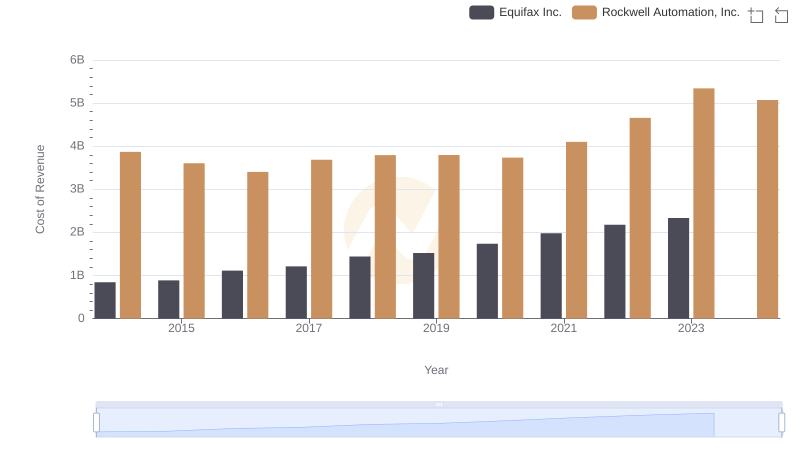

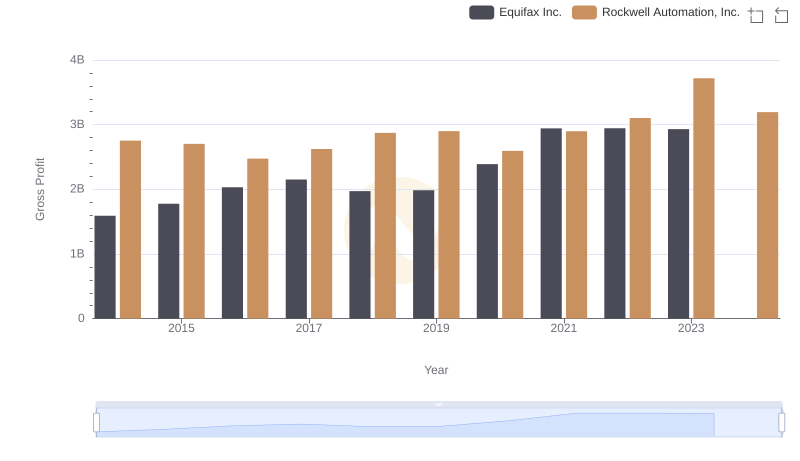

| __timestamp | Equifax Inc. | Rockwell Automation, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2436400000 | 6623500000 |

| Thursday, January 1, 2015 | 2663600000 | 6307900000 |

| Friday, January 1, 2016 | 3144900000 | 5879500000 |

| Sunday, January 1, 2017 | 3362200000 | 6311300000 |

| Monday, January 1, 2018 | 3412100000 | 6666000000 |

| Tuesday, January 1, 2019 | 3507600000 | 6694800000 |

| Wednesday, January 1, 2020 | 4127500000 | 6329800000 |

| Friday, January 1, 2021 | 4923900000 | 6997400000 |

| Saturday, January 1, 2022 | 5122200000 | 7760400000 |

| Sunday, January 1, 2023 | 5265200000 | 9058000000 |

| Monday, January 1, 2024 | 5681100000 | 8264200000 |

Unleashing the power of data

In the ever-evolving landscape of corporate giants, the battle for revenue supremacy is fierce. Over the past decade, Rockwell Automation, Inc. has consistently outpaced Equifax Inc. in revenue generation. From 2014 to 2023, Rockwell Automation's revenue surged by approximately 37%, peaking at an impressive $9.06 billion in 2023. In contrast, Equifax Inc. experienced a robust growth of around 116% during the same period, reaching $5.27 billion in 2023.

Despite Equifax's remarkable growth rate, Rockwell Automation's revenue remains significantly higher, maintaining a lead of over 70% in 2023. This trend highlights Rockwell's stronghold in the industrial automation sector, while Equifax continues to expand its footprint in the credit reporting industry. As we look to the future, the absence of Equifax's 2024 data leaves room for speculation on whether it can close the gap.

Cost of Revenue Comparison: Equifax Inc. vs Rockwell Automation, Inc.

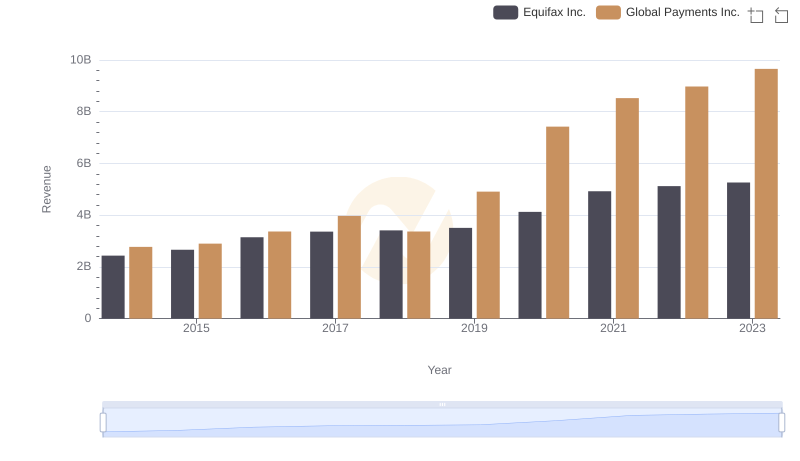

Comparing Revenue Performance: Equifax Inc. or Global Payments Inc.?

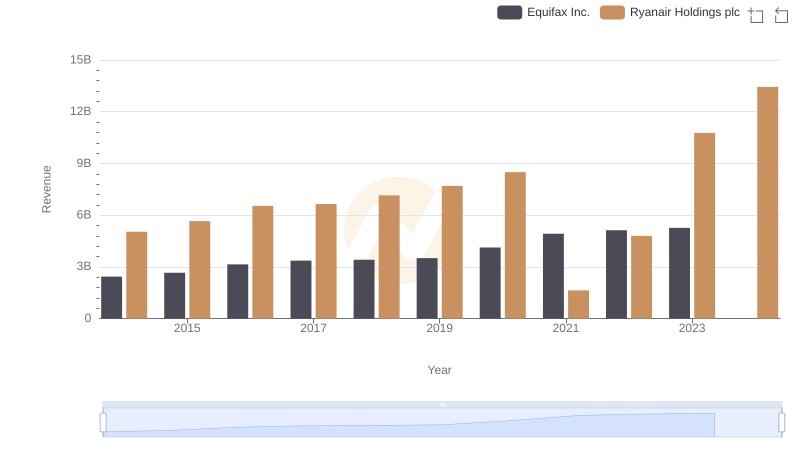

Revenue Showdown: Equifax Inc. vs Ryanair Holdings plc

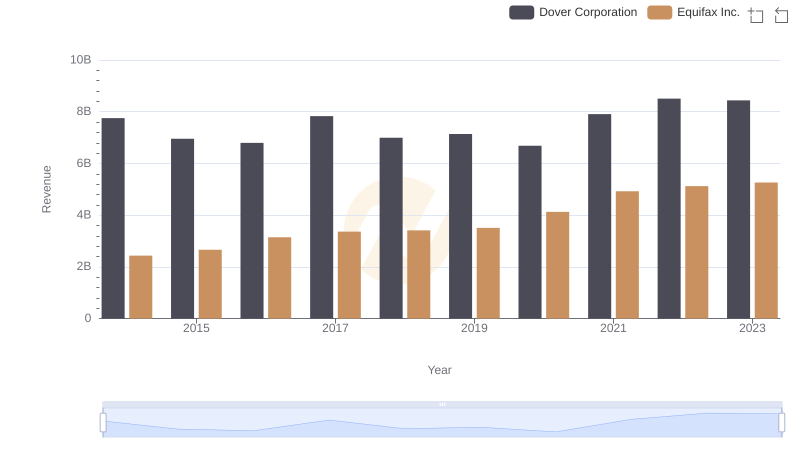

Equifax Inc. vs Dover Corporation: Annual Revenue Growth Compared

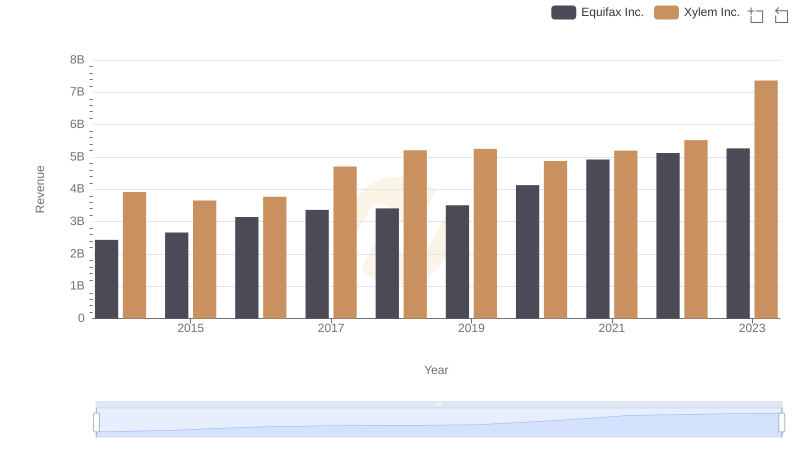

Annual Revenue Comparison: Equifax Inc. vs Xylem Inc.

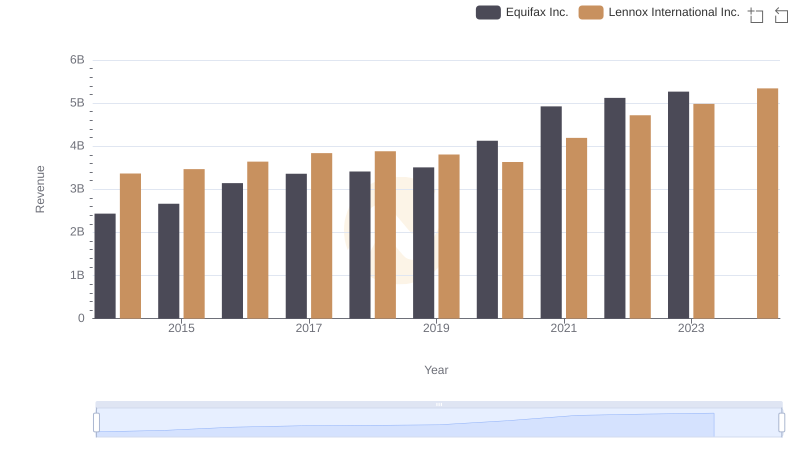

Annual Revenue Comparison: Equifax Inc. vs Lennox International Inc.

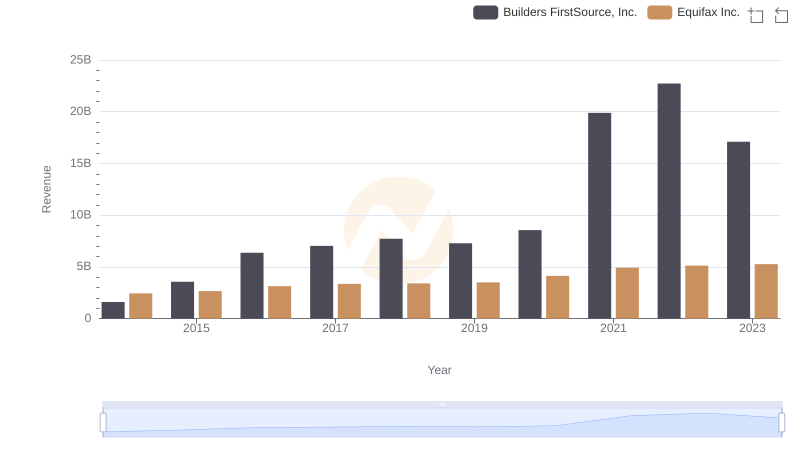

Annual Revenue Comparison: Equifax Inc. vs Builders FirstSource, Inc.

Gross Profit Analysis: Comparing Equifax Inc. and Rockwell Automation, Inc.

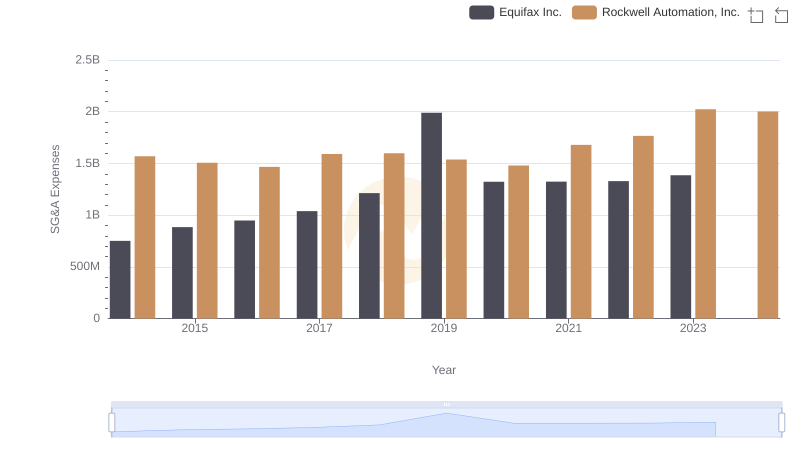

SG&A Efficiency Analysis: Comparing Equifax Inc. and Rockwell Automation, Inc.

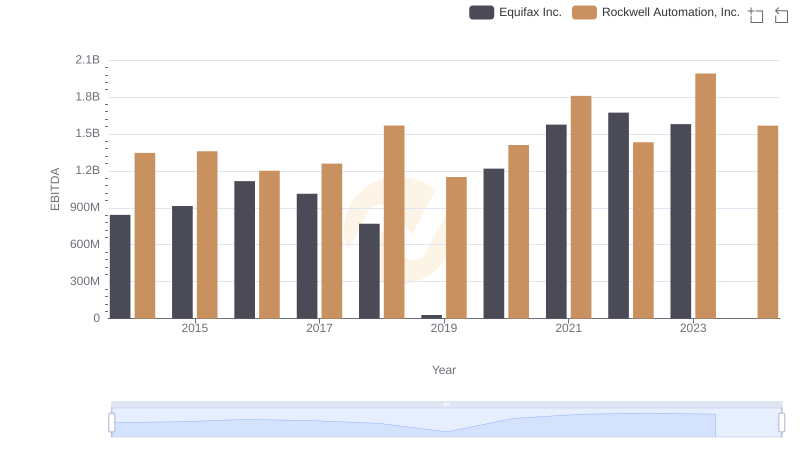

EBITDA Analysis: Evaluating Equifax Inc. Against Rockwell Automation, Inc.