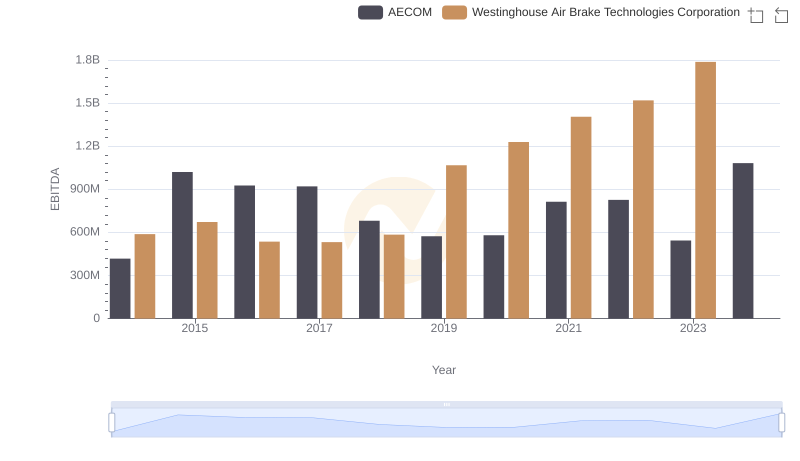

| __timestamp | AECOM | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 80908000 | 324539000 |

| Thursday, January 1, 2015 | 113975000 | 319173000 |

| Friday, January 1, 2016 | 115088000 | 327505000 |

| Sunday, January 1, 2017 | 133309000 | 482852000 |

| Monday, January 1, 2018 | 135787000 | 573644000 |

| Tuesday, January 1, 2019 | 148123000 | 936600000 |

| Wednesday, January 1, 2020 | 188535000 | 877100000 |

| Friday, January 1, 2021 | 155072000 | 1005000000 |

| Saturday, January 1, 2022 | 147309000 | 1020000000 |

| Sunday, January 1, 2023 | 153575000 | 1139000000 |

| Monday, January 1, 2024 | 160105000 | 1248000000 |

Igniting the spark of knowledge

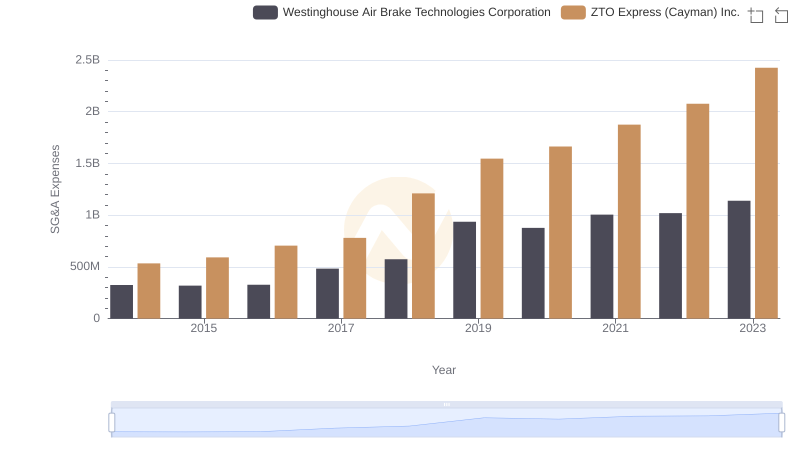

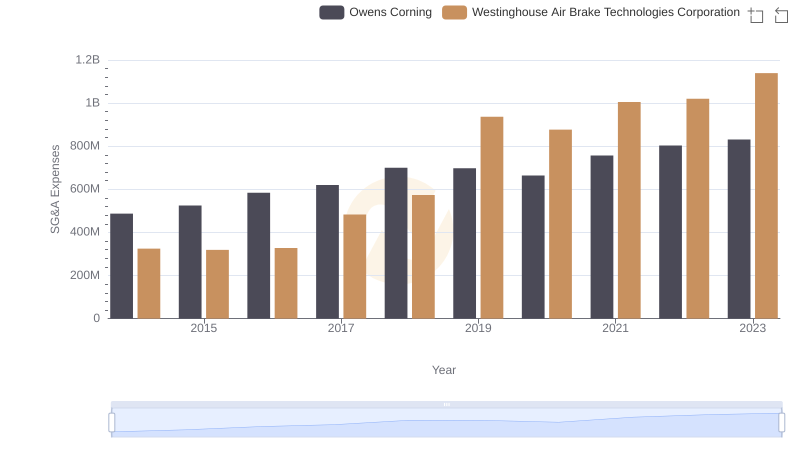

In the world of corporate finance, Selling, General, and Administrative (SG&A) expenses are a crucial indicator of a company's operational efficiency. Over the past decade, Westinghouse Air Brake Technologies Corporation and AECOM have showcased contrasting trends in their SG&A expenses. From 2014 to 2023, Westinghouse's expenses surged by approximately 250%, peaking in 2023, while AECOM's expenses grew by about 98% over the same period. This divergence highlights Westinghouse's aggressive expansion strategy compared to AECOM's more conservative approach. Notably, Westinghouse's expenses consistently outpaced AECOM's, with 2023 figures showing a staggering 640% higher SG&A expenses for Westinghouse. However, data for 2024 remains incomplete, leaving room for speculation on future trends. This analysis provides a window into the strategic priorities of these industry leaders, offering valuable insights for investors and analysts alike.

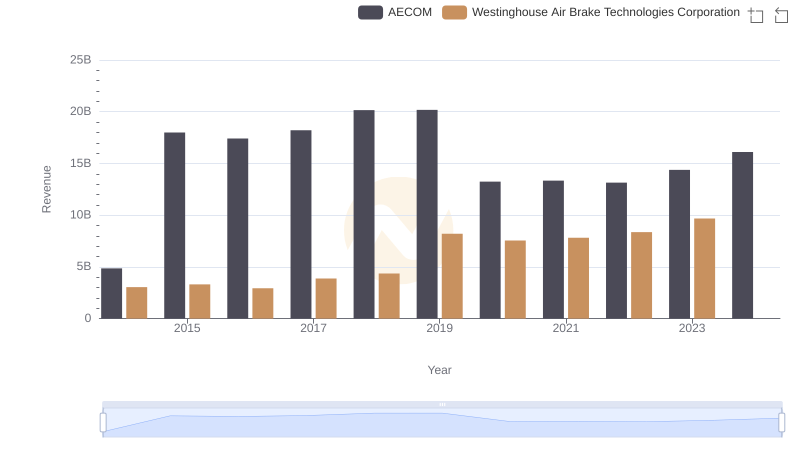

Westinghouse Air Brake Technologies Corporation vs AECOM: Annual Revenue Growth Compared

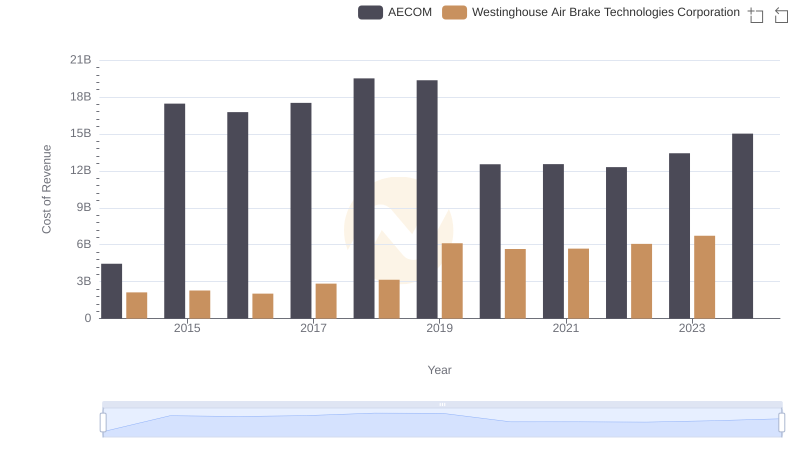

Analyzing Cost of Revenue: Westinghouse Air Brake Technologies Corporation and AECOM

Westinghouse Air Brake Technologies Corporation or ZTO Express (Cayman) Inc.: Who Manages SG&A Costs Better?

Who Optimizes SG&A Costs Better? Westinghouse Air Brake Technologies Corporation or Owens Corning

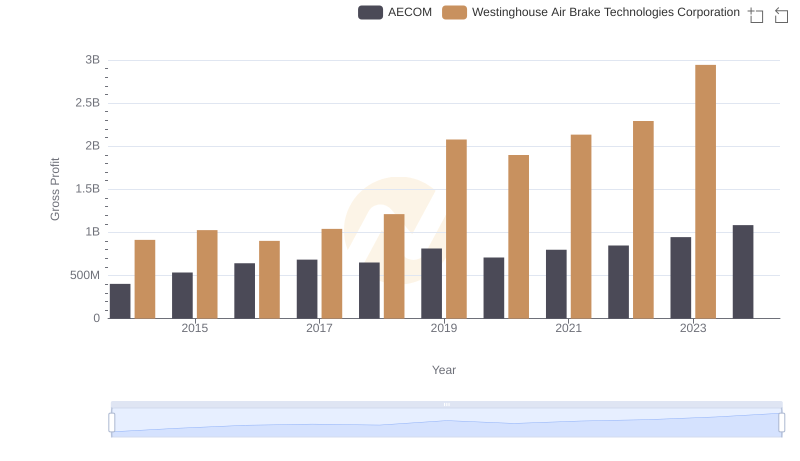

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and AECOM Trends

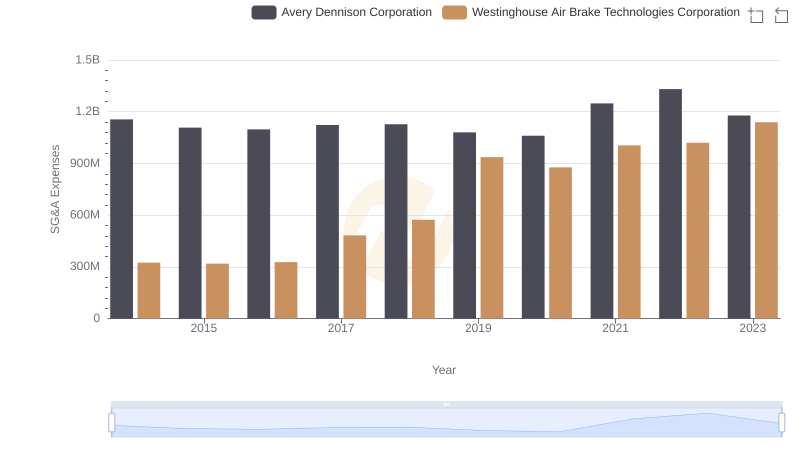

Westinghouse Air Brake Technologies Corporation vs Avery Dennison Corporation: SG&A Expense Trends

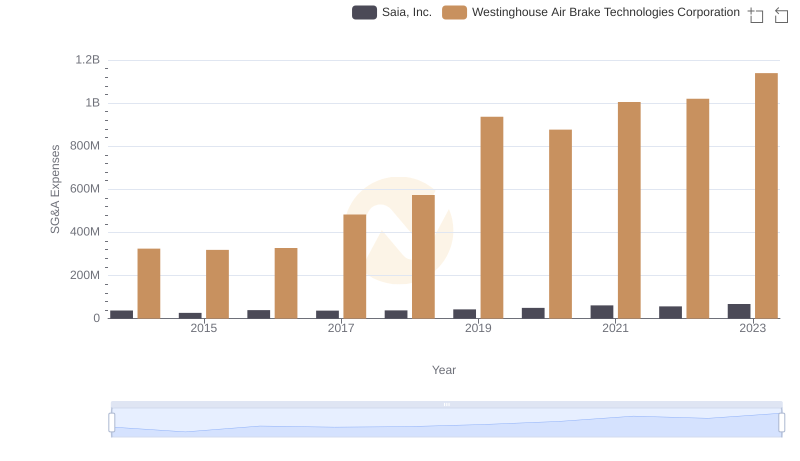

Comparing SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs Saia, Inc. Trends and Insights

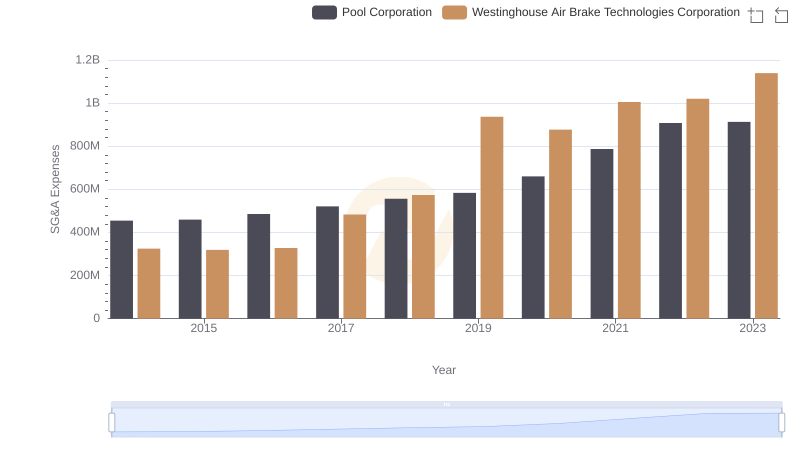

Westinghouse Air Brake Technologies Corporation vs Pool Corporation: SG&A Expense Trends

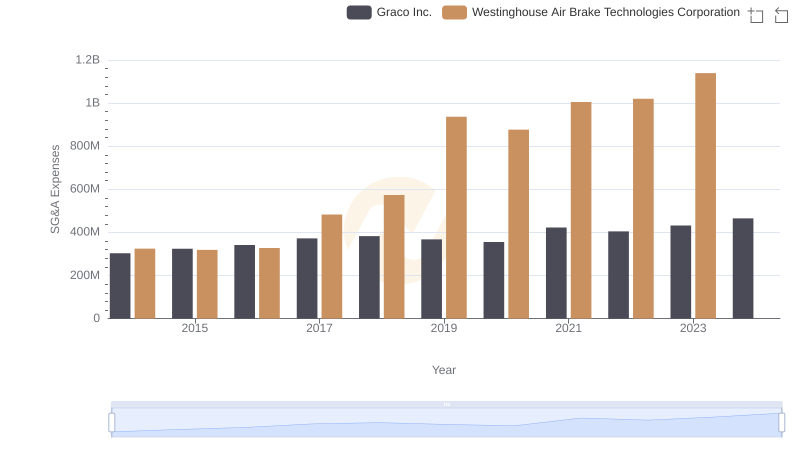

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs Graco Inc.

EBITDA Performance Review: Westinghouse Air Brake Technologies Corporation vs AECOM

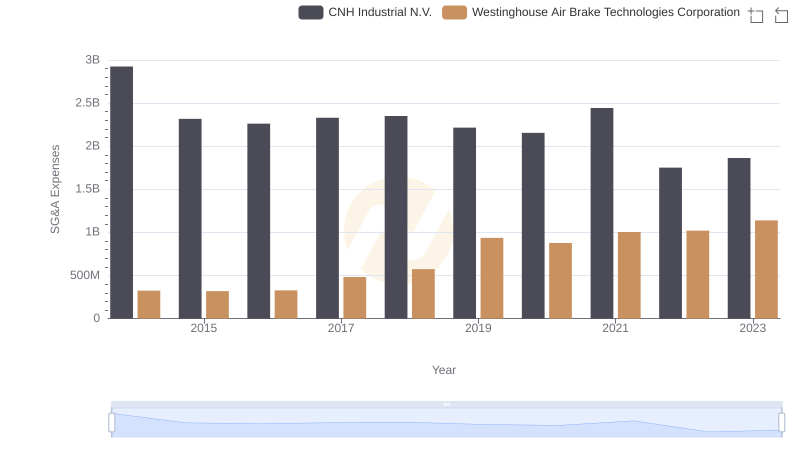

Westinghouse Air Brake Technologies Corporation or CNH Industrial N.V.: Who Manages SG&A Costs Better?

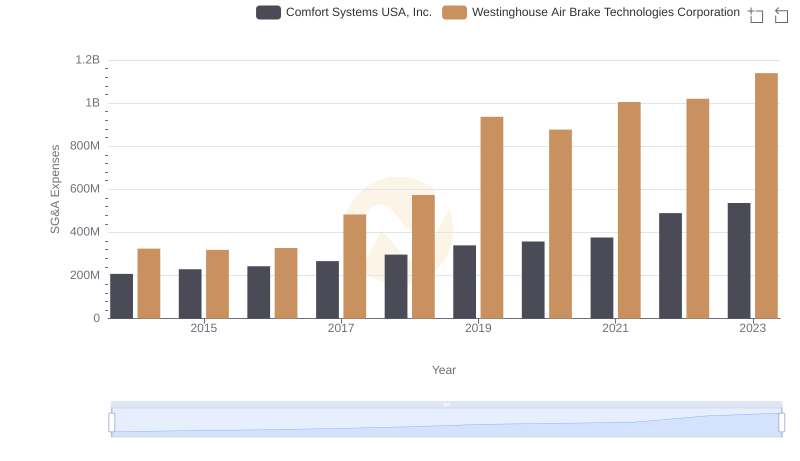

Westinghouse Air Brake Technologies Corporation vs Comfort Systems USA, Inc.: SG&A Expense Trends