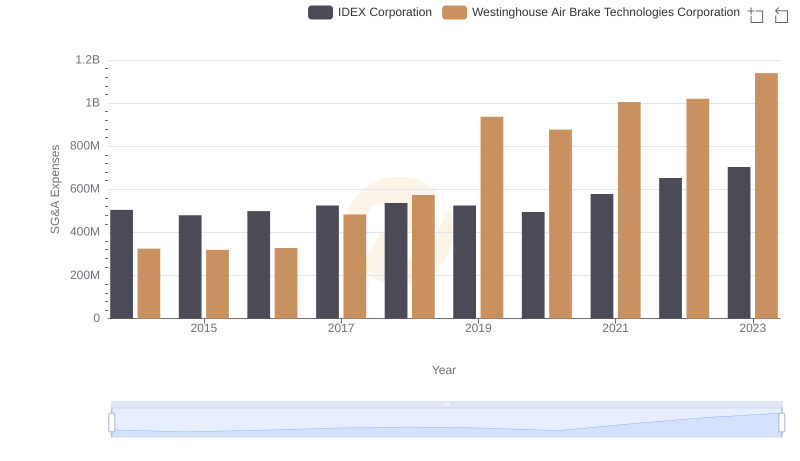

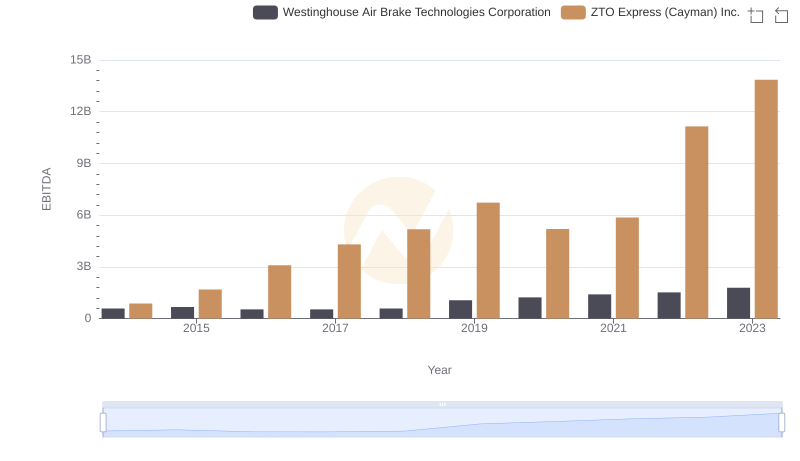

| __timestamp | Westinghouse Air Brake Technologies Corporation | ZTO Express (Cayman) Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 324539000 | 534537000 |

| Thursday, January 1, 2015 | 319173000 | 591738000 |

| Friday, January 1, 2016 | 327505000 | 705995000 |

| Sunday, January 1, 2017 | 482852000 | 780517000 |

| Monday, January 1, 2018 | 573644000 | 1210717000 |

| Tuesday, January 1, 2019 | 936600000 | 1546227000 |

| Wednesday, January 1, 2020 | 877100000 | 1663712000 |

| Friday, January 1, 2021 | 1005000000 | 1875869000 |

| Saturday, January 1, 2022 | 1020000000 | 2077372000 |

| Sunday, January 1, 2023 | 1139000000 | 2425253000 |

| Monday, January 1, 2024 | 1248000000 |

Cracking the code

In the competitive landscape of the transportation industry, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Westinghouse Air Brake Technologies Corporation and ZTO Express (Cayman) Inc. have shown distinct approaches over the past decade. From 2014 to 2023, Westinghouse's SG&A expenses grew by approximately 250%, while ZTO Express saw a staggering increase of around 350%. Despite ZTO's higher growth rate, Westinghouse maintained a more consistent expense management, with a lower average annual increase. By 2023, ZTO's SG&A expenses were more than double those of Westinghouse, highlighting the challenges of rapid expansion. This data underscores the importance of strategic cost management in sustaining long-term growth and profitability. As investors and analysts evaluate these companies, understanding their SG&A trends offers valuable insights into their operational efficiency and financial health.

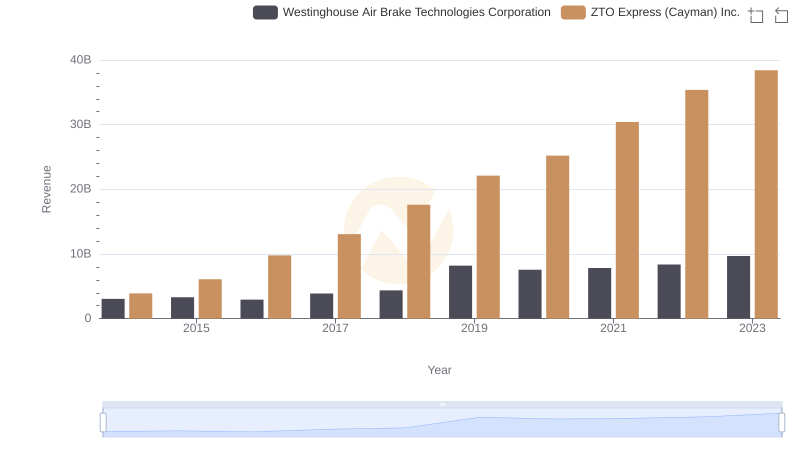

Who Generates More Revenue? Westinghouse Air Brake Technologies Corporation or ZTO Express (Cayman) Inc.

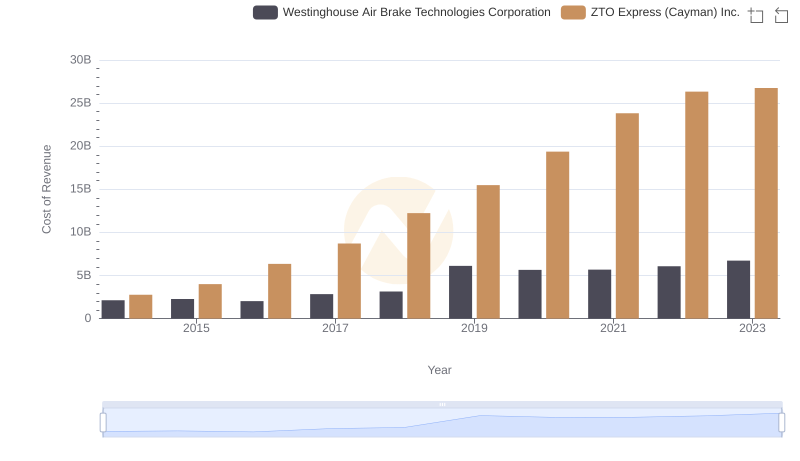

Cost of Revenue Trends: Westinghouse Air Brake Technologies Corporation vs ZTO Express (Cayman) Inc.

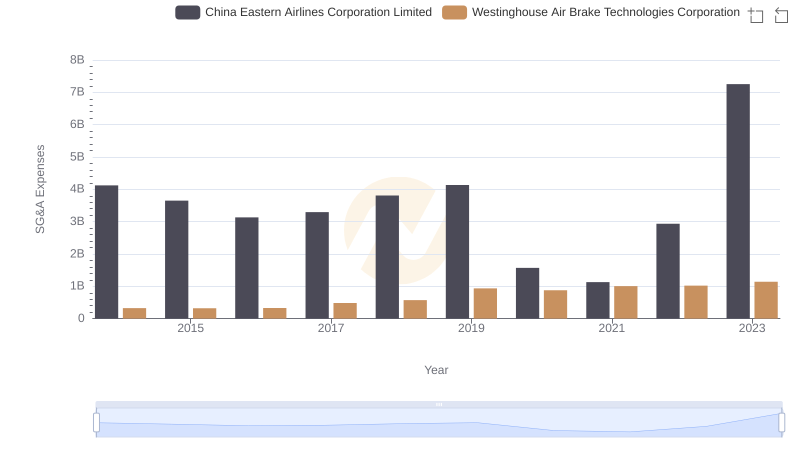

Westinghouse Air Brake Technologies Corporation or China Eastern Airlines Corporation Limited: Who Manages SG&A Costs Better?

Cost Management Insights: SG&A Expenses for Westinghouse Air Brake Technologies Corporation and IDEX Corporation

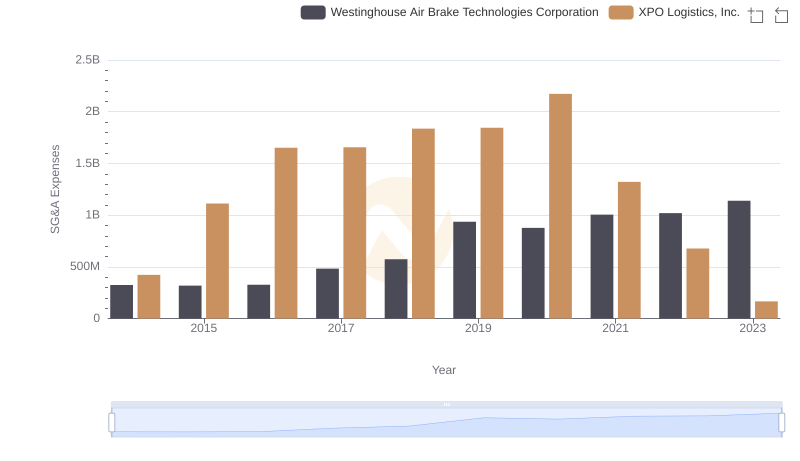

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs XPO Logistics, Inc.

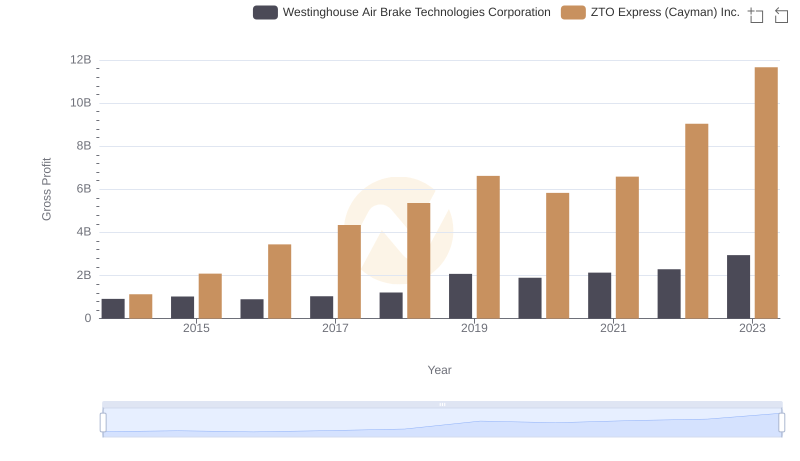

Westinghouse Air Brake Technologies Corporation and ZTO Express (Cayman) Inc.: A Detailed Gross Profit Analysis

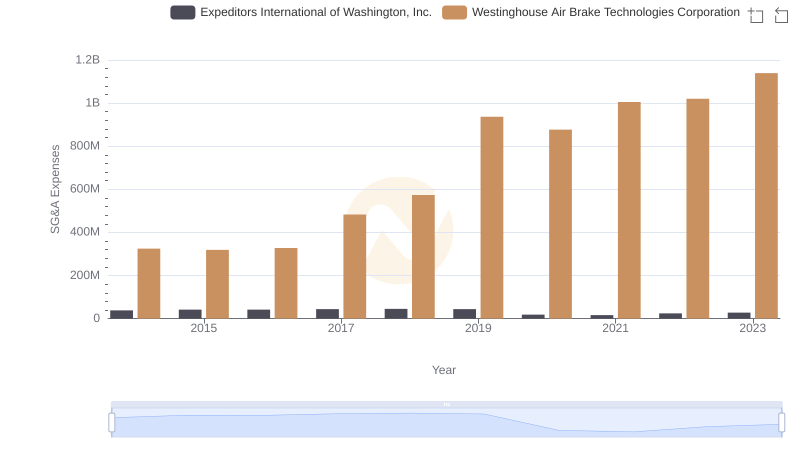

Breaking Down SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs Expeditors International of Washington, Inc.

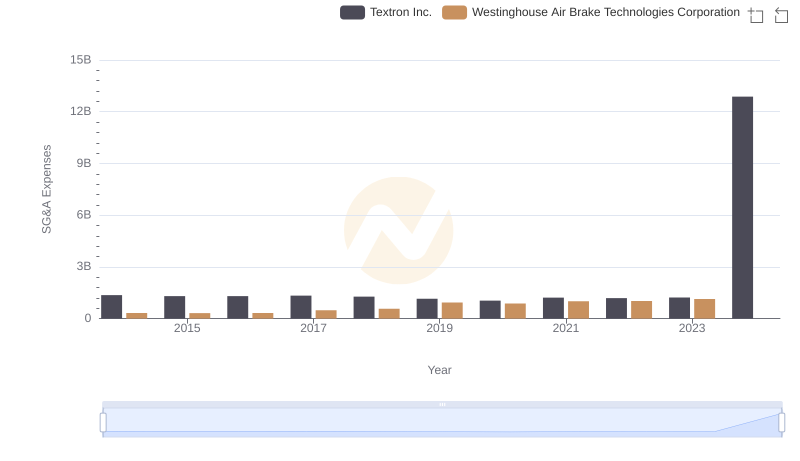

Operational Costs Compared: SG&A Analysis of Westinghouse Air Brake Technologies Corporation and Textron Inc.

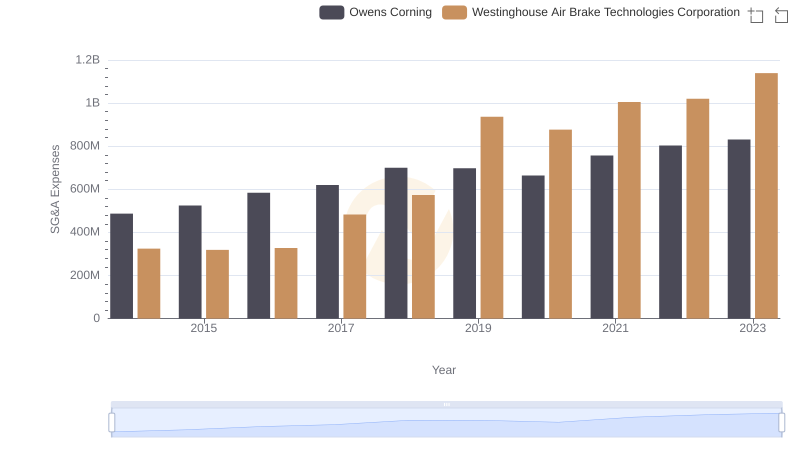

Who Optimizes SG&A Costs Better? Westinghouse Air Brake Technologies Corporation or Owens Corning

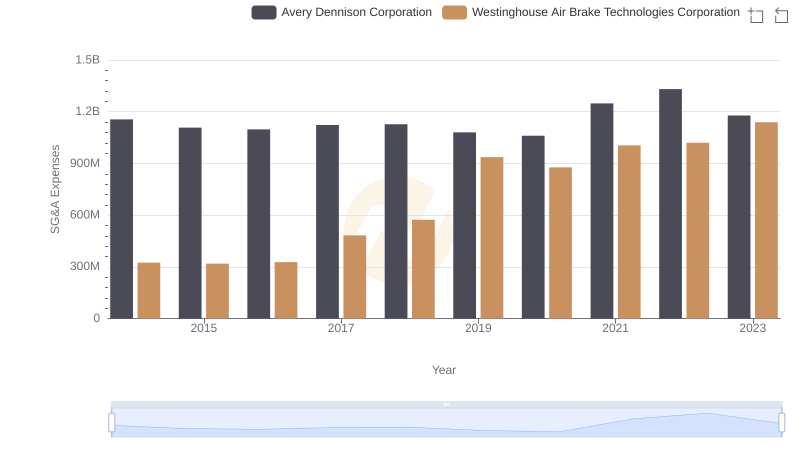

Westinghouse Air Brake Technologies Corporation vs Avery Dennison Corporation: SG&A Expense Trends

Professional EBITDA Benchmarking: Westinghouse Air Brake Technologies Corporation vs ZTO Express (Cayman) Inc.

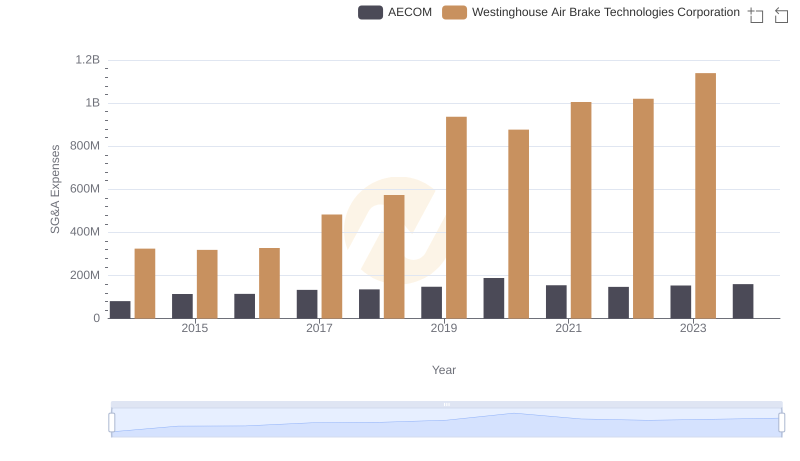

Comparing SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs AECOM Trends and Insights