| __timestamp | Saia, Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 37563000 | 324539000 |

| Thursday, January 1, 2015 | 26832000 | 319173000 |

| Friday, January 1, 2016 | 39625000 | 327505000 |

| Sunday, January 1, 2017 | 37162000 | 482852000 |

| Monday, January 1, 2018 | 38425000 | 573644000 |

| Tuesday, January 1, 2019 | 43073000 | 936600000 |

| Wednesday, January 1, 2020 | 49761000 | 877100000 |

| Friday, January 1, 2021 | 61345000 | 1005000000 |

| Saturday, January 1, 2022 | 56601000 | 1020000000 |

| Sunday, January 1, 2023 | 67984000 | 1139000000 |

| Monday, January 1, 2024 | 1248000000 |

Infusing magic into the data realm

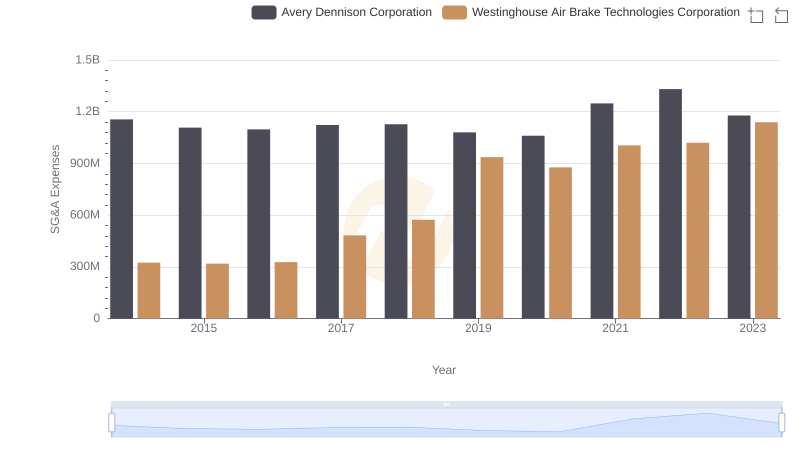

In the competitive landscape of the transportation industry, understanding the financial dynamics of key players is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of Westinghouse Air Brake Technologies Corporation and Saia, Inc. from 2014 to 2023.

Over the past decade, Westinghouse has seen a significant rise in SG&A expenses, peaking at approximately $1.14 billion in 2023. This represents a staggering 250% increase from 2014, reflecting the company's aggressive expansion and operational scaling.

In contrast, Saia, Inc.'s SG&A expenses have grown more modestly, reaching around $68 million in 2023, a 81% increase since 2014. This steady growth indicates a more conservative approach to managing operational costs.

The data highlights the contrasting strategies of these two companies, with Westinghouse focusing on rapid growth and Saia maintaining a steady course. Understanding these trends provides valuable insights for investors and industry analysts alike.

Westinghouse Air Brake Technologies Corporation and Saia, Inc.: A Comprehensive Revenue Analysis

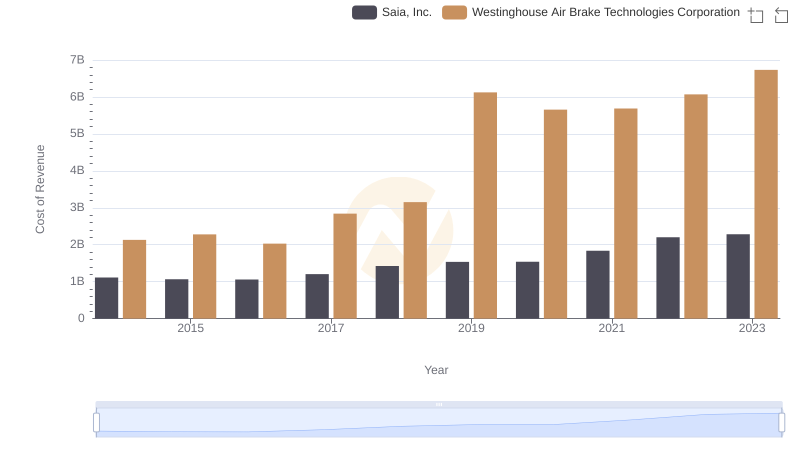

Comparing Cost of Revenue Efficiency: Westinghouse Air Brake Technologies Corporation vs Saia, Inc.

Westinghouse Air Brake Technologies Corporation vs Avery Dennison Corporation: SG&A Expense Trends

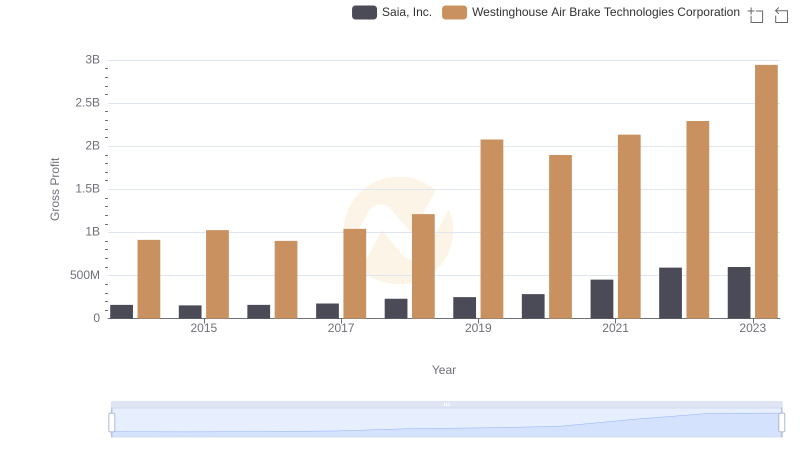

Gross Profit Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Saia, Inc.

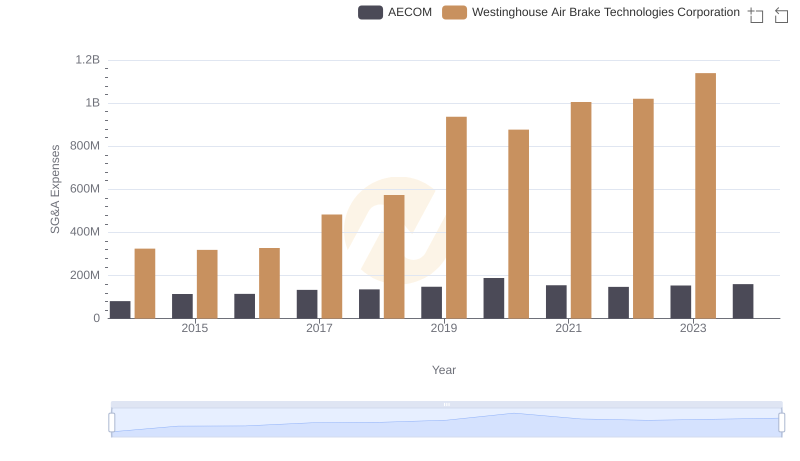

Comparing SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs AECOM Trends and Insights

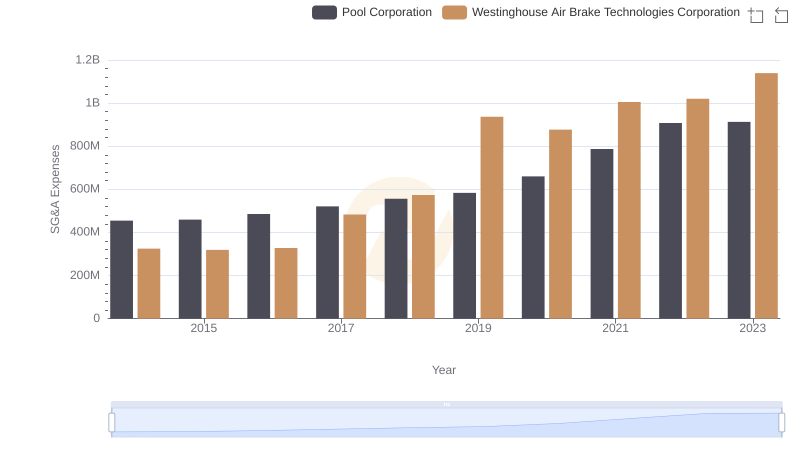

Westinghouse Air Brake Technologies Corporation vs Pool Corporation: SG&A Expense Trends

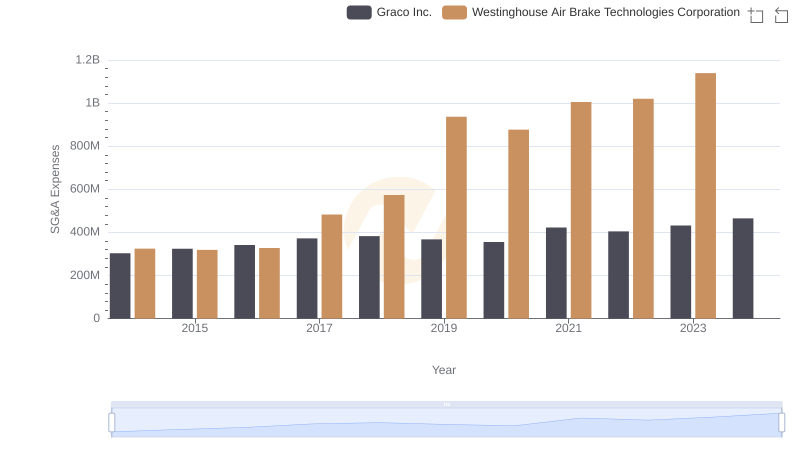

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs Graco Inc.

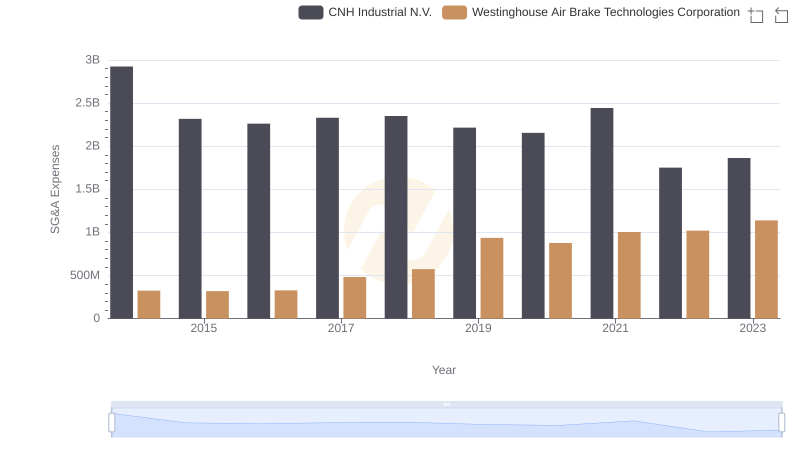

Westinghouse Air Brake Technologies Corporation or CNH Industrial N.V.: Who Manages SG&A Costs Better?

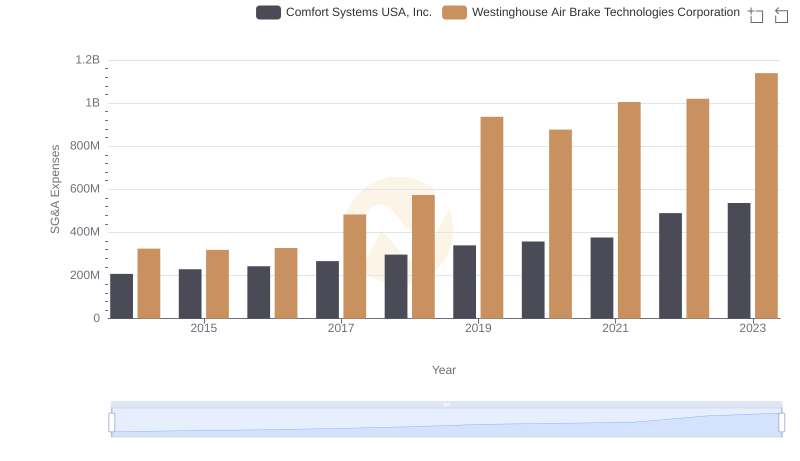

Westinghouse Air Brake Technologies Corporation vs Comfort Systems USA, Inc.: SG&A Expense Trends

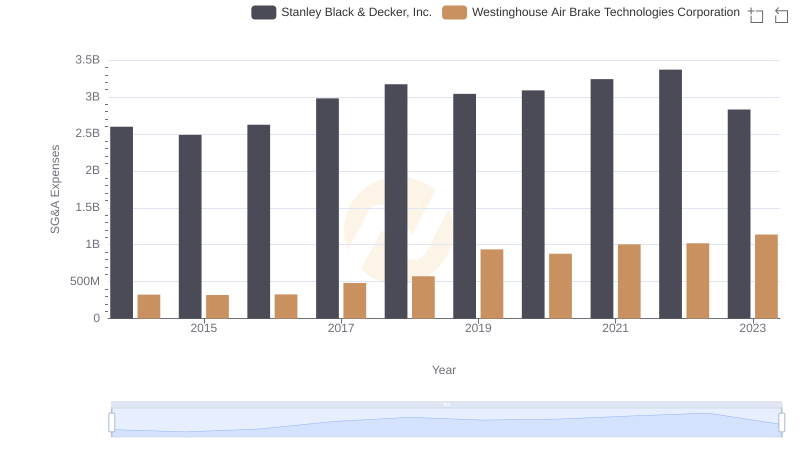

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs Stanley Black & Decker, Inc.

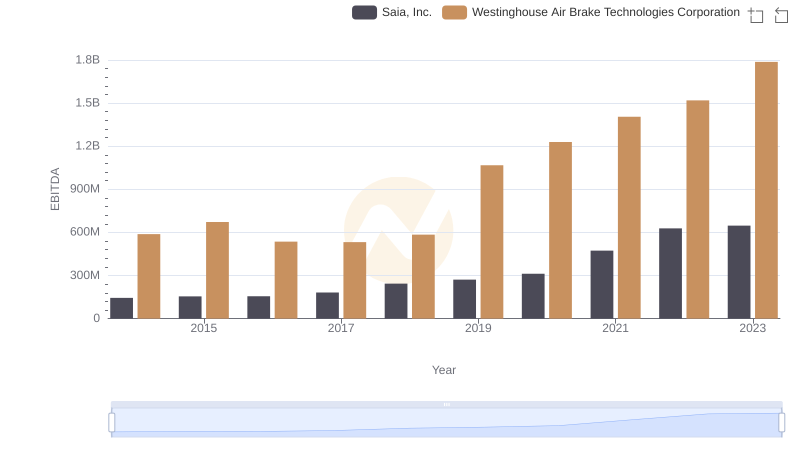

Professional EBITDA Benchmarking: Westinghouse Air Brake Technologies Corporation vs Saia, Inc.

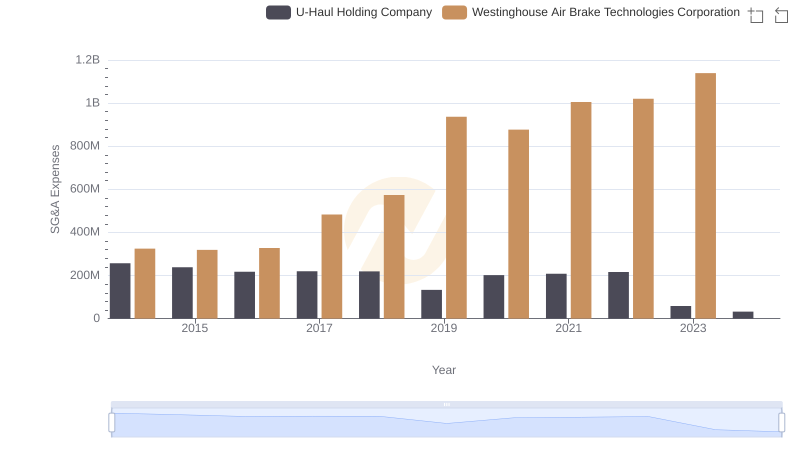

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs U-Haul Holding Company