| __timestamp | AECOM | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 403176000 | 913534000 |

| Thursday, January 1, 2015 | 535188000 | 1026153000 |

| Friday, January 1, 2016 | 642824000 | 901541000 |

| Sunday, January 1, 2017 | 683720000 | 1040597000 |

| Monday, January 1, 2018 | 650649000 | 1211731000 |

| Tuesday, January 1, 2019 | 813445000 | 2077600000 |

| Wednesday, January 1, 2020 | 709560000 | 1898700000 |

| Friday, January 1, 2021 | 798421000 | 2135000000 |

| Saturday, January 1, 2022 | 847974000 | 2292000000 |

| Sunday, January 1, 2023 | 945465000 | 2944000000 |

| Monday, January 1, 2024 | 1084341000 | 3366000000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of industrial giants, AECOM and Westinghouse Air Brake Technologies Corporation (WAB) have showcased intriguing financial trajectories over the past decade. From 2014 to 2023, AECOM's gross profit surged by approximately 170%, reflecting its robust growth strategy and market adaptability. Meanwhile, WAB demonstrated an impressive 220% increase, underscoring its dominance in the transportation sector.

Starting in 2014, AECOM's gross profit was around 400 million, steadily climbing to over 1 billion by 2023. This growth highlights AECOM's strategic expansions and successful project executions. On the other hand, WAB's gross profit began at just over 900 million, reaching nearly 3 billion in 2023, despite missing data for 2024. This remarkable growth trajectory positions WAB as a leader in its field, capitalizing on technological advancements and market demands.

As we look to the future, both companies are poised for continued success, with AECOM focusing on sustainable infrastructure and WAB leveraging its technological innovations. Investors and industry watchers should keep a keen eye on these trends as they unfold.

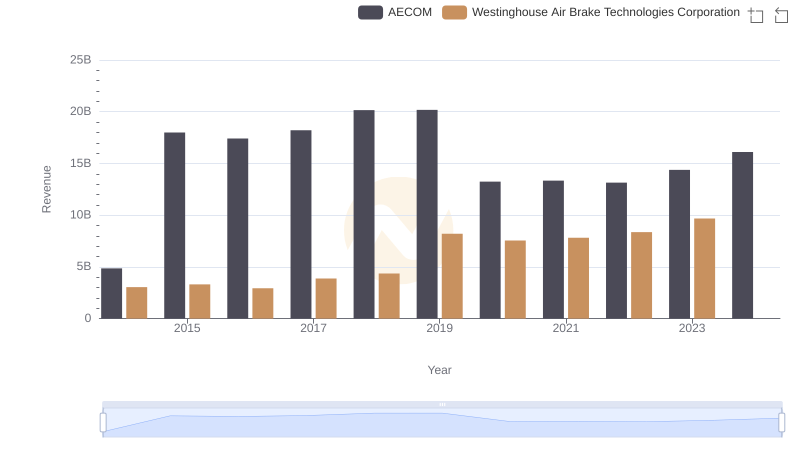

Westinghouse Air Brake Technologies Corporation vs AECOM: Annual Revenue Growth Compared

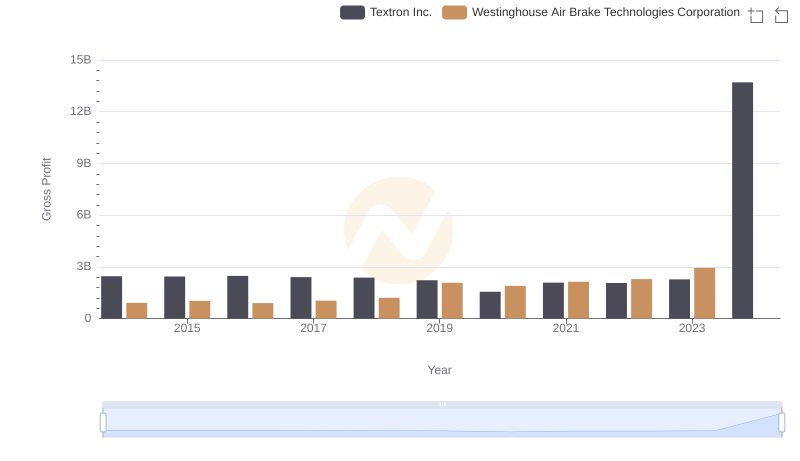

Westinghouse Air Brake Technologies Corporation vs Textron Inc.: A Gross Profit Performance Breakdown

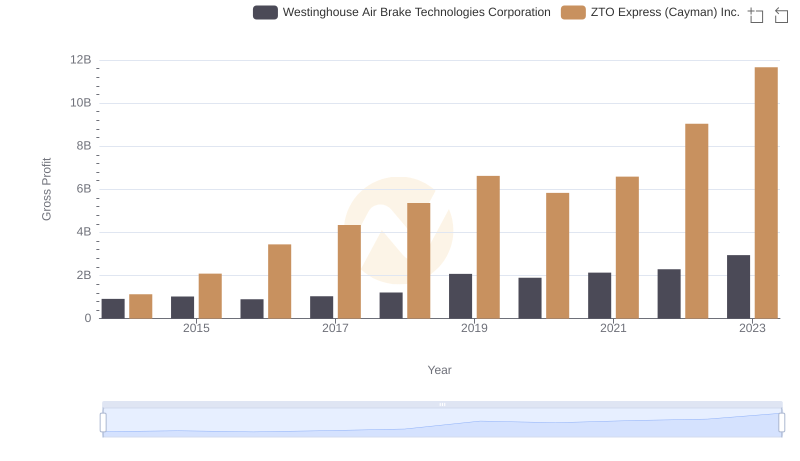

Westinghouse Air Brake Technologies Corporation and ZTO Express (Cayman) Inc.: A Detailed Gross Profit Analysis

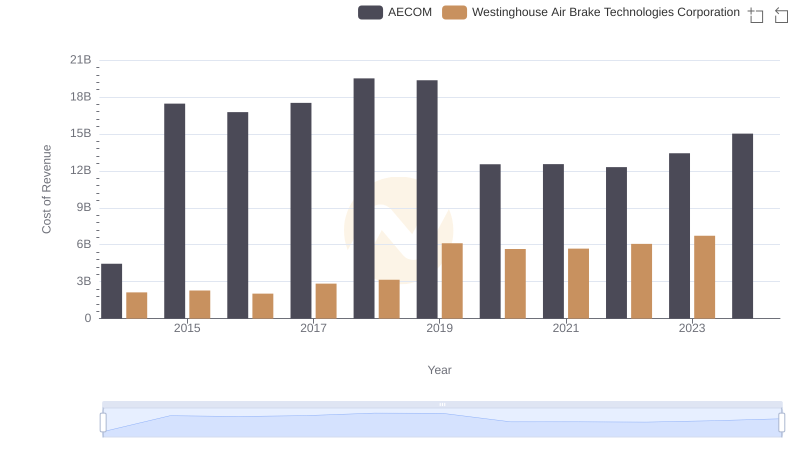

Analyzing Cost of Revenue: Westinghouse Air Brake Technologies Corporation and AECOM

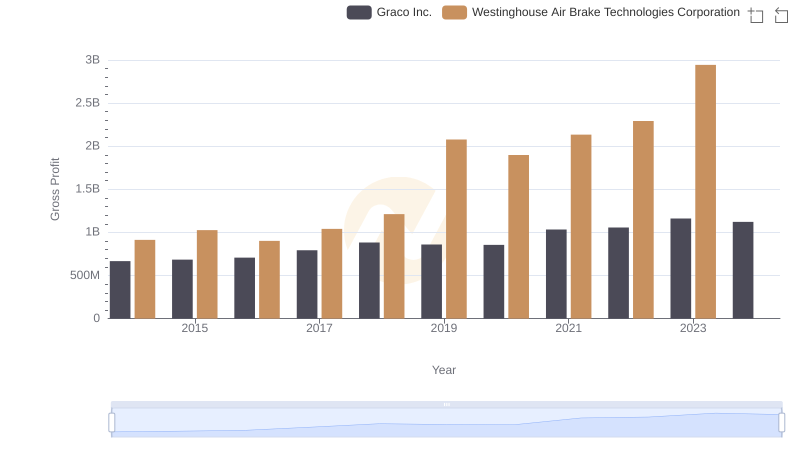

Who Generates Higher Gross Profit? Westinghouse Air Brake Technologies Corporation or Graco Inc.

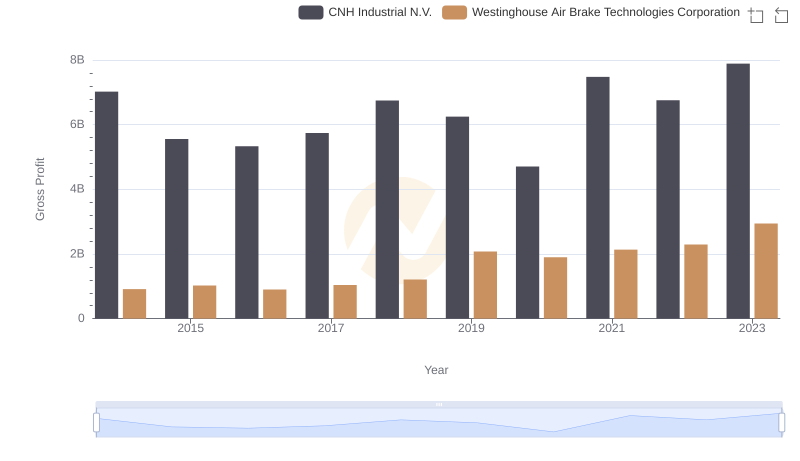

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and CNH Industrial N.V. Trends

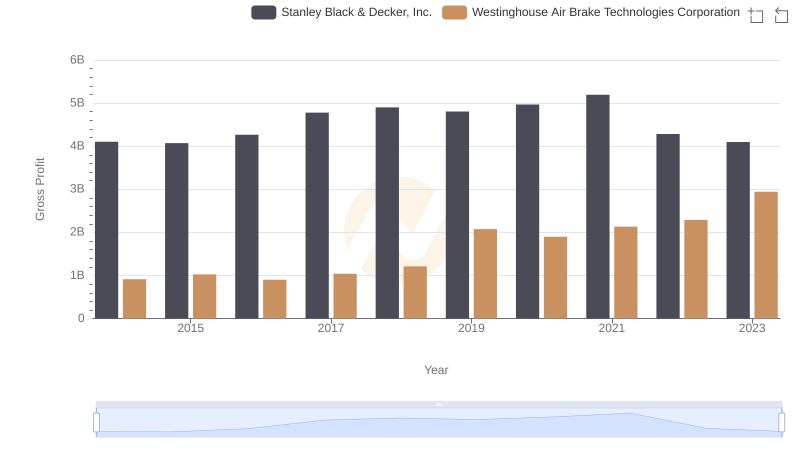

Who Generates Higher Gross Profit? Westinghouse Air Brake Technologies Corporation or Stanley Black & Decker, Inc.

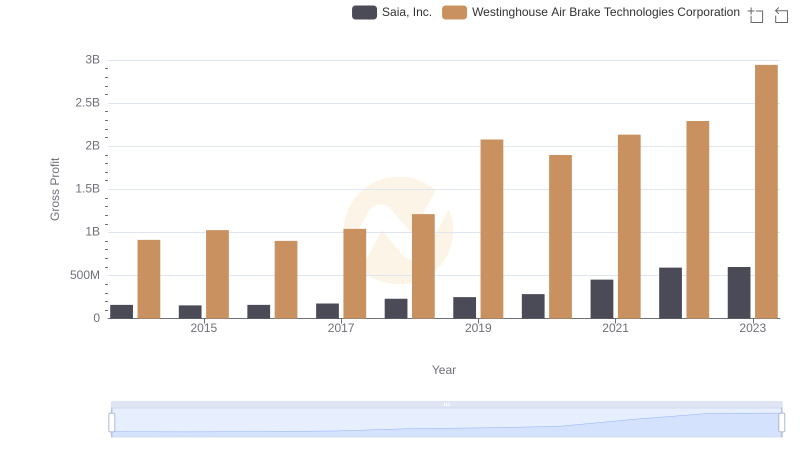

Gross Profit Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Saia, Inc.

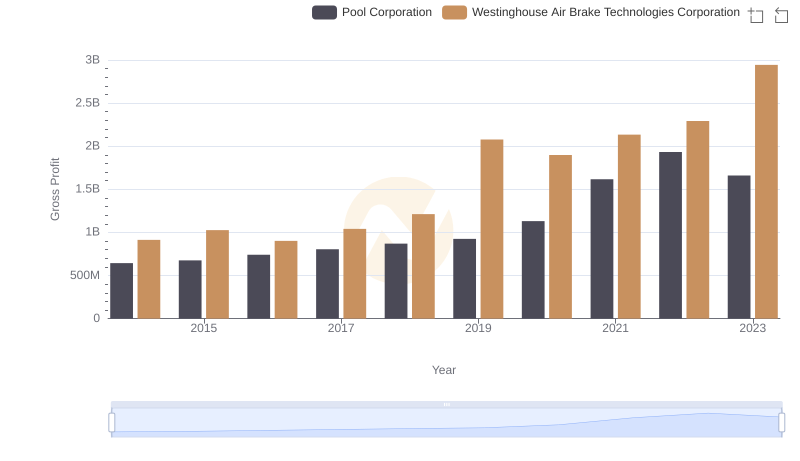

Gross Profit Comparison: Westinghouse Air Brake Technologies Corporation and Pool Corporation Trends

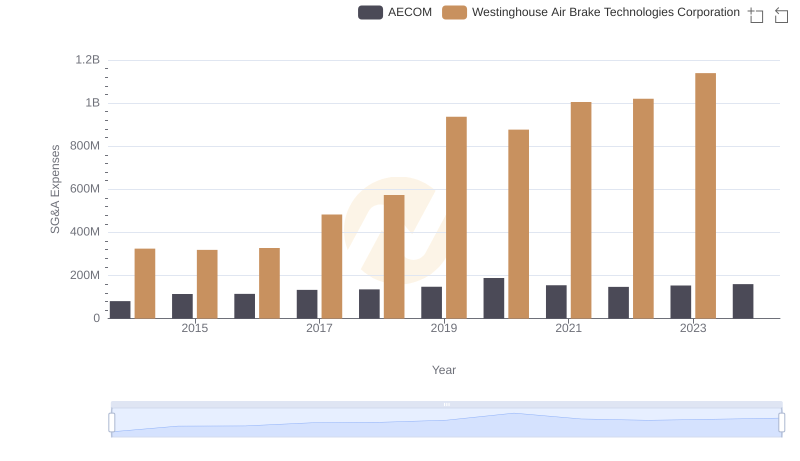

Comparing SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs AECOM Trends and Insights

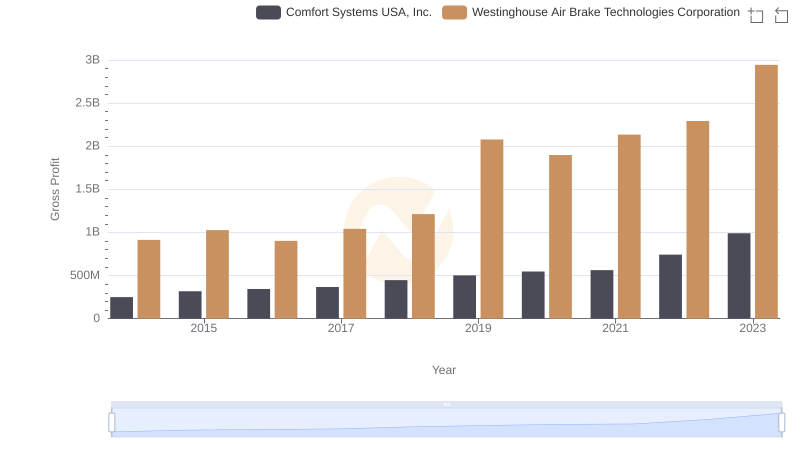

Westinghouse Air Brake Technologies Corporation and Comfort Systems USA, Inc.: A Detailed Gross Profit Analysis

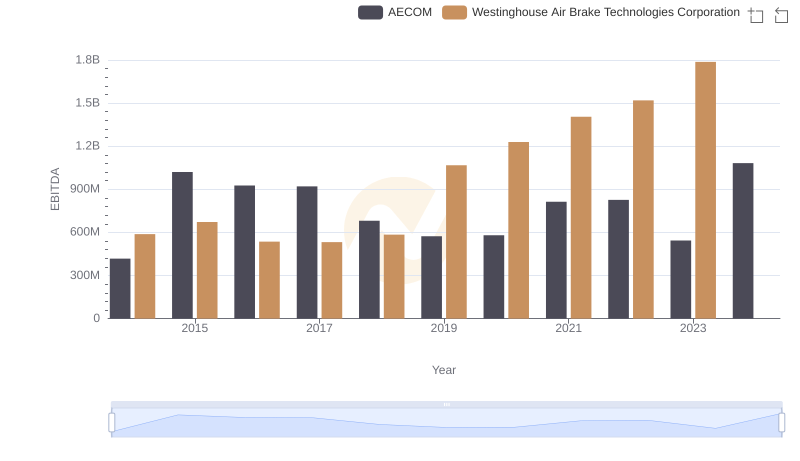

EBITDA Performance Review: Westinghouse Air Brake Technologies Corporation vs AECOM