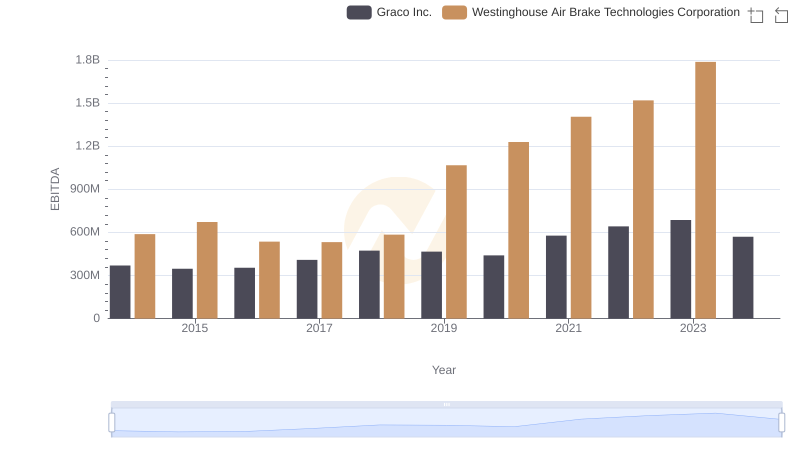

| __timestamp | Graco Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 303565000 | 324539000 |

| Thursday, January 1, 2015 | 324016000 | 319173000 |

| Friday, January 1, 2016 | 341734000 | 327505000 |

| Sunday, January 1, 2017 | 372496000 | 482852000 |

| Monday, January 1, 2018 | 382988000 | 573644000 |

| Tuesday, January 1, 2019 | 367743000 | 936600000 |

| Wednesday, January 1, 2020 | 355796000 | 877100000 |

| Friday, January 1, 2021 | 422975000 | 1005000000 |

| Saturday, January 1, 2022 | 404731000 | 1020000000 |

| Sunday, January 1, 2023 | 432156000 | 1139000000 |

| Monday, January 1, 2024 | 465133000 | 1248000000 |

Unveiling the hidden dimensions of data

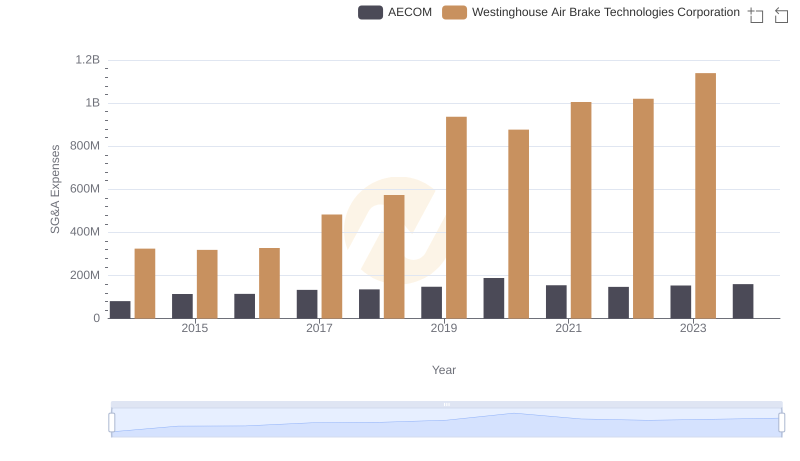

In the competitive landscape of industrial manufacturing, understanding the financial dynamics of key players is crucial. Westinghouse Air Brake Technologies Corporation and Graco Inc. have been pivotal in shaping the industry. From 2014 to 2023, these companies have shown distinct trends in their Selling, General, and Administrative (SG&A) expenses.

Graco Inc. has maintained a steady increase in SG&A costs, growing approximately 53% over the decade. This reflects their strategic investments in marketing and administration to bolster their market presence. In contrast, Westinghouse Air Brake Technologies Corporation experienced a more volatile trajectory, with a staggering 250% increase in SG&A expenses by 2023, indicating aggressive expansion and operational scaling.

Interestingly, data for 2024 is incomplete, leaving room for speculation on future trends. As these companies continue to evolve, their financial strategies will undoubtedly influence their competitive edge.

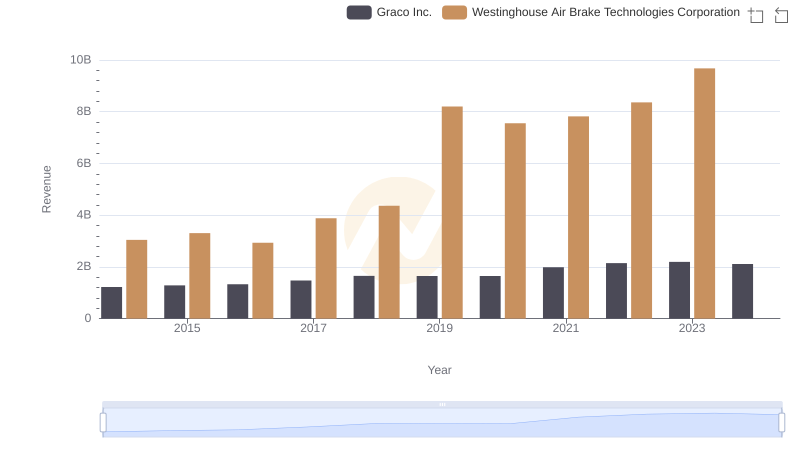

Westinghouse Air Brake Technologies Corporation vs Graco Inc.: Annual Revenue Growth Compared

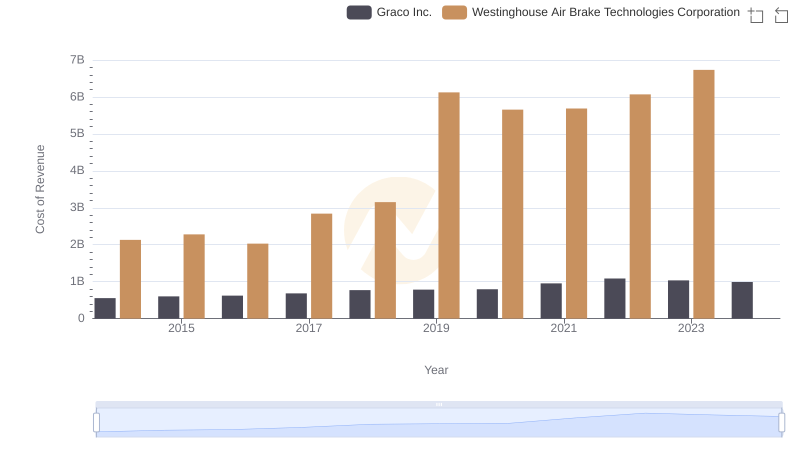

Cost of Revenue: Key Insights for Westinghouse Air Brake Technologies Corporation and Graco Inc.

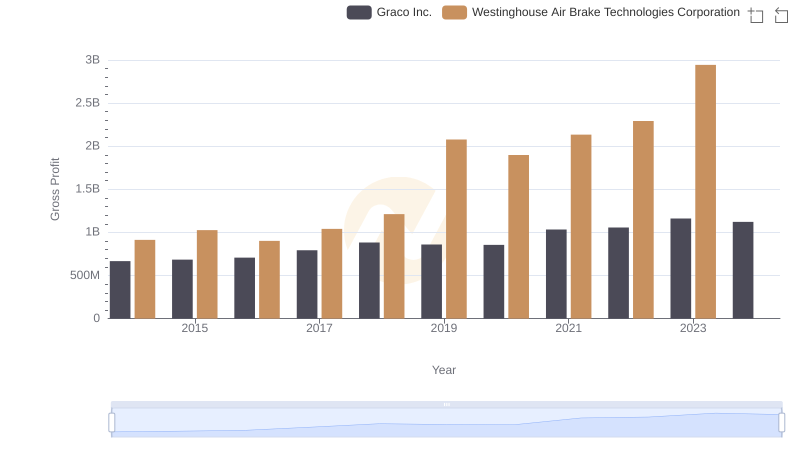

Who Generates Higher Gross Profit? Westinghouse Air Brake Technologies Corporation or Graco Inc.

Comparing SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs AECOM Trends and Insights

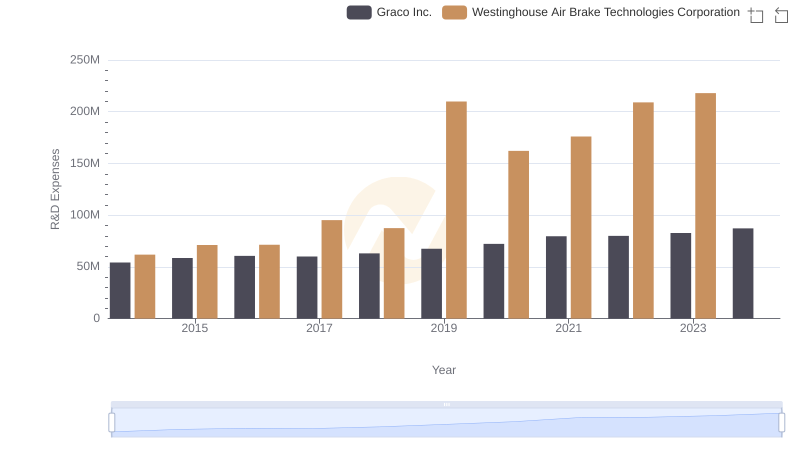

Who Prioritizes Innovation? R&D Spending Compared for Westinghouse Air Brake Technologies Corporation and Graco Inc.

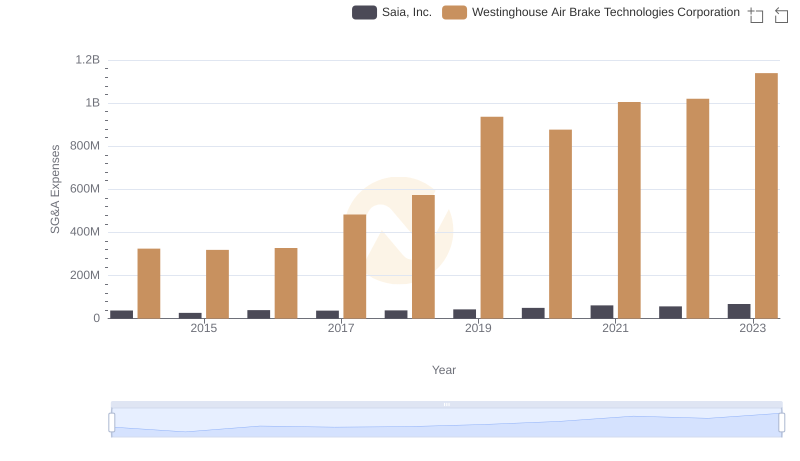

Comparing SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs Saia, Inc. Trends and Insights

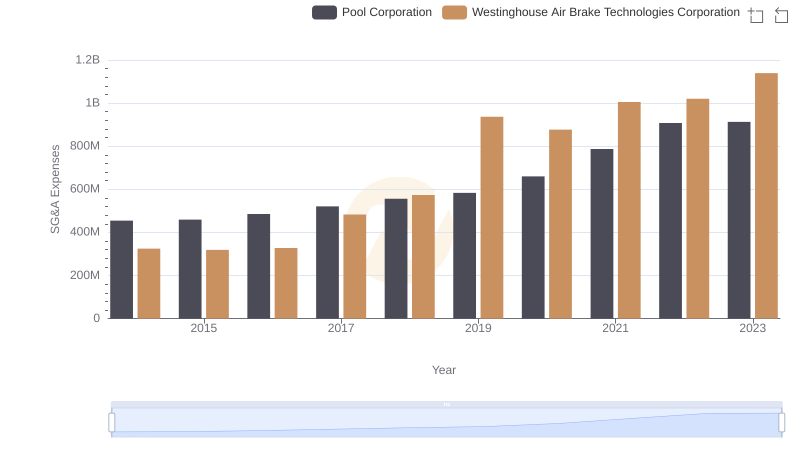

Westinghouse Air Brake Technologies Corporation vs Pool Corporation: SG&A Expense Trends

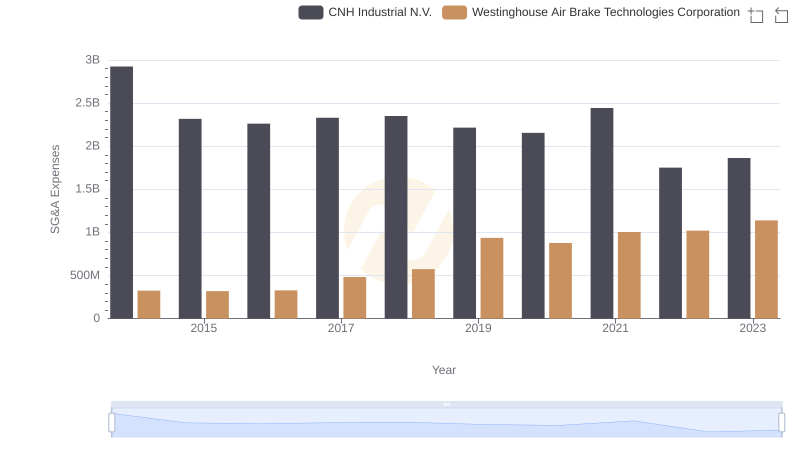

Westinghouse Air Brake Technologies Corporation or CNH Industrial N.V.: Who Manages SG&A Costs Better?

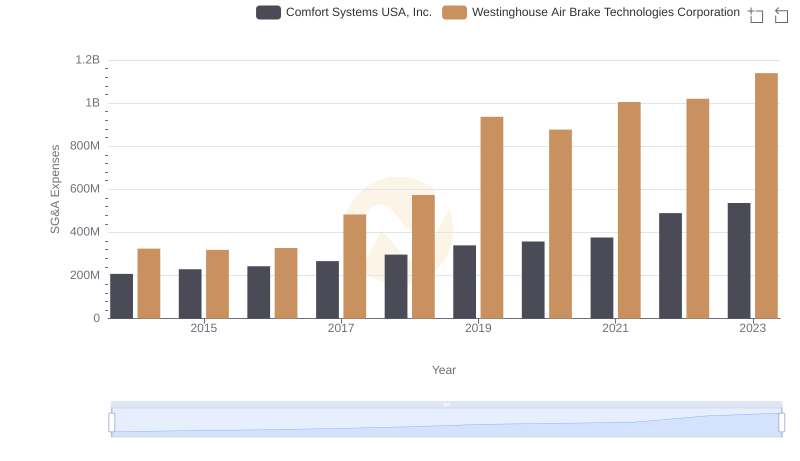

Westinghouse Air Brake Technologies Corporation vs Comfort Systems USA, Inc.: SG&A Expense Trends

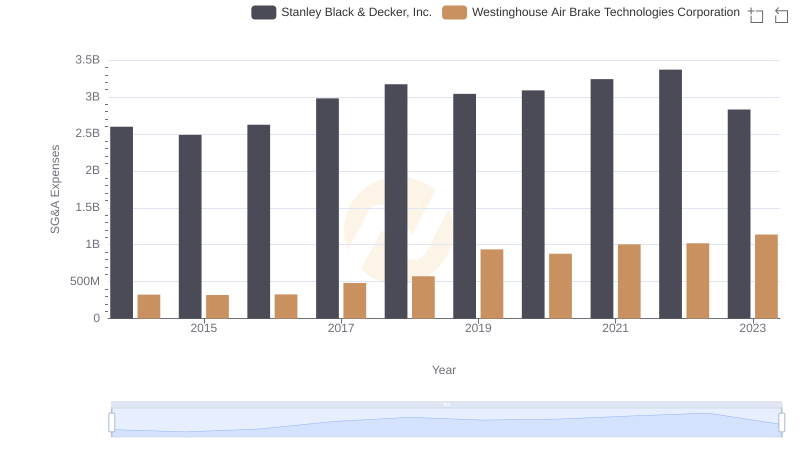

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs Stanley Black & Decker, Inc.

Westinghouse Air Brake Technologies Corporation and Graco Inc.: A Detailed Examination of EBITDA Performance

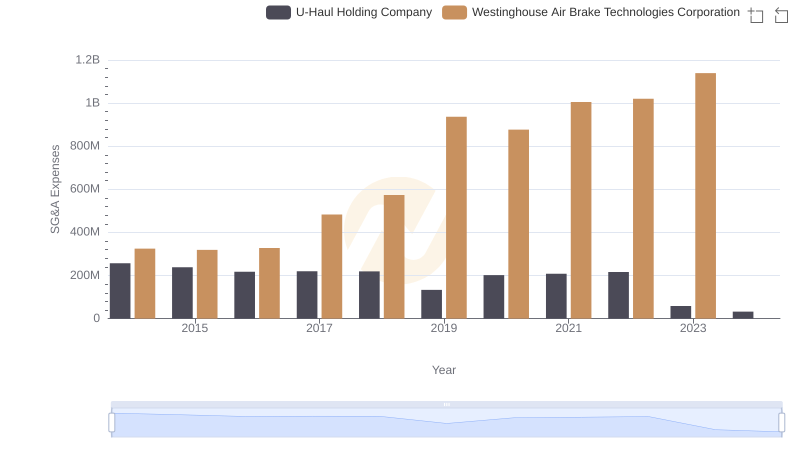

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs U-Haul Holding Company