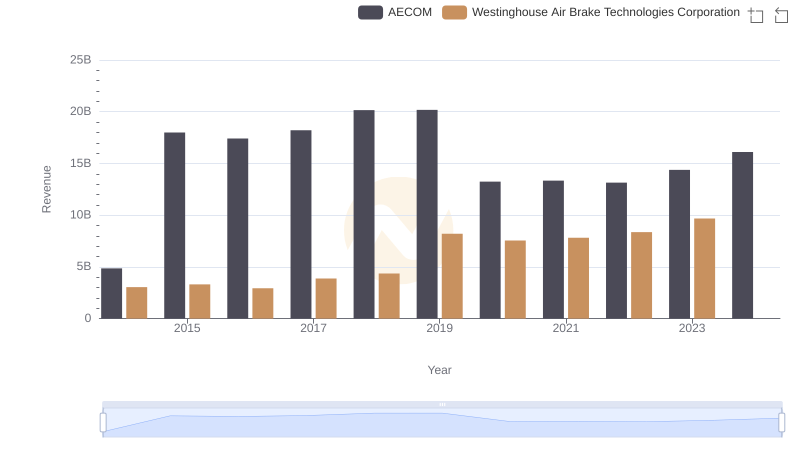

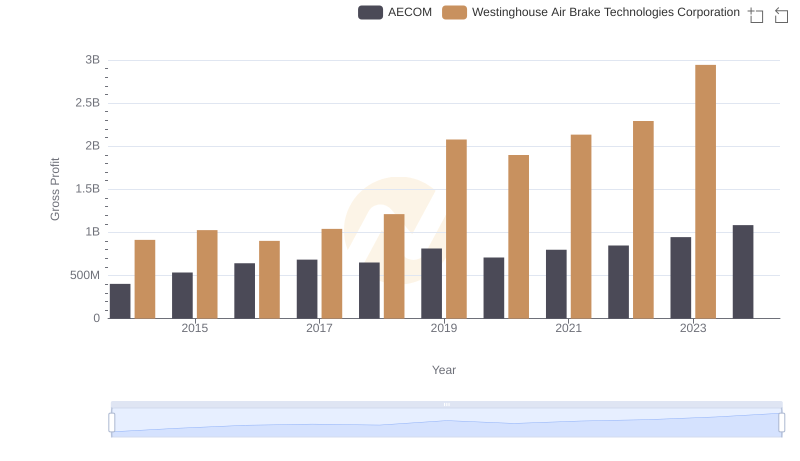

| __timestamp | AECOM | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 4452451000 | 2130920000 |

| Thursday, January 1, 2015 | 17454692000 | 2281845000 |

| Friday, January 1, 2016 | 16768001000 | 2029647000 |

| Sunday, January 1, 2017 | 17519682000 | 2841159000 |

| Monday, January 1, 2018 | 19504863000 | 3151816000 |

| Tuesday, January 1, 2019 | 19359884000 | 6122400000 |

| Wednesday, January 1, 2020 | 12530416000 | 5657400000 |

| Friday, January 1, 2021 | 12542431000 | 5687000000 |

| Saturday, January 1, 2022 | 12300208000 | 6070000000 |

| Sunday, January 1, 2023 | 13432996000 | 6733000000 |

| Monday, January 1, 2024 | 15021157000 | 7021000000 |

Igniting the spark of knowledge

In the ever-evolving landscape of industrial giants, understanding cost efficiency is paramount. AECOM and Westinghouse Air Brake Technologies Corporation (WAB) have been pivotal players in their respective sectors. From 2014 to 2023, AECOM's cost of revenue has shown a dynamic trend, peaking in 2018 with a 33% increase from 2014, before stabilizing around 2023. Meanwhile, WAB's cost of revenue has more than tripled, reflecting significant operational expansions. Notably, 2019 marked a pivotal year for WAB, with a 93% surge compared to 2018, indicating strategic investments or acquisitions. However, data for 2024 remains incomplete, leaving room for speculation. This analysis not only highlights the financial strategies of these corporations but also underscores the importance of cost management in maintaining competitive advantage. As industries continue to evolve, these insights offer a glimpse into the financial health and strategic direction of these industrial titans.

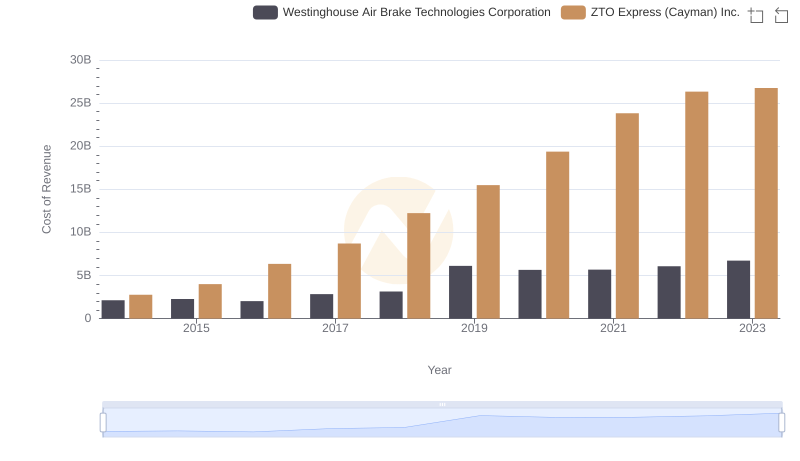

Cost of Revenue Trends: Westinghouse Air Brake Technologies Corporation vs ZTO Express (Cayman) Inc.

Westinghouse Air Brake Technologies Corporation vs AECOM: Annual Revenue Growth Compared

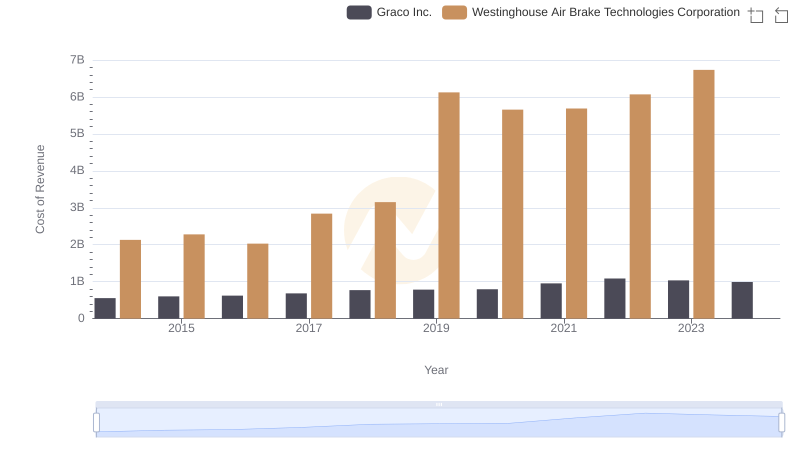

Cost of Revenue: Key Insights for Westinghouse Air Brake Technologies Corporation and Graco Inc.

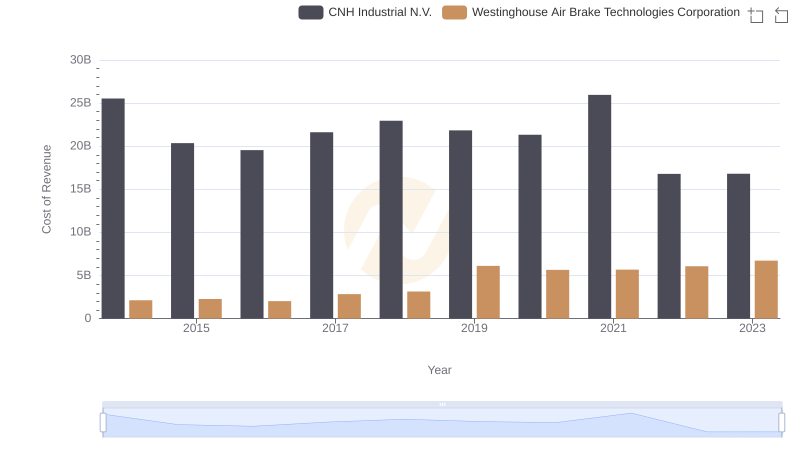

Cost Insights: Breaking Down Westinghouse Air Brake Technologies Corporation and CNH Industrial N.V.'s Expenses

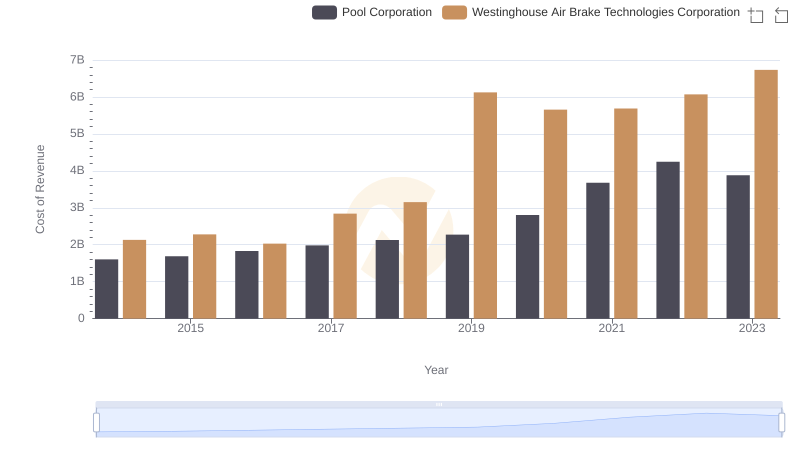

Cost of Revenue Comparison: Westinghouse Air Brake Technologies Corporation vs Pool Corporation

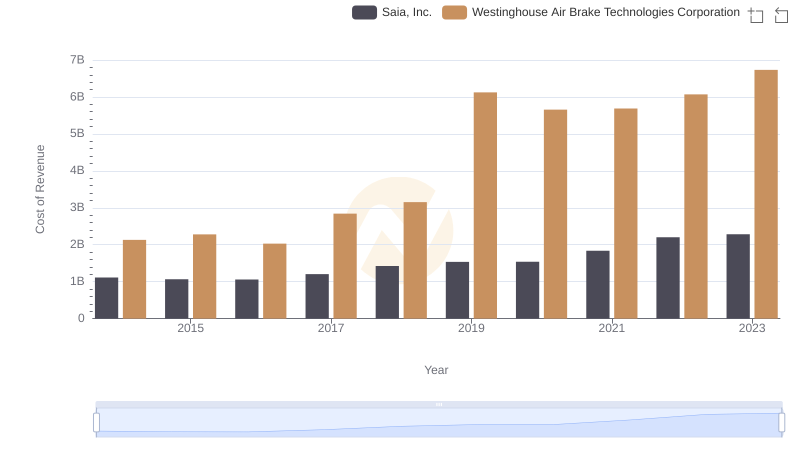

Comparing Cost of Revenue Efficiency: Westinghouse Air Brake Technologies Corporation vs Saia, Inc.

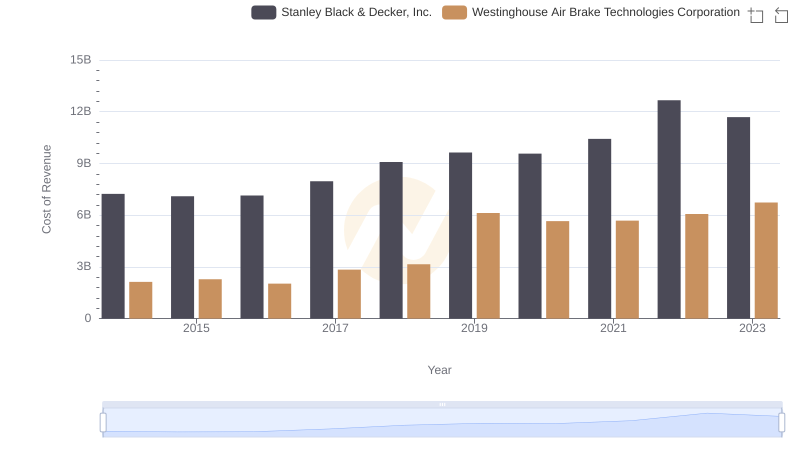

Cost of Revenue Comparison: Westinghouse Air Brake Technologies Corporation vs Stanley Black & Decker, Inc.

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and AECOM Trends

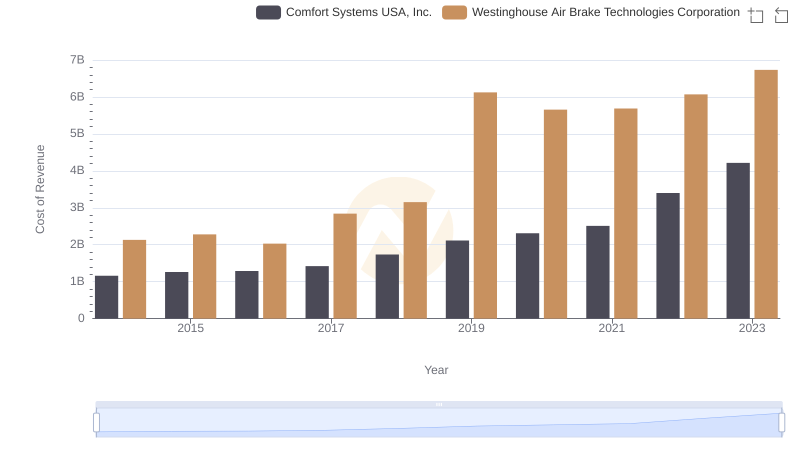

Cost of Revenue Trends: Westinghouse Air Brake Technologies Corporation vs Comfort Systems USA, Inc.

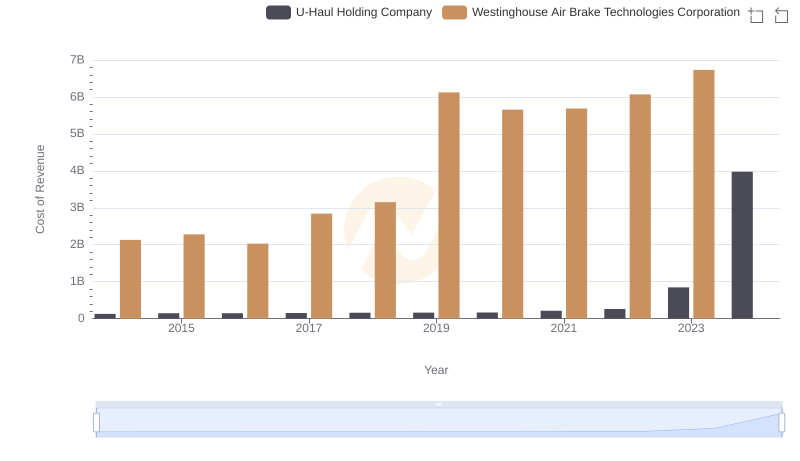

Cost Insights: Breaking Down Westinghouse Air Brake Technologies Corporation and U-Haul Holding Company's Expenses

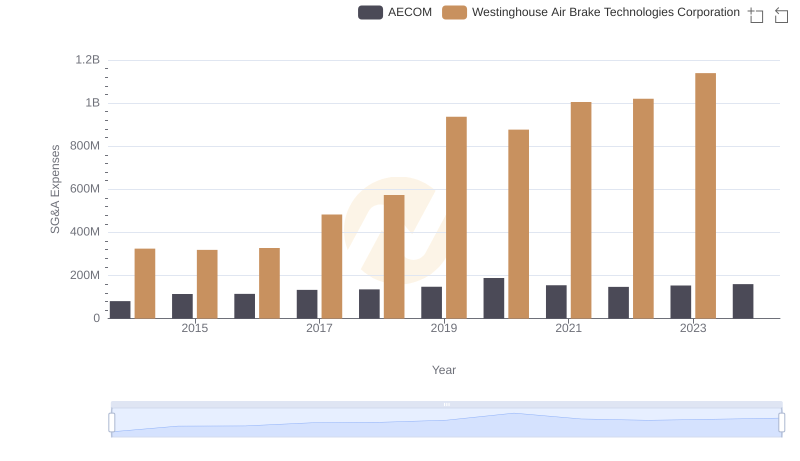

Comparing SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs AECOM Trends and Insights

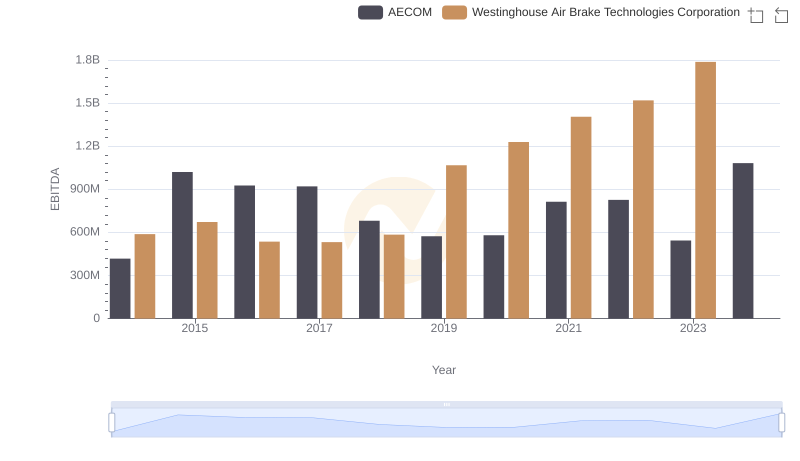

EBITDA Performance Review: Westinghouse Air Brake Technologies Corporation vs AECOM