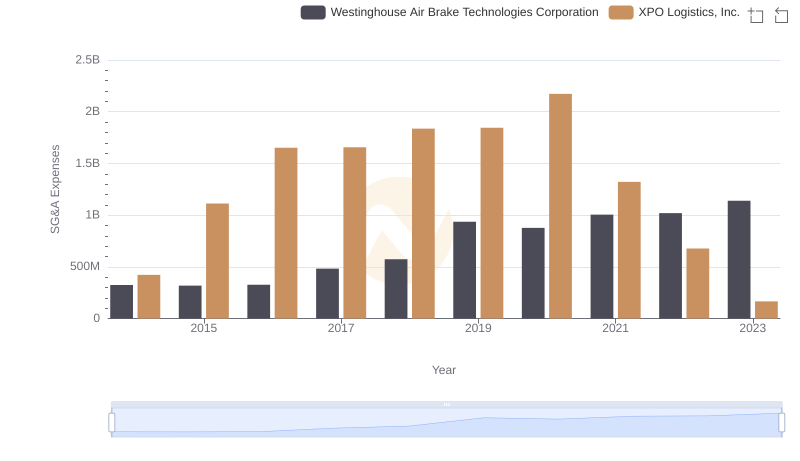

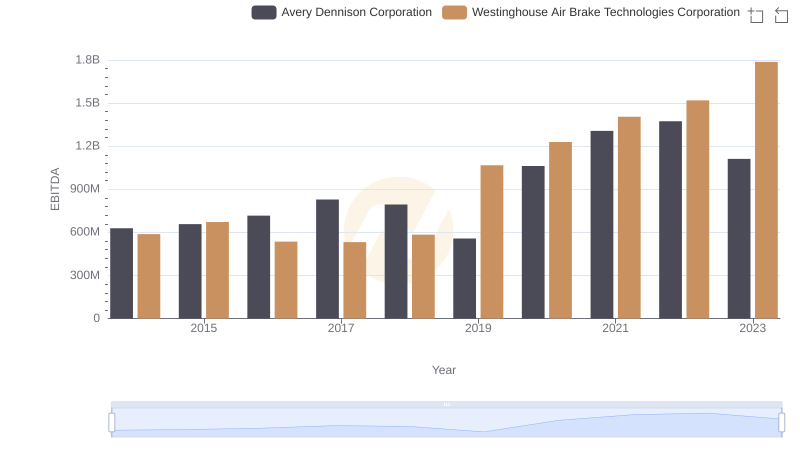

| __timestamp | Avery Dennison Corporation | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1155300000 | 324539000 |

| Thursday, January 1, 2015 | 1108100000 | 319173000 |

| Friday, January 1, 2016 | 1097500000 | 327505000 |

| Sunday, January 1, 2017 | 1123200000 | 482852000 |

| Monday, January 1, 2018 | 1127500000 | 573644000 |

| Tuesday, January 1, 2019 | 1080400000 | 936600000 |

| Wednesday, January 1, 2020 | 1060500000 | 877100000 |

| Friday, January 1, 2021 | 1248500000 | 1005000000 |

| Saturday, January 1, 2022 | 1330800000 | 1020000000 |

| Sunday, January 1, 2023 | 1177900000 | 1139000000 |

| Monday, January 1, 2024 | 1415300000 | 1248000000 |

Igniting the spark of knowledge

In the ever-evolving landscape of corporate finance, understanding the trends in Selling, General, and Administrative (SG&A) expenses is crucial. This analysis delves into the SG&A expense patterns of two industry giants: Avery Dennison Corporation and Westinghouse Air Brake Technologies Corporation, from 2014 to 2023.

Avery Dennison has shown a steady increase in SG&A expenses over the years, peaking in 2022 with a 15% rise from 2014. This upward trend reflects the company's strategic investments in marketing and administrative capabilities, crucial for maintaining its competitive edge.

In contrast, Westinghouse Air Brake Technologies experienced a more volatile trajectory. Starting at a lower base in 2014, their SG&A expenses surged by over 250% by 2023, indicating significant expansion and restructuring efforts.

These trends highlight the diverse strategies employed by these corporations in managing operational costs, offering valuable insights for investors and analysts alike.

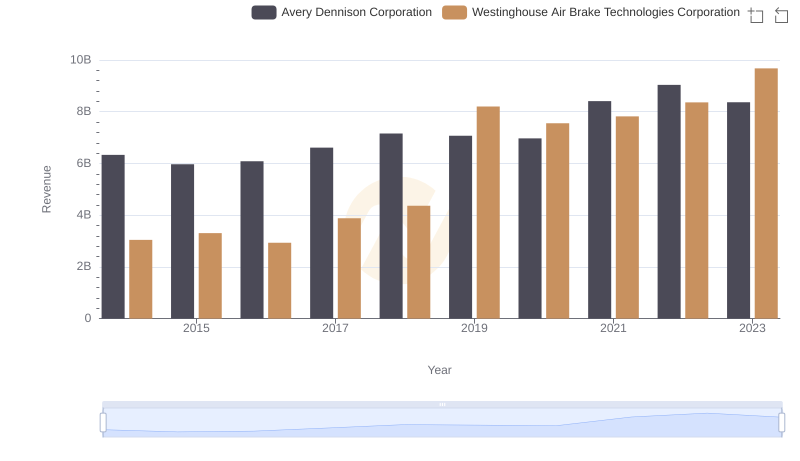

Annual Revenue Comparison: Westinghouse Air Brake Technologies Corporation vs Avery Dennison Corporation

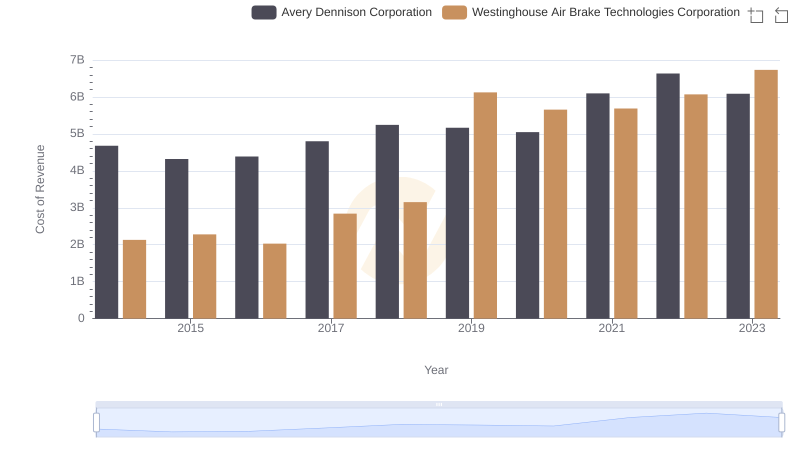

Cost of Revenue Trends: Westinghouse Air Brake Technologies Corporation vs Avery Dennison Corporation

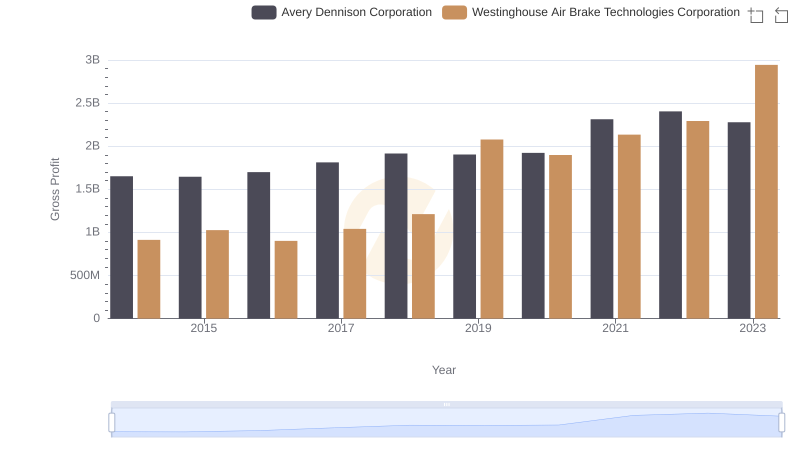

Gross Profit Trends Compared: Westinghouse Air Brake Technologies Corporation vs Avery Dennison Corporation

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs XPO Logistics, Inc.

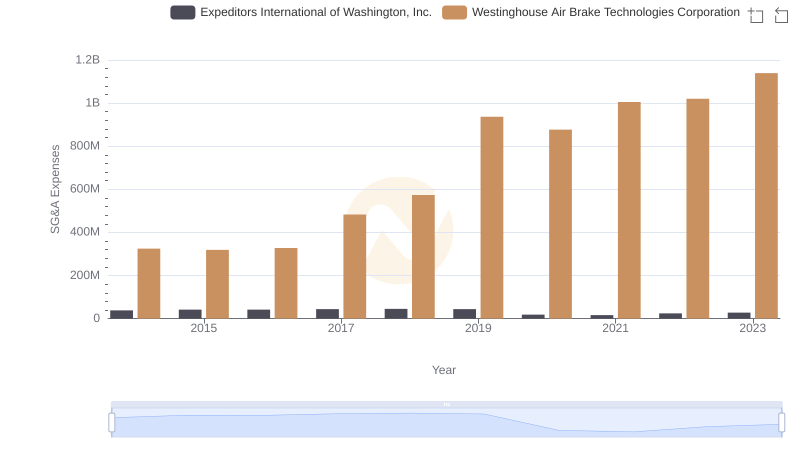

Breaking Down SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs Expeditors International of Washington, Inc.

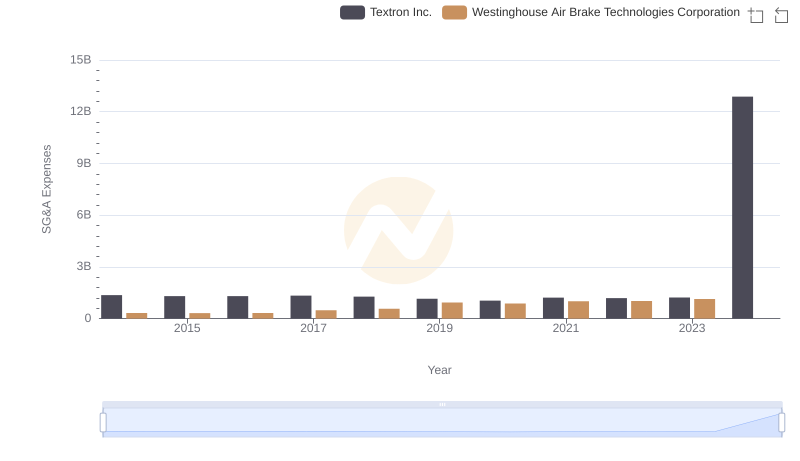

Operational Costs Compared: SG&A Analysis of Westinghouse Air Brake Technologies Corporation and Textron Inc.

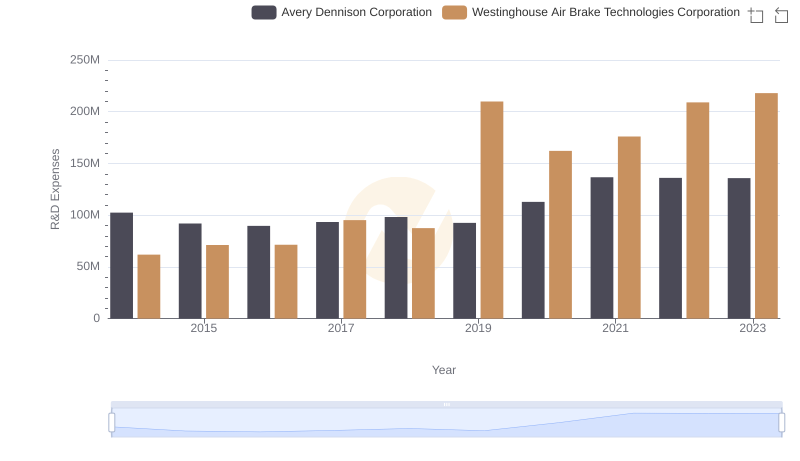

Westinghouse Air Brake Technologies Corporation or Avery Dennison Corporation: Who Invests More in Innovation?

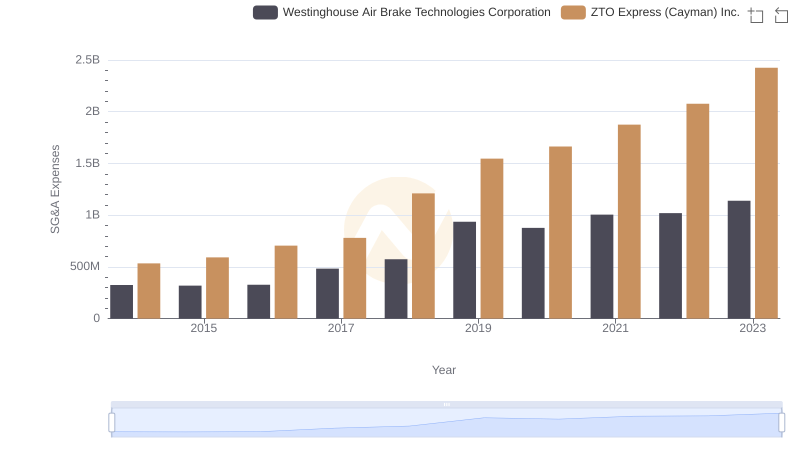

Westinghouse Air Brake Technologies Corporation or ZTO Express (Cayman) Inc.: Who Manages SG&A Costs Better?

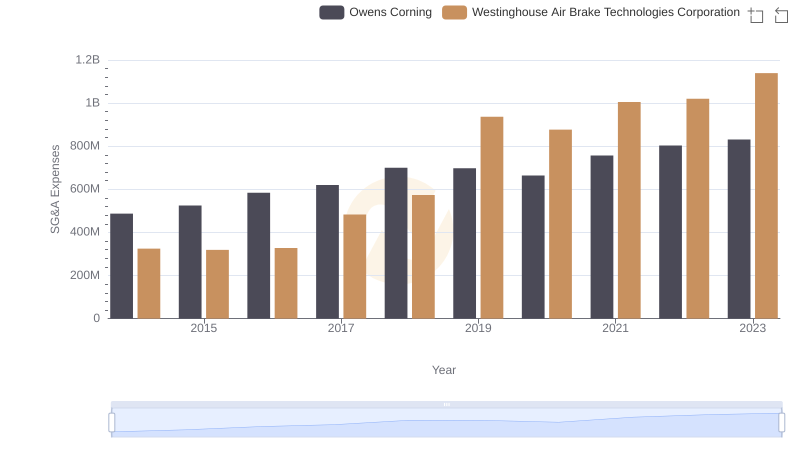

Who Optimizes SG&A Costs Better? Westinghouse Air Brake Technologies Corporation or Owens Corning

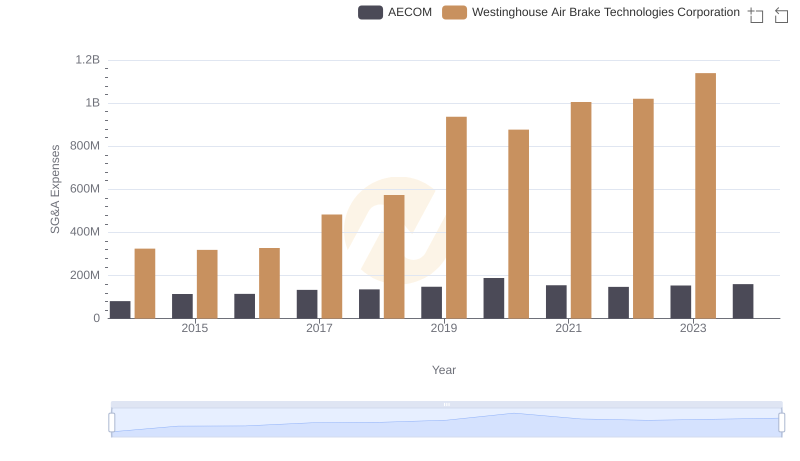

Comparing SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs AECOM Trends and Insights

EBITDA Performance Review: Westinghouse Air Brake Technologies Corporation vs Avery Dennison Corporation

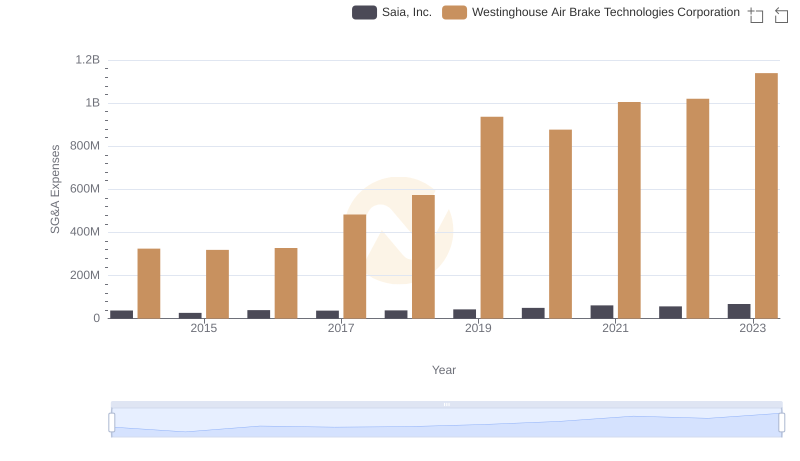

Comparing SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs Saia, Inc. Trends and Insights