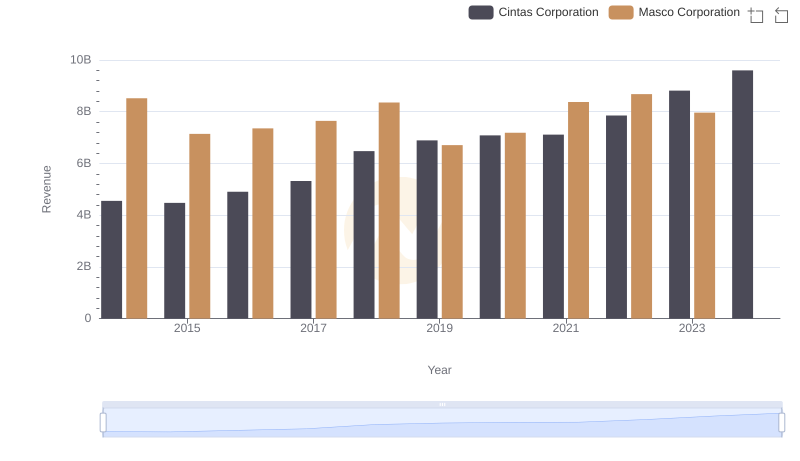

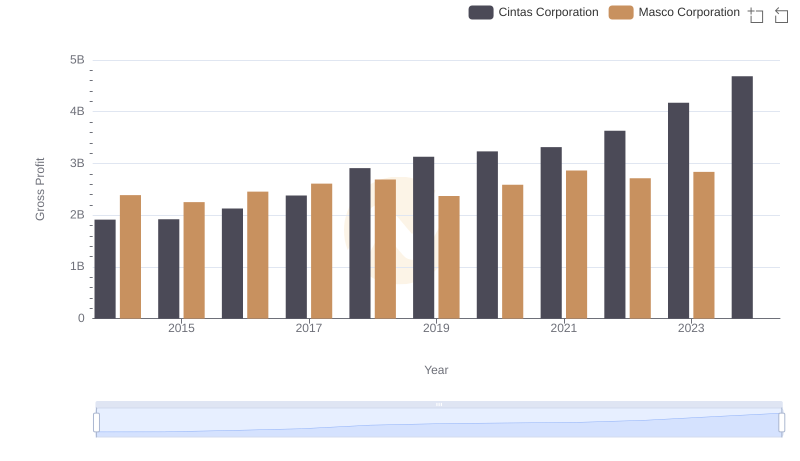

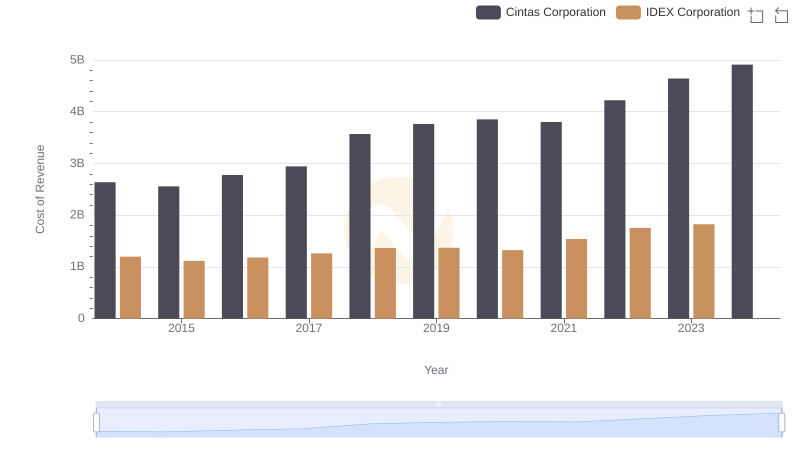

| __timestamp | Cintas Corporation | Masco Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2637426000 | 6134000000 |

| Thursday, January 1, 2015 | 2555549000 | 4889000000 |

| Friday, January 1, 2016 | 2775588000 | 4901000000 |

| Sunday, January 1, 2017 | 2943086000 | 5033000000 |

| Monday, January 1, 2018 | 3568109000 | 5670000000 |

| Tuesday, January 1, 2019 | 3763715000 | 4336000000 |

| Wednesday, January 1, 2020 | 3851372000 | 4601000000 |

| Friday, January 1, 2021 | 3801689000 | 5512000000 |

| Saturday, January 1, 2022 | 4222213000 | 5967000000 |

| Sunday, January 1, 2023 | 4642401000 | 5131000000 |

| Monday, January 1, 2024 | 4910199000 | 4997000000 |

Data in motion

In the competitive landscape of corporate America, cost efficiency is a critical metric for success. This analysis compares the cost of revenue efficiency between Cintas Corporation and Masco Corporation from 2014 to 2023. Over this period, Cintas Corporation demonstrated a remarkable 86% increase in cost of revenue, rising from approximately $2.64 billion in 2014 to $4.91 billion in 2023. In contrast, Masco Corporation's cost of revenue fluctuated, peaking at $6.13 billion in 2014 and settling at $5.13 billion in 2023, marking a 16% decrease.

The data reveals Cintas's consistent upward trend, reflecting strategic cost management and growth. Meanwhile, Masco's variable performance suggests challenges in maintaining cost efficiency. This comparison underscores the importance of strategic financial planning in achieving long-term corporate success.

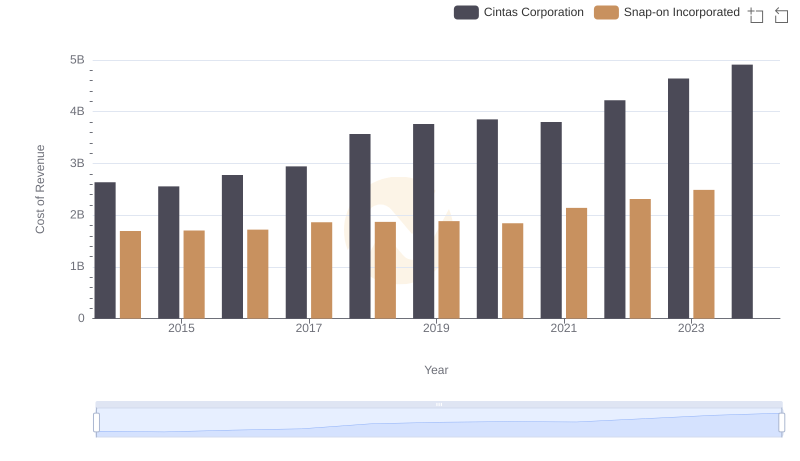

Analyzing Cost of Revenue: Cintas Corporation and Snap-on Incorporated

Who Generates More Revenue? Cintas Corporation or Masco Corporation

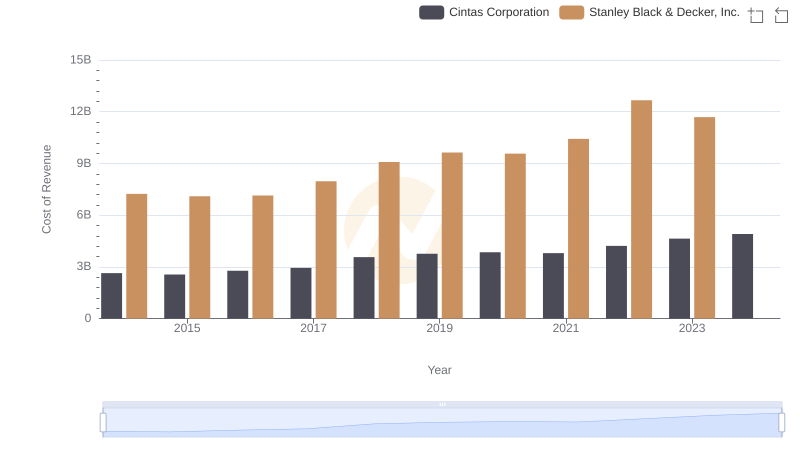

Cost of Revenue: Key Insights for Cintas Corporation and Stanley Black & Decker, Inc.

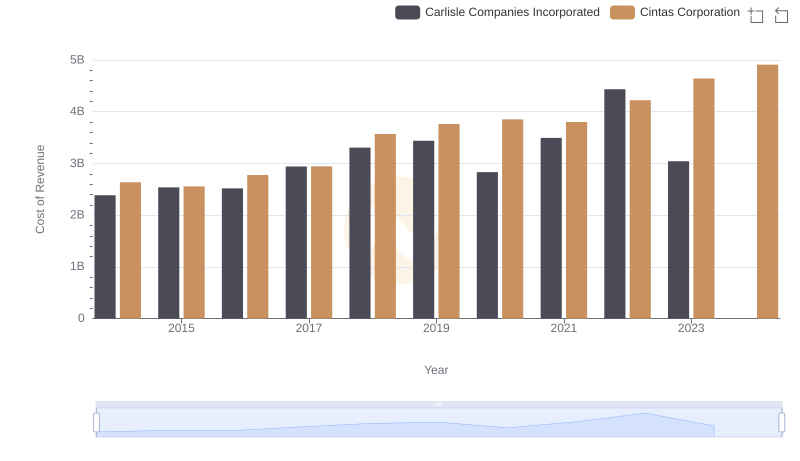

Cost of Revenue: Key Insights for Cintas Corporation and Carlisle Companies Incorporated

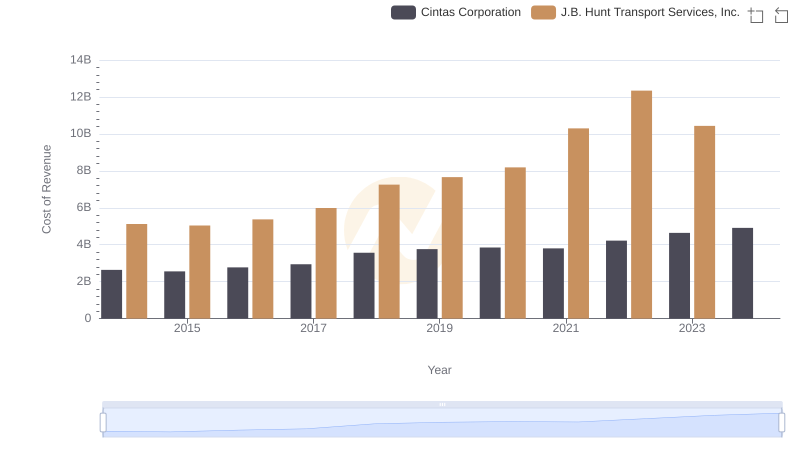

Cintas Corporation vs J.B. Hunt Transport Services, Inc.: Efficiency in Cost of Revenue Explored

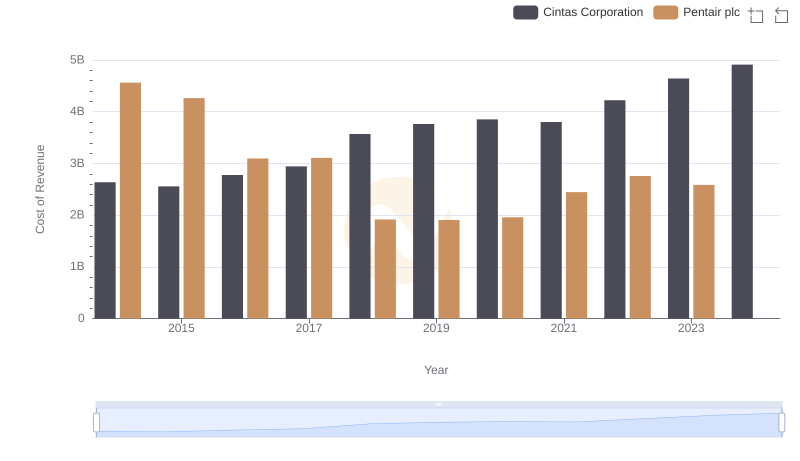

Cost of Revenue Comparison: Cintas Corporation vs Pentair plc

Gross Profit Analysis: Comparing Cintas Corporation and Masco Corporation

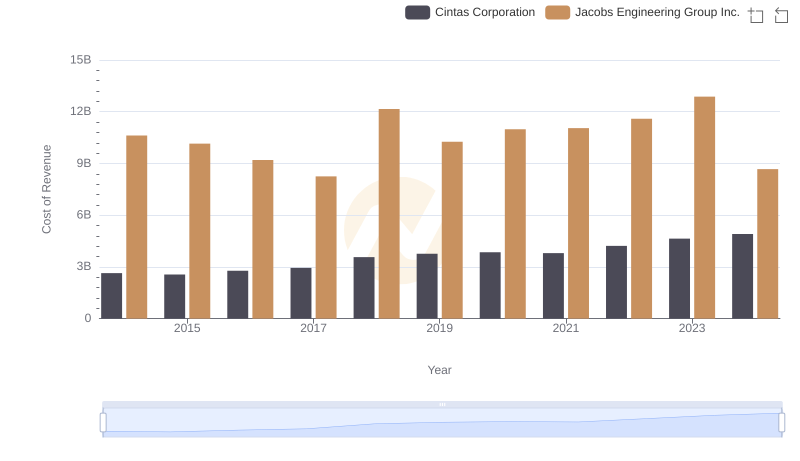

Cintas Corporation vs Jacobs Engineering Group Inc.: Efficiency in Cost of Revenue Explored

Cintas Corporation vs IDEX Corporation: Efficiency in Cost of Revenue Explored

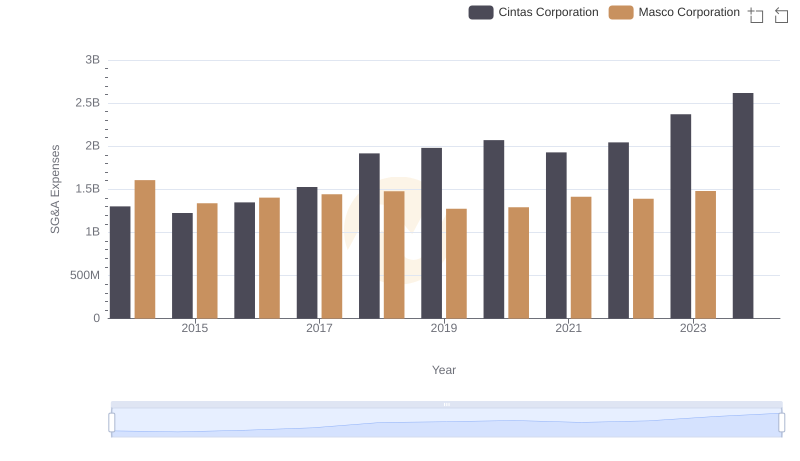

Cintas Corporation vs Masco Corporation: SG&A Expense Trends

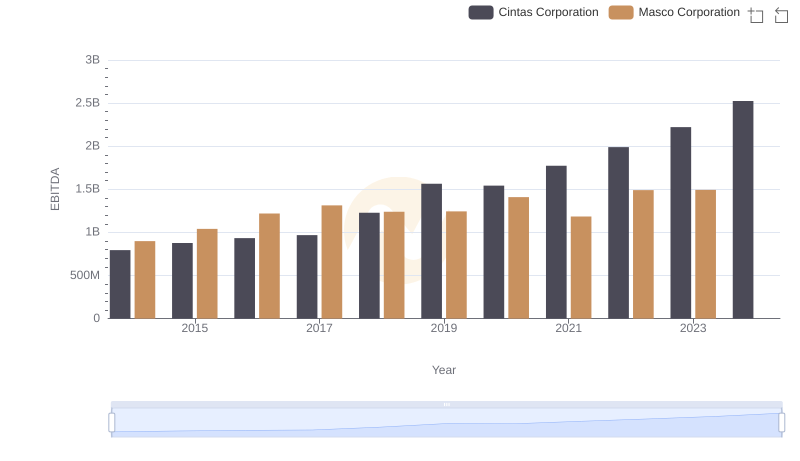

Cintas Corporation and Masco Corporation: A Detailed Examination of EBITDA Performance