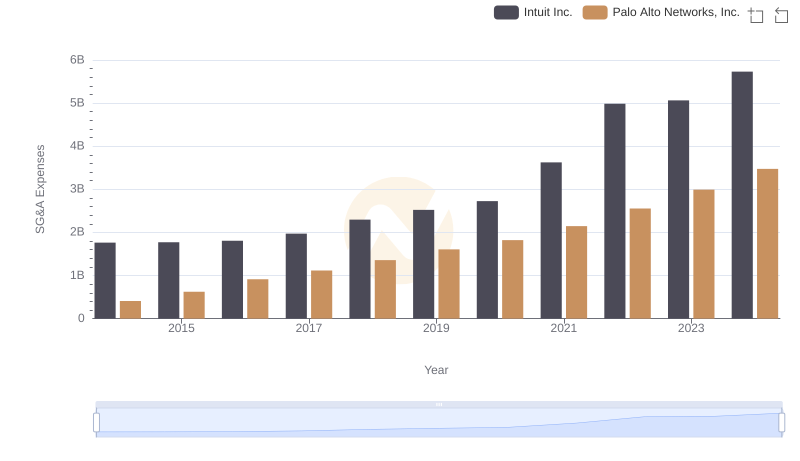

| __timestamp | Intuit Inc. | Palo Alto Networks, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 4506000000 | 598179000 |

| Thursday, January 1, 2015 | 4192000000 | 928052000 |

| Friday, January 1, 2016 | 4694000000 | 1378500000 |

| Sunday, January 1, 2017 | 5177000000 | 1761600000 |

| Monday, January 1, 2018 | 5964000000 | 2273100000 |

| Tuesday, January 1, 2019 | 6784000000 | 2899600000 |

| Wednesday, January 1, 2020 | 7679000000 | 3408400000 |

| Friday, January 1, 2021 | 9633000000 | 4256100000 |

| Saturday, January 1, 2022 | 12726000000 | 5501500000 |

| Sunday, January 1, 2023 | 14368000000 | 6892700000 |

| Monday, January 1, 2024 | 16285000000 | 8027500000 |

Cracking the code

In the ever-evolving landscape of technology, Intuit Inc. and Palo Alto Networks, Inc. have emerged as significant players, each carving out a unique niche. From 2014 to 2024, Intuit's revenue has surged by approximately 261%, reflecting its robust growth strategy and market adaptability. Meanwhile, Palo Alto Networks has experienced an impressive 1,243% increase, underscoring its pivotal role in cybersecurity.

Intuit's journey from $4.5 billion in 2014 to an anticipated $16.3 billion in 2024 highlights its consistent innovation in financial software. On the other hand, Palo Alto Networks' rise from $598 million to $8 billion showcases its expanding influence in securing digital infrastructures. This decade-long trajectory not only illustrates the dynamic nature of the tech industry but also emphasizes the importance of strategic foresight and adaptability in achieving sustained growth.

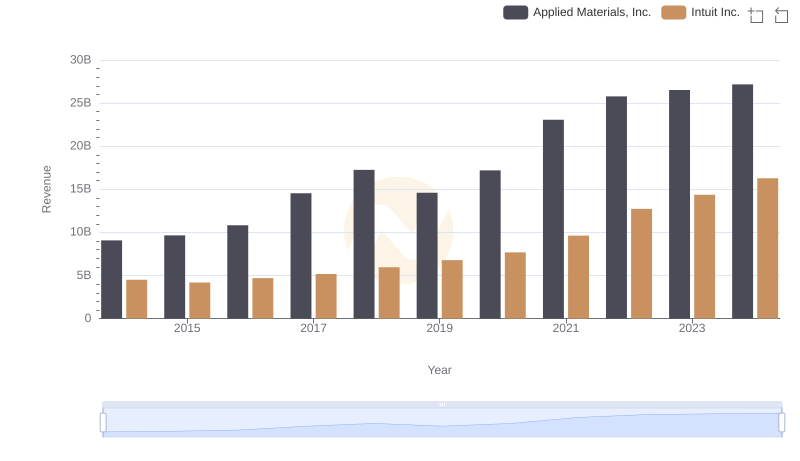

Revenue Insights: Intuit Inc. and Applied Materials, Inc. Performance Compared

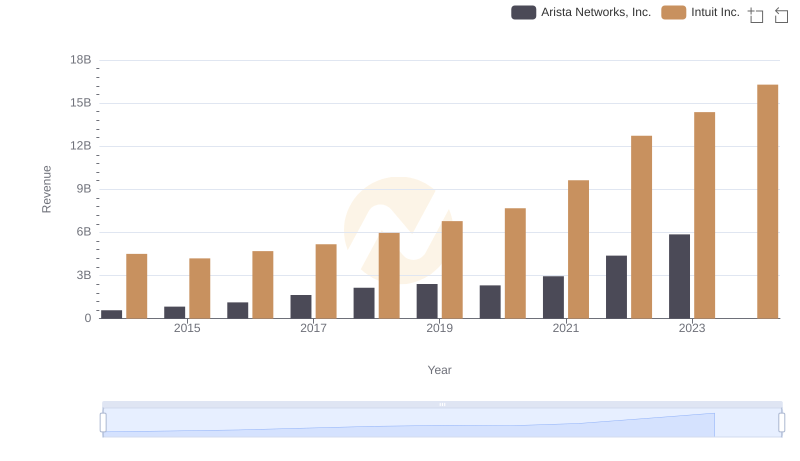

Annual Revenue Comparison: Intuit Inc. vs Arista Networks, Inc.

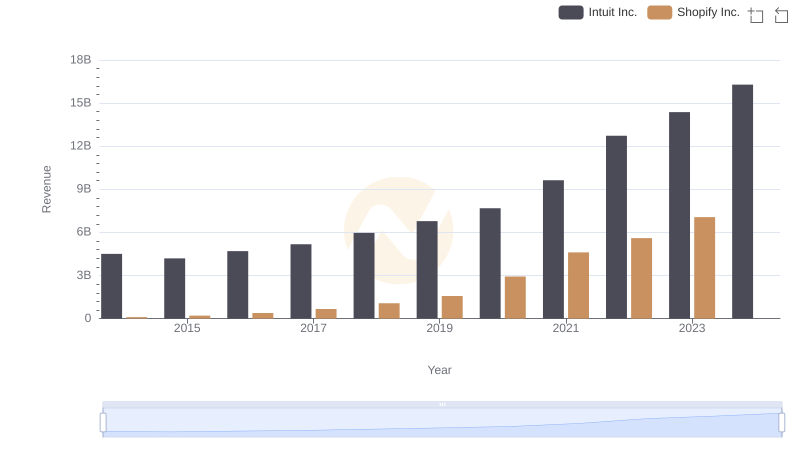

Breaking Down Revenue Trends: Intuit Inc. vs Shopify Inc.

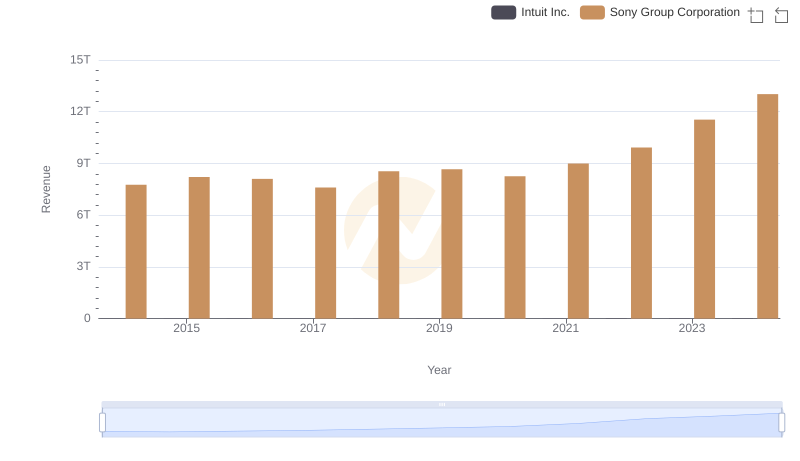

Annual Revenue Comparison: Intuit Inc. vs Sony Group Corporation

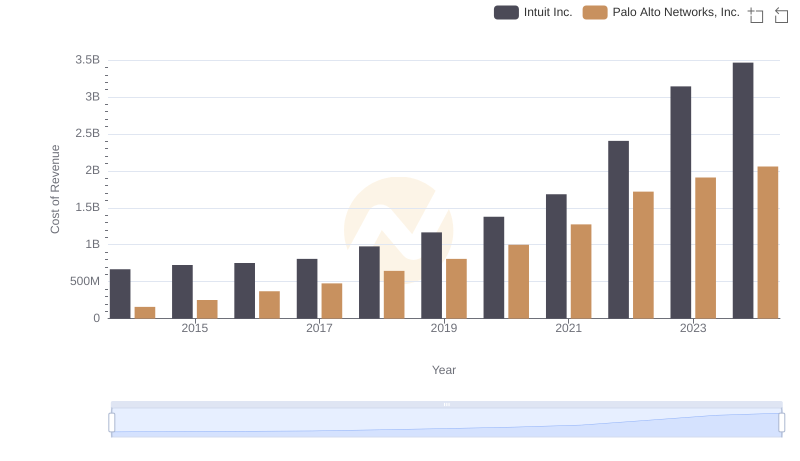

Cost Insights: Breaking Down Intuit Inc. and Palo Alto Networks, Inc.'s Expenses

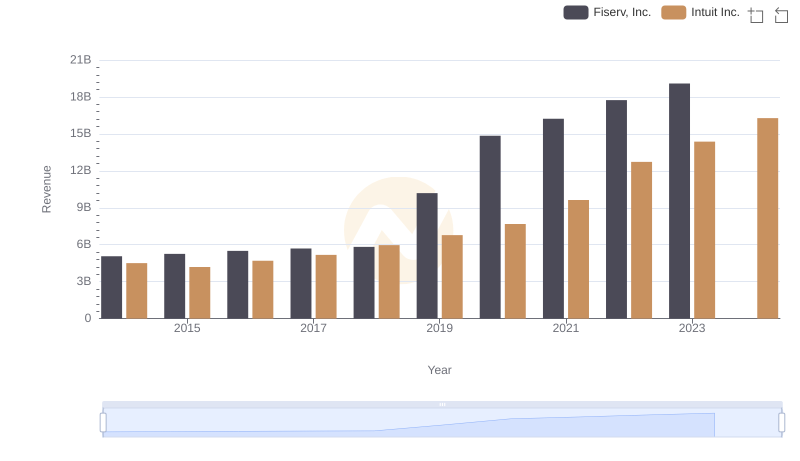

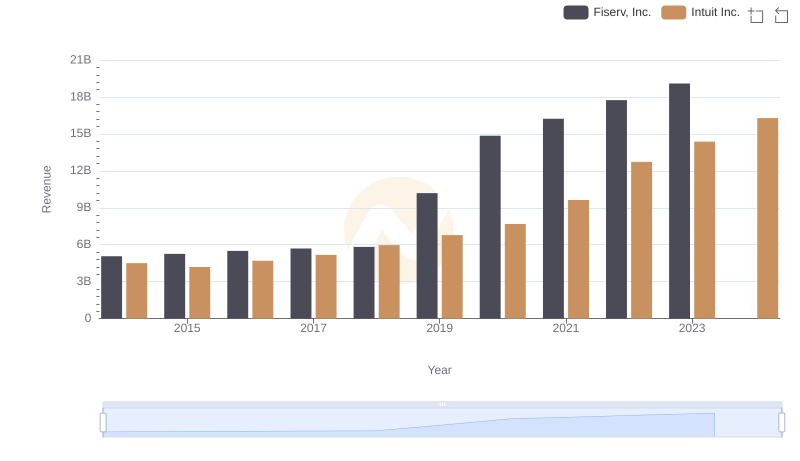

Comparing Revenue Performance: Intuit Inc. or Fiserv, Inc.?

Annual Revenue Comparison: Intuit Inc. vs Fiserv, Inc.

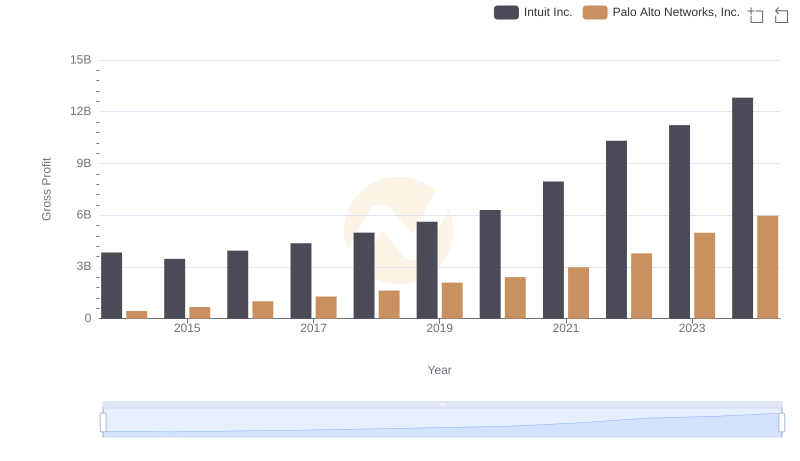

Who Generates Higher Gross Profit? Intuit Inc. or Palo Alto Networks, Inc.

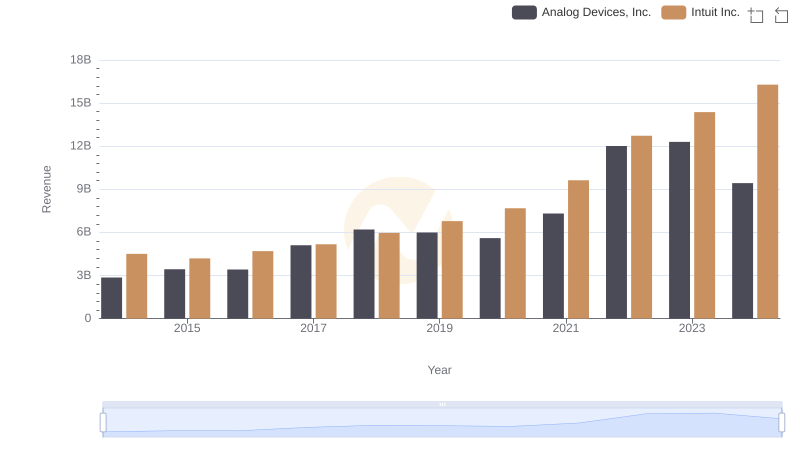

Who Generates More Revenue? Intuit Inc. or Analog Devices, Inc.

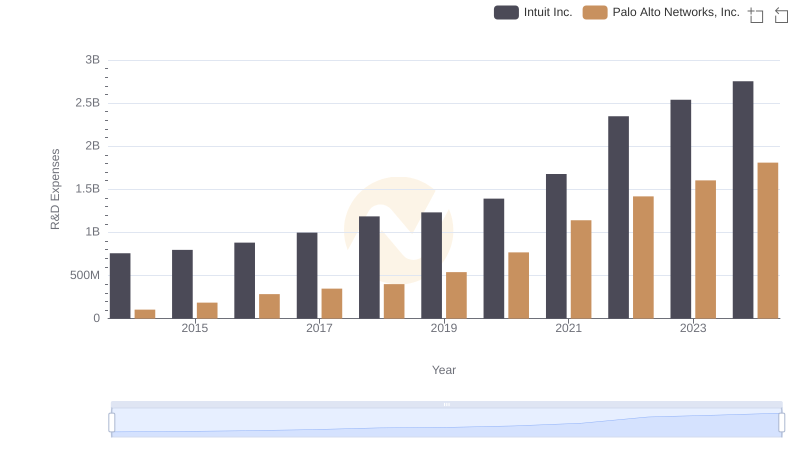

Comparing Innovation Spending: Intuit Inc. and Palo Alto Networks, Inc.

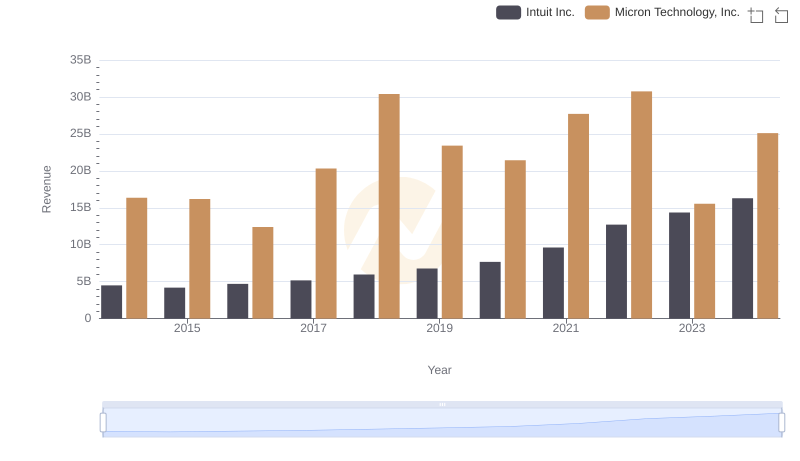

Breaking Down Revenue Trends: Intuit Inc. vs Micron Technology, Inc.

Comparing SG&A Expenses: Intuit Inc. vs Palo Alto Networks, Inc. Trends and Insights