Revenue Explored

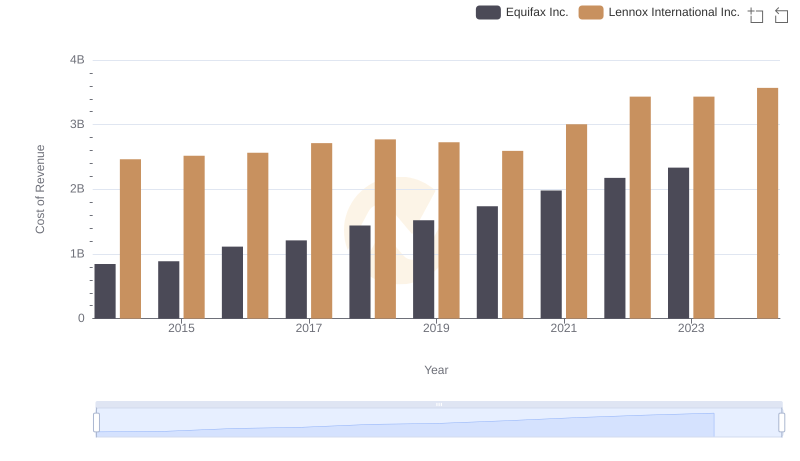

Cost of Revenue Comparison: Equifax Inc. vs Lennox International Inc.

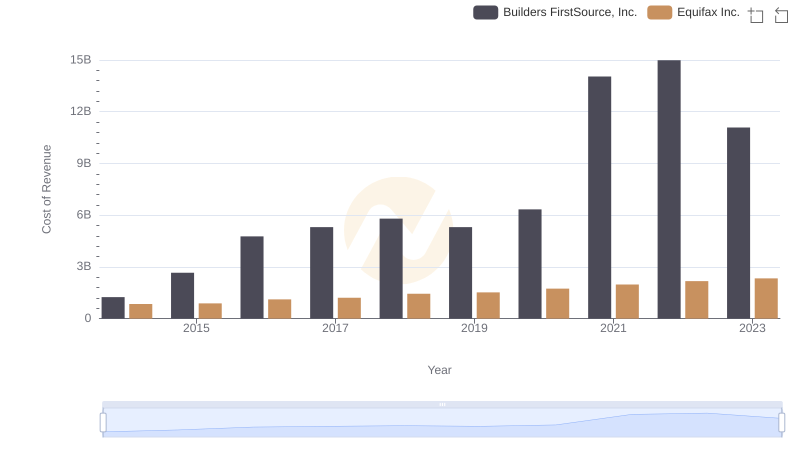

Cost Insights: Breaking Down Equifax Inc. and Builders FirstSource, Inc.'s Expenses

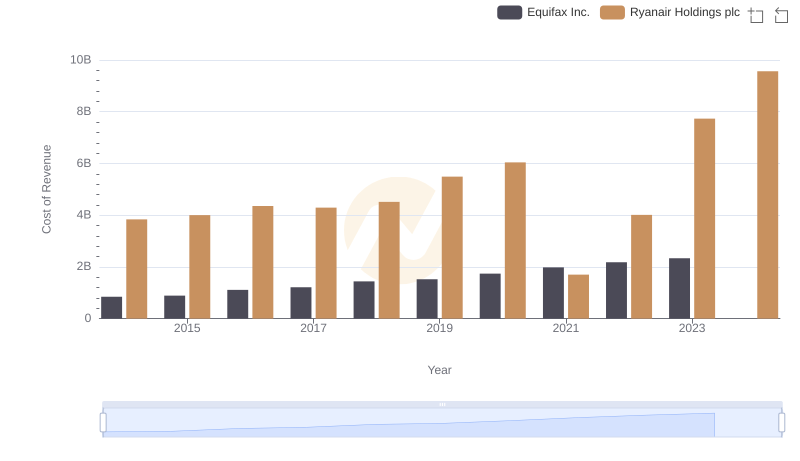

Equifax Inc. vs Ryanair Holdings plc: Efficiency in Cost of Revenue Explored

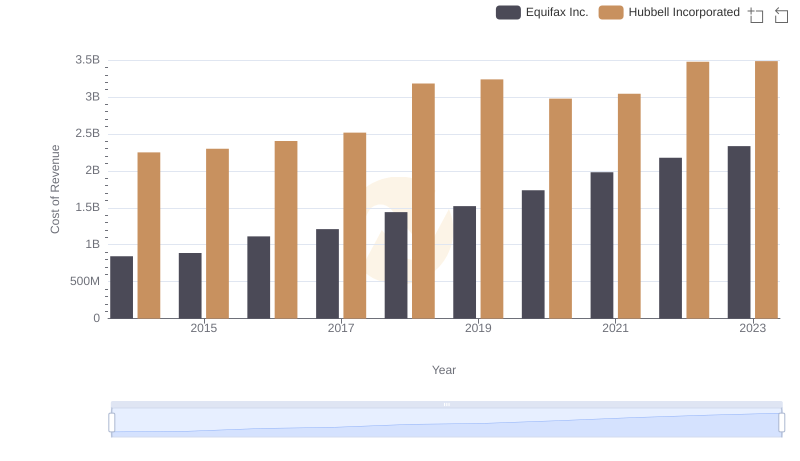

Cost Insights: Breaking Down Equifax Inc. and Hubbell Incorporated's Expenses

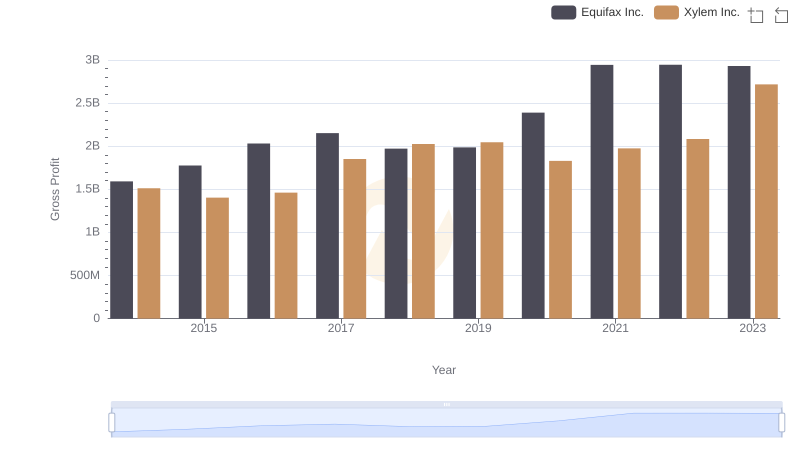

Gross Profit Trends Compared: Equifax Inc. vs Xylem Inc.

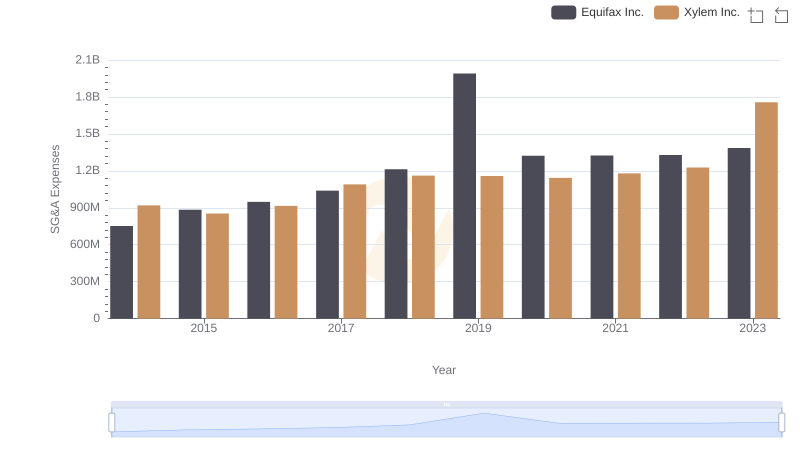

Equifax Inc. or Xylem Inc.: Who Manages SG&A Costs Better?