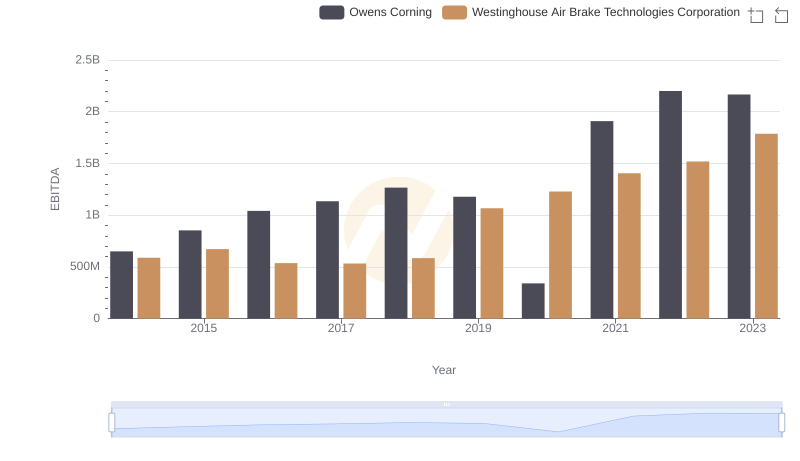

| __timestamp | AECOM | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 417662000 | 588370000 |

| Thursday, January 1, 2015 | 1020478000 | 672301000 |

| Friday, January 1, 2016 | 926466000 | 535893000 |

| Sunday, January 1, 2017 | 920292000 | 532795000 |

| Monday, January 1, 2018 | 680801000 | 584199000 |

| Tuesday, January 1, 2019 | 573352000 | 1067300000 |

| Wednesday, January 1, 2020 | 580017000 | 1229400000 |

| Friday, January 1, 2021 | 813356000 | 1405000000 |

| Saturday, January 1, 2022 | 826856000 | 1519000000 |

| Sunday, January 1, 2023 | 543642000 | 1787000000 |

| Monday, January 1, 2024 | 1082384000 | 1609000000 |

Unleashing insights

In the dynamic landscape of the North American transportation and infrastructure sectors, the financial performance of companies often serves as a barometer for their operational efficiency and market positioning. This article delves into the EBITDA performance of two prominent players: Westinghouse Air Brake Technologies Corporation (WAB) and AECOM (ACM). Both companies have demonstrated resilience and adaptability over the years, yet their financial trajectories reveal intriguing contrasts.

Since 2014, both WAB and ACM have navigated a variety of economic climates, from post-recession recovery to the challenges posed by the global pandemic. EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, is a critical metric that provides insights into a company's operational profitability. It strips away extraneous factors, allowing stakeholders to focus on core business performance.

Analyzing the EBITDA figures from 2014 to 2023, we observe that Westinghouse Air Brake Technologies Corporation has consistently outperformed AECOM in terms of absolute EBITDA figures. For instance, in 2021, WAB reported an EBITDA of approximately $1.41 billion, marking a staggering 74% increase from its performance in 2014. In contrast, AECOM's EBITDA peaked at around $1.02 billion in 2015, before experiencing fluctuations that led to a decline of nearly 47% by 2023.

The data indicates that while AECOM has shown resilience, with its EBITDA hovering around $600 million to $800 million in recent years, it has not been able to match the robust growth trajectory of WAB. In fact, AECOM's EBITDA in 2023 was approximately $543 million, representing a 47% drop from its 2015 peak.

The year-on-year analysis reveals that Westinghouse Air Brake Technologies Corporation has maintained a steady upward trend in EBITDA, particularly notable in the years following the pandemic. For instance, from 2020 to 2021, WAB's EBITDA surged by 22%, reflecting its strategic investments and operational efficiencies. Conversely, AECOM's performance has been more volatile, with a significant dip in 2020, followed by a modest recovery in subsequent years.

Interestingly, both companies experienced a decline in EBITDA during 2019, likely due to external market pressures and shifting economic conditions. However, WAB's recovery post-2020 has been more pronounced, with a remarkable 48% increase in EBITDA by 2022 compared to 2020.

As we look to the future, the financial trajectories of Westinghouse Air Brake Technologies Corporation and AECOM will be shaped by their ability to adapt to changing market dynamics and capitalize on emerging opportunities. While WAB has established itself as a leader in operational profitability, AECOM's ongoing efforts to streamline its operations and innovate will be crucial for its resurgence.

In summary, the EBITDA performance of these two corporations not only reflects their individual strategies and market conditions but also serves as a valuable indicator for investors and stakeholders in the transportation and infrastructure sectors. As they continue to evolve, the ability to sustain growth and enhance profitability will be paramount in navigating the complexities of the modern business landscape.

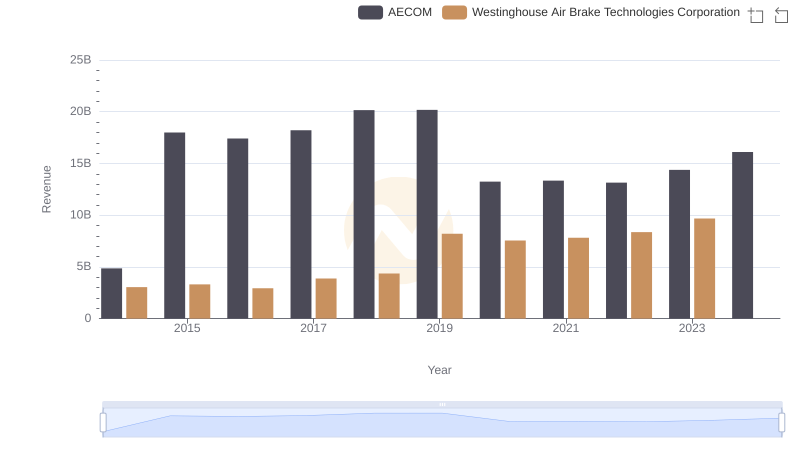

Westinghouse Air Brake Technologies Corporation vs AECOM: Annual Revenue Growth Compared

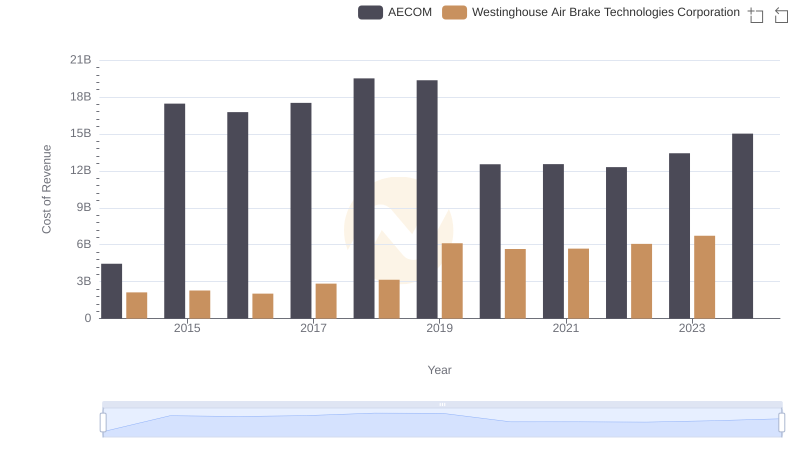

Analyzing Cost of Revenue: Westinghouse Air Brake Technologies Corporation and AECOM

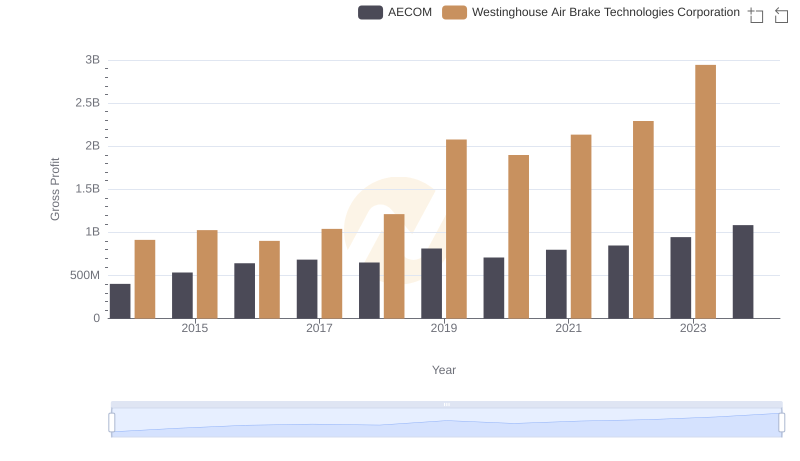

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and AECOM Trends

A Side-by-Side Analysis of EBITDA: Westinghouse Air Brake Technologies Corporation and Owens Corning

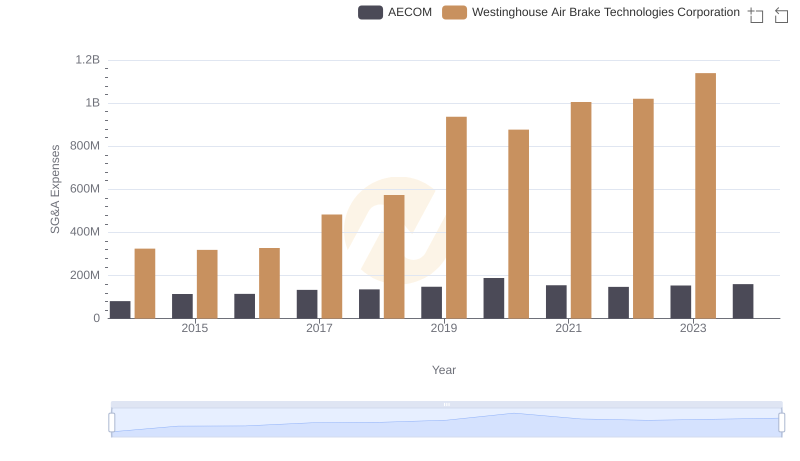

Comparing SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs AECOM Trends and Insights

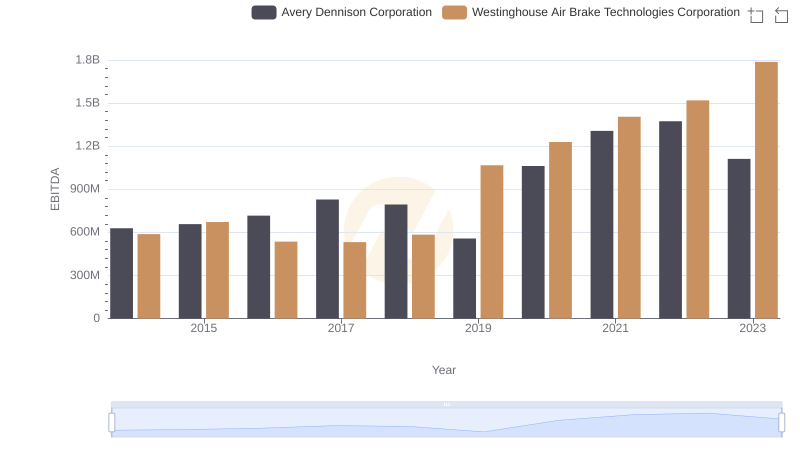

EBITDA Performance Review: Westinghouse Air Brake Technologies Corporation vs Avery Dennison Corporation

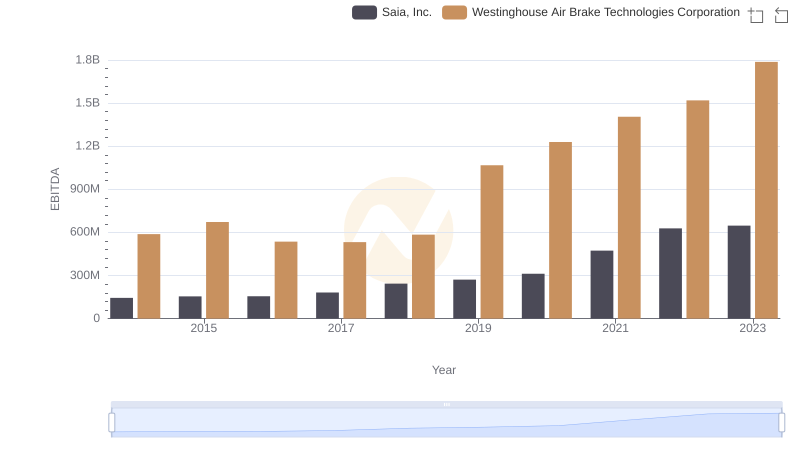

Professional EBITDA Benchmarking: Westinghouse Air Brake Technologies Corporation vs Saia, Inc.

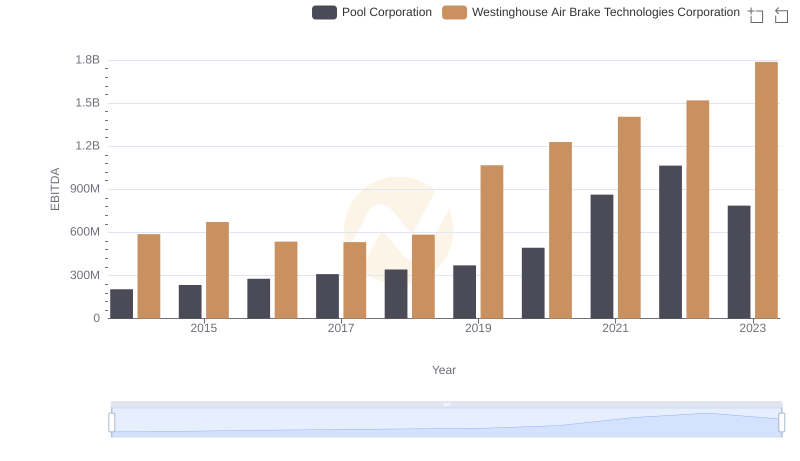

Westinghouse Air Brake Technologies Corporation vs Pool Corporation: In-Depth EBITDA Performance Comparison

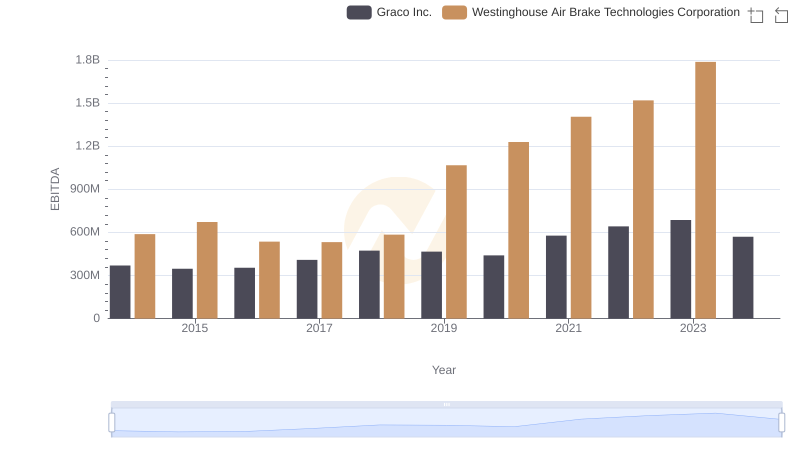

Westinghouse Air Brake Technologies Corporation and Graco Inc.: A Detailed Examination of EBITDA Performance

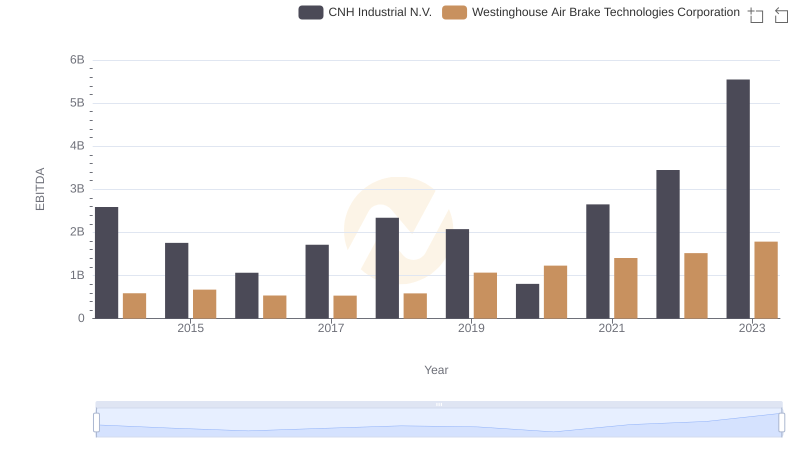

Westinghouse Air Brake Technologies Corporation and CNH Industrial N.V.: A Detailed Examination of EBITDA Performance

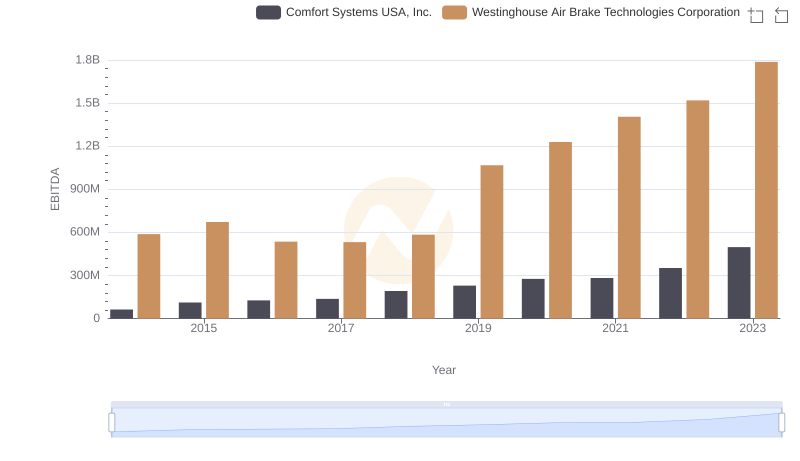

Westinghouse Air Brake Technologies Corporation vs Comfort Systems USA, Inc.: In-Depth EBITDA Performance Comparison

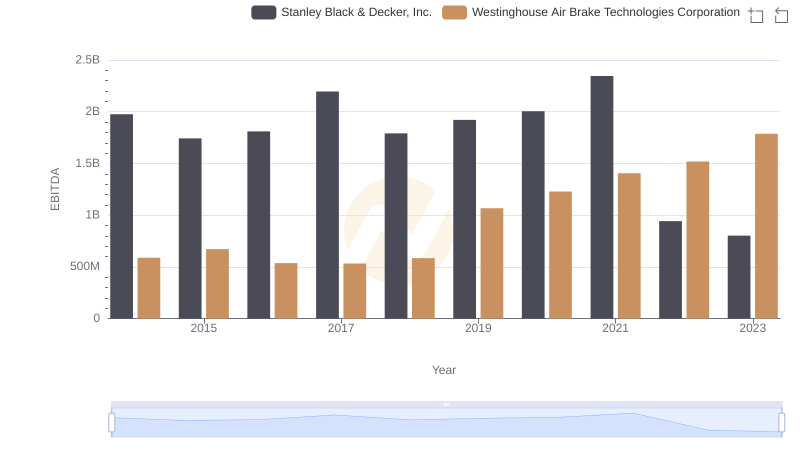

Westinghouse Air Brake Technologies Corporation and Stanley Black & Decker, Inc.: A Detailed Examination of EBITDA Performance