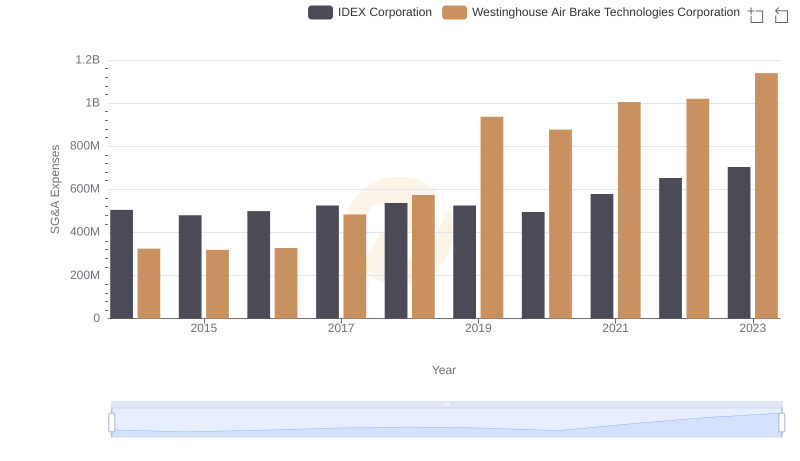

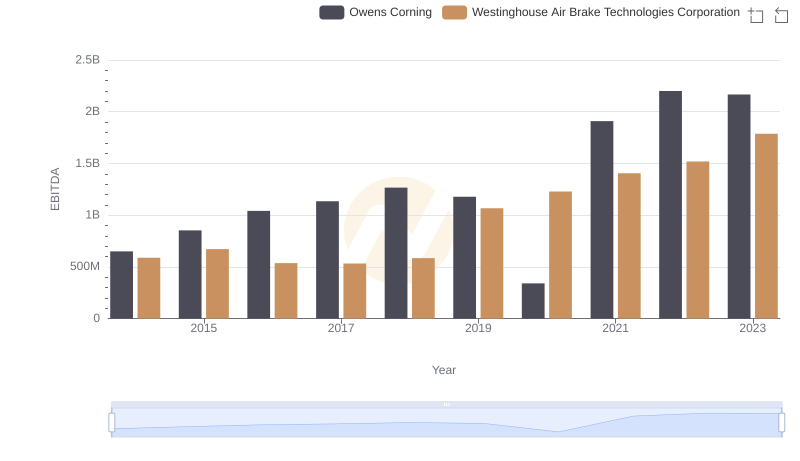

| __timestamp | Owens Corning | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 487000000 | 324539000 |

| Thursday, January 1, 2015 | 525000000 | 319173000 |

| Friday, January 1, 2016 | 584000000 | 327505000 |

| Sunday, January 1, 2017 | 620000000 | 482852000 |

| Monday, January 1, 2018 | 700000000 | 573644000 |

| Tuesday, January 1, 2019 | 698000000 | 936600000 |

| Wednesday, January 1, 2020 | 664000000 | 877100000 |

| Friday, January 1, 2021 | 757000000 | 1005000000 |

| Saturday, January 1, 2022 | 803000000 | 1020000000 |

| Sunday, January 1, 2023 | 831000000 | 1139000000 |

| Monday, January 1, 2024 | 1248000000 |

Data in motion

In the competitive landscape of industrial manufacturing, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, Westinghouse Air Brake Technologies Corporation and Owens Corning have demonstrated contrasting strategies in optimizing these costs. From 2014 to 2023, Owens Corning's SG&A expenses grew by approximately 71%, while Westinghouse's expenses surged by 251%. This stark difference highlights Westinghouse's aggressive expansion and investment strategies, compared to Owens Corning's more conservative approach.

Owens Corning maintained a steady increase in SG&A expenses, reflecting a consistent growth strategy. In contrast, Westinghouse's expenses peaked significantly in 2023, indicating a potential shift towards scaling operations. This data provides a fascinating insight into how two industry leaders navigate financial management, offering valuable lessons for businesses aiming to optimize their operational costs.

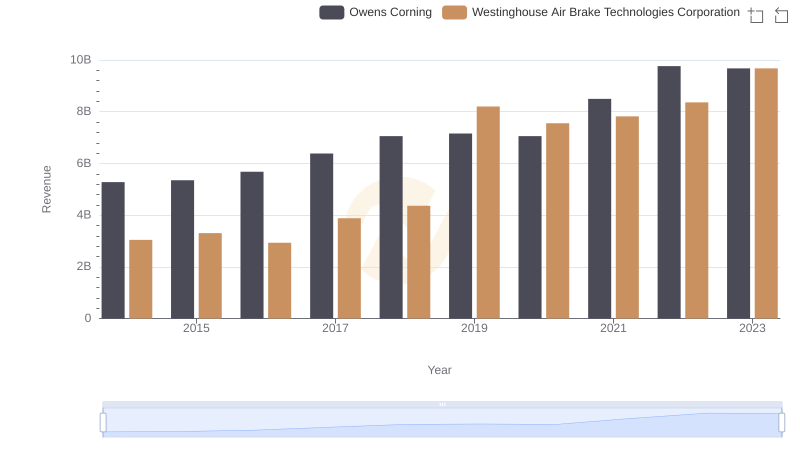

Annual Revenue Comparison: Westinghouse Air Brake Technologies Corporation vs Owens Corning

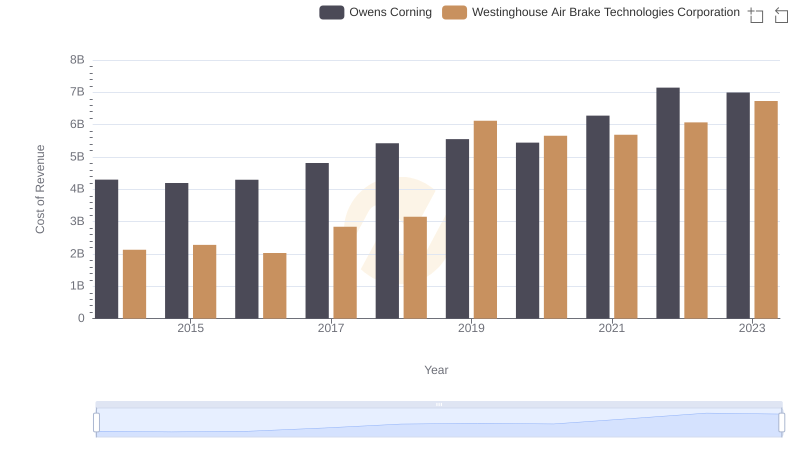

Westinghouse Air Brake Technologies Corporation vs Owens Corning: Efficiency in Cost of Revenue Explored

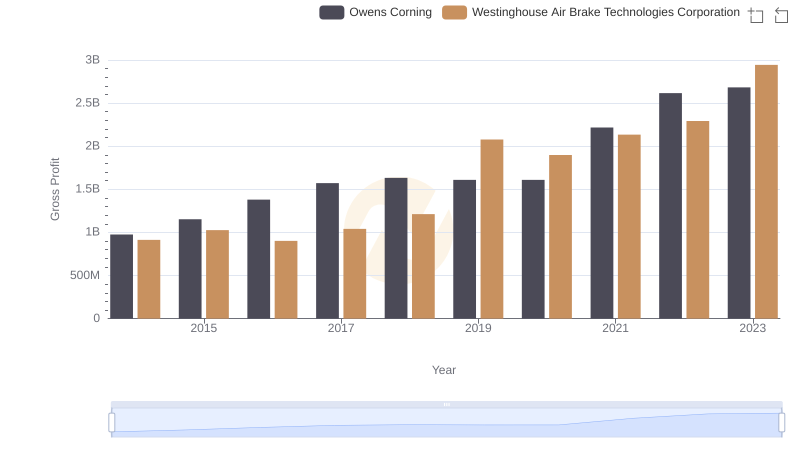

Gross Profit Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Owens Corning

Cost Management Insights: SG&A Expenses for Westinghouse Air Brake Technologies Corporation and IDEX Corporation

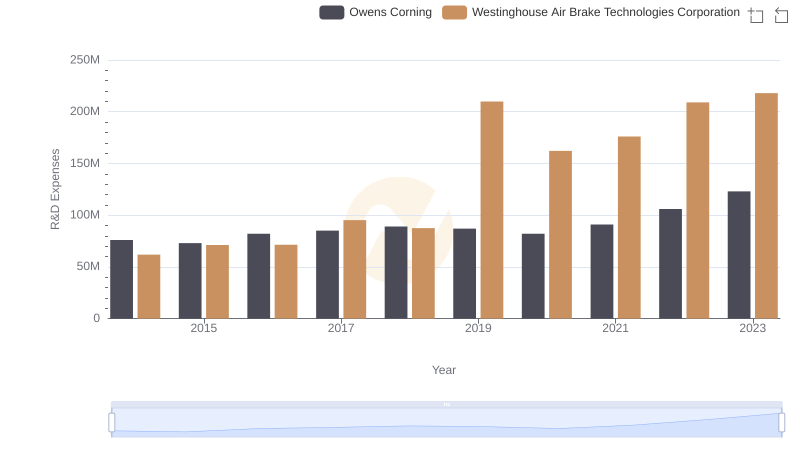

Westinghouse Air Brake Technologies Corporation vs Owens Corning: Strategic Focus on R&D Spending

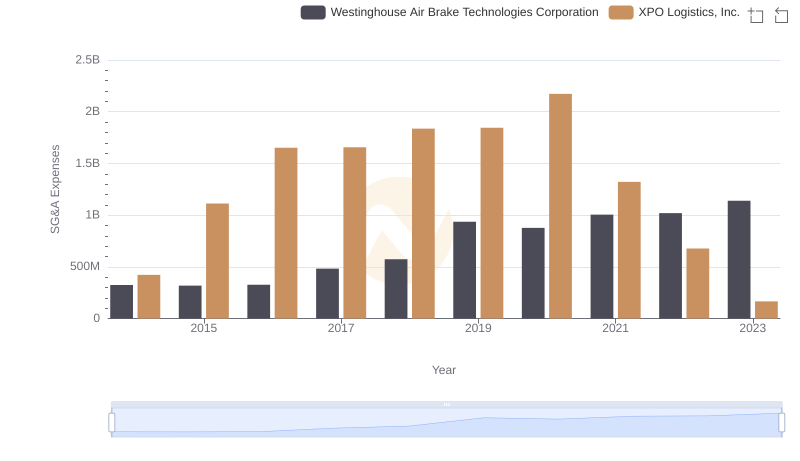

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs XPO Logistics, Inc.

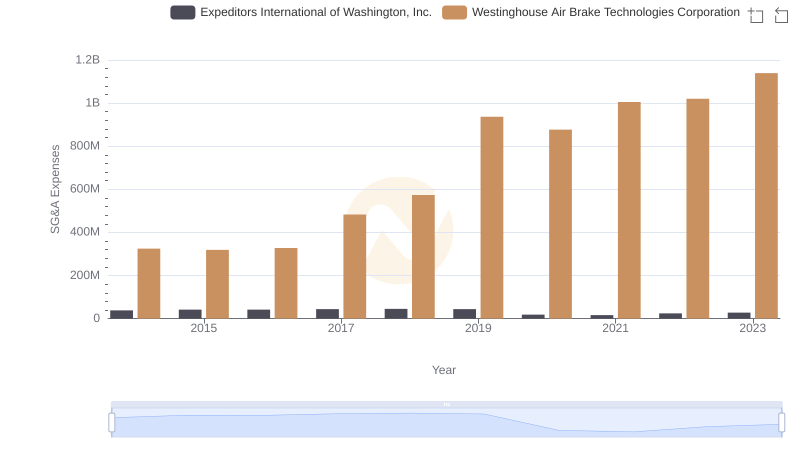

Breaking Down SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs Expeditors International of Washington, Inc.

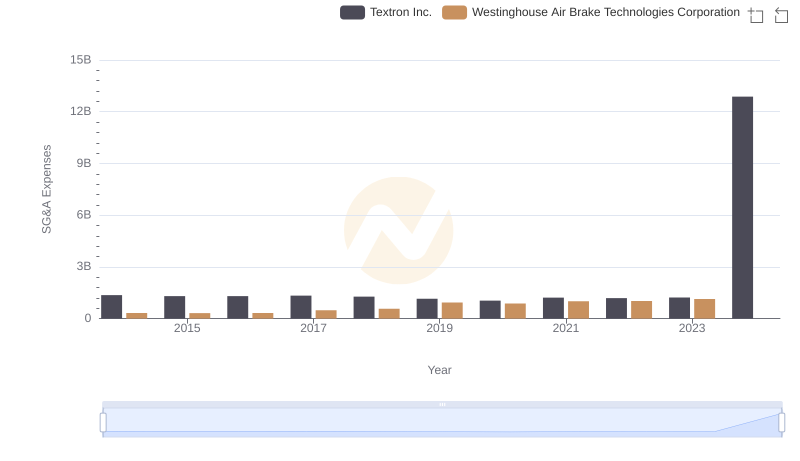

Operational Costs Compared: SG&A Analysis of Westinghouse Air Brake Technologies Corporation and Textron Inc.

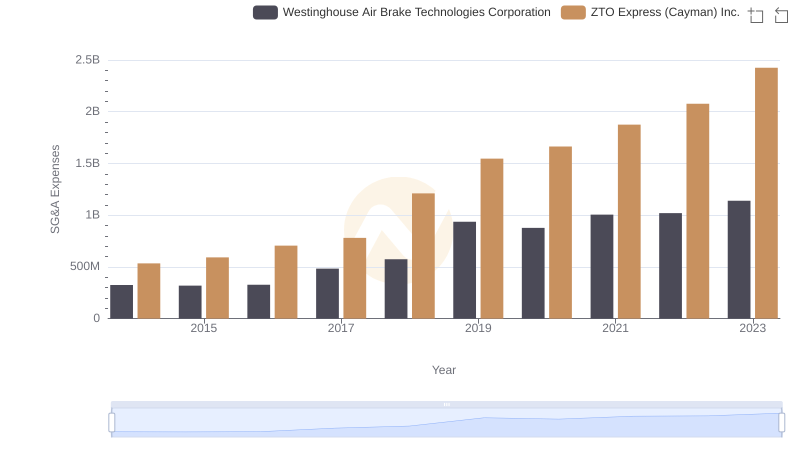

Westinghouse Air Brake Technologies Corporation or ZTO Express (Cayman) Inc.: Who Manages SG&A Costs Better?

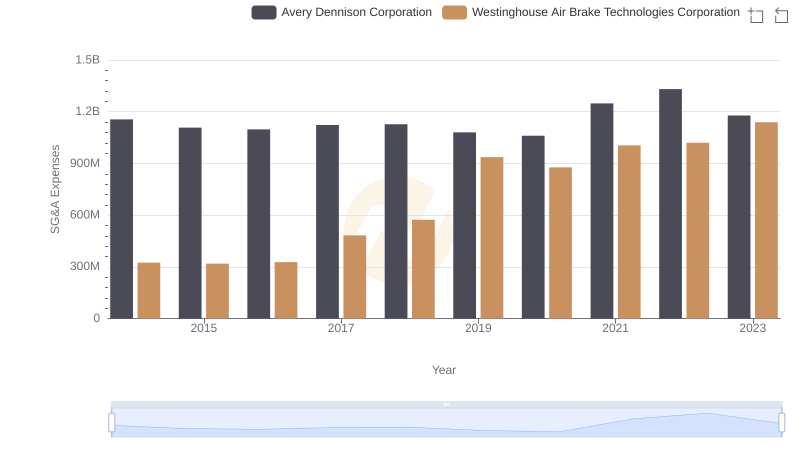

Westinghouse Air Brake Technologies Corporation vs Avery Dennison Corporation: SG&A Expense Trends

A Side-by-Side Analysis of EBITDA: Westinghouse Air Brake Technologies Corporation and Owens Corning

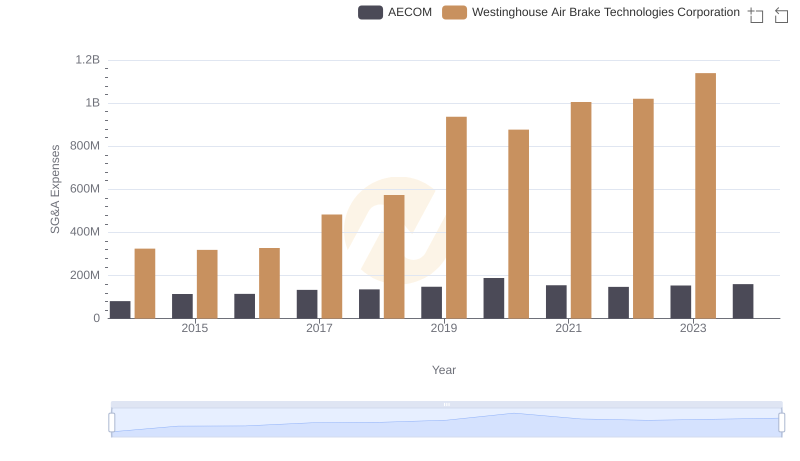

Comparing SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs AECOM Trends and Insights