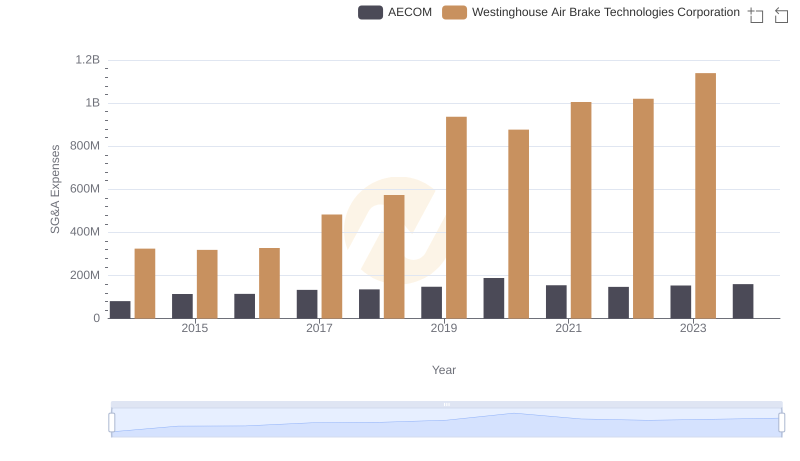

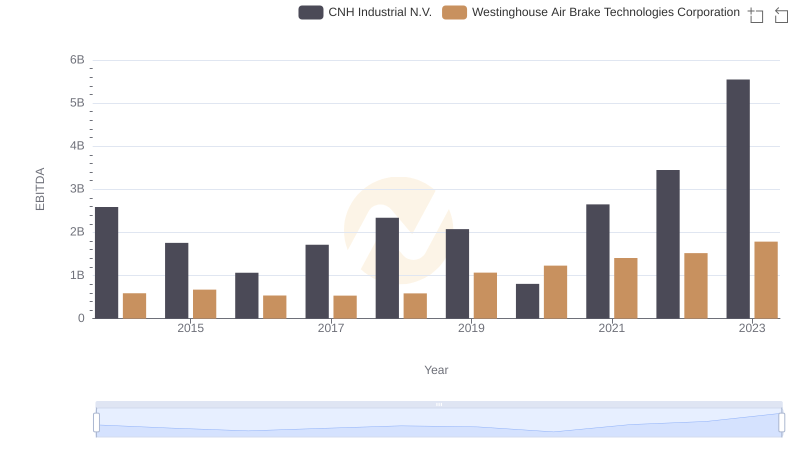

| __timestamp | CNH Industrial N.V. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2925000000 | 324539000 |

| Thursday, January 1, 2015 | 2317000000 | 319173000 |

| Friday, January 1, 2016 | 2262000000 | 327505000 |

| Sunday, January 1, 2017 | 2330000000 | 482852000 |

| Monday, January 1, 2018 | 2351000000 | 573644000 |

| Tuesday, January 1, 2019 | 2216000000 | 936600000 |

| Wednesday, January 1, 2020 | 2155000000 | 877100000 |

| Friday, January 1, 2021 | 2443000000 | 1005000000 |

| Saturday, January 1, 2022 | 1752000000 | 1020000000 |

| Sunday, January 1, 2023 | 1863000000 | 1139000000 |

| Monday, January 1, 2024 | 1248000000 |

In pursuit of knowledge

In the competitive landscape of industrial giants, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. From 2014 to 2023, CNH Industrial N.V. and Westinghouse Air Brake Technologies Corporation have shown contrasting trends in their SG&A management. CNH Industrial, despite having higher absolute SG&A expenses, has seen a significant reduction of approximately 36% over the decade, from $2.9 billion in 2014 to $1.9 billion in 2023. In contrast, Westinghouse Air Brake Technologies has experienced a steady increase, with SG&A expenses rising by about 250%, from $324 million to $1.1 billion in the same period. This divergence highlights CNH Industrial's strategic cost-cutting measures, while Westinghouse's growth in expenses may reflect expansion efforts. Understanding these trends offers valuable insights into each company's operational strategies and financial health.

Revenue Insights: Westinghouse Air Brake Technologies Corporation and CNH Industrial N.V. Performance Compared

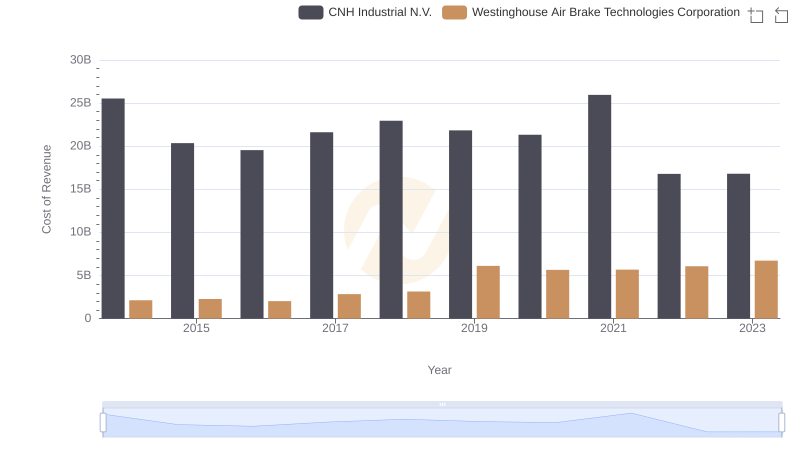

Cost Insights: Breaking Down Westinghouse Air Brake Technologies Corporation and CNH Industrial N.V.'s Expenses

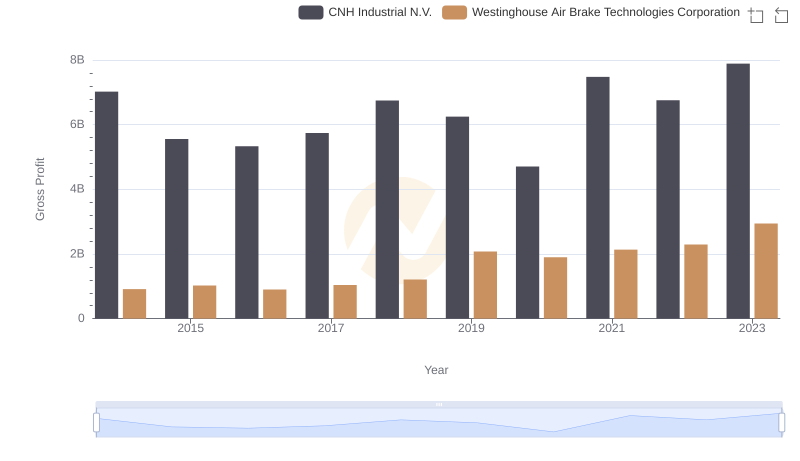

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and CNH Industrial N.V. Trends

Comparing SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs AECOM Trends and Insights

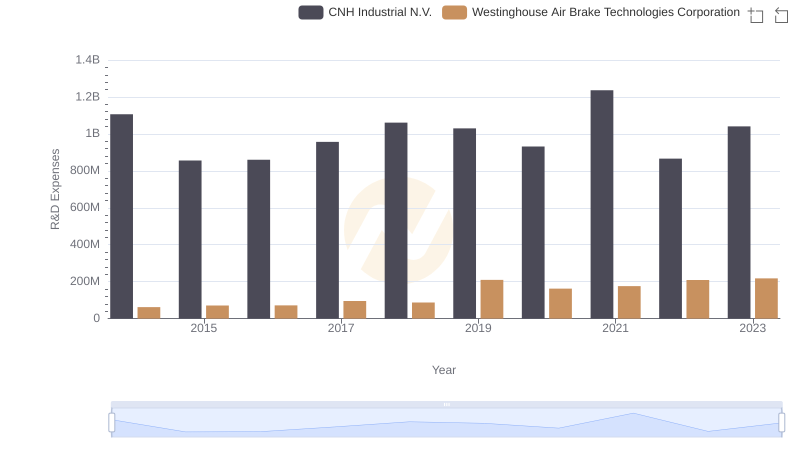

Who Prioritizes Innovation? R&D Spending Compared for Westinghouse Air Brake Technologies Corporation and CNH Industrial N.V.

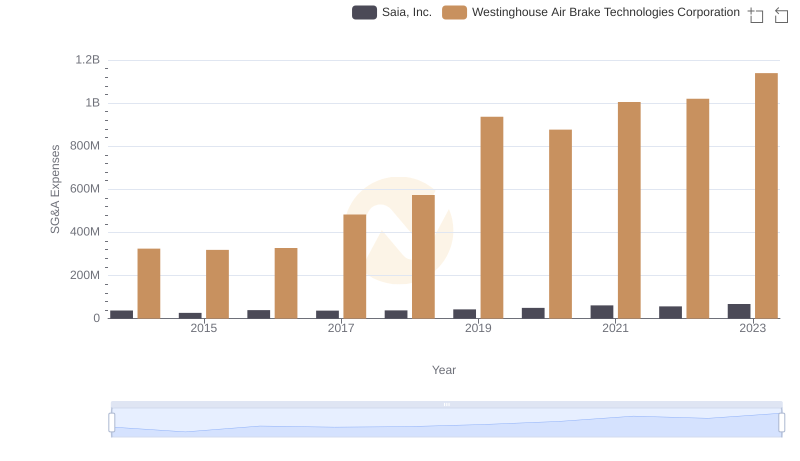

Comparing SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs Saia, Inc. Trends and Insights

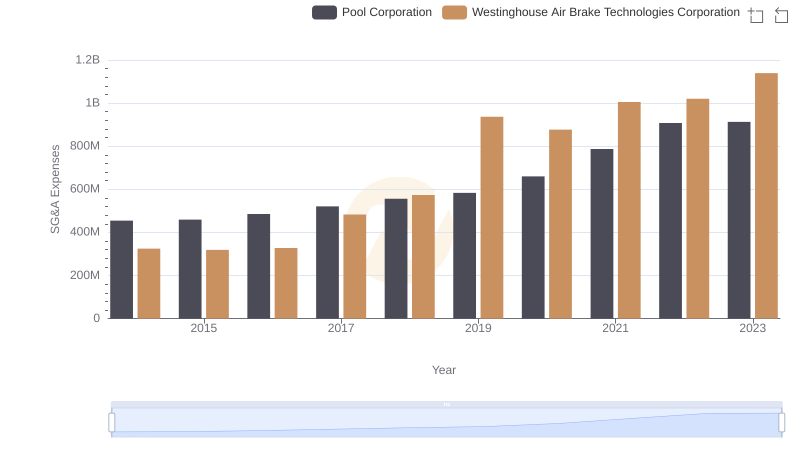

Westinghouse Air Brake Technologies Corporation vs Pool Corporation: SG&A Expense Trends

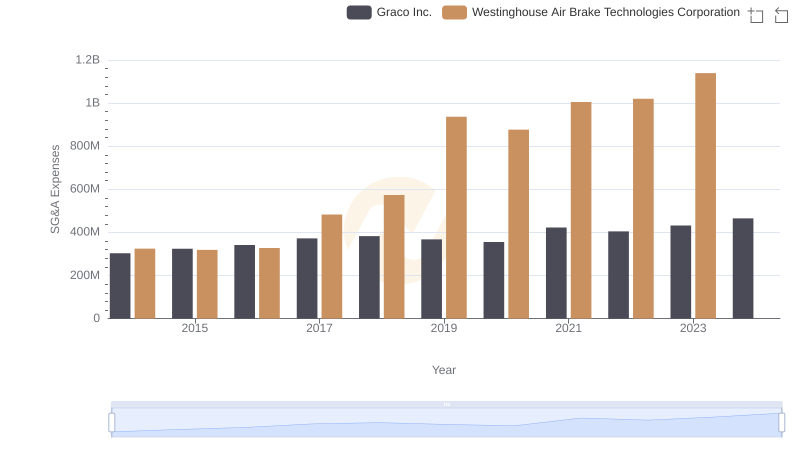

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs Graco Inc.

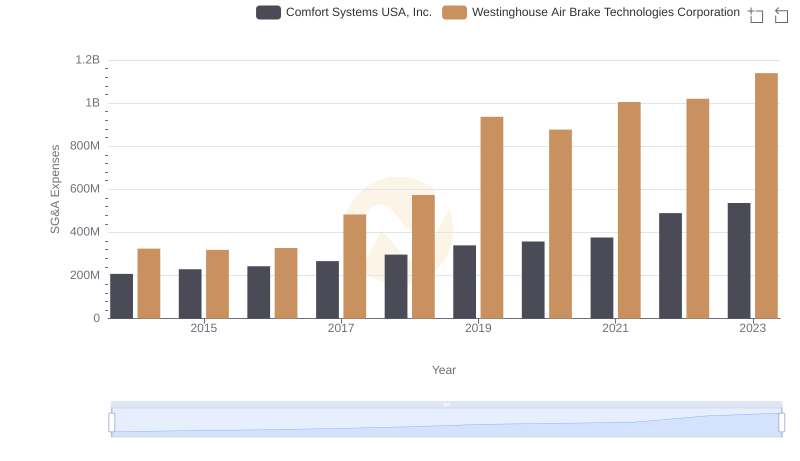

Westinghouse Air Brake Technologies Corporation vs Comfort Systems USA, Inc.: SG&A Expense Trends

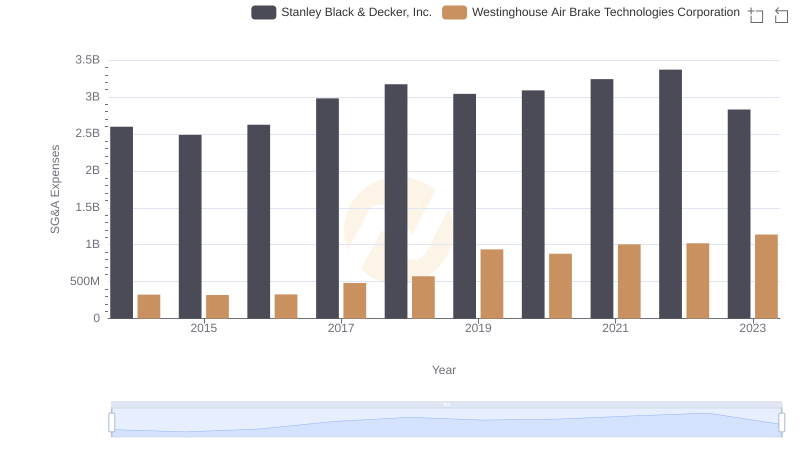

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs Stanley Black & Decker, Inc.

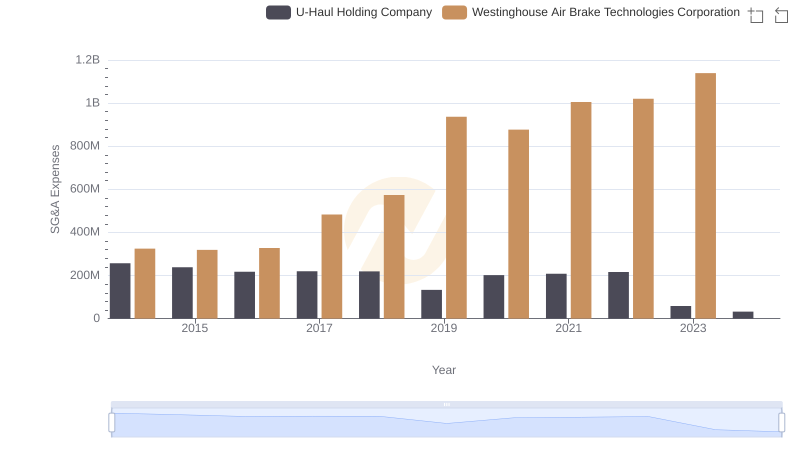

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs U-Haul Holding Company

Westinghouse Air Brake Technologies Corporation and CNH Industrial N.V.: A Detailed Examination of EBITDA Performance